Best Zero Spread Forex Brokers

Investors are always looking to save money while trading in the forex market. In some cases, zero-spread accounts can help traders save on trading fees. There are a number of forex brokers in the market that feature zero-spread accounts. In this article, we will be looking at the best zero spread forex brokers.

Exness

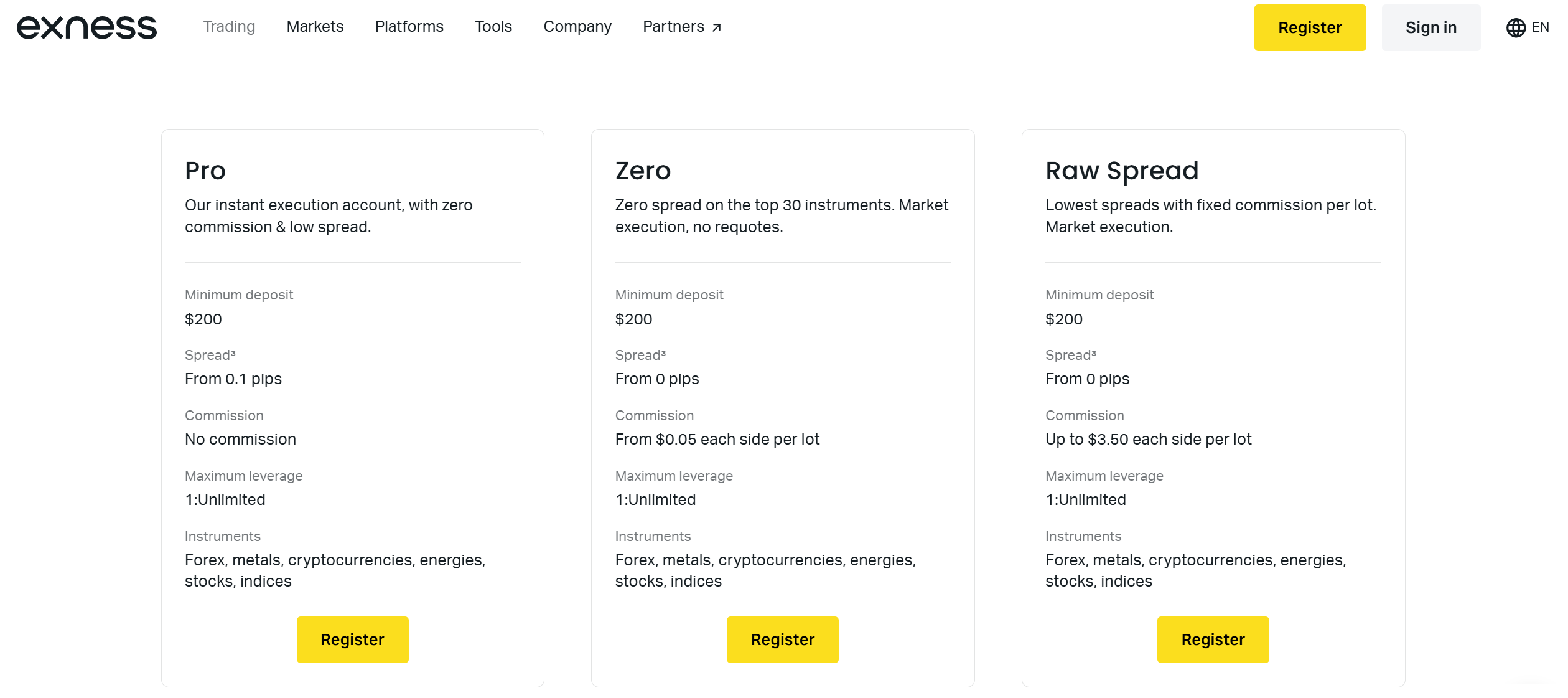

Exness, one of the largest retail forex brokers globally, offers zero-spread accounts with highly competitive trading conditions. There are two accounts that feature spreads from zero pips: the Raw Spread and Zero Spread accounts. However, users of these accounts have to pay commissions to trade. The Raw Spread account requires traders to pay a fixed commission of up to $3.50 per side side per lot. The minimum deposit you can make on this account is $200*.

On the other hand, the zero spread account requires traders to pay a variable commission. This commission starts from $0.05 per side per lot. These are some of the best trading conditions any zero-spread broker has. The minimum deposit for this account is also $200*.

Users of these two accounts have access to a variety of markets. They can trade instruments from the forex, metals, cryptocurrencies, energies, stocks and indices markets. This allows willing investors to try their hand at trading different market instruments. Exness has multiple regulations. The company is regulated by the FSCA in South Africa, the CMA in Kenya, the CySEC in Cyprus, the JSC in Jordan, and the FSC in Mauritius.

This means that multiple regulators are watching their every move to ensure they obey the law. Additionally, the broker offers fairly high leverage. Unfortunately, the broker does not accept retail forex traders from the UK and EU, traders from most other countries are welcome tho.

Remember that forex and CFDs available at Exness are leveraged products and can result in the loss of your entire capital. Please ensure you fully understand the risks involved.

FP Markets

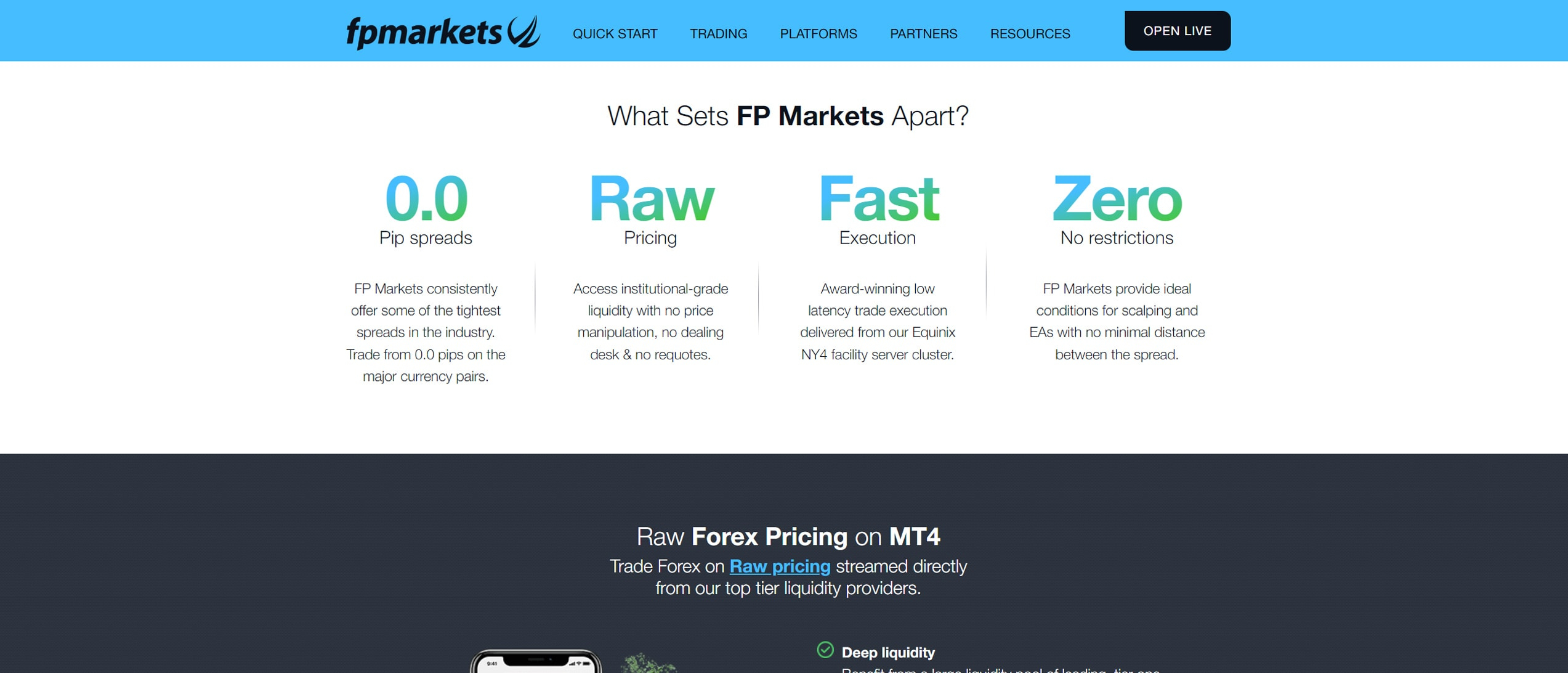

FP Markets is a popular Forex and CFD broker that features an account on which the spreads start from zero pips. There are two main accounts on this platform. These include the Standard account and the Raw account. The Raw account features spreads starting from 0.0 pips but users have to pay a commission. Traders using this account pay a commission of $3 per side per lot.

The Islamic accounts also feature a Raw account with spreads starting from 0.0 pips. The commission on this account is also at $3 per lot each way. However, users of Islamic accounts have to pay administration fees on positions. Clients can trade various markets on FP Markets. They can trade forex pairs, CFDs on shares, metals, commodities, cryptocurrency, indices, bonds and ETFs. This is a wide variety and accommodates all kinds of traders.

FP Markets is a reputable broker featuring trading from zero pips. This is because the company has regulations from various regulators. These regulators include ASIC in Australia, CySEC in Cyprus and the FSA in Seychelles.

72.44% of retail CFD accounts lose money

Tickmill

TickMill launched its online brokerage services in 2014 and features multiple markets on its platform. Clients can trade forex and CFDs on stock indices, oil, precious metals, bonds, stocks and cryptocurrency. The company features a variety of markets to accommodate all kinds of traders.

Additionally, the company features several trading accounts for its clients. These include the Classic account, the Raw account and the Tickmill Trader Raw. Both the Raw account and the Tickmill Trader Raw feature spreads starting from zero pips. However, as expected, users of these accounts have to pay a commission fee when trading. While clients using the Raw account pay $3 per lot per side, clients of the Tickmill Trader Raw account pay a commission fee of $3.5 per lot per side.

Trading with regulated brokers is the safest bet for any investor. Luckily, Tickmill has regulations in multiple jurisdictions. It is regulated by the FCA in the UK, the CySEC in Cyprus, the FSCA in South Africa, and the FSA in Seychelles. Such regulation makes Tickmill one of the best zero-spread forex brokers in the market.

71-74% of retail investor accounts lose money when trading CFDs with this provider.

HFM

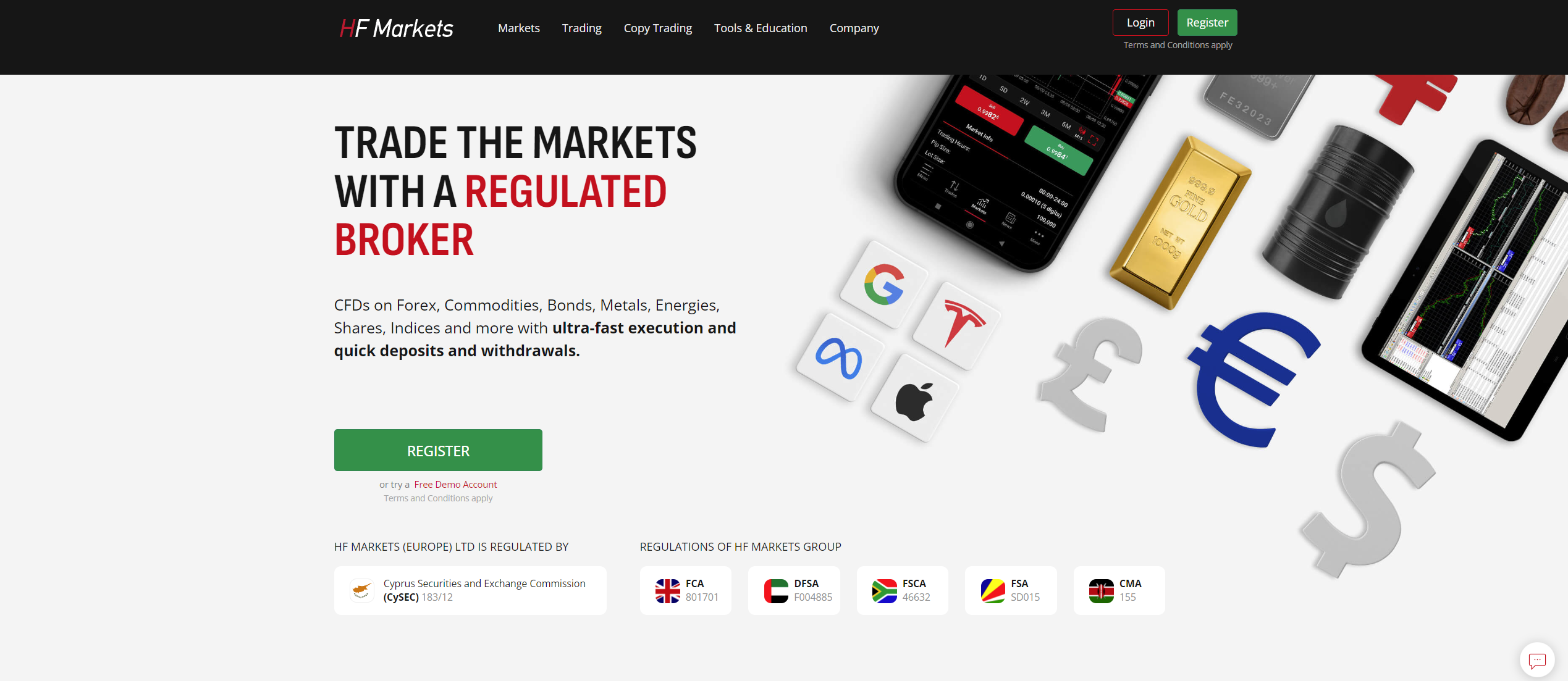

HFM (formerly HotForex) is another forex/CFD broker offering a zero spread account. The Zero Spread account on HFM offers spreads starting from 0 pips on forex. Predictably, users of this account have to pay a commission to trade. The commission amount varies depending on the currency pairs one is trading. For example, investors pay a $3 commission per lot per side when trading USD against major currency pairs. However, when trading USD against other pairs, the commission is $4 per lot per side.

In terms of regulations, HFM is licensed and authorized to operate in various jurisdictions. It is regulated by the FCA in the UK, the DFSA in Dubai, the FSCA in South Africa, and the FSA in Seychelles. This shows that the company remains committed to following the laws.

68% of retail investor accounts lose money when trading CFDs with this provider.

Admiral Markets

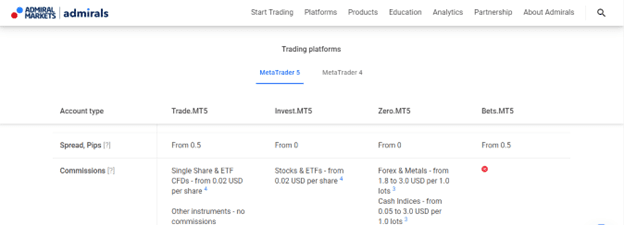

Admiral Markets has been in the market since 2001. It has regulations by the FCA, CySEC, ASFL, JSC and FSCA. These are all reputable regulators keeping a keen eye on this company’s activities. This gives Admiral Markets some credibility in the market. Further, Admiral Markets tries to accommodate all kinds of traders. They do this by offering a variety of trading accounts. The accounts available on Admiral Markets include Trade.MT5, Invest.MT5, Zero.MT5, Bets.MT5, Trade.MT4 and the Zero.MT4. Three of these accounts feature spreads starting from 0 pips. They include the Invest.MT5, Zero.MT5 and the Zero.MT4 accounts.

The Invest.MT5 account gives clients access to only two markets. Investors can only trade Stocks and ETFs on this account. As trading fees, traders pay a commission when trading. The commission for this account is $ 0.02 per share for both Stocks and ETFs.

On the other hand, the Zero.MT5 account allows clients to four markets. These include Forex, Metal CFDs, Cash Index CFDs and Energy CFDs. The commission on this account depends on the market in which a user is trading. For example, the commission on Forex and Metals is from $1.8 to $3 per lot. The Zero.MT4 account is identical to the Zero.MT5 account. The only difference is the trading platform available to clients. As the names suggest, the Zero.MT5 uses the MT5 platform while the Zero.MT4 uses the MT4 platform.

InstaForex

InstaForex has been providing forex and CFD brokerage services since 2007. The company vows to accommodate all kinds of traders. For this, the company features four account types. These include Insta.Standard account, Insta.Eurica account, Cent.Standard account and the Cent.Eurica account. Two of these accounts feature spreads starting from zero pips when trading. These are the Insta.Eurica and the Cent.Eurica accounts.

The Insta.Eurica and the Cent.Eurica accounts have the same features. However, the Cent.Eurica allows traders to place orders as little as 0.0001 lots. This is suitable for beginner traders looking to trade with minimal risk as they learn the ropes. However, both the Insta.Eurica and the Cent.Eurica accounts feature a commission. Clients have to pay a commission between 0.03% to 0.07%. Traders have access to various markets on InstaForex. These include the forex, CFDs on shares, indices, metals, oil and gas, commodity futures, crypto and instafutures. InstaForex is regulated by the BVIFSC of the British Virgin Islands and the FSC of St. Vincent and the Grenadines and by the CySEC in Cyprus.

Summary of the Best Zero Spread Forex Brokers

This review looked at the best zero spread forex brokers in the market. While zero spreads are impressive, it is important to note other fees that apply. In most cases, traders have to pay a commission every time they trade. Make sure the charges involved suit your needs before you start trading.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.