Fastest Execution Forex Brokers

Financial markets move at a very fast pace. As such, traders need to move at a similar speed to match the market's speed. A fast trading platform can be the difference between winning a trade and missing out on potential profits. As such, it is essential to trade with a forex broker providing a trading platform with fast order execution times.

Please note that order execution speed is not the only thing that matters when trading with a forex broker. For example, how often positive or negative slippage happens is also a key factor. Today, we are going to look at some of the best brokers with the fastest execution speeds. We are also going to see what kind of trading conditions they provide to their clients. Let’s jump into it.

Quick Speed Comparison table

In accordance with our findings, we discovered that only a very few brokers officially list the execution speed at which most of the trades executed by their clients have been carried out. Luckily some of the popular ones do so, so we made a table of the ones we could find, here it is;

| Broker | Average Execution Time | Percentage of limit orders executed at improved price |

| Pepperstone | 0.03-0.06 seconds (depending on the branch) | - |

| FP Markets | 0.04 seconds | - |

| Forex.com | 0.06 seconds | 58.86% |

| XTB | 0.201 seconds | 25.66% |

| IQ Option | 0.6 seconds | - |

| City Index | 0.05 seconds | 52.36% |

Pepperstone - Fastest Execution Broker

Pepperstone is a multi-asset broker that supports trading 1,200 trading assets. These include CFDs on forex, indices, shares, currency indices, cryptocurrencies, commodities, and ETFs. These trading instruments are accessible on a variety of platforms including MT4, MT5, TradingView, and cTrader. The charges for trading on Pepperstone are fairly low with spreads starting from 1.0 pips for major currency pairs on the standard account and no commissions paid.

Notably, Pepperstone stands out for its exceptionally fast order execution times, ranking among the fastest in the market. Most orders are executed in less than 30 milliseconds (Pepperstone Group Limited) and 60ms (Pepperstone Limited) measured from the time each order reaches Pepperstone's bridge. Clients of Pepperstone Group Limited are those accessing the company’s services through its Australian branch. Conversely, clients from other regions, including the UK, Europe, Africa, and additional jurisdictions, are served by Pepperstone Limited.

Closing out on Pepperstone, let’s see how the company’s activities are regulated. The company operates under the strict supervision of the FCAs, the ASIC, the BaFin, and the CMA. While regulations alone are not enough, it is always a good sign when a company has multiple licenses from various institutions.

75.3% of retail CFD accounts lose money

FP Markets

FP Markets promises its clients fast executions, according to their official site they they have ultra-fast execution times of under 40ms. The trading platforms clients can choose on this broker site include the MT4, MT5, cTrader, and FP Markets trading App. These are some of the fastest trading platforms in the market so it makes sense why FP Markets can promise fast order execution. Moreover, ECN brokers like FP Markets usually have faster order execution times.

On another note, FP Markets offers some of the best pricing in the market. For starters, the spreads on the standard account can fall as low as 1.0 pips for major currency pairs and no commissions are paid. Additionally, the broker offers a commission account charging $3 per lot per side and spreads as low as 0.0 pips. For Muslim traders, FP Markets is one of the reputable brokers that offer Islamic accounts to their clients.

Further, FP Markets has a wide collection of trading instruments including forex currency pairs and CFDs on shares, bonds, metals, indices, ETFs, and commodities. In total, there are over 10,000 trading instruments to invest in. On this broker site, investors are spoilt for choice. Better yet, they will be trading with a forex broker regulated by the CySEC in Cyprus, the ASIC in Australia, and the FSCA in South Africa.

72.44% of retail CFD accounts lose money

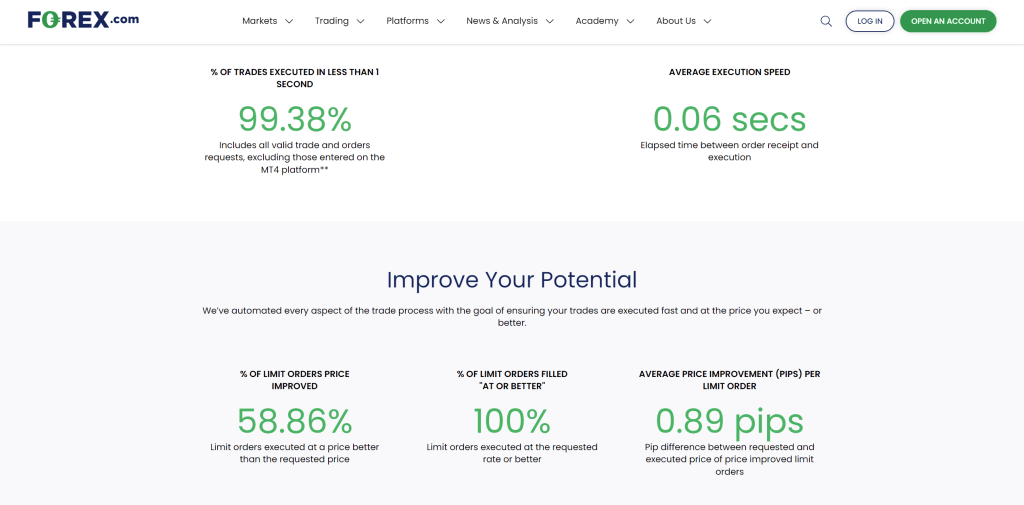

Forex.com

Forex.com is one of the fastest order execution platforms in the market. The average order execution time listed by the broker sits at merely 0.06 seconds. The broker further lists on its site that 99.38% of trades are executed within 1 second. This is lightning-speed execution time on a tier one broker. Remarkably, this broker offers its clients some of the best trading platforms including MetaTrader 4, MetaTrader 5, and Forex.com Trader.

Additionally, this broker site features a favourably high number of trading instruments. Clients from most countries can trade forex pairs alongside CFDs on stocks, commodities, cryptocurrencies, and indices. On the other hand, clients from the US can trade over 80 currency pairs, Gold and Silver, Futures and Futures Options.

Trading these instruments on the Forex.com broker site does not incur extreme charges. For example, the spreads on this broker site can fall as low as 1.0 pips for major currency pairs on the standard account. The Commission account and the Direct Market Access (DMA) account both charge a commission. The commission account features spreads starting from 0.2 pips and charges a commission of $5 per 100k traded. The DMA account charges different commissions depending on the trading volume of a client. For example, a trader with a trading volume of $0M – $100M per month would pay a commission of $60 per $1 million traded.

Closing out on the regulations of this broker, it does not disappoint. The evidence suggests that this broker is committed to following the law. This is because the broker is regulated by reputable organizations including the FCA, the ASIC, the IIROC, the CYSEC, the CFTC and the NFA.

76-77% of retail investor accounts lose money when trading CFDs with this provider.

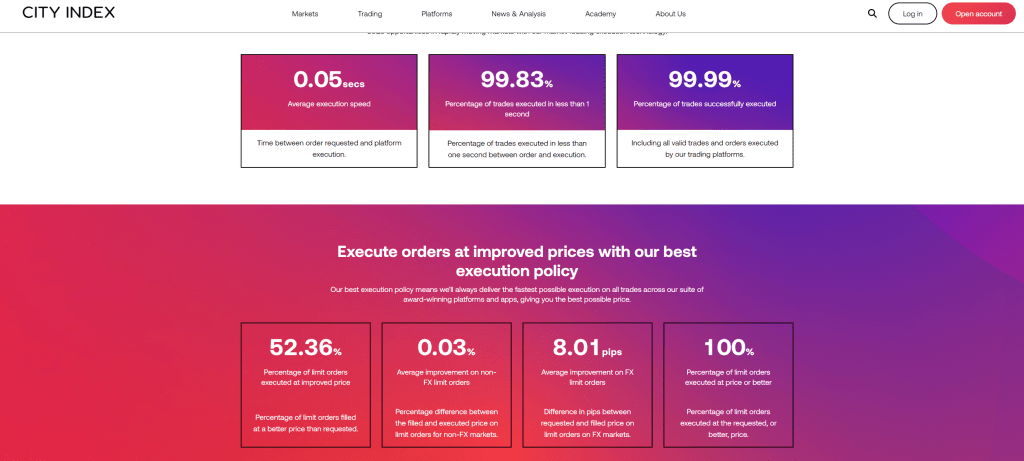

City Index

City Index posts one of the fastest order execution times in the market. The average execution speed listed on the platform is 0.05 seconds which is extremely fast. Coupled with this fast execution time is the promise of low spreads. On this broker site, the spreads on major currency pairs can go as low as 0.6 pips on the standard account.

Further, this broker features many trading instruments, making it possible for clients to diversify their portfolios. These include CFDs on indices, shares, forex, commodities, interest rates, bonds, options, and cryptocurrency. Clients trade these instruments on MetaTrader 4, WebTrader, and Tradingview. In terms of regulations, this broker has a nice collection of regulatory licenses. The broker is regulated by the CySEC, the ASIC, and the FCA, three of the top financial regulators in the market today.

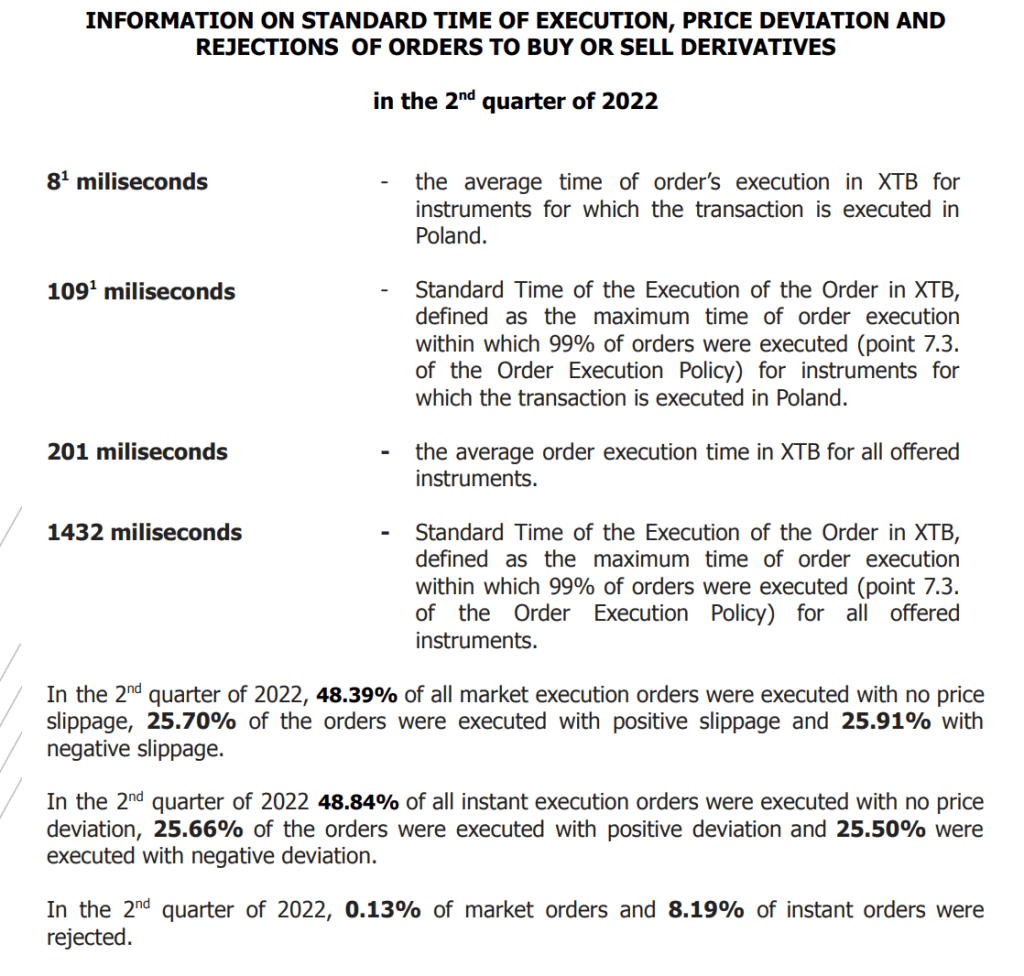

XTB

XTB is yet another reputable broker that has ultra-fast order execution time. According to their official page about execution policies, the average execution time is at XTB 0.201 seconds. Its native platform xStation is the only platform available to clients wishing to invest with this broker.

Notably, investors can trade over 2,100 global markets on the XTB trading site. These include currency pairs, indices, and commodities alongside CFDs on stocks, cryptocurrencies, and ETFs. Luckily, the charges for trading these instruments are not extravagant. For example, the spreads on major currency pairs on this site can go as low as 0.5 pips. On another note, XTB has several regulations in several jurisdictions. These include the UK by the FCA, Cyprus by the CySEC, Poland by the KNF, and Belize by the IFSC

75-78% of retail investor accounts lose money when trading CFDs with this provider.

IQ Option

We close out with a forex broker that provides its in-house-built trading platforms to its clients. IQ Option avails the IQ option trading platform to its clients for use in trading. Nonetheless, this platform has some of the fastest order execution times, according to one of their pages on the site called "IQ Option in Numbers", the estimated execution time is 0.6 seconds.

With this broker, clients can trade over 250 different assets. CFDs on forex, cryptocurrencies, commodities, stocks, indices, and ETFs are all available to invest in. This is a great collection of trading instruments for investors to spread their capital on. Better yet, the company is very transparent about each fee they charge to traders. Traders can find the spreads charged under each asset when they click on the asset. They are fairly low and industry-standard starting from 1.0 pips for major currency pairs. Finally, IQ Option operates under a CySEC license which is one of the best regulators in the world. Notably, this license allows the company to operate freely in most European countries.

Other Brokers With One of the Fastest Execution Times (usually below 1 sec.)

XM

The trading platforms clients can use on this broker site include MetaTrader 4, MetaTrader 5, and XM Trading APP. Understandably, this broker promises clients their orders will be executed in under 1 second. According to the official XM site, 99.35% of all orders are executed within this timeframe. Regarding trading instruments, this broker site offers clients a diverse collection of assets to invest in. They can invest in over 1,000 trading instruments including CFDs on forex, stocks, indices, shares, commodities, precious metals, and energies. Clients outside the EEA can also trade CFDs on some popular cryptocurrencies.

On top of the huge collection of instruments, XM offers low competitive spreads. There are three account types that come with different spreads. For example, the standard account has spreads as low as 1.0 pips for major currency pairs. In contrast, the spreads can go as low as 0.6 pips on the XM Ultra Low account. Next, we look at the regulations of this forex broker. Fortunately, this broker has regulations in the UK by the FCA, in Cyprus by the CySEC, and in Belize by the IFSC.

Vantage Markets

Vantage Markets also features trading platforms known for their fast order execution. On the website, clients can choose between MetaTrader 4, MetaTrader 5, ProTrader, and WebTrader. Mobile traders can also choose to use the Vantage App built by Vantage Markets. Remarkably, traders can invest in more than 1,000 different assets from various asset classes. This includes CFDs on forex pairs, indices, precious metals, commodities, energy, ETFs, shares, and bonds. Diversifying your portfolio on this broker site is not a problem.

Additionally, Vantage Markets does not charge expensive fees when trading. The spreads on Vantage Markets depend on the account type a user is using. For example, the average spread on the Standard STP account starts at 1.4 pips for major currency pairs. The company also provides an ECN account based on commissions. Traders pay a commission of $3 per side per lot on this account.

In terms of regulations, Vantage Markets is a regulated company in Australia by the ASIC, in Cyprus by the CySEC, in the Cayman Islands by the CIMA, and in Vanuatu by the VFSC. While regulations alone are not enough, the CySEC and the ASIC are two of the best regulators in the market. Companies have to follow strict laws and regulations before acquiring a license from these two organizations.

Admiral Markets

There are many trading instruments available to clients for trading on the Admiral Markets broker site. Traders can invest in CFDs on forex, commodities, indices, stocks, ETFs, and bonds. Clients trade these assets on world-class platforms including MT4, MT5, MetaTrader WebTrader, and Admirals Mobile App.

Evidently, the fast order execution time is an attractive feature of Admiral Markets. Another attractive feature of this broker is the spreads it offers. The spreads on this broker site depend on the account a client is using. The Trade.MT5 account has spreads starting from as low as 0.5 pips on major currency pairs. This is the main trading account on Admiral Markets. The other accounts feature spreads starting from 0.0 pips with commissions paid. The commissions range from $1.8 to $3 per lot depending on the account. Fore regulations, this company has licenses from reputable organisations including the FCA, the CySEC, the ASFL, the JSC, and the FSCA. Having several regulatory licences allows a broker to operate freely within multiple jurisdictions.

IC Markets

IC Markets allows investors to trade CFDs on commodities, indices, futures, stocks, and metals. Traders interested in diversifying their portfolios will not have to leave IC Markets to invest in multiple markets. This is a bonus for all kinds of traders. The trading platforms available on the IC Markets trading site include MT4, MT5, and cTrader. These platforms have some of the fastest order execution times. Consequently, the company promises ultra-fast processing, ensuring investors do not miss out on potentially profitable traders

Further, the spreads on this platform are manageable and fairly low. The spreads on the standard account start from 0.6 pips for major currency pairs. These are some of the lowest spreads you will see in the market. Finally, IC Markets is under the supervision of several regulators. These include the CySEC in Cyprus, the ASIC in Australia, and the FSA in Seychelles.

Use A VPS to Mitigate Latency

Latency is the delay between a command entered by a user and the execution of the command by a computer. A good example of latency is the time taken for a computer to open a buy order that an investor has just placed. It can be caused by hardware issues, internet issues, system errors and more.

Unfortunately, latency can lead to slower order execution on some broker sites. However, using a Virtual Private Server can help mitigate some of the problems that cause latency and hence potentially increase the success of traders on markets. Notably, there are forex brokers with free VPS offers to their clients provided they meet some terms and conditions. Such brokers might have faster order execution times due to reduced latency.

Conclusion on Brokers With the Fastest Execution Speed

It is no surprise that the brokers with the fastest execution speeds offer some of the best trading platforms in the market. For starters, most such brokers offer MetaTrader 4 and MetaTrader 5 alongside others. The MetaTrader platforms are widely considered the fastest platforms in the world. Understandably, brokers featuring these platforms have fast order execution times.

Additionally, some of the brokers that execute orders fast are no-dealing desk brokers. This allows them to match traders directly to liquidity providers reducing the processing time. Nonetheless, these brokers both have upsides and downsides. We encourage our readers to always pick and choose brokers that best suit their trading needs. Better yet, investors should always trade with brokers that have regulations from reputable organizations as it is always a safer bet.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.