XAU/USD Lowest Spread Brokers

As a gold trader, one of the most important factors to consider when choosing your broker is the spread. Your broker’s spread is how the company makes money every time you place a trade on financial instruments including XAU/USD. The spread is the difference between your broker’s sell and buy rates. The spread charged can fluctuate – depending on the current market's conditions. To reduce the costs of placing a trade, you should choose to use a broker with a low-spread charge per transaction.

Since increased market volatility leads to increased spread which also increases the cost of placing a trade, it is best for you to use a broker with the lowest spread per trade transaction no matter the volatility of the market. XAU/USD is one of the most traded commodity pairs because of its inverse relationship with the US dollar plus the fact that gold is considered to be a safe and very reliable asset. This is why we will be looking at some of the best low-spread brokers for gold trading you can choose to use.

At each broker listed on this page, XAU/USD is traded as CFDs. Please note that the spreads at each broker might change over time so we recommend visiting directly their sites to see the most up-to-date information.

Quick XAUUSD Spread Comparison Table

A great number of brokers support trading on Gold. We couldn't possibly list all brokers, but we do feature some of the most renowned brands with a solid reputation and good regulatory standing. Here is a quick spread comparison table for XAUUSD that each broker listed in the article has. Some brokers do not list both minimum and average spreads, which is why there are two columns on the spread details.

| Broker | Average XAUUSD Spread on Standard Account (in $) | Minimum XAUUSD Spread on Standard Account (in $) |

| Pepperstone | 0.18 | 0.05 |

| Exness | 0.16 | - |

| FP Markets | 0.27 | - |

| HFM | - | 0.25 |

| XM.com | 0.37 | 0.27 |

| XTB | 0.35 | 0.30 |

| Forex.com | - | 0.53 |

Spreads are subject to change. Check your platform for the most up to date data.

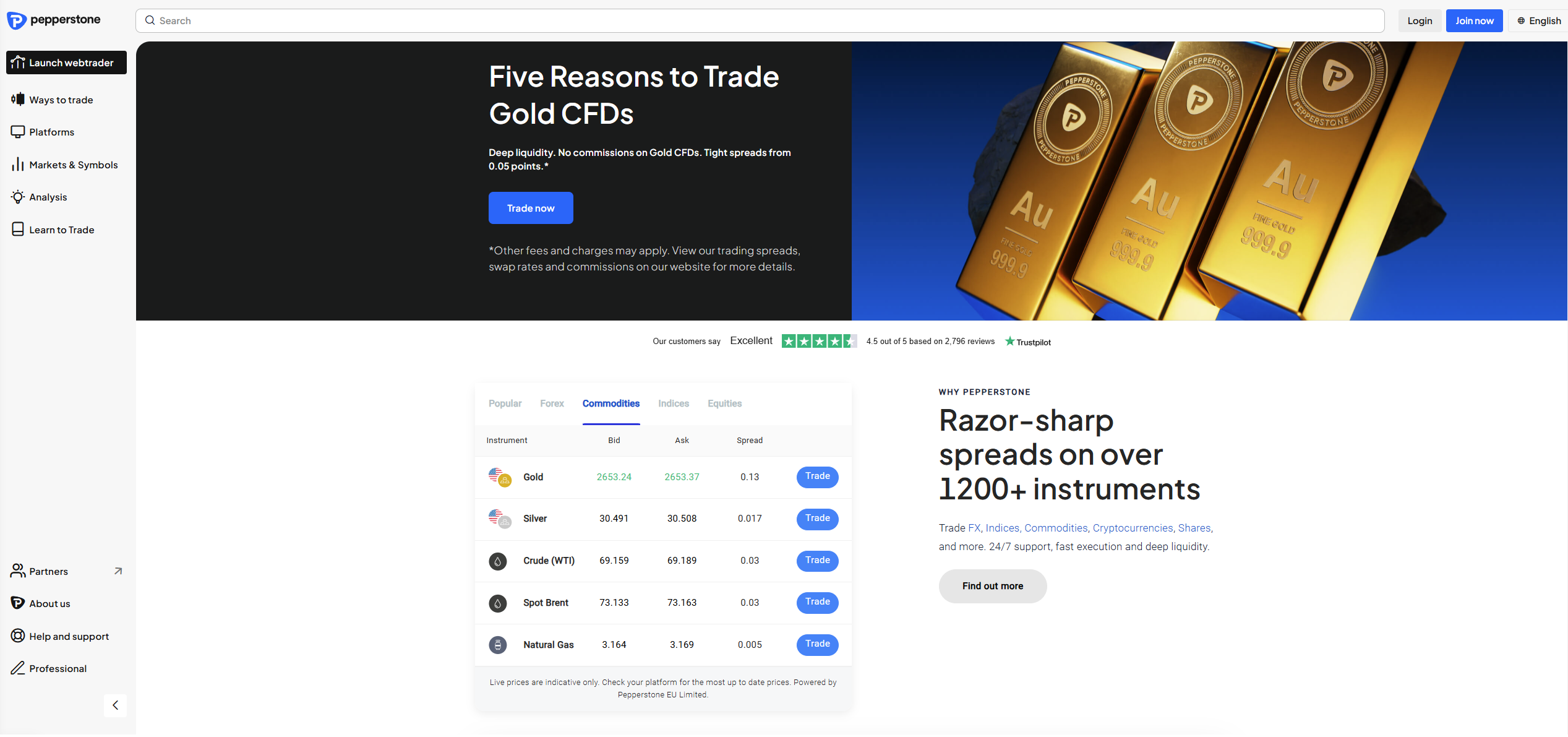

Pepperstone

Pepperstone stands out as a top choice for traders seeking low spreads on gold. The XAUSD pair, for instance, boasts a minimum spread of just 0.05$ and an average spread of 0.18$ with no commissions paid. Pepperstone caters to a wide range of trading styles with its diverse platform options. These include MetaTrader 4, MetaTrader 5, cTrader, TradingView, and its own Pepperstone Trading Platform.

Spreads are subject to change. Check your platform for the most up to date data.

Spreads are subject to change. Check your platform for the most up to date data.

In terms of regulation, Pepperstone has earned a solid reputation for its global oversight. It's regulated by leading authorities such as the FCA in the UK, the ASIC in Australia, the CySEC in Cyprus, the BaFin in Germany, and the DFSA in the DIFC, among others. Further, Pepperstone isn't just about gold. Traders can explore over 1,200 CFDs, including forex, indices, commodities, cryptocurrencies, and ETFs.

75.3% of retail CFD accounts lose money

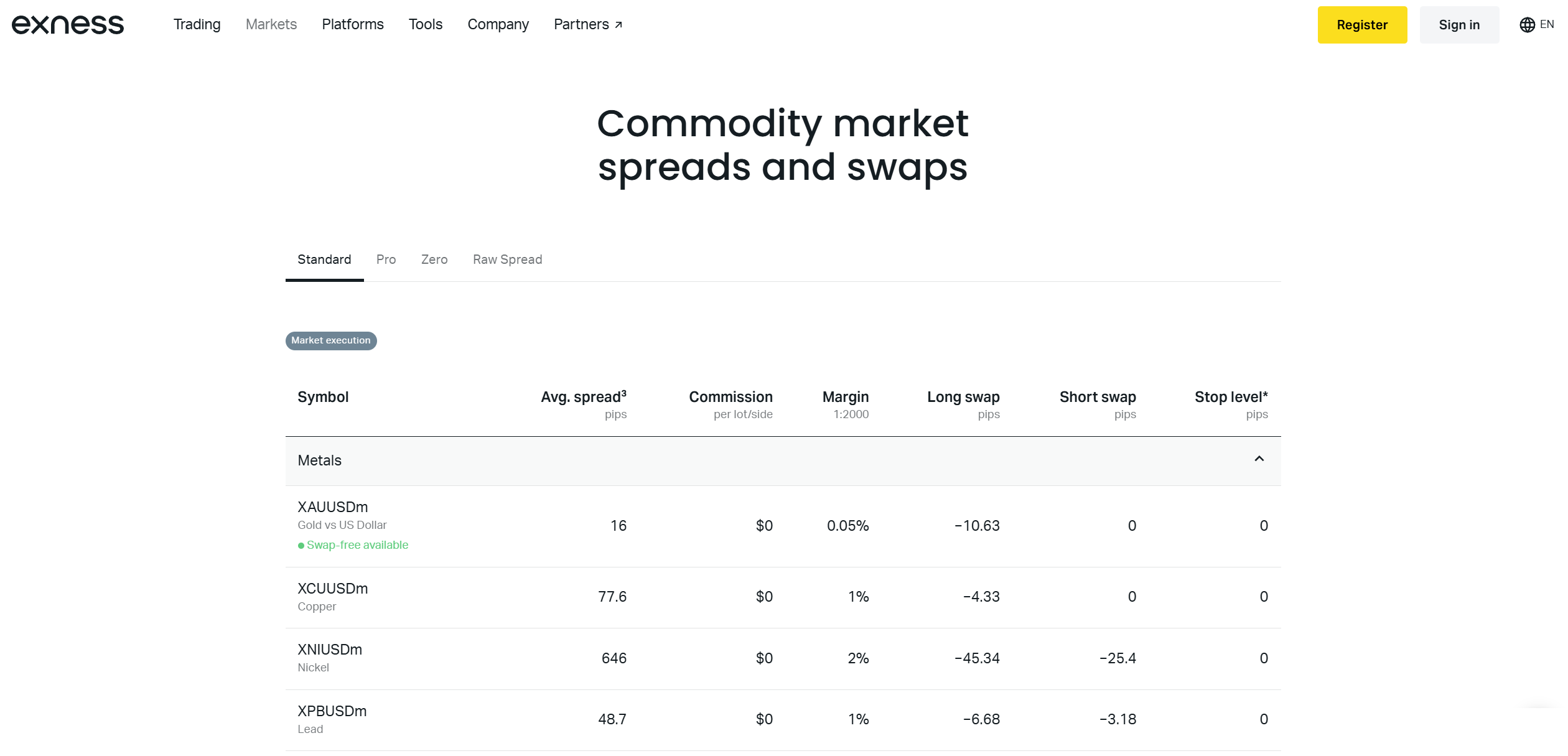

Exness

Established in 2008, Exness is a low-spread Forex and CFDs broker. This broker offers 2 standard accounts (Min. deposit here is 10 USD) and 3 professional accounts (Min. deposit here is 200 USD+). On the standard accounts, the average spread for XAUUSD is $0.16, and on the Pro account, the average spread for Gold is $0.112. Neither of these accounts comes with any commission fees.

Interestingly enough, the broker also offers two commission-based accounts with competitive trading conditions for gold. The Raw Spread account features an average spread of $0.037 on gold, with a commission fee of $3.50 per side per lot. In contrast, the Zero Spread account offers average spreads as low as 0.0 pips on gold, with a commission fee of $5.50 per side per lot.

Spreads are subject to change. Check your platform for the most up to date data.

Spreads are subject to change. Check your platform for the most up to date data.

Interestingly, Exness is one of the few Gold CFD brokers that offer an Extended Swap-Free feature for gold trading, even without an Islamic account. This means you won’t incur any swaps for this instrument. This is ideal for traders who do not wish to worry about how long they want to stay in their position on gold. However, Exness may revoke the swap-free status if you regularly keep large positions open overnight or seldom trade during active market hours.

Exness also gives you access to trade over 200 financial CFD instruments including forex, shares, metals, and cryptocurrency in multiple trading platforms such as MetaTrader 4, and MetaTrader 5. Exness is available in a wide range of countries, but in some, it is prohibited to retail clients. That means, for instance, that they are not available to retail traders from European countries.

Remember that Forex and CFDs available at Exness are leveraged products and their trading can result in the loss of your entire capital.

Please ensure you fully understand the risks before trading.

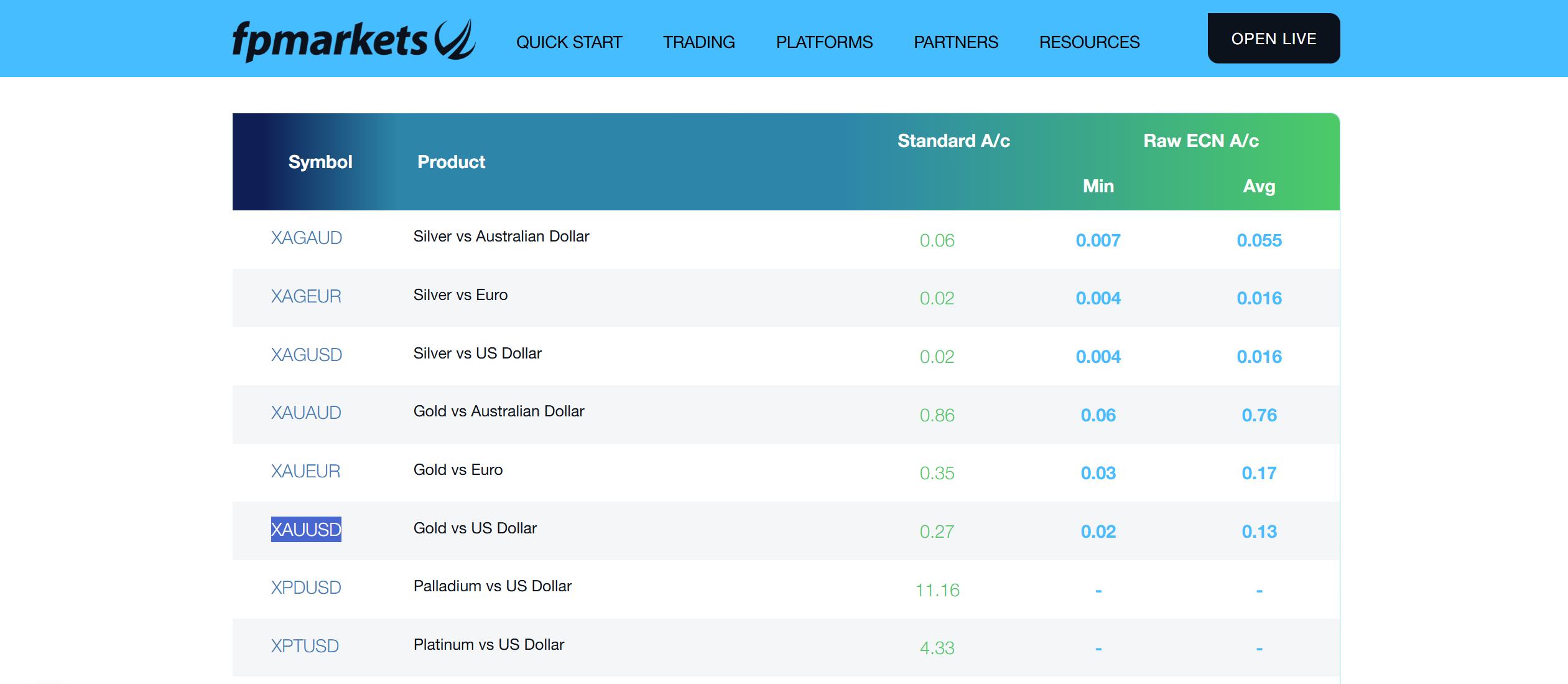

FP Markets

Founded in 2005 and regulated by the Australian Securities and Investment Commission (ASIC) and by the CySEC in Cyprus FP Markets is a popular choice for trading Gold. Due to its ECN (Electronic Communication Network) execution, FP Markets offers low spreads and fast execution times. Gold can be traded here not only against the USD but also against other major currencies such as the Euro or the Australian Dollar. The spreads on the standard accounts for XAU/USD are 0.27. On the raw account, they start from 0.02 and average at 0.13. On the raw account, a *$3 commission fee per side per lot applies.

Spreads are subject to change. Check your platform for the most up to date data.

Spreads are subject to change. Check your platform for the most up to date data.

72.44% of retail CFD accounts lose money

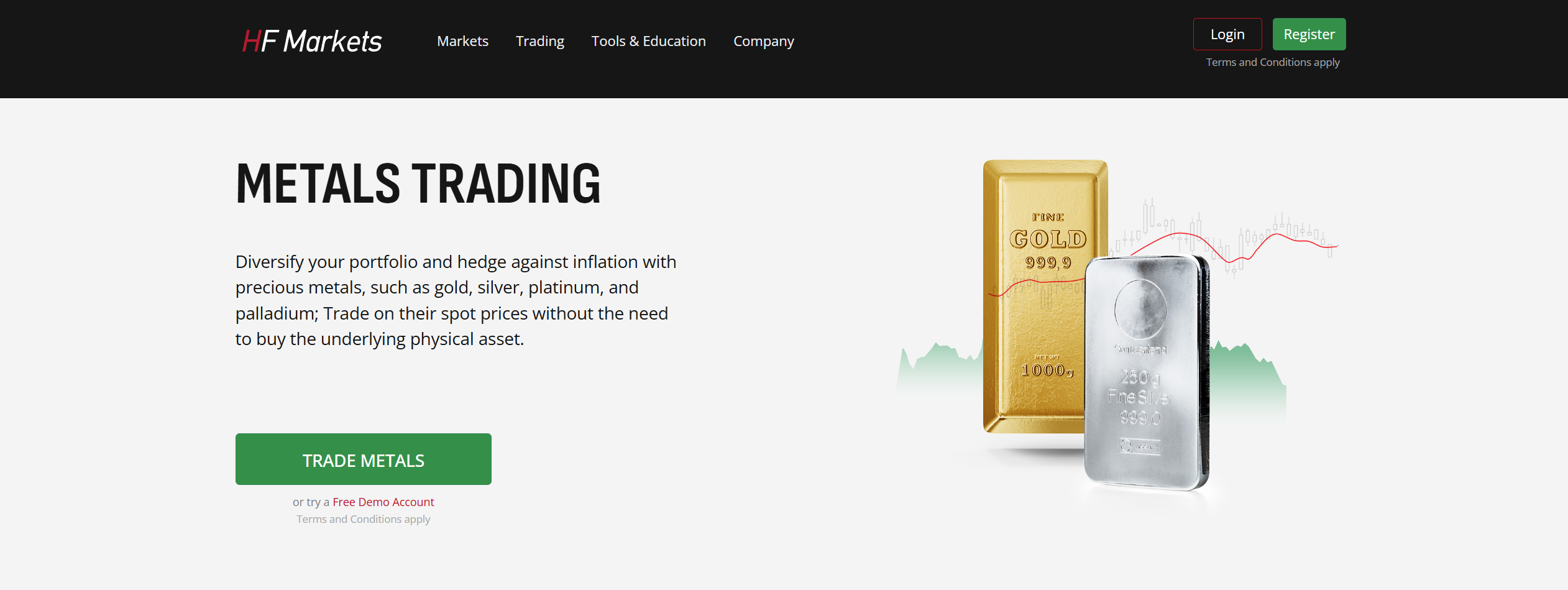

HFM

HFM is a globally recognised broker that offers competitive spreads for gold trading on both standard and raw account types. It is well-regulated by several financial authorities, including the FSCA in South Africa, the CMA in Kenya, the FCA in the UK, the CySEC in Cyprus, and the FSA in Seychelles. The spreads that traders enjoy when trading this asset depend on the account type.

Spreads are subject to change. Check your platform for the most up to date data.

Spreads are subject to change. Check your platform for the most up to date data.

XAUUSD is available with spreads starting from just $0.25 points on both the Premium and Cent accounts. The Pro account offers even tighter spreads, beginning at $0.16 for gold. For regions where the Top-Up Bonus account is offered, spreads start from $0.26. The Zero account provides the most competitive pricing, with spreads as low as $0.03, plus a commission of $5 per side per lot.

In addition to gold, HFM offers a wide range of trading instruments. In total, traders have access to over 1,000 assets, which include CFDs on forex, energies, indices, stocks, commodities, bonds, ETFs, and cryptocurrencies. The trading platforms available ot use include MetaTrader 4, MetaTrader 5, and the HFM platform.

Remember that Forex and CFDs available at HFM are leveraged products.

Their trading can result in the loss of your entire capital.

XM

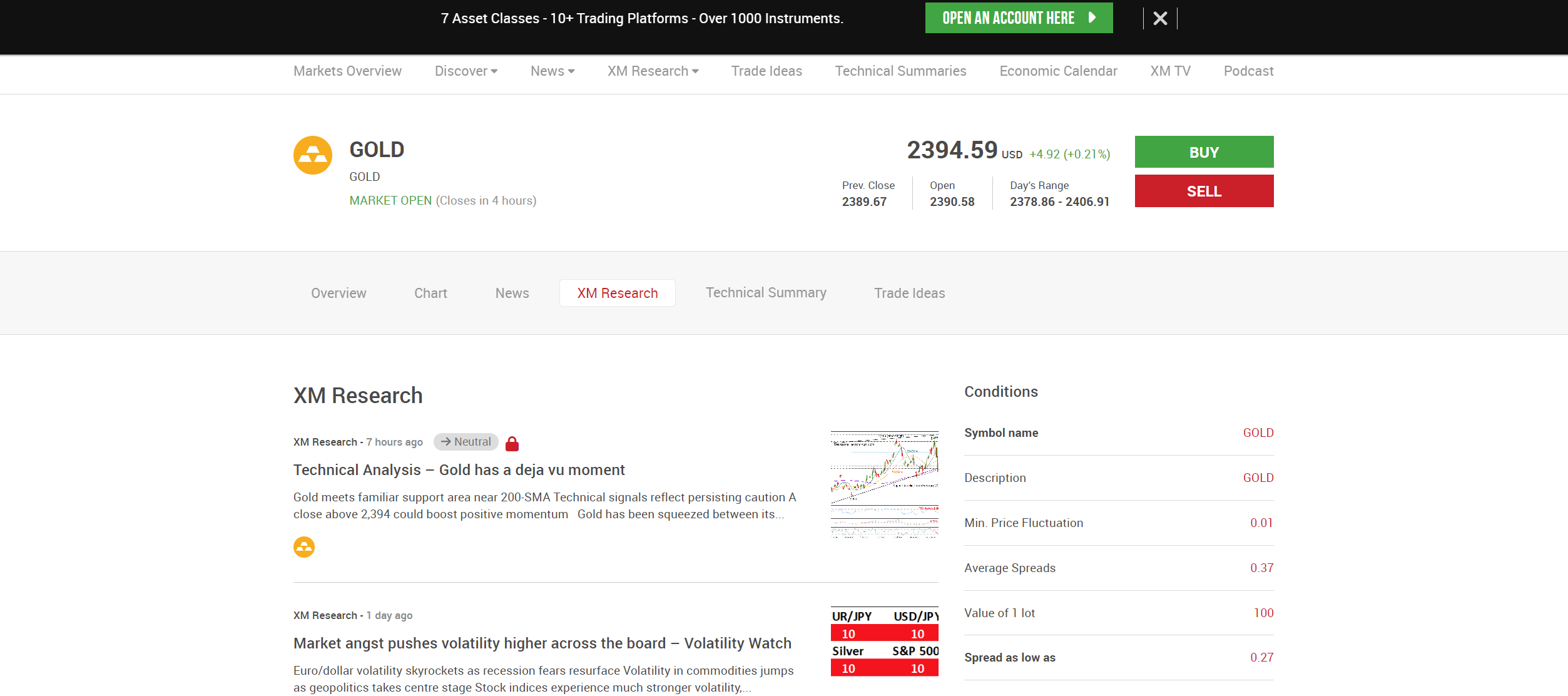

XM is another broker that supports trading gold. This company is internationally well known with regulations in Cyprus by the CySEC, in the UK by the FCA and in Australia by the ASIC. The spreads for XAU/USD start from 0.27 and average at 0.37. Apart from gold trading, one can trade here also other commodities and assets such as forex, stocks and indices. All trading is done either on the MT4 or MT5 trading platforms.

Spreads are subject to change. Check your platform for the most up to date data.

Spreads are subject to change. Check your platform for the most up to date data.

75.18% of retail investor accounts lose money when trading CFDs with this provider.

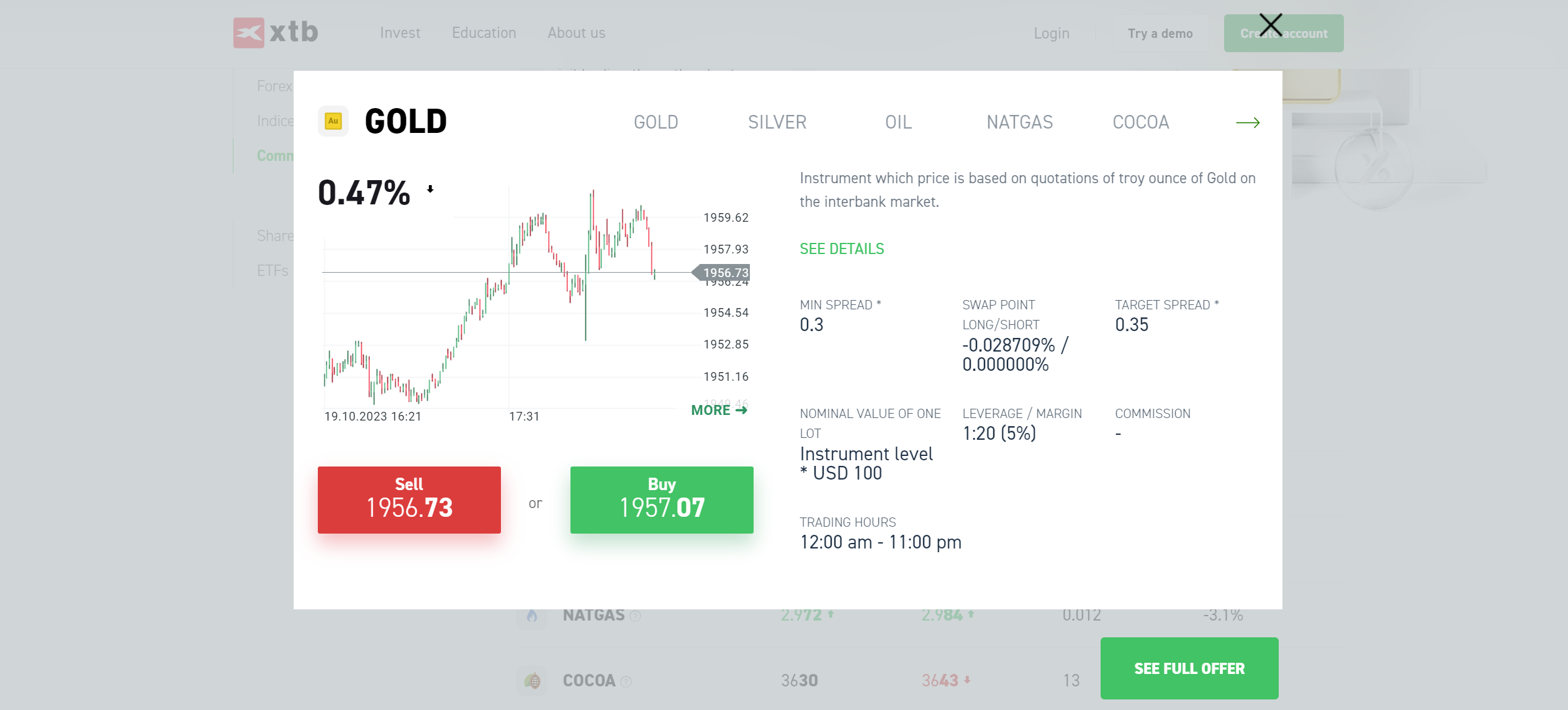

XTB

XTB was founded in 2002 and is headquartered in Warsaw Poland, but they have local offices in multiple countries around the world. XTB is regulated by the Cyprus Securities and Exchange Commission in Cyprus, by the FCA in the UK, and by the South African FSCA among others. The company has a minimum spread for XAU/USD 0.3 with a target spread sitting at 0.35. Apart from CFDs on metals, one can find here also assets from other markets such as forex, stocks, indices or cryptocurrencies.

Spreads are subject to change. Check your platform for the most up to date data.

Spreads are subject to change. Check your platform for the most up to date data.

75-78% of retail investor accounts lose money when trading CFDs with this provider.

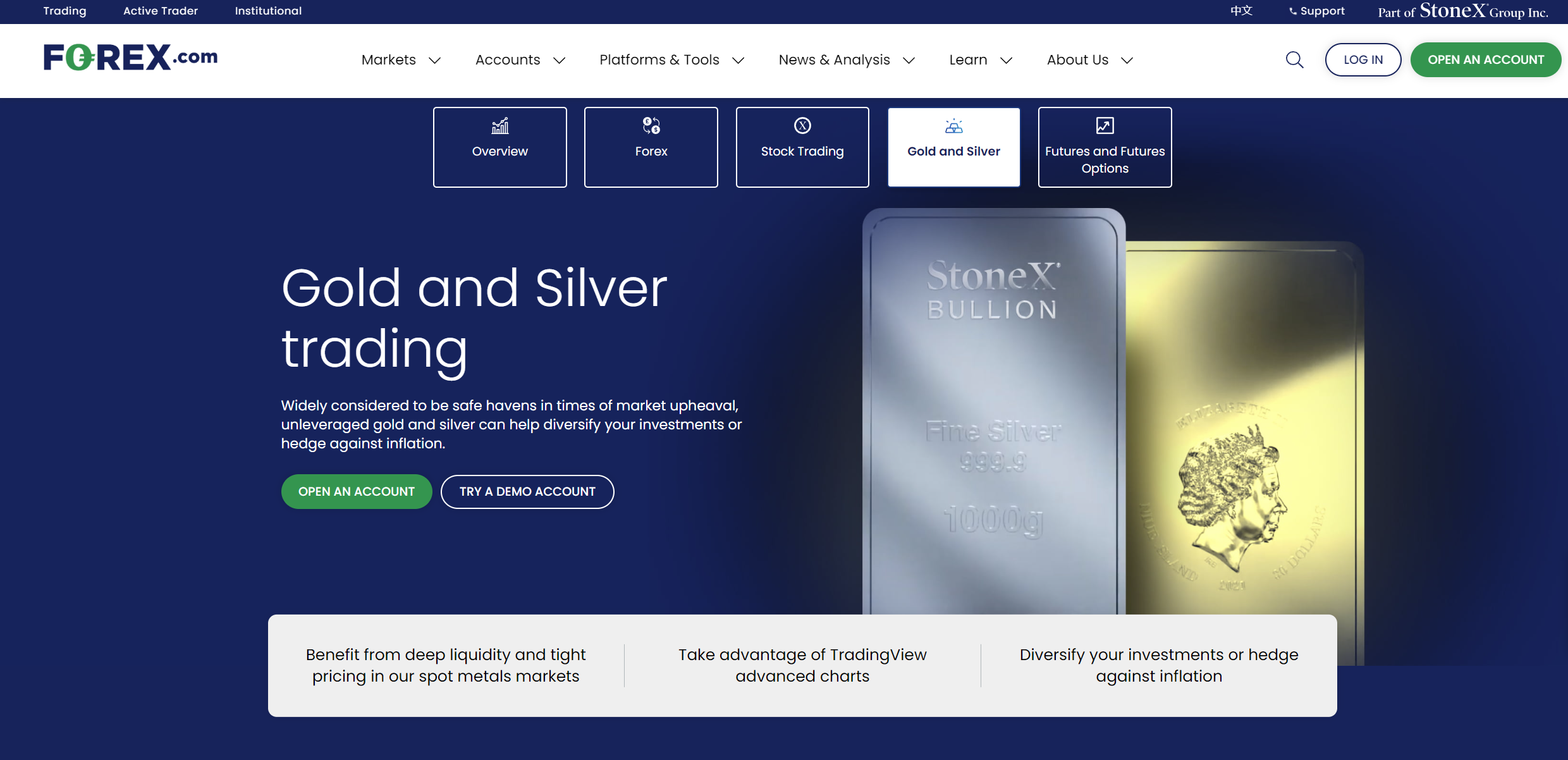

Forex.com

Founded in 2001, Forex.com is a well-known metal, forex, and CFDs broker with low spreads for gold trading starting from 0.53. The company features two popular trading platforms MT4 and MT5 and one analytical platform TradingView. There is also the option to trade other financial instruments like forex currency pairs. Forex.com spread fees are considerably lower than its competitors and have 24/7 customer service. In the US Forex.com gold and silver are traded via futures and options. In other parts of the world including Europe, Gold is traded as a leveraged margin product.

Spreads are subject to change. Check your platform for the most up to date data.

Spreads are subject to change. Check your platform for the most up to date data.

76-77% of retail investor accounts lose money when trading CFDs with this provider.

Conclusion on XAU/USD Lowest Spread Brokers

As a trader considering XAU/USD trading, you have to consider all factors before you choose a broker to start trading your funds with. These factors include regulatory approval within your country, access to global and reliable trading platforms, like MT4 and MT5, technology and trading tools, customer support, investment opportunities, and of course the spreads.

In this article, we showed you some of the best low-spread brokers for gold trading (XAU/USD) and some basic information about them. Remember that trading the financial market is already risky in itself and choosing the right broker can at least remove the extra risk of losing your trading capital to scam brokers. Don’t forget to choose wisely.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.