Crypto Demo Account vs. Real Account - Psychology lesson

Trading conditions on the cryptocurrency market are rarely different when moving from a demo account to a real account. However, there is one thing that changes significantly and that is your mindset, i.e. your trading psychology. Most of the new cryptocurrency traders start their journey to break the routine and experience something new and exciting with the promise of a good profit. However, the excitement only lasts until they experience their first loss. Some can cope with loss better than others but no one is completely immune to the stress it brings about.

When reality does not meet expectations, anxiety rises and the vulnerability to hasty decisions is much greater. Although keeping emotions from influencing one’s decisions might seem easy, it is, in fact, an issue most cryptocurrency traders have to deal with. Thus, it is crucial to understand the two main aspects of cryptocurrency trading psychology. Just keep reading to find out more.

Keep your expectations real

To stay a confident and successful trader you need to know your limits and keep in your “comfort zone“ as stepping out of it can cause considerable distress. It is a fact that the less stressed you are, the better decisions you make and the more successful you become. Therefore, when you start losing your money it is important to stay as calm and focused as possible. Once the panic sets in, you are bound to make strategic mistakes resulting in an even greater loss.

The common mistake those new to cryptocurrency trading make is letting the panic get to them whenever there is a small problem. Many of them then practice the double-up strategy (martingale), meaning they invest double the amount of what they have lost hoping they can get their balance back to where it was. However, not only is this very risky, it just does not work in the long run. As many experienced traders say, learning to lose is the first step toward success.

Stay calm and focused

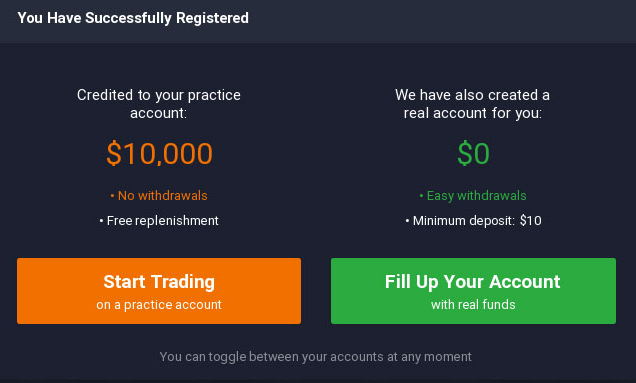

It is hard to get a real feel of the cryptocurrency market environment when starting as a demo account trader. It is the same as playing a poker game not using any real money. There is almost no stress, no pressure, and most importantly no responsibility for one’s actions.

Although cryptocurrency market conditions are no different using a demo account or a real account, users’ behaviour does change when transitioning from one to the other. To stay in perspective, keep in mind that what matters are your monthly results. Shift your focus from small gains and losses to seeing the bigger picture. In other words, your last trades’ outcomes say nothing about how successful you really are or can be.

Avoid greed and overexcitement

The other thing to watch for is your greediness which often stems from overexcitement over a recent successful trading streak. We can again draw a parallel between cryptocurrency trading and poker. It is super easy for a poker player to lose control over his emotions and let greed take over when his game leader position seems stable and unshakeable. With a feeling of complete victory within his reach, he is overflowing with confidence and starts to take more and more risks. The problem is he forgets about what has made him the leader and that is patience and consistency.

The situation is slightly different when trading, as your success does not depend so much on your luck. Though some may disagree, traders can to a great extent eliminate the luck factor if they stick to their pre-set strategy. Unfortunately, as many as 90% of traders do become overexcited easily and forget about the key principles that have made them successful – business strategy, money management, patience, and most importantly consistency.

Regulated Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.