Top 10 Richest & Most Successful Forex Traders in the World

The forex market is the largest and most liquid financial market in the world, with trillions of dollars changing hands daily. This vast and dynamic landscape offers immense opportunities for traders to profit from currency fluctuations. While many try their hand at Forex trading, only a select few achieve legendary status.

A few notable individuals have been able to amass significant wealth and notoriety in the forex trading community. In this detailed article, we will take a closer look at the 10 richest forex traders in the world. We will focus on their trading journeys, their strategies, some of their notable achievements, and their contributions to the trading community.

Disclaimer About Our Selections

Before we dive into the names of these traders, there are two things we need to clarify. First, Accurately quantifying the net worth of forex traders is very challenging. The forex market is very secretive and most people do not reveal their earnings. Additionally, some of the earnings of these forex traders may be tied to other investments, making precise figures difficult to obtain. As such, we will base much of the information provided here on publicly available data and worldwide recognition of the various traders.

Another thing we would like to clarify is the inherent risk that forex trading involves. The individuals featured here are simply examples of successful traders, but their experiences may not be representative of all traders. Their success does not guarantee your own success in the market. Remember, success in this field requires a balance between skill, discipline, and risk management. With that said, let’s now take a look at the 10 richest forex traders in the world.

10 Richest Forex Traders in the World

George Soros

No discussion about the richest forex traders in the world is complete without mentioning George Soros. He is arguably the most popular forex trader of all time. In 1992, he famously shorted the British pound during the Black Wednesday crisis, earning over $1 billion in a single day. This firmly cemented his place in financial history.

Soros, through his Quantum Fund, recognised that the pound was overvalued within the European Exchange Rate Mechanism (ERM). He took a massive short position, betting that the pound would fall. Eventually, the Bank of England withdrew the pound from the ERM, Soros' prediction came true, resulting in a monumental profit. Today, people popularly refer to him as The Man Who Broke the Bank of England.

George Soros's forex trading strategy is heavily based on macroeconomic analysis. He focuses on economic imbalances and speculative opportunities, leveraging large positions to maximise gains. He believes that people's feelings and opinions in the market can influence market prices.

Aside from trading, Soros is a seasoned investor in other sectors like gold, encompassing a diversified portfolio. He is also a philanthropist who has donated billions through his Open Society Foundations to support education, human rights, and democracy worldwide. His estimated net worth at the time of writing this is an impressive $7.2 billion.

Aspiring traders can learn a few tips from George Soros by reading his various publications. A good example is his book The Alchemy of Finance where he explains his theory of reflexivity and how market dynamics work.

Illustrative picture. Not George Soros

Ray Dalio

Ray Dalio is widely regarded as one of the most successful investors of all time. He earned his MBA from Harvard Business School and founded Bridgewater in 1975 from his apartment. Under his leadership, Bridgewater grew to become the largest hedge fund in the world, managing over $150 billion in assets at its peak.

Dalio’s forex and macroeconomic strategies center around deep research and technical analysis. He pioneered the concept of risk parity, diversifying investments across multiple asset classes to reduce volatility. His approach also incorporates the use of algorithm-driven trading models to eliminate emotional bias in decision-making.

Dalio has generously shared his insights and knowledge through his writings and public appearances. In 2017, Dalio published Principles: Life and Work, a bestselling book that outlines his principles for success in investing, decision-making, and life. Ray Dalio’s legacy in the forex and financial markets is unmatched. Estimates place his net worth at an outstanding $14 billion.

Paul Tudor Jones

Paul Tudor Jones is another highly successful trader known for his accurate market predictions. He famously predicted the 1987 stock market crash and profited handsomely from it. Although primarily a stock and commodities trader, forex trading plays a significant role in his portfolio. He is a strong advocate for risk management and capital preservation.

Jones’ trading strategy involves rigorous research and the use of technical analysis to identify trading opportunities. Notably, he is probably the best swing trader in the world. He is also a strong advocate for risk management and capital preservation. Additionally, he focuses on identifying trend reversals and exploiting market inefficiencies. While trading, Jones excels at remaining calm and disciplined in his trading strategy.

On another note, Jones is actively involved in philanthropic endeavours. He supports various charitable causes through his Robin Hood Foundation, which focuses on poverty reduction in New York City. Jones also supports charitable efforts towards education. At the time of writing this, his estimated net worth stands at $8.1 billion.

While Jones may not have published books himself, his theories and techniques are well documented in books like Market Wizards by Jack D. Schwager.

Bruce Kovner

Bruce Kovner is a highly respected trader known for his disciplined approach and his focus on fundamental analysis. He founded Caxton Associates, a hedge fund that achieved remarkable success under his leadership. Kovner is popular for his extensive research and his ability to identify long-term trends in the market.

Notably, Kovner’s trading career began with a $3,000 loan, which he used to trade soybeans before transitioning to forex and other markets. Kovner’s strategy is rooted in macroeconomic analysis, leveraging global economic trends to inform his trades. He is also a strong believer in risk management and emphasises the importance of cutting losses quickly. Additionally, he stresses the importance of discipline and emotional control in trading.

Like Jones and Soros, Kovner is a generous philanthropist who supports various educational and cultural institutions. His net worth at the time of writing this stands at $8.6 billion. Kovner hasn’t written books, but his trading career is detailed in Market Wizards. He usually keeps a low profile.

Illustrative picture. Not Bruce Kovner

Stanley Druckenmiller

Stanley Druckenmiller is a highly regarded investor and hedge fund manager who worked alongside George Soros at the Quantum Fund. He played a key role in the famous bet against the British pound in 1992. This collaboration with Soros solidified his reputation as one of the best traders in the world.

Like Soros, Druckenmiller relies on macroeconomic trends. Druckenmiller is known for his ability to identify undervalued assets and his willingness to take concentrated positions. He’s known for his big-bet approach, concentrating resources on high-confidence trades. He is another contender for the top swing traders in the world. To identify these trading opportunities, Druckenmiller relies on his strong analytical skills.

Druckenmiller’s philanthropic efforts focus on education and medical research. He’s donated millions to universities and research institutions. Some reports place his estimated net worth at $6.9 billion. While Druckenmiller has not written a book, his strategies are extensively covered in trading literature, including The New Market Wizards.

Joe Lewis

Joe Lewis is a British businessman and investor who is known for his successful Forex trading. He reportedly collaborated with George Soros in the bet against the British pound in 1992. Lewis is a private individual who keeps a low profile, but his success in the financial markets is well-documented.

Lewis employs a long-term investment approach, focusing on macroeconomic trends. He is popular for his contrarian investment style and his ability to identify undervalued assets. However, he emphasises the importance of diversification across multiple asset classes.

Lewis is more of an investor than an educator, and he focuses on philanthropic projects rather than direct trading education. Lewis mostly supports medical research and educational initiatives worldwide. Aside from trading, Lewis is a prominent art collector. At the time of writing this, reports estimate that his net worth is upwards of $6.3 billion.

Andrew Krieger

Andrew Krieger is a Forex trader who gained notoriety for his aggressive trading style. He is widely popular for his bold bet against the New Zealand dollar (NZD) in 1987. His position, worth hundreds of millions of dollars, caused a significant depreciation of the NZD and earned him substantial profits for Bankers Trust.

Krieger attributes his success to a bold trading style and his ability to identify profitable opportunities in volatile markets. However, his aggressive approach also highlights the importance of risk management in forex trading. His strategy revolves around identifying overvalued currencies using analytical analysis. He isn’t afraid to use leverage to amplify his positions.

While Krieger maintains a low profile, his trading exploits have become part of trading folklore. Traders can gain insights into his trading philosophy by reading his book, The Money Bazaar: Inside the Trillion-dollar World of Currency Trading. According to some reports, Krieger’s net worth is upwards of $3 billion.

Bill Lipschutz

Bill Lipschutz is a renowned currency trader who made his name at Salomon Brothers in the 1980s. He is known for his deep understanding of currency markets and his ability to manage large trading positions. This has earned him the nickname, Sultan of Currencies. His trading career began when he turned a $12,000 inheritance into $250,000. He later lost his earnings due to a terrible trading mistake.

Later, Lipschutz became a part of the infamous Salomon Brothers trading program. His career at Salomon Brothers is legendary, where he became a key player in their forex division. He’s now the principal and director of portfolio management at Hathersage Capital Management. At the time of writing this, reports place Bill’s net worth at $2 billion.

Lipschutz emphasises understanding market psychology and leveraging technical analysis. He also believes in the importance of understanding the fundamental factors that drive currency movements. He is known for his focus on risk management and patience in the market. Lipschutz usually takes his time waiting for the right trading opportunities.

Lipschutz has shared his insights and experience through lectures and interviews, contributing to the education of aspiring traders. While Lipschutz hasn't authored books, his story is featured in Market Wizards by Jack Schwager.

Illustrative picture. Not Bill Lipschutz.

Michael Marcus

Michael Marcus is a highly successful trader who has mentored many other prominent traders, including Bruce Kovner. Marcus started his career at Commodities Corporation where he was mentored by Ed Seykota, another well-known trader. He stands out for his ability to identify long-term trends and his patient approach to trading. Marcus famously turned a $30,000 investment into $80 million. At least one report estimated his net worth at $1.2 billion.

Marcus is a strong believer in learning from mistakes and continuously improving one's trading skills. His success is attributed to his disciplined approach, his ability to identify profitable trends, and his continuous pursuit of knowledge. Additionally, his patience in the market is noteworthy as he is always willing to hold positions for months on end.

Marcus has mentored many successful traders, sharing his knowledge and experience with the trading community. His strategies and success stories are the subject of several books including Jack Schwager’s Market Wizards and Technical Analysis.

Richard Dennis

Richard Dennis is a famous trader known for his Turtle Trader experiment. He believed that trading could be taught and recruited a group of novice traders, whom he trained using a specific set of rules. The Turtles, as they were called, went on to achieve significant success, proving Dennis' theory.

Reportedly, Dennis started his journey with a $1,600 loan which he turned into a fortune by trading futures and currencies. At the time of writing this, some reports estimate his net worth to be over $300 million. His belief in systematic trading led to the development of the Turtle Trading system. Dennis’ strategy focuses on trend-following using predefined rules and risk management principles.

The Turtle Trader experiment has had a lasting impact on the trading community. It popularised the concept of systematic trading and demonstrated the importance of rules and discipline. Investors can learn more about Richard Dennis’s concepts by reading his book Red Ink: A Guide to Understanding the Deficit Dilemma.

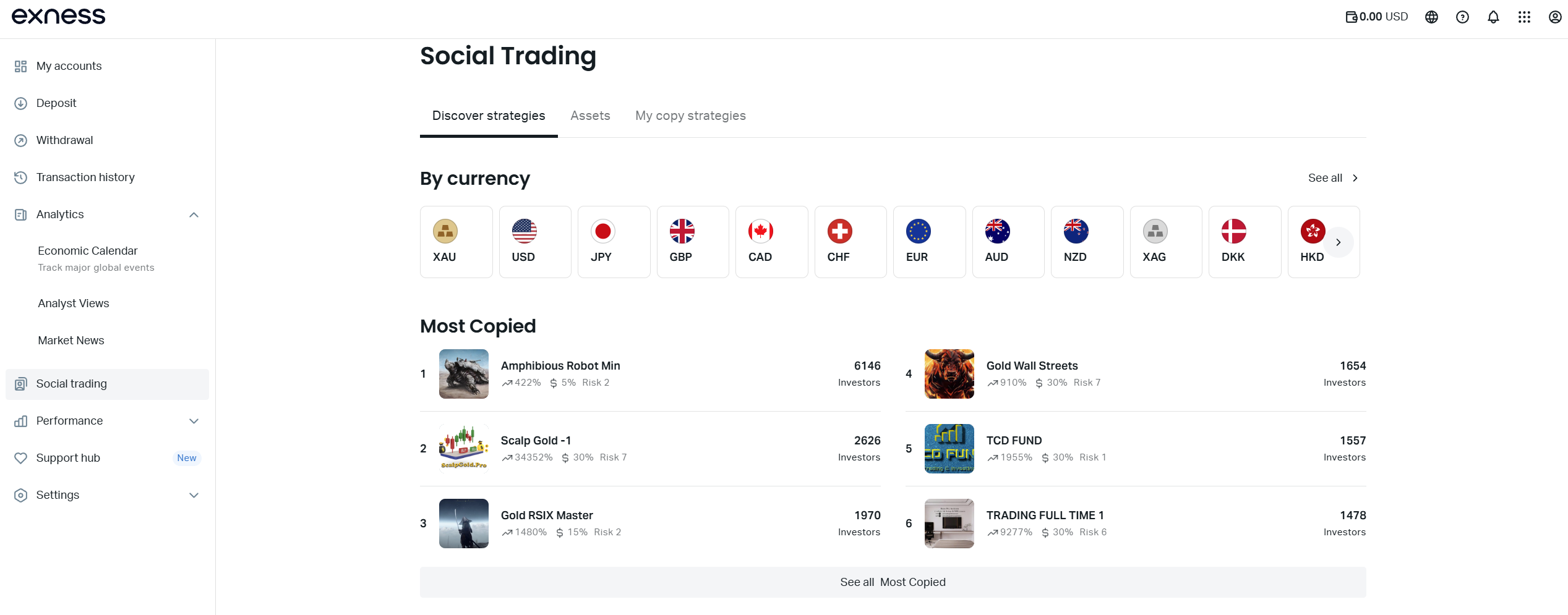

Top Traders In the World on HFM and Exness

HFM and Exness, two leading Forex and CFD brokers, provide top-tier copy trading platforms featuring some of the world's best traders. Users can follow and replicate their trades, gaining access to expert strategies.

68% of retail investor accounts lose money when trading CFDs with this provider.

Past performance is no guarantee of future results.

Remember that Forex and CFDs available at Exness are leveraged products.

Their trading can result in the loss of your entire capital.

Past performance is no guarantee of future results.

Common Traits Among the Richest Forex Traders

Despite their diverse backgrounds and strategies, these ten traders share some common traits that contributed to their success. Below are a few:

- Discipline - These masters stick to their trading plans, control their emotions, and execute trades consistently. They avoid impulsive decisions as the market is inherently unpredictable and impulsive reactions can be a recipe for disaster.

- Risk Management - They prioritise protecting their capital and manage risk effectively. They do this through position sizing, stop-loss orders, and understanding leverage.

- Market Understanding - These masters possess a comprehensive understanding of the factors that influence currency movements. They use both technical and fundamental analysis to analyse market trends as well as considering market sentiment and trader psychology.

- Continuous Learning - The richest forex traders in the world are committed to continuously improving their trading skills and knowledge. They do this by constantly learning, staying informed, analysing past trades, adapting to change, and sometimes benefiting from mentorship.

- Patience - These traders understand the importance of waiting for the right trading opportunities. They are selective in their trades, avoid overtrading, and maintain a long-term perspective.

Lessons for Aspiring Traders

For those aspiring to follow in the footsteps of these forex giants, here are some actionable takeaways:

- Invest in Education - A strong understanding of forex trading basics can be a game changer. Begin by mastering concepts such as currency pairs, pips, leverage, and margin. Stay informed about global economic trends, geopolitical events, and central bank policies. Such factors have a significant influence on currency movements.

- Start Small - For beginners, starting with a modest investment reduces financial risk and allows you to learn without significant losses. Many brokers offer demo accounts where you can practice trading with virtual funds. Once you feel confident, transition to a live account with small amounts.

- Embrace Technology - Modern technology provides traders with an edge that was unavailable to earlier generations. The power of trading tools can significantly improve your decision-making and execution.

- Find a Mentor - Learning from an experienced trader can provide invaluable insights and shortcuts.

- Stay Disciplined - Discipline separates successful traders from the rest. Developing and adhering to a well-thought-out trading plan ensures emotional stability and reduces impulsive decisions.

- Manage Risks - The forex market involves a lot of risks, making risk management a necessary skill in trading. There are various risk management strategies that traders can use in their journey.

Closing Remarks

The stories of the 10 richest forex traders in the world serve as both inspiration and education for aspiring traders. Positively, most of these traders have also had great influence in their communities through their philanthropic efforts and by educating future investors. While replicating their success is a challenging endeavour, studying their strategies and approaches can provide valuable insights and inspiration for traders.

For those willing to put in the effort, the forex market offers immense opportunities to potentially build wealth and achieve financial independence. Nonetheless, always remember that success in forex trading requires more than just ambition. The forex market involves a lot of risks. It requires resilience, adaptability, effective risk management, and a commitment to mastering the craft.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.