The Biggest Forex Brokers in the World

There are hundreds and hundreds of brokers and you have probably already wondered

who is the biggest of them all?

In this article, you will get your answer! We have researched the biggest forex brokers on the market by their trading volume and by the number of clients they have and listed them below. Please read the full disclaimer below the rankings about the selection.

Biggest Forex Brokers by Trading Volume:

1# Exness = $2.275 trillion (source: Finance Magnates)2# IC Markets = $1.016 trillion (Source: Finance Magnates)3# Saxo = $322 billion (Source: Finance Magnates)4# ATFX = $188 billion (Source: Finance Magnates)5# AvaTrade = $70 billion (Source: AvaTrade official site, About us page)6# FxPro UK = $5.33 billion (Source: Finance Magnates)7# IQ Option = $380 M (Source: IQ Option official site)Biggest Forex Brokers by Number of Clients:

1# IQ Option = 90 million total, 1 800 000 active traders daily (Source: IQ Option official site)2# eToro = 28.5 million users (Statista)3# XM.com = Over 5 million users (Source: XM.com official site, About Us > Who is XM?)4# HotForex = 3.5+ million total5# FXPro = 2,188,592+ users (Source: Fxpro official site, Homepage)6# Forex.com = 750k + (Source: Forex.com official site, About us page)7# XTB = 495,000 clients (Source: XTB official site, Why XTB > About us)8# IG Group = 400,000 active clients (Source: iggroup.com, About Us > Who we are)9# Pepperstone = 300,000 traders (Source: Pepperstone official site, Why Pepperstone > About)10# AvaTrade = 300,000 (Source: AvaTrade About us page)11# ATFX = 51,745 active users (Source: Finance Magnates)12# OANDA = 36,015 (Source: Oanda official site, Legal documents > Regulatory Public Disclosures)About the listing - Disclaimer

The listing above includes forex and CFD brokers offering forex trading. Please note that the table does not include all brokers on the market and some of the biggest brokers are not in both categories. This might be because a lot of the brokers do not publicly disclose their monthly trading volumes or the number of users they currently have. So while I tried my best to find data from well-respected sources such as Finance Magnates or the official site of a given broker, please take the listing above with a pinch of salt.

Exness

Exness is an internationally regulated broker offering forex, metals, cryptocurrencies and CFDs. Customer service is available 24/7 at the broker with full support for MT4 and MT5 trading platforms. Deposits and withdrawals are free on Exness. Also, a member of the Investor Compensation Fund, Exness offers a wide range of assets for new traders and professionals alike.

There are two standard trading accounts and three professional trading accounts on Exness. The Standard Cent Account is a very suitable account for beginner forex traders who want to learn to trade with little risk, with a minimum deposit of $1, spreads as low as 0.3 pips, and unlocked micro lots. The Standard Account also has a $1 minimum deposit. Standard Account users can access more assets and MT5 platforms, including indices and cryptocurrencies, in addition to the Cent Account. Professional accounts have a higher minimum deposit requirement, trading commissions of $3.50 and spreads as low as 0 pips.

Pros

Pros- Tight spreads

- Strong regulation

- 24/7 customer service

- Multi-language website

- Limited market analysis

- Limited education

- Does not accept EU and US clients

Risk warning: Trading margined products carries a high level of risk.

IQ Option

IQ Option is a popular online broker offering forex, cryptocurrencies and other CFDs. With a unique social trading platform and simple trading platforms, the broker has a minimum deposit requirement of as low as $10. The broker is particularly popular in South America and Asia where the broker offers also trading binary and digital options. IQ Option has created a proprietary social trading platform, especially for beginner traders. Allowing social trading with a feature tool labelled Community Live Deal, the broker offers users a variety of sentiment indicators and a wide variety of charts.

Competitive spreads are available on IQ Option starting from 0.7 pips. While depositing on IQ Option is free, there are high withdrawal fees for wire transfers and an inactivity fee of €10 per month after 90 days of inactivity. Educational materials are scarce on IQ Option.

Pros- Tight spreads from 0.7 pips

- $10 minimum deposit

- Demo account

- Easy interface

- Expensive withdrawal fees

- Limited educational opportunity

Risk warning: Trading margined products carries a high level of risk.

IC Markets

IC Markets is a broker founded in 2007 in Australia. This trusted company, which has been in partnership with the Traders Association for many years, offers traders lots as small as 0.01, low spreads and high customer service quality. IC Market's order execution speed is noticeably faster than most platforms. IC Markets is suitable for traders of any level of experience. All users can access additional resources, analysis and training materials at any time.

Traders can trade CFDs on commodities, indices, over 65 currency pairs, futures, stocks and metals in popular, highly liquid markets. Orders have average spreads between 0.0 pips and 0.1 pips and the broker offers some of the lowest spreads in the world. The minimum deposit requirement is $200 and if you encounter any problems, you can talk to their 24/5 support customer representatives.

The company does not charge transaction fees when withdrawing funds, except for withdrawals through international banks. The company's trading servers are located in LD5 (London) and NY4 (New York). The broker's order execution and withdrawal speed is noticeably better than its competitors.

Pros- Resources such as risk depth, spread monitoring, risk calculator and similar can be used

- Order execution speed is high

- Tight spreads from 0 pips

- Analytical training materials available

- Sometimes there are delays in payments

- Events such as contests, bonuses, giveaways are not organized on the platform

Forex.com

Forex.com is operated by GAIN Capital Group LLC, which was founded in 1999 by Wall Street veterans. Forex.com is a broker that offers its users easy and advanced trading tools, extensive educational resources and low account minimums. Forex.com is one of the most comprehensive currency trading providers in the world, allowing you to buy and sell over 80 currency pairs. Trading with technical analysis on the platform has become easier thanks to more than 90 individual indicators. You can add multiple indicators to a chart with one click.

You can find many forex-related educational tools at this broker, including live webinars for beginners and risk management courses for advanced traders. Forex, options, spot metals and futures can be traded on the platform. The account minimum is $100 and Forex.com charges lower average trading spreads than many competing brokers. Still, the platform has variable spreads.

Forex.com's Active Trader Program allows traders with at least a $10,000 balance in their account to receive cashback on active trading volume. Supporting the popular MT4 platform suite, Forex.com offers its clients comprehensive trading platforms designed for currency traders on mobile, web and desktop platforms.

Pros- Accepts US and Canadian traders

- Over 80 fiat currencies for trading

- Easy-to-use platform interface

- Wide range of research and educational tools

- Limited number of assets

77.7% of retail investor accounts lose money when trading CFDs with this provider.

XM

XM Global Limited is a broker company established in Belize in 2017. Forex, valuable materials, commodities, stocks trading orders are all executed within a second on the platform. Customer service is available 24/5 in 17 languages. One of the best things about the broker, which offers the possibility to trade more than 60 currency pairs, is that the minimum deposit is only $5. This amount is very suitable for beginners and those who are just learning about the market.

XM Group offers users four types of accounts: micro, standard, zero and ultra-low. There are no commissions or hidden fees for trading activities with the broker on any account type. Deposit and withdrawal payment methods are bank, credit card, Skrill, Neteller and similar standard methods.

XM offers users various promotions, bonuses and special extras. Special seasonal bonuses, a welcome bonus, a deposit bonus, a loyalty bonus, a trading bonus and loyalty programs are bonuses offered by the broker. Hower their availability is subject to availability (they are not available in certain countries). Offering both an intuitive platform interface for daily use and a variety of bonuses, this broker has built a pretty good reputation within the entire industry.

Pros- Customer service is very good

- Bonus system with continuous and newly added bonuses

- Strong regulation

- Great educational tools

- Higher spreads on Micro and Standard accounts

Saxo

Saxo Capital Markets is a global service provider serving in 180 countries offering forex, futures, CFDs, stocks and ETFs. Working as a subsidiary of Saxo Bank within the body of Saxo Group, the broker offers a wide range of investments consisting of close to 40,000 instruments. The broker offers spreads starting from 0.4 pips to CFD and forex traders.

Saxo is fully regulated in 15 different jurisdictions including Singapore, England, Denmark and Australia. There are 3 different account types in Saxo: Classic, Platinum and VIP. The minimum deposit requirement for the Classic account is £500. The Platinum account has a minimum deposit requirement of £200,000 and the VIP account has a minimum deposit requirement of £1,000,000. The overall fees and commissions at the broker are competitive for users who can reach Platinum or VIP account level or make more than 100 trades per month, but high for Classic account users.

Saxo has an impressive range of products including forex, futures, indices, commodities, options and bonds. Saxo has created a platform for large and professional investors. Withdrawing from Saxo is free, but inactive investors will face aggressive inactivity fees. Transactions are discounted for Platinum and VIP accounts.

Pros- A highly customizable desktop platform

- Very advanced charting

- Strong regulation

- Commissions, fees, and spreads are not transparent

- Customer service is not very good

HotForex

HotForex is a market maker broker that was established in 2010 and is regulated by seven regulatory agencies. Offering MetaTrader 4 and MetaTrader 5 trading platforms, the broker offers several bonus programs for new members. HotForex offers tight spreads on over 50 currency pairs, with a minimum deposit of $5.

The HotForex website has a wide variety of educational materials. Those who want a good understanding of the main concepts for Forex, financial markets and CFD trading can check out the HotForex e-learning and training center. The broker is a novice friendly broker by organizing webinars regularly, focusing on current trends in the markets and teaching some technical analysis techniques. A demo account with 100,000 USD virtual funds with unlimited usage can be created at the broker. They offer 24/5 customer support via phone, email and LiveChat.

Deposits and withdrawals to HotForex are free. Money can be deposited and withdrawn via credit card, debit card, wire transfer and Skrill, and the withdrawal time varies between 2-10 days depending on the method used. Bonus options up to 100% can be used on deposits.

Pros- Low minimum deposit

- Strong regulation

- No 24/7 customer support

- Withdrawals can take a long time

OANDA

OANDA is an online forex broker that is headquartered in the USA, the company was established in 1996. OANDA's intuitive interface allows users to trade directly from the chart as well as use various analysis tools. Providing access to live exchange rates, the platform also offers an efficient automated trading service thanks to its API libraries.

OANDA has an app for mobile devices. Usually charging low commissions. You can use payment tools such as wire transfer, debit and credit cards, and PayPal to fund your OANDA account. OANDA provides a longer-term demo account compared to other brokers, allowing traders to try out their strategies.

Pros- Creating an account is easy

- Low fees compared to most brokers

- Easy to use

- There are fees such as deposit, withdrawal, inactivity fee, ACH

AvaTrade

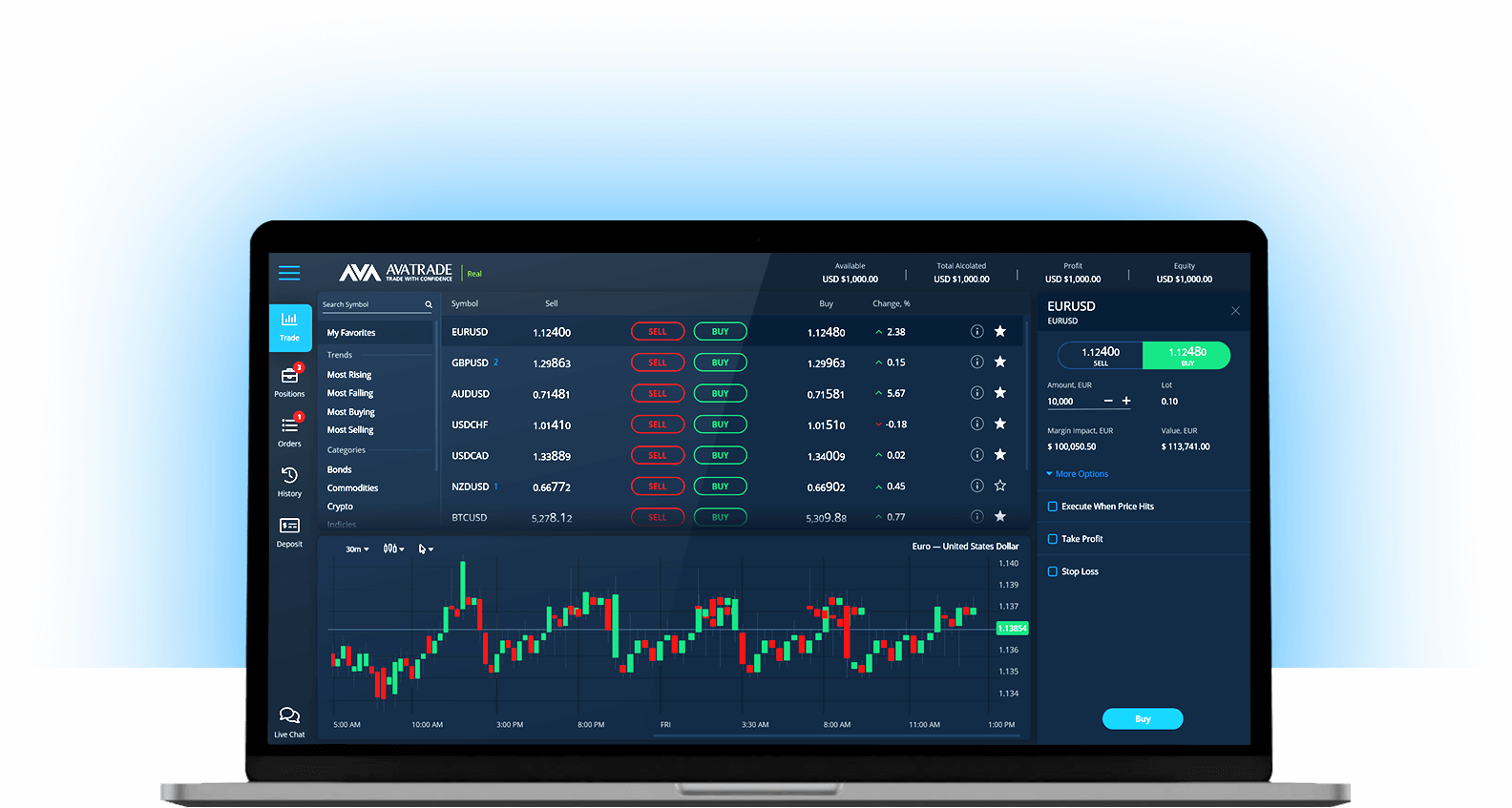

AvaTrade is a well-regulated broker with a global client base of over 200,000 clients. The Dublin-based firm launched in 2006. The platform has something for everyone as its supported investment instruments include bonds, indexes, stocks, forex, forex options, commodities, cryptocurrencies and ETFs.

The platform offers MT4 and MT5 trading platform options. For those interested in social trading and copy trading, packages such as ZuluTrade and DupliTrade are available. Customers are offered 24/5 multilingual professional customer support service. A variety of educational materials and resources are provided for both beginner and professional traders, including professional trading strategies, ebooks, trading videos and blogs.

Pros- Customer service provides competent assistance in 15 languages 24/5

- Wide variety of trading tools

- Auto trade option

- Educational materials and webinars

- Customers from the USA are not accepted

- Site interface is complex

- Trading terminals rarely freeze

76% of retail investor accounts lose money when trading CFDs with this provider.

IG Markets

IG Markets is an easy, reliable, and low commission broker, launched in 1999, which is the market leader especially in the UK. IG Markets offers trading forex, commodities, cryptocurrencies, stocks and CFDs 24 hours a day. Regulated by many regulators, the company is a member of the London Stock Exchange (LSE). Offering more than 19,000 financial instruments, IG Markets has no minimum deposit requirement. The broker has around 240,000 users and the platform is accessible via web browser, Windows and Mac app, Android and iOS apps.

IG has trading tools for both seasoned professionals and new traders. The easy-to-use broker also gives traders the chance to open a demo account. Operating in 188 countries, the broker does not charge withdrawal fees but charges fees for inactive accounts. The platform has educational resources and financial research tools.

Pros- Strong regulation

- No minimum deposit requirement

- No guaranteed stop loss

Pepperstone

Pepperstone is an advanced broker offering trading forex, stocks, indices, commodities and CFDs. Both novice and professional traders can trade on competitive terms at this Australian based broker, including MT4, MT5 and cTrader platforms. Spreads at Pepperstone start at 1.0 pips. Standard account has negative balance protection, Razor account has very good spreads and requires a minimum of $200 to own this account. While the spreads are wide in standard accounts, no commission is taken from the transactions, while in the Razor account, the spreads are much tighter and there are small commissions in line with the industry averages.

Pepperstone offers training materials, weekly webinars, and helpful tips for beginners. The training part is not as detailed as other brokers. The broker with 24/7 customer service will answer your questions in any case. Pepperstone won the Best Forex Trading Support award in 2018.

Pros- Wide platform support

- Strong regulation

- Tight spreads

- Wide range of assets

- 24/7 customer service

- Limited market analysis

FxPro

FxPro is a broker founded in 2006 that provides forex, futures, stocks, commodities, indices, cryptocurrencies and CFD trading. With institutional and retail clients in more than 170 countries, the broker is regulated by many authorities. FxPro offers a wide range of investments. Beginner traders can try trading strategies with the demo account and powerful educational resources.

FxPro places emphasis on providing fast order execution. Offering cTrader, MT4 and MT5 platform range, FxPro offers its clients more than 2,100 trading instruments. Professional traders can take advantage of tight spreads, various platforms and third-party tools like Trading Central. An application called FxPro Wallet has been developed for customers to deposit and withdraw money easily.

Pros- Fast deposits and withdrawals

- Fast order execution

- Competitive spreads

- Inactivity fee

Conclusion on the biggest fx brokers

Forex trading requires professionalism and skill. You should not be emotional and act rationally when trading Forex. What is mentioned in this content is not investment advice. One of the good ways to get started with Forex trading is through the demo account learning process. Forex trading can be good for you if you are willing to take the time to learn the right methods of trading.

Regulated Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.