IUX Broker Review - What to expect from the broker

IUX is an international CFD broker that offers traders access to over 230 different market instruments across various sectors. These include CFDs on forex currency pairs, stocks, commodities, indices, and cryptocurrencies. In this IUX.com review, we will explore the features this broker offers to its traders. We will examine the broker's range of market products, its trading platform, the spreads and fees it charges, and its regulatory status and credibility. Let’s dive in.

| General Risk Warning: 74–89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. |

Basic Information About IUX

- Website Address: iux.com

- Instruments: CFDs - Forex, metals, indices, energies, stocks, and cryptocurrencies.

- Minimum Deposit: $10

- Demo Account: Yes.

- Trading Platform: IUX App Trader, IUX Web Trader, MT5.

- Methods of Deposit and Withdrawal: Credit/Debit cards, Bank Transfers, MTN Mobile Money, G-Cash, Coins.ph, Union Pay, and Doku, among others.

Trading Platforms of IUX

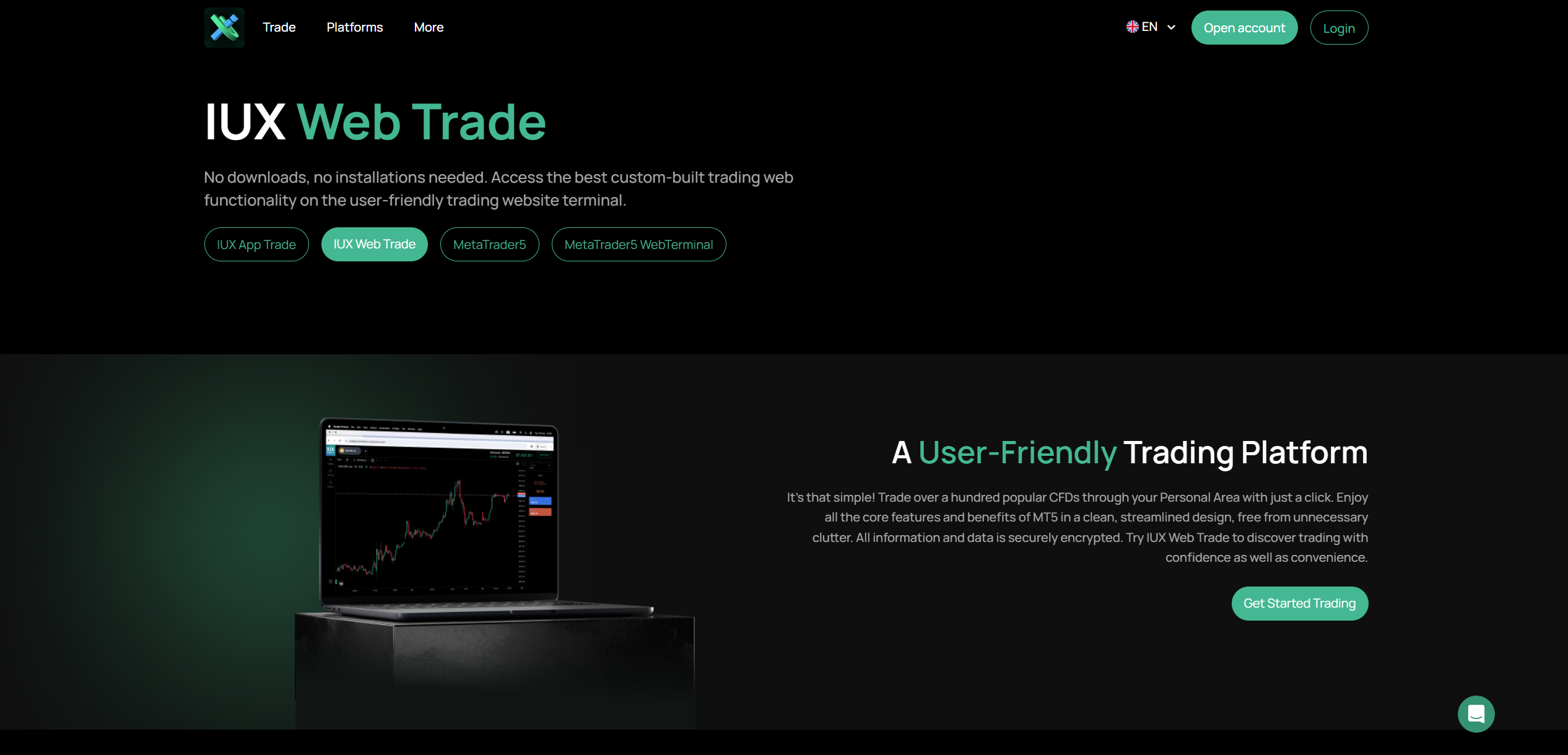

IUX offers its traders three main trading platforms depending on the trader's needs. First, the broker offers the IUX App Trader which allows investors to trade on the go directly. This app is fully customisable and fast-executing. It is user-friendly ensuring hassle-free trading for both beginner and experienced traders. The app is available for both iOS and Android users.

Additionally, IUX offers traders its IUX Web Trader which allows investors to execute trades without the need to download software. This platform is built on the core of MT5 bringing some of the core features of MT5 to traders. Its streamlined design allows investors to trade in an environment free from clutter. Its advanced charting tools allow traders to analyse markets with ease.

Finally, the broker offers the renowned MT5 platform which is used widely around the world. This platform is a top choice for modern traders due to its feature-rich and intuitive properties. On this platform, traders have access to over 80 technical indicators, 100 simultaneous charts, and a variety of free and ready-made tools for in-depth analysis.

Assets Available On IUX

IUX offers a good range of CFDs covering various major markets. In total, this broker allows its clients to access over 250 different market products. Here is a breakdown of the different market categories available:

- Forex - Traders can buy and sell a wide range of currency pairs, including major, minor, and exotic pairs. In total, there are over 90 different currency pairs to trade.

- Indices - The broker provides access to major global indices as well as some lesser-known indices. Some of the indices available on this broker site include the US30 index, the US Dollar Index, UK 100, and Germany 30, among others.

- Metals - IUX also gives its traders the opportunity to invest in precious metals like gold and silver.

- Commodities - Under this category, investors have access to assets such as oil, natural gas, and agricultural products.

- Stocks - IUX also allows traders to speculate on the price movements of a variety of global stocks. These include the stocks of companies like Amazon, Adobe, AMD, Visa, Meta, and more.

- Cryptocurrencies - Finally, the platform supports trading in popular cryptocurrencies like Bitcoin, Ethereum, Cardano, and more.

IUX Spreads and Fees

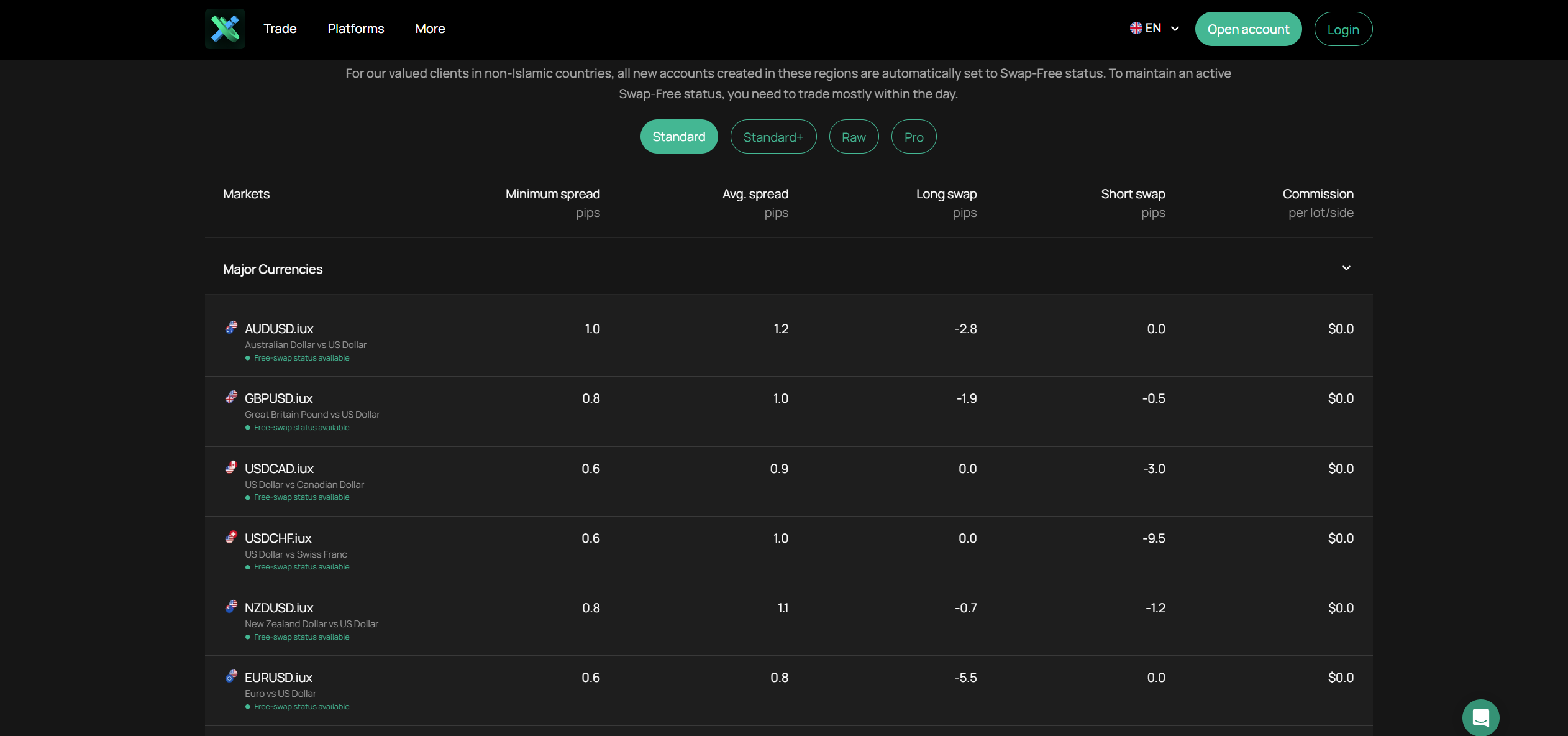

The costs associated with trading play a significant role in a trader's overall experience. Traders are always looking for brokers with the lowest trading fees to allow them to maximise their earnings. Notably, IUX.com offers different account types, each with its own fee structure. There are three main types of trading accounts available including the standard, the raw, and the pro accounts.

The standard account on the IUX broker site features spreads from 0.2 pips for major currencies. On the other hand, the pro account has spreads from 0.1 pips. Both these accounts do not charge a commission when trading. In contrast, the raw spread account offers traders spreads from 0.0 pips but charges a commission of $3 per side per lot.

On another note, traders have to pay a swap fee if they wish to hold positions overnight. The swap fee that applies depends on the asset and the size of the trade of the investor. IUX insists that traders can trade swap-free if they concentrate their trading mostly during the day.

IUX Education Section

Trading financial markets require an ongoing learning process as the market evolves with time. Brokers that provide educational material to their clients will always be held in high regard among traders of all experience levels. Luckily, IUX understands this and provides its clients with a rich education section with articles, webinars, and an academy packed with lessons. These various materials cover various topics across different markets, from the basics to more complex concepts.

For beginner traders, these are priceless resources that help them get started with their journey. They can go into the market with informed minds for sound decision-making. On the other hand, more advanced traders can learn new concepts to sharpen their skills and improve their strategies.

IUX Customer Support

Customer support is essential for any broker, especially one dealing with financial investments. Traders should be able to reach the company any time they have issues or queries. IUX.com provides 24/7 customer support via Email and Phone. Traders can reach the support team via email at

[email protected]. Clients can also reach the company via their mobile number +357 25247681. However, live chat seems to be absent, which might be a drawback for some traders.

IUX Credibility

Before investing with any broker, it is crucial to consider its regulatory status and overall credibility. This broker has regulations from five different organisations in the world. These include the FSCA in South Africa, the ASIC in Australia, the FSA in St Vincent and the Grenadines and the FSC in Mauritius. Investing with a broker with regulation from more than one regulator is always a safer bet than investing with an unregulated broker. To enhance its credibility, IUX could benefit significantly from obtaining a license from a top-tier regulator such as the FCA, CySEC, or ASIC.

Final Verdict

IUX.com presents itself as a solid option for traders of varying experience levels. For starters, it offers a broad range of market instruments across different categories. Additionally, traders gain access to a comprehensive trading environment on the various platforms available. The broker offers various account types with competitive spreads and fees, allowing traders to choose an account that fits their trading style. Its strong educational support makes it a compelling choice. While its regulatory status may not be the most robust, it still provides a layer of oversight.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.