eToro Review - the Pioneer of Online Social Trading

This time, we are reviewing the eToro company and its social trading platform. Let’s have a look at how it works, what it offers and what the fees are.

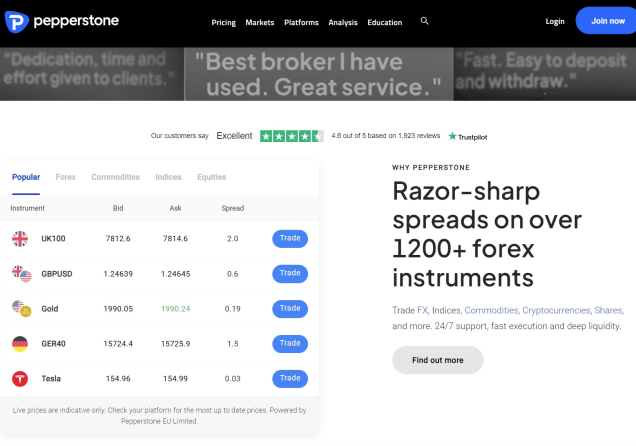

eToro is a modern trading and investing provider that ranks among the top social trading networks in the world. The company, founded back in 2007, offers a trading solution for both experienced and inexperienced traders who can benefit from its tight spreads, a free demo account, and an all-inclusive trading platform. Each client can trade on his own or take advantage of the CopyTrader™ system that allows users to follow and copy top-performing traders on the platform. As far as the regulation of the company is concerned, eToro adheres to the strict guidelines of the tier one regulator, the UK's FCA, and of the CySEC and ASIC.

| General Risk Warning: 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. |

Detailed information about eToro

- Website address: www.eToro.com

- Instruments: Stocks and Cryptocurrencies (Real underlying assets), CFDs - Forex, stocks, commodities, indices, ETFs

- Minimum deposit: from $50 (depending on your country of residence)

- Demo account: Yes, free of charge

- Methods of deposit and withdrawal: Debit cards, Wire transfer, Skrill, Neteller

eToro trading platform

The eToro trading platform is suitable for day traders as well as for long-term investors. Clients lacking experience or time can use the eToro social trading network to follow and copy the moves of the top-performing traders on the platform by using the CopyTrader ™ system. This technology replicates all the trading activity of a selected trader. You can choose the trader you want to copy based on their past performance, risk score, portfolio diversity and much more. Experienced traders who decide to lead other investors can, apart from their earnings, also receive an additional 1.5% profit reward of their Assets Under Management (AUM). The more successful they are, the higher their position on the ladder board is and the more people copy their trades. The eToro trading platform is very intuitive and you can give it a shot using a free demo account credited with $100,000 virtual money.

eToro Fees

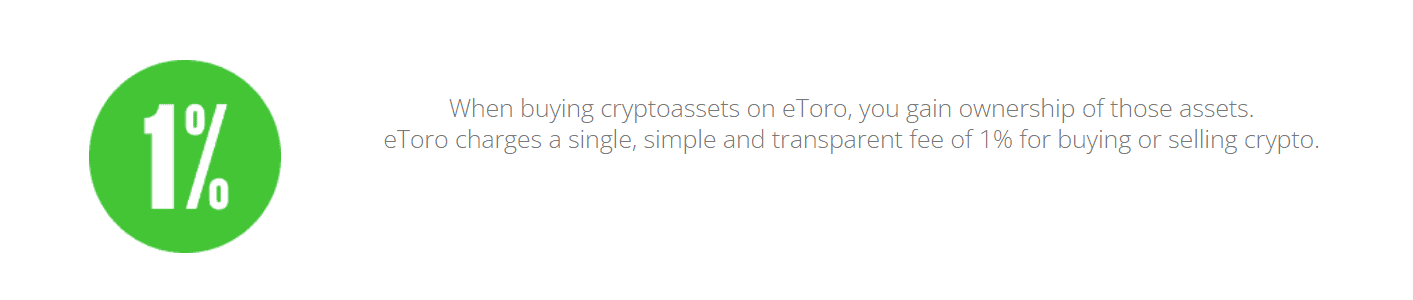

As a regulated company, the eToro platform is committed to full transparency, which means there are no hidden fees to watch for. To make all the fee information easily accessible, eToro created an individual Market Hours & Fees page featuring its rates. For instance, they have recently unified their crypto fees to be more straightforward and transparent and crypto users will now pay a single fixed fee of 1% when trading any coin, on top of the market price (AKA Bid-Ask spread) for each BUY and SELL crypto position. To be aware of the current fees in place, make sure to check their Fees page regularly to stay updated about the current fees (as fees are subject to change).

Cryptocurrencies on the eToro platform

In total, eToro features 70 crypto pairs, this number, however, changes frequently as new ones are added nearly every week. These include Bitcoin, Ethereum, SHIB, MANA, Ripple, Dash, Litecoin, Cardano, IOTA, Stellar, EOS, NEO, ZCASH, Binance Coin, Tron, Tezos and many others.

Traders can trade these popular cryptocurrencies not only against the dollar but also against other fiat currencies (BTC/EUR, BTC/GBP, ETH/EUR, ETH/GBP, EOS/GBP, EOS/JPY, XRP/GBP, XRP/JPY) or digital coins (ETH/BTC, ETH/EOS, ETH/XLM, BTC/EOS, BTC/XLM, EOS/XLM). (Limited availability to FCA customers). So in total, there are 30 tradable cryptocurrency pairs.

Interesting facts

# eToro is the first-ever company to pay for a Premier League partnership in bitcoin. It is now a partner of 6 prestigious English football clubs - Tottenham Hotspur, Brighton & Hove Albion F.C., Cardiff City F.C., Crystal Palace F.C., Leicester City F.C., Newcastle United F.C. and Southampton F.C.

# In June 2021, eToro reached 20 million registered users

Conclusion - Is eToro a good and safe option?

eToro offers a unique trading platform suitable for both experienced and inexperienced traders who can benefit from using the world's leading social network. The platform is fairly easy to use and I did not experience any freezing or other problems when trading myself without using the copy system. eToro is a credible company subjected to regulatory oversight of the Cyprus Securities Exchange Commission (CySEC, license number 109/10), The Financial Conduct Authority (FCA, license no. 583263.), and the Australian Securities and Investments Commission (ASIC, ABN 66 612 791 803).

I recommend testing eToro and its social trading network using a free demo account that can be set up in no time.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

Your review can make a difference to other traders, please leave a comment if you have any personal experience with eToro.

Regulated Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.