Pepperstone Review – What to expect from the broker

In this review, we introduce a popular broker called Pepperstone and review what to expect from the company. We will especially look at the trading conditions and the company’s background. Let’s jump in.

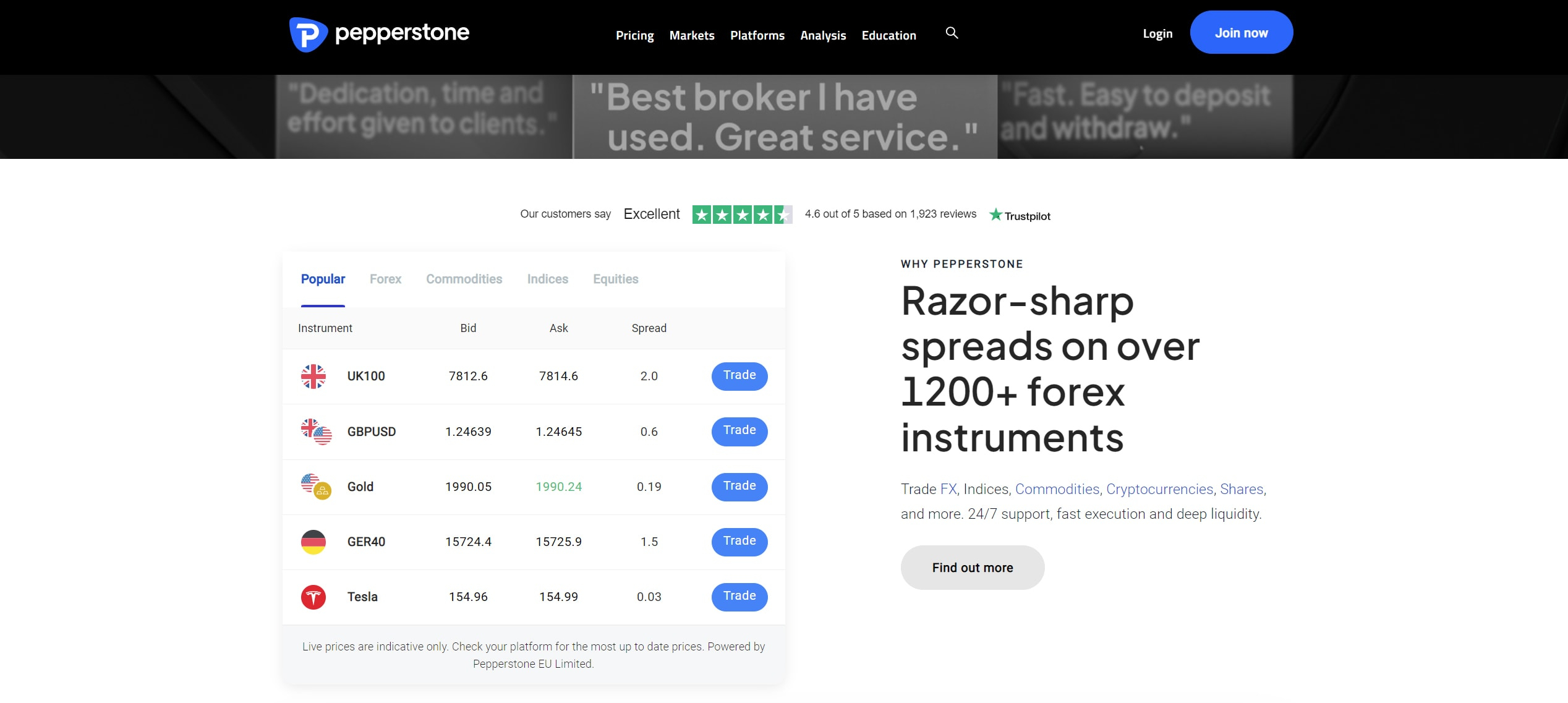

Pepperstone is a global CFDs broker that was voted TradingView Broker of The Year 2022 in the TradingView Broker Awards. With this broker, clients can trade over 1,200 CFDs from a variety of global markets. These include forex currency pairs, shares, indices, ETFs, commodities, and currency indices.

| General Risk Warning: 75.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. |

Basic Information About Pepperstone

- Website Address: http://www.pepperstone.com

- Instruments: CFDs - Forex, shares, indices, ETFs, commodities, and currency indices.

- Minimum Deposit: No minimum deposit, account base currencies: USD, EUR, GBP, CHF

- Demo Account: Yes.

- Methods of Deposit and Withdrawal: Visa, MasterCard, bank transfer, MPESA and PayPal.

Trading Platforms On Pepperstone

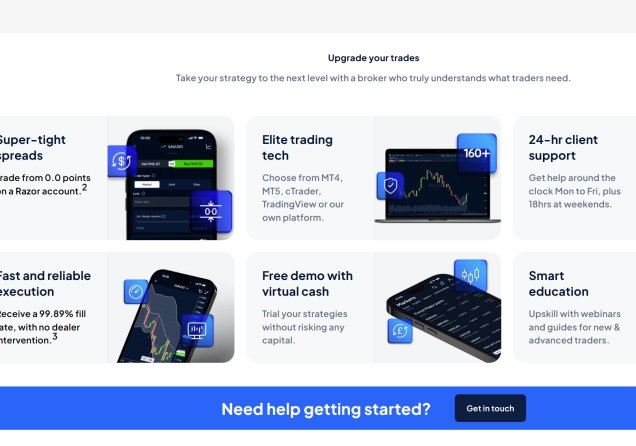

Pepperstone offers four main trading platforms and a wide range of tools to support clients in their trading. The four main platforms available include TradingView, MetaTrader 4, MetaTrader 5 and cTrader. Also, these tools are available on Windows and MacOS for desktops and on Android and iOS for mobile and tablets. Additionally, clients can trade on the web via WebTrader.

The MetaTrader platforms are well-designed to be user-friendly and also offer a wide range of features such as interactive charts and charting tools, expert advisors, and custom indicators just to name a few. Both beginners and seasoned professionals will find these platforms appealing and quite easy to use. Nonetheless, they can still choose to use the revolutionary TradingView and cTrader platforms.

These trading platforms have some of the fastest order execution speeds. Consequently, Pepperstone promises clients ultra-fast order execution. Most orders are executed in under 30 milliseconds for clients of Pepperstone Group Limited and in under 60 milliseconds for clients of Pepperstone Limited. Clients accessing the Australian branch of the company are served by Pepperstone Group Limited, while clients from other regions, including the UK, Europe, Africa, and other jurisdictions, are served by Pepperstone Limited.

Further, clients have a number of trading tools to assist them in their trading activities. These include two top market analysis tools, Capitalise.ai and Autochartist. It also includes Social trading tools like Myfxbook AutoTrade, MetaTrader Signals, and DupliTrade.

Trading Instruments

As mentioned, Pepperstone offers over 1,200 CFDs on forex, commodities, indices, cryptocurrencies, shares and ETFs.

- Forex: Pepperstone offers clients over 60 currency pairs with no dealing or intervention desk required. The broker features majors like EURUSD, minors like CADJPY, and a plethora of exotics like USDZAR.

- Commodities: Clients can trade a wide range of commodities such as gold, silver, crude oil, and natural gas, among others.

- Indices: Pepperstone offers a wide range of trading instruments in this market. This includes US Tech 100, CANADA 60, US Wall Street 30 and US 2000 just to list a few.

- Shares: A wide range of US, UK, AU and German shares are available on this platform.

- EFTs: There is a huge collection of Exchange-traded funds available to invest in on Pepperstone. These come from a variety of markets including Asia and Pacific, North America, Africa, Emerging Markets, and more.

- Cryptocurrencies: Pepperstone supports the trading of 21 different crypto CFDs (Crypto CFDs are only available to professional customers in the UK).

Pepperstone Demo Account

A demo account is very vital for clients before embarking on an actual live account as it helps clients to polish their skills and to familiarize themselves with a broker’s services. Most top-tier brokers make sure they avail a demo account to their clients.

The demo account comes with a minimum of 200 USD/GBP virtual funds and a maximum of 50000 USD/GBP virtual funds to practice your trading. Clients can select the amount to start with via a drop-down menu found on the sign-up page. Point to note, MT4 and MT5 demo accounts expire automatically after 30 days unless a client has a live funded account and requests the company to set the demo account to non-expiry. cTrader demo accounts will not expire if they are logged into at least once every 30 days.

Fees and Spreads

ECN brokers normally have lower spreads as they match buy orders directly to liquidity providers. As an ECN broker, Pepperstone offers fairly low spreads that start from 1.0 pips on major currency pairs with no commissions paid on the standard account. However, clients can trade forex on even lower spreads on the Razor account. Specifically, the razor account has spreads as low as 0.0 pips and a low commission paid. The commission on this account is €2.60 per side per lot for forex trading, or $3.50 if your base account currency is in USD, for traders using the MT4 or MT5 platforms.

Forex traders using cTrader pay a commission of $3.00 per side per lot, while TradingView users are charged $3.50 per side per lot. If your trading account is not held in USD but, for example, in EUR, the commission will be converted to your account currency at the spot rate. For all other instruments (except forex), spreads and trading conditions remain identical across the Standard and Razor accounts.

| Standard account | EUR/USD | GBP/USD | USD/JPY |

| Average spreads | 1.0 pips | 1.3 pips | 1.4 pips |

| Minimum spreads | 1.0 pip | 1.0 pip | 1.0 pip |

| Razor account | EUR/USD | GBP/USD | USD/JPY |

| Average spreads | 0.0 pips | 0.3 pips | 0.4 pips |

| Minimum spreads | 0.0 pips | 0.0 pips | 0.0 pips |

*Spreads recorded on 01.11.2024 at 10:00 GMT from the official website of the broker.

Other fees that also apply include Swaps which differ depending on the instrument a client is trading. A Swap fee is a rollover fee charged for holding positions overnight. Clients can find the different Swap rates on Pepperstone’s website under pricing.

Pepperstone Credibility

Traders are advised to only trade with well-regulated companies. This is because regulated companies have organizations watching their every activity to ensure they are fair to the traders. Luckily, Pepperstone is licensed and regulated by the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC) in Australia, and the Cyprus Securities and Exchange Commission (CySEC) in Cyprus.

On top of that, it is regulated by the Federal Financial Supervisory Authority in Germany (Bafin), the Capital Markets Authority in Kenya (CMA), and the Dubai Financial Services Authority in Dubai (DFSA). This regulatory status is one of the things that improves the legitimacy case of the broker.Moreover, Pepperstone is greatly regulated online. The company enjoys a high rating of 4.6 out of 5 stars after 1923 reviews on Trustpilot. This shows that most of the clients enjoy the services offered by Pepperstone.

Education Section on Pepperstone

For beginner traders, financial markets can present a huge challenge to enter and succeed. While it takes time to develop successful trading strategies, brokers can provide education sections that can give such traders a head start in the market. Additionally, seasoned traders can also use such a section to improve their trading strategies.

On the Pepperstone site, clients have access to many educational materials including educational videos, trading guides and webinars. Additionally, they have access to informational material that introduces them to basic concepts of different markets. There is even a course on how to trade with MT4 which can greatly help reduce the learning curve of new traders.

The Conclusion of Our Pepperstone Review

Pepperstone has a lot of good things going for it. For starters, it is well-regulated in multiple jurisdictions. A company having ample regulations is of high priority to us. Additionally, Pepperstone is an ECN broker that matches clients directly with liquidity providers. This comes with several advantages enjoyed by the traders. Finally, the company offers a wide range of trading instruments with industry-standard trading costs applied.

If these features fit your trading needs, you can sign up with the company to see what it offers. Moreover, you can use their free demo account to first test out the services before you commit any real cash.

75.3% of retail CFD accounts lose money

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.