Non-Expiring MT4 Demo Account

Demo accounts are a crucial part of forex trading. They allow traders to test out a broker before making an investment. Additionally, they allow traders to try out new trading strategies without putting their money on the line. Non-expiring demo accounts are even better. Traders always have access to these accounts, which means they can come back at any time to test out new trading strategies.

Most forex brokers in the world provide demo accounts to their clients. The only problem is that the demo accounts on most of these brokers expire after a while, usually after a month. In this review, we will look at some of the best forex brokers that offer non-expiring MT4 demo accounts.

FP Markets

FP Markets is widely recognized as a top-tier Forex and CFD broker, known for its robust regulatory framework, extensive range of tradable assets, advanced platforms, and competitive spreads. Notably, FP Markets offers a demo account that is available on all four of its trading platforms: MT4, MT5, cTrader, and TradingView.

Unlike many brokers, FP Markets' demo accounts have no fixed expiration period, allowing you to use them indefinitely as long as the account remains active. However, it’s important to note that all demo accounts may be deactivated after 30 days of inactivity. Provided you remain active on them, they will, however, never expire.

Clients can invest in forex currencies and CFDs in shares, metals, commodities, indices, cryptocurrencies, bonds, and ETFs. Forex traders have here over 60 currency pairs, while crypto traders have 11 different crypto assets clients can trade against the US Dollar. In total, there are over 10,000 trading instruments on FP Markets.

The spreads on FP Markets are competitive and reasonably low. The spreads on the standard account can go as low as 1.0 pips for major currency pairs. Clients looking to trade with ultra-low spreads can use the Raw ECN account with spreads starting from 0.0 pips. The Raw ECN account charges clients reasonably low commissions when trading financial markets.

The regulatory status of FP Markets does not disappoint. The company has licenses and regulations from the CySEC in Cyprus and the ASIC in Australia. These are two of the best regulators in the markets today.

72.44% of retail CFD accounts lose money

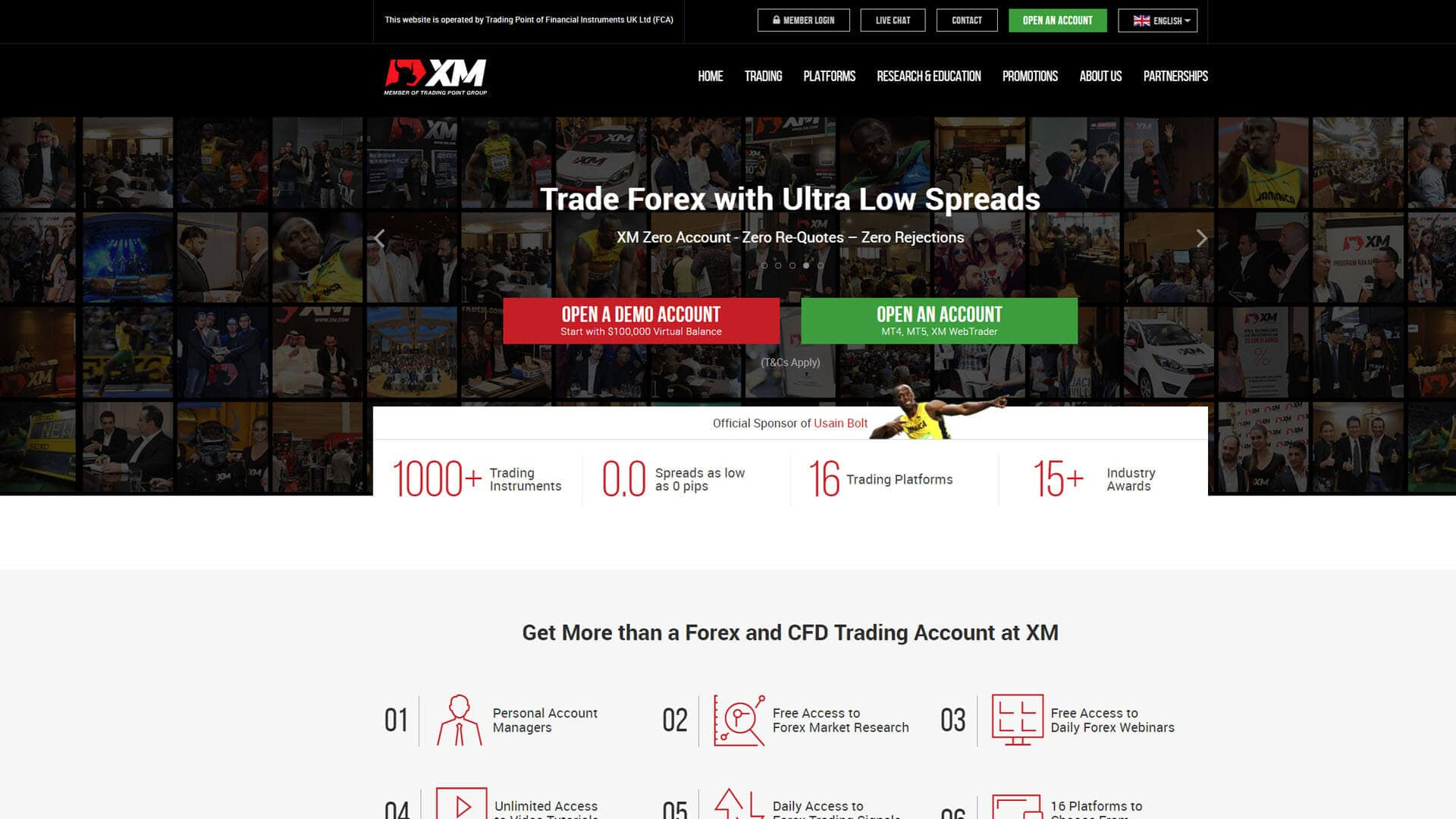

XM

XM offers clients a free demo account that they can use as long as they want. This account comes with $100,000 worth of virtual currency to trade. This allows traders to practice trading strategies and test features without risking real money. This account is available on MT4, MT5, and even the XM trading app. The spreads on XM are industry standard and competitive.

There are three account types that come with different spreads. For example, the standard account has a spread of 1.6 pips for the EUR/USD pair. However, there is no commission for this account. On XM, clients can trade over 1,000 trading instruments. These fall under 8 different markets. These include CFDs on forex, stocks, indices, shares, cryptocurrency, commodities, precious metals, and energies.

XM is under the strict regulation of two main organizations including the CySEC, and the ASIC. This means that the company can operate in many countries within the EU without any problems. Regulations are crucial to protect investors in financial markets. However, they are not enough. Companies still need to demonstrate they can follow the rule of law.

75.18% of retail investor accounts lose money when trading CFDs with this provider.

Libertex

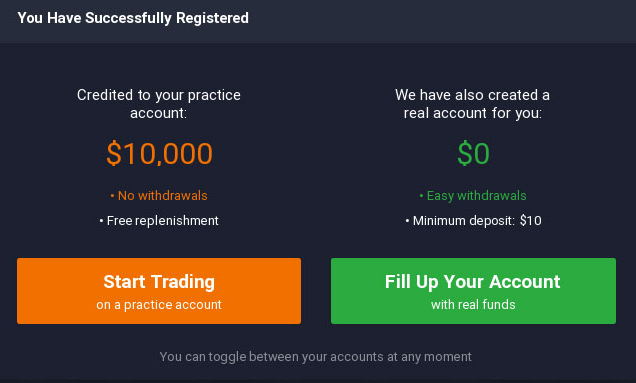

A free MT4 demo account is also available on Libertex for as long as traders wish. The company starts clients on a $50,000 balance that they can top up at any time. The account is always available to clients who want to practice trading strategies and assess risk levels before deploying them in the real market. This account is also available on the Libertex trading platform. Some of the trading instruments investors can trade on Libertex CFDs on forex, stocks, metals, oil and gas, ETFs, and cryptocurrencies. This is a great place for investors to diversify their accounts. However, traders should know the risks involved in trading CFDs. Over 75% of retail investor accounts lose money when trading CFDs.

There are a lot of perks and flexibility for traders using professional accounts on Libertex. Libertex follows the strict regulatory guidelines of the CySEC in Cyprus. This regulation allows Libertex to operate in many jurisdictions within Europe. CySEC is one of the best regulators in the market today. This is one feature that attracts many traders to Libertex.

OANDA US

OANDA US gives clients access to an unlimited free demo MT4 account to test out the platform and trading strategies under real market conditions. Clients can reset or adjust their 10,000-unit starting balance at any time. They can also change the leverage and use flexible trade sizes to test their comfort levels. There are a variety of trading instruments available on OANDA, and investors can practice trading them on the demo account. Investors have access to trading across more than 71 currency pairs. The OANDA Trade platform and the MT4 are both available on the demo account. Therefore, traders have unlimited access to an MT4 demo account that does not have any time limit expirations.

The spreads on OANDA are not exorbitant. They are fairly low, starting from 1 pip for major currency pairs. The demo account comes with the same conditions to mimic real market conditions for clients who want to test their trading strategies.

Forex trading involves significant risk of loss and is not suitable for all investors.

IG

IG’s demo account expires after 30 days but can be set to non-expiry upon request. Here, you will have access to CFDs on forex, indices, commodities, shares, cryptocurrencies, and more. They can trade these assets using MT4 alongside other platforms. This allows clients to test out the platforms on IG and the trading conditions it offers. The spreads on IG are not exorbitant and most traders will afford to trade on this platform. The average spreads on IG can fall as low as 0.6 pips for some major currency pairs. The spreads on the demo account are somewhat similar to mimic market conditions. However, note that these are not real market conditions. The live market can be more brutal no matter the success a trader experiences on the demo account.

IG is a regulated broker in a number of jurisdictions. The company is regulated by the FCA in the UK, the ASIC in Australia, and BaFin in Germany. These are great regulators with strict guidelines that brokers have to follow. Still, regulations alone are not enough. You still have to look at a company’s track record and ensure they have a history of following the law.

IC Markets

IC Markets is another broker that allows clients to keep their demo accounts as long as they are active. The demo accounts only expire after 30 days of inactivity. On this account, clients can trade CFDs on commodities, indices, futures, stocks, and metals. MetaTrader 4 and MetaTrader 5 are both available for clients to test out.

IC Markets has three main accounts: the Standard account and two Raw Spread accounts. The Standard account allows clients to trade on spreads starting from 0.6 pips for major currency pairs. On the other hand, the Raw Spread accounts feature a commission when trading. In Australia, IC Markets is under ASIC’s regulation under the ACN number 123 289 109. The company is also under the regulation of the CySEC in Cyprus and the FSA in Seychelles. Having regulations from two top-tier regulators, the ASIC and the CySEC, makes IC Markets stand out among most forex brokers in the market today.

InstaForex

InstaForex allows investors to trade CFDs on forex, shares, indices, metals, oil and gas, commodity futures, cryptocurrencies, and instafutures. This way, InstaForex accommodates a wide range of traders. Further, InstaForex offers a variety of trading accounts. It is one of the regulated brokers that offer PAMM accounts to their clients. Investors do not have to go straight into trading the live market on InstaForex. They can test out the broker and their trading strategies on a demo account. This demo account on InstaForex expires after 30 days of inactivity.

If a trader continues using it, the account remains active. The MT4 and the MT4 WebTerminal are both available to test out on this demo account. The spreads on InstaForex depend on the account a user is on. There are two main spread-based accounts, the Insta.Standard and the Cent.Standard accounts. The spreads on these accounts range from 3 to 7 pips. The Cent.Standard account is best suited for traders who want to invest small amounts at a time.

There are a number of reputable forex brokers that offer cent accounts to their clients. InstaForex has regulations from three organizations. These include the CySEC, the BVIFSC, and the FSC. On this list, the CySEC is noteworthy as it has some of the strongest regulatory laws compared to the others.

Vantage Markets

Closing out our list of non-expiring MT4 demo account brokers is Vantage Markets. This broker avails a demo account with virtual funds on the MetaTrader 4 and MetaTrader 5 with no expiry. Clients can come back to the account to test out their trading strategies at any time. The spreads on Vantage Markets depend on the account type a user is using. For example, the average spread on the Standard STP account is 1.4 pips.

The company also provides an ECN account based on commissions. Traders pay a commission of $3 per side per lot on this account. The demo account tries to emulate these market conditions as tightly as it can. Vantage Markets allows clients to invest in more than 1,000 different assets to invest in. People can trade CFDs on forex, indices, precious metals, commodities, energy, ETFs, shares, and bonds. All these asset groups are available on the demo account which means that clients can practice diversifying their accounts.

In terms of regulations, Vantage Markets is a regulated company in Australia by the ASIC, in Cyprus by the CySEC, in the Cayman Islands by the CIMA, and in Vanuatu by the VFSC. While regulations alone are not enough, the CySEC and the ASIC are two of the best regulators in the market. Companies have to follow strict laws and regulations before acquiring a license from these two organizations.

Conclusion on Non-Expiring MT4 Demo Account

Demo accounts are a necessity for both new and existing traders. They can test out a trading platform before investing their cash. Additionally, they can test out their trading strategies in a simulated market before deploying them in the live market. Most forex brokers try to emulate market conditions as tightly as they can on demo accounts.

However, traders should know that a simulated market is not the same as a live market. Some strategies that succeed in the virtual market might flop in the live market. This is because the live market is more brutal and price movement is triggered by a plethora of events happening in the real world. Traders should still understand the risks involved before investing their own money. In this review, we looked at some of the best non-expiring MT4 demo account brokers.

Our job is to kickstart the research for our readers. We still encourage you to do your own research before investing. Moreover, this list is not exhaustive. There are other reputable brokers that did not make it to our list.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.