XTB review - What to expect from the broker

In this review, we take a look at XTB (which stands for X-Trade Brokers). We will examine the broker's background, trading platforms, fees and overall offer.

XTB is a leading European broker with an international presence that was founded in 2004. The company attracts traders on some of the tightest spreads in the industry, superior execution time speed and access to the xStation platform. XTB is regarded as one of the largest stock exchange-listed brokers in the world with offices in 11 countries including the UK, Poland, Germany, France and Turkey. The broker is licensed and authorised by 4 regulatory bodies, in Europe by the CySEC (Cyprus), KNF (Poland), FCA (The UK) and in Belize by the FSC.

| General Risk Warning: 75-78% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. |

Detailed information about XTB

- Website: www.xtb.com

- Instruments: Stocks, ETFs, CFDs – Cryptocurrencies, Forex, Indices, Commodities, Shares, ETFs

- Minimum deposit: $1 (Account base currencies: USD, EUR, GBP PLN, CZK, HUF)

- Demo account: Yes, free of charge (30-day expiry)

- Methods of deposit and withdrawal: Debit/Credit Card, bank transfer, Paypal, Paysafe. Withdrawals are processed the same day if requested before 1 pm. Next day if requested after.

XTB Trading Platform

XTB has its own trading platform called xStation that measures up more than favourably against some of its competitors. It includes an array of features, is fully customisable, and is quite intuitive for a first time trader - or a first time user of the platform itself. It’s been recognised for its level of quality as well, having won ‘Best Trading Platform 2016’ as voted by the Online Personal Wealth Awards.

In fact, one of XTB’s biggest strengths is most likely its trading platform. xStation offers live audio commentary on the markets, a macroeconomic calendar, a range of technical indicators, a sentiment map and stock scanner, an extensive video tutorial section under its education tab (including lessons from heavyweight traders like Lex van Dam and Jack Schwager), and real-time performance statistics that help you to identify weaknesses in your trading approach. It will break down your trading behaviours for you and tell you whether you have a greater win ratio going long or short, your average trade duration, overall profit and more.

Overall, the platform’s reliability and execution speed is top-notch. The only drawback seems to be while the platform is highly advanced on the desktop, not all the same features are available on the mobile app, so that’s something to bear in mind if you’re considering them as your broker.

Assets Available on XTB

With XTB, traders can access a global marketplace of over 5,800 trading instruments. This extensive range allows for diversified investment strategies across various markets. With this broker, investors have access to both CFDs and some real underlying assets. Let’s first look at the CFDs available:

- Forex - With XTB, traders can explore a wide range of 71 currency pairs. These range from major and minor pairs to a variety of exotic options.

- Indices - XTB also provides access to over 30 global indices, including popular ones like UK100, DE30, US500, US2000, FRA40, EU50, and more.

- Commodities - XTB offers a range of popular commodities for trading. These include gold, silver, oil, natural gas, and cocoa.

- Stocks - XTB also allows for the speculating of the prices of company stocks from various countries like the US, UK, and more. Popular stocks like AAPL (Apple), AMZN (Amazon), BARC (Barclays), and BMW are available.

- Cryptocurrencies - Further, investors can explore the world of cryptocurrencies with XTB. They can trade popular digital assets like Bitcoin, Ethereum, Stellar, and Dogecoin through CFDs.

- ETFs - ETFs are also available to trade on the XTB broker site. These allow investors to diversify their portfolios by investing in entire sectors, industries, and even regions.

And now the real underlying assets:

- Stocks - On XTB, traders have access to real underlying company stocks. This means that you will own the stocks that you purchase until you sell them.

- ETFs - XTB also allows investors to buy and sell real ETFs. There are over 500 different funds available to trade on this broker site.

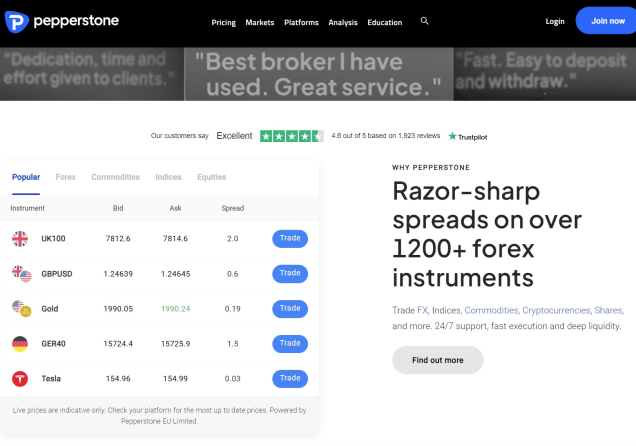

XTB’s Fees and Spreads

XTB primarily offers a single trading account type, the standard account. This account is designed to accommodate traders of all experience levels, from beginners to seasoned professionals. This account features highly competitive spreads, making XTB one of the lowest spreads brokers in the world. Traders can benefit from spreads starting as low as 0.8 pips on major currency pairs, with no commission fees on trades. The only additional cost is a swap fee for holding positions overnight, which varies depending on the asset and position size.

XTB also provides a swap-free account for traders who cannot pay overnight fees. This swap-free account maintains similarly low spreads, starting from 0.7 pips on major currency pairs, and, like the standard account, has no commission charges. This account is perfect for Muslim traders who cannot pay swap fees due to Sharia law restrictions. Please note that the Islamic account is only available from predominantly Islamic countries like the UAE, Saudi Arabia, Kuwait, Oman, Qatar, Jordan, Bahrain, Lebanon, Egypt, Algeria, Morocco, Tunisia, and Malaysia.

XTB Forex Rebates

XTB offers a cashback rebate program for high-volume traders, though its availability depends on the trader's country of residence. Where available, XTB provides cashback as part of its loyalty program for traders with a monthly trading volume of at least 15 lots. To enrol, you must reach out to your account manager, who will set up a customised discount program tailored to you. Cashback is calculated monthly, based on closed positions within that month. Since each program is personalised, traders need to confirm their eligibility and cashback level individually. This program is not accessible to traders in the EU, UK, and UAE.

XTB’s Credibility

The credibility of a broker is probably the most important thing to consider before investing with them. To assess the credibility of a broker, we usually consider its regulatory background and the online reviews of its customers. Fortunately, XTB has good standing regarding regulations. This broker operates under the oversight of several financial regulators. These include the FCA in the UK, the CySEC in Cyprus, the FSC in Belize, and the KNF in Poland. This multi-regulatory framework is always a welcoming factor to traders.

Regarding customer reviews, XTB enjoys a positive review on Trustpilot after over 1,200 different reviews. This broker has a rating of 3.6 stars out of 5 which suggests an overall positive experience by its customers. Moreover, the broker replies to comments, both positive and negative to resolve any issues traders have.

Support, education and analysis

While XTB’s platform is second to none, its support and analysis also put this broker head and shoulders above some of their competition. As a reputable CFD provider that lists transparency and speed of execution as its core values, it has won a wide range of prestigious awards including Bloomberg’s EMEA #1 ranking in FX accuracy for 2018. If you’re looking for confirmation of a trade or simply inspiration, XTB’s analysis team releases articles and research on an almost hourly basis which is available on their website for free or through the platform.

Personal account managers are designated when you open an account, and 24/5 support is available. XTB also releases event-driven trading packages, including a guide on day trading (in light of ESMA’s leverage restrictions) and how to trade political events like the US Midterm Elections, Brexit etc. Overall, the content is very educational, digestible and actionable for both new and experienced traders.

Conclusion - is XTB a good option?

Overall, XTB’s strong points are clearly its fees and educational/analytical offering. xStation seems to be very intuitive and powerful, the support team was readily available and happy to answer any of my questions. Spreads for this broker are competitive, and while it doesn’t boast the same number of markets as some other brokers, it has more than enough on offer for both beginning and advanced traders.

75-78% of retail investor accounts lose money when trading CFDs with this provider.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.