Best ECN Forex Brokers - List

ECN stands for Electronic Communication Network. ECN brokers use Electronic Communication Networks to connect buyers to liquidity providers in the market. Essentially, such brokers match buy orders to sell orders. Hence, ECN brokers eliminate middlemen in the market. This is not the only advantage associated with ECN brokers. Before we are going to review what are some of the best ECN brokers in the market we shall take a look at the main pros and cons of ECN brokers.

Advantages of ECN Brokers

- ECN brokers allow clients to trade at all times. Most brokers have trading hours when markets are active. ECN brokers allow clients to trade even outside market hours.

- ECN brokers offer more transparency to traders. Clients can access all the market information, including prices and orders.

- Order execution on ECN brokers is very fast. Once you identify a favourable order, the execution is lightning-fast.

- ECN brokers offer tight spreads to traders. ECN brokers allow traders to have more control of trading conditions. This can lead to some of the tightest spreads in the market.

- High liquidity is also associated with ECN brokers. Many traders are willing to match buy orders on ECN broker sites.

- High liquidity on ECN brokers can lead to fairly low spreads.

- Trading on ECN accounts offers clients anonymity in the market.

Disadvantages of ECN Brokers

- While spreads might be low on ECN brokers, commissions can be very high. This leads to higher trading costs.

- ECN accounts might not be suitable for beginner traders.

- High deposit amounts are associated with ECN brokers. This can increase the cost of trading.

Our Criteria For the ECN Broker List

In this review, we will consider the following while choosing our ECN broker list.

- The forex broker has to offer ECN accounts. This is a given.

- The trading fees involved. We always have to consider the trading fees on a platform.

- Trading instruments available. A wide variety of trading instruments is a good bonus of any broker.

- The regulatory status of a broker. Regulated brokers are more reputable in the market than unregulated ones.

Now, below is our ECN broker list.

Pepperstone

Pepperstone is an ECN broker with attractive features to traders. The company does not run any proprietary trading book. Instead, it sources pricing from external liquidity providers. There are two main trading accounts on Pepperstone. The standard trading account offers clients spreads starting from 1.0 pips for some major currency pairs with no commission paid.

On the other, the Razor account has raw spreads starting from 0.0 pips and low commissions. The commission depends on what trading platform you use. For instance, clients using MT4, MT5 or TradingView pay a commission of $3.50 per side per lot. On the other hand, clients using the cTrader commission account pay a commission of $3 per side per lot.

There are over 1,200 CFDs available for trading on Pepperstone. Clients can trade instruments from the forex, shares, ETFs, indices, commodities, and cryptocurrency markets. This variety of trading options is a characteristic of professional brokers who want to accommodate all kinds of traders. Another attractive feature of Pepperstone is its regulatory status. The FCA regulates this broker in the UK, BaFin in Germany, and the ASIC in Australia. These are some of the best regulators in the market. You are always safer investing with companies with regulations from reputable institutions.

There are over 1,200 CFDs available for trading on Pepperstone. Clients can trade instruments from the forex, shares, ETFs, indices, commodities, and cryptocurrency markets. This variety of trading options is a characteristic of professional brokers who want to accommodate all kinds of traders. Another attractive feature of Pepperstone is its regulatory status. The FCA regulates this broker in the UK, BaFin in Germany, and the ASIC in Australia. These are some of the best regulators in the market. You are always safer investing with companies with regulations from reputable institutions.

75.3% of retail CFD accounts lose money

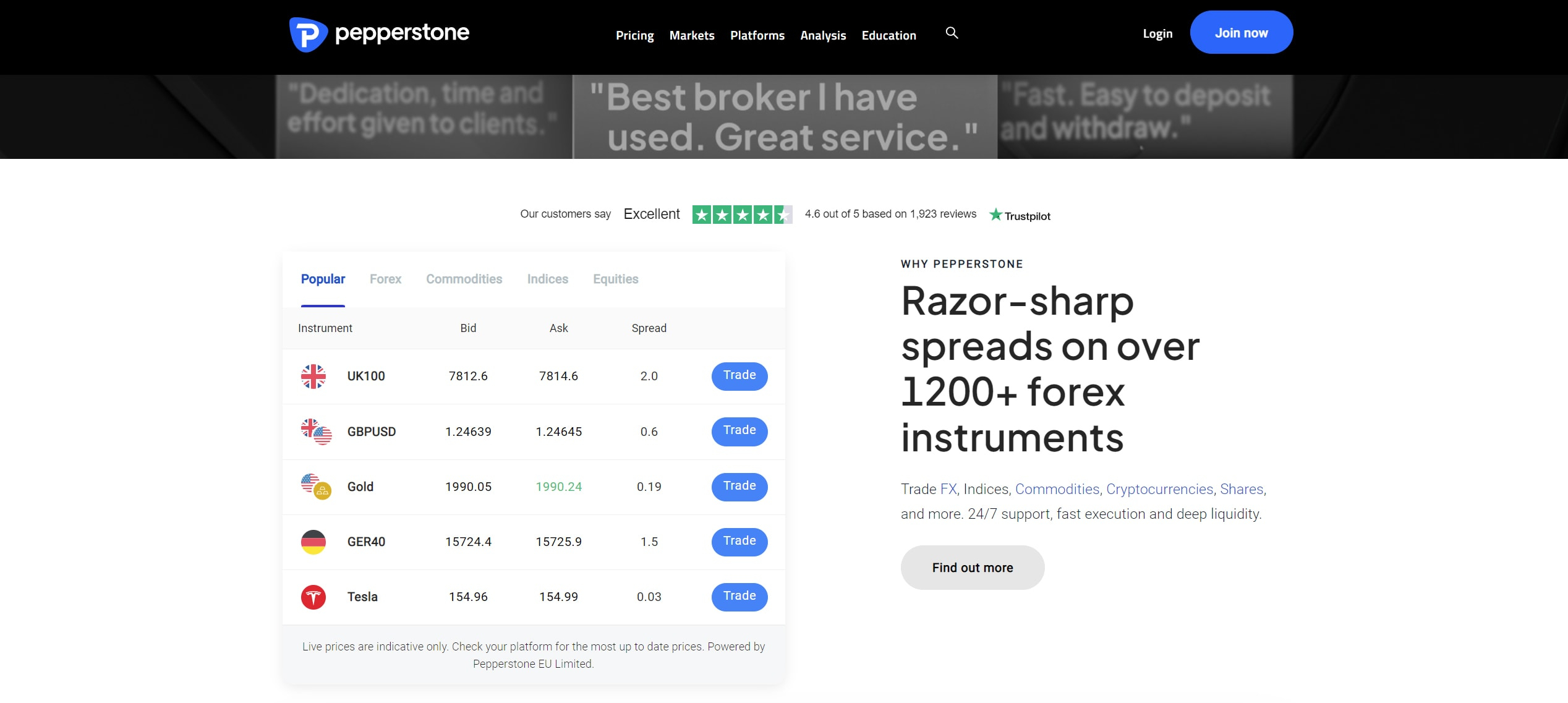

FP Markets

FP Markets is a popular forex broker that offers clients ECN accounts. Here, clients get a choice between two main accounts. These include the Standard and the Raw accounts. Both of these are ECN accounts. The Standard account offers traders spreads starting from 1.0 pips and no commissions on trading. On the other hand, the Raw account comes with spreads starting from 0.0 pips and a commission of $3 per lot per side. The minimum deposit on both of these accounts is 100 USD or equivalent.

In our reviews, we always look at a company's regulatory status. This is one of the most crucial things to consider before investing. Generally, regulated companies are more trustworthy than unregulated ones. Luckily, FP Markets has regulations from two of the best regulators in the market today. These are the ASIC in Australia and the CySEC in Cyprus.

Further, it is very easy to diversify your assets on FP Markets. This is because there are a variety of trading instruments across various markets available on this platform. Traders can access instruments from the forex, stocks, metals, commodities, indices, cryptocurrencies, bonds, and ETF markets. In total, there are over 10,000 CFDs on FP Markets. To trade these instruments, traders can use MetaTrader 4, MetaTrader 5, TradingView or cTrader.

72.44% of retail CFD accounts lose money

Exness

Exness is one of the best ECN brokers in the market today. The broker has two professional accounts from a minimum deposit of $500 that provide spreads as low as 0.0 pips and attract a low commission fee. These two accounts come with a plethora of impressive features for traders.

The first Zero spread account has spreads from 0.0 pips and a commission fee from $0.05 per side per lot. This account allows you to speculate on the top 30 instruments from the Forex, metals, cryptoсurrencies, energies, stocks and indices markets. The second account that also had spreads from as low as 0.0 pips, called the Raw Spread account, has a fixed commission per lot of up to $3.5 per side per lot. This account allows you to trade all the assets available at Exness (not just the top 30) from the forex, metals, cryptoсurrencies, energies, stocks and indices markets.

On top of that, Exness is a regulated broker in several jurisdictions. These include the FSCA, the FSC, the CySEC, and the FCA. It is always better to invest with forex brokers that have regulations. Better yet, brokers with regulations in several jurisdictions are less likely to defraud their clients. Moreover, traders have access to some of the best retail forex trading platforms in the world. These include the Exness Trader, MetaTrader 4, and MetaTrader 5. These come with a plethora of tools to support clients in their trading.

Remember that forex and CFDs available at Exness are leveraged products and can result in the loss of your entire capital. Please ensure you fully understand the risks involved.

Forex.com

While Forex.com is primarily a market maker broker, it offers clients a commission account with ECN-like trading conditions. This account gives clients flexibility when trading and ultra-low spreads starting from 0.2 pips for the EURUSD pair. The commission on this account stands at $5 per 100k traded. Forex.com claims that traders can lower their trading costs by up to 15% on this commission account.

There are many assets available to clients on Forex.com. Traders from most countries can trade Forex and CFDs on stocks, commodities, cryptos and indices while US traders can trade over 80 currency pairs, Futures and Futures Options. These are some of the most active markets online. Hence, Forex.com accommodates different kinds of traders on its platform, whether they want to trade in a single market or diversify their portfolios.

Luckily, Forex.com has ample regulations in various jurisdictions. The company has authorization and licenses from the CFTC, the NFA, the FCA, the CIMA, and the FFAJ. These are some of the most reputable regulators in the market. This suggests that Forex.com plays by the book, avoiding any criminal activities. Traders on Forex.com have access to two of the best trading platforms in the industry. They can use the MetaTrader 4 or the MetaTrader 5 in their trading. These platforms have a wide range of charting tools to support clients in their activities.

76-77% of retail investor accounts lose money when trading CFDs with this provider.

IC Markets

IC Markets is a broker that offers clients an ECN pricing model on its website. IC Markets has three main accounts: the Standard account and two Raw Spread accounts. The Standard account allows clients to trade on Spread based conditions. The spreads on this account start from 0.6 pips for major currency pairs. On the other hand, the Raw Spread accounts feature a commission when trading. One of the accounts is only available on the cTrader trading platform. This account features a commission of $3 per $100,000 traded and spreads starting from 0.0 pips. The other account is available on the MetaTrader platforms. This account comes with a commission of $3.5 per side per lot.

Traders can trade CFDs on commodities, indices, over 65 currency pairs, futures, stocks, and metals. Seeing this, traders interested in diversifying their portfolios will not have to leave IC Markets to invest in multiple markets. This is a bonus for all kinds of traders. IC Markets is under the supervision of several regulators. These include the CySEC in Cyprus, the ASIC in Australia, and the FSA in Seychelles. Regulation on its own is not assurance that a company does not operate criminally. However, this company’s longevity in the market and reputation give it good standing among traders.

Vantage Markets

Vantage Markets is a globally recognized and regulated broker offering an ECN account to its clients. The company promises clients the lowest commissions on this ECN account. Traders pay a commission of $3 per side per lot. Additionally, the spreads on this account are very low starting from 0.0 pips. The minimum deposit for this account is $50 and the maximum leverage is 1:500. This makes Vantage Markets one of the highest leverage forex brokers in the market.

On this platform, you can choose from more than 1,000 different assets to invest in. People can trade CFDs on forex, indices, precious metals, commodities, energy, ETFs, shares, and bonds. Not all traders want to invest in multiple markets. However, it is great to know that this option is available to those who want to diversify their portfolios. We always look at the regulatory status of brokers. Regulated brokers are more reputable and offer better services than unregulated brokers. Fortunately, Vantage Markets is a regulated company. It is regulated by the ASIC in Australia, the CySEC in Cyprus, the CIMA in the Cayman Islands, and the VFSC in Vanuatu.

Finally, Vantage Markets has a plethora of powerful trading platforms available to clients. They have the Vantage App, MT4 and MT5, the Protrader, and WebTrader available. All these are industry standard and powerful trading tools. Traders can pick and choose the trading platform that best suits their trading needs.

Roboforex

Roboforex is a forex and CFDs broker with over 10 years of experience in the market. The company offers two of the best ECN accounts to traders, the ECN account and the Prime account. These accounts allow clients to trade with ultra-low spreads starting from 0.0 pips. As expected, both of these accounts require clients to pay a commission when trading. The ECN account requires a commission of $20 while the Prime account charges a commission of $10 and above.

The assets available for trading on the ECN account include 36 different currency pairs, metals, and cryptocurrencies. In contrast, the Prime account only features 28 currency pairs, metals, and cryptocurrencies. The trading platforms available to clients include the R WebTrader and R MobileTrader, R StocksTrader, MetaTrader 4, and MetaTrader 5. These are some of the best trading platforms in the world. Luckily, Roboforex has regulatory licenses from two regulators in the industry. These include the CySEC in Cyprus and the FSC in Belize. Regulation on its own is not an assurance of a clean cut forex broker. However, regulated brokers are much safer to trade with than unregulated brokers.

FXTM

FXTM boasts of having the best ECN accounts in the industry today. The company provides clients with the best trading platforms in the market. Traders have access to the MT4, MT5, and the FXTM Trader trading platforms at their disposal. These are powerful and responsive trading platforms with many tools to help traders in their trading journey. The ECN account also comes with some of the lowest spreads in the market. The spreads on this account can go as low as 0.0 pips for major currency pairs. However, there is a commission involved. Traders pay an average commission of $0.4 to $2 depending on the volume. The commission is variable on this platform and traders should be aware of the fees involved.

Further, there are a variety of trading instruments available to traders to invest in. They can invest in assets in the forex, metals, commodities, indices, forex indices, stocks, stock baskets, and stock CFDs. Therefore, traders can comfortably diversify their investments. Finally, we look at the regulation of FXTM. FXTM has regulations from two of the best watchdogs in the industry, the FCA in the UK and the CySEC in Cyprus. Regulated companies have the best reputation in the market for a reason. Regulations from multiple regulators show that a company is committed to obeying the rule of law.

InstaForex

InstaForex is one of the most popular ECN brokers in the market today. Here, clients have 24-hour access to ECN trading due to the high internal liquidity rate. There are four main accounts on InstaForex. These include the Insta.Standard, the Insta.Eurica, the Cent.Standard, and the Cent.Eurica accounts. Boh the Insta.Standard and Cent.Standard accounts are spread-based. The spreads on these accounts range from 3 to 7 pips. On the other hand, the insta.Eurica and Cent.Eurica accounts are commission based. Clients on this account pay a fee of 0.03% to 0.07%. All of these accounts have access to a variety of trading instruments. Clients can invest in assets in the forex, shares, indices, metals, oil and gas, commodity futures, crypto, and Instafutures.

This is a great collection of trading instruments for clients wishing to invest in multiple markets. Regarding trading platforms, InstaForex delivers multiple software to pick from. Clients have access to the MetaTrader 4, MetaTrader 5, Multiterminal, WebTrader, and InstaTick Trader. They can pick and choose the trading platform that best suits their trading needs. Fortunately enough, InstaForex is a regulated broker in multiple countries. The company has authorization and regulations in Cyprus by the CySEC, in the British Virgin Islands by the BVIFSC, and in St Vincent and the Grenadines by the FSC. Note that regulation alone is not assurance for fund safety. However, trading with unregulated brokers is a bad idea. You are much safer with brokers with top-notch watchdogs keeping them in check.

Final Thoughts on Our ECN Broker List

There are a lot of advantages associated with ECN brokers. They offer a level of anonymity and control that is not available at other types of brokers. Additionally, these brokers have some of the fastest order execution times in the market. In this review, we presented some of the best ECN brokers in the market today. Evidently, the brokers on this list offer some of the best trading conditions in the market. They have favourably low fees and a plethora of trading instruments. Additionally, they offer the best trading platforms in the market.

However, this is not an exhaustive list. There are other reputable brokers that did not make it to this list. Make sure you do your research before picking the broker that best suits your needs. The brokers on this list are a good place to start. These are regulated platforms with great offerings to their clients.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.