DFSA Regulated Forex Brokers in Dubai - List

The DFSA, also known as the Dubai Financial Services Authority, is an independent financial services regulator in Dubai, United Arab Emirates. DFSA was founded in 2004. The DFSA regulatory mandate includes overseeing the financial markets sector and ensuring the environment remains fair and within legal limits.

Today we will look at some of the DFSA-regulated forex brokers. We will look at the trading conditions they have to offer including the spreads, the trading platforms, and the assets available.

Understanding the DFSA’s Regulations

The Dubai Financial Services Authority (DFSA) is the regulatory body responsible for overseeing financial services and related activities in the Dubai International Financial Centre (DIFC). It was established in 2004 and operates as an independent regulator. Its primary goal is maintaining the integrity and stability of the financial system within its jurisdiction.

Notably, the DFSA supervises and regulates 665 authorised firms, 100 DNFBPs, 2 authorised market institutions, and 17 registered Auditors. The DFSA boasts of administering and enforcing world-class regulations on forex brokers. It is well respected worldwide and is one of the regulators making their name in the market lately.

Note that in the UAE mainland, forex trading is regulated by the Securities and Commodities Authority (SCA). With that, let’s look at some of the best DFSA-regulated brokers in the world.

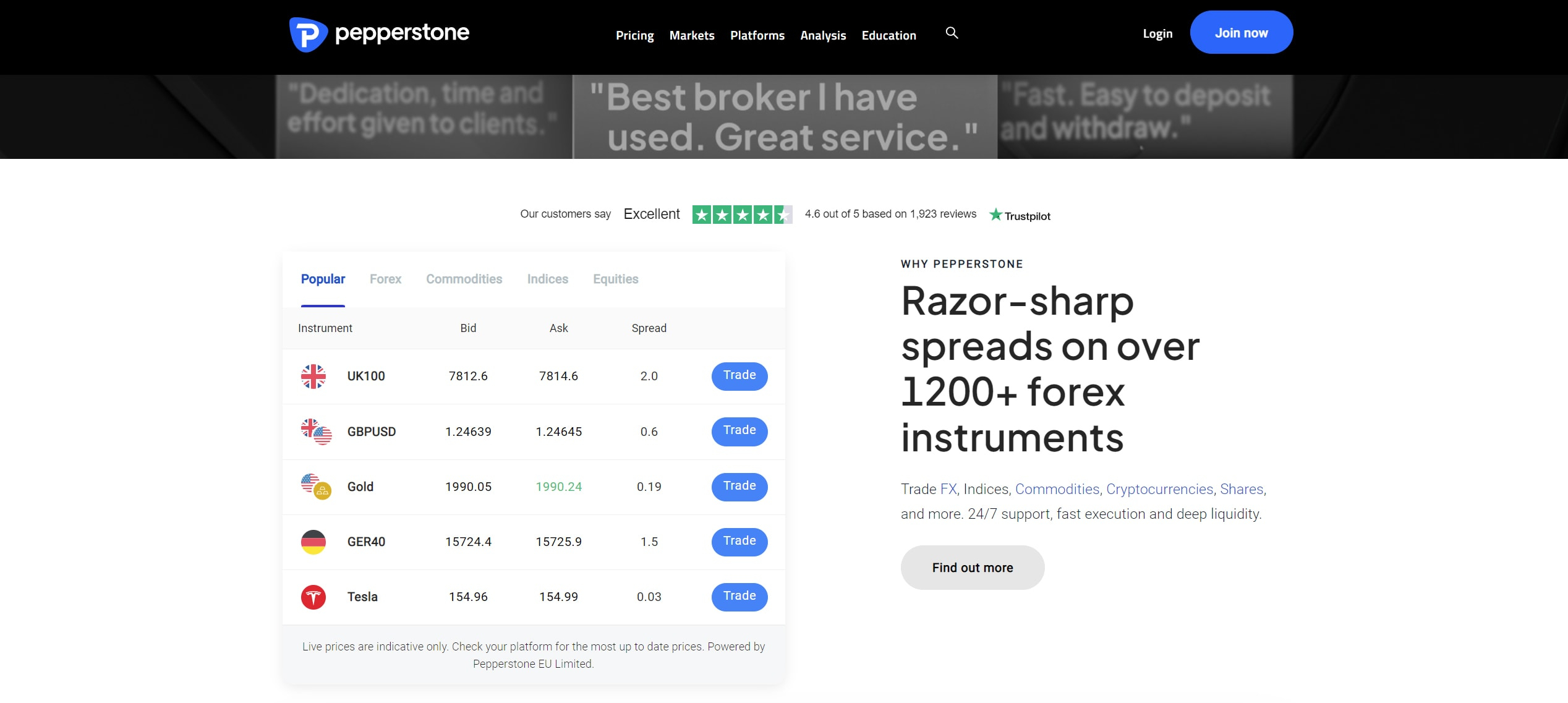

Pepperstone

Pepperstone is one of the Top Forex and CFDs brokers with regulations from the DFSA in Dubai under license number F004356. Launched in 2010, this broker is one of the most heavily regulated companies in the forex space. Apart from the DFSA, the broker has other regulations from other organizations including the ASIC in Australia, the FCA in the UK, the CySEC in Cyprus, and the CMA in Kenya.

Notably, Peppestone provides various trading instruments from various markets. In total, the broker allows traders to invest in over 1,200 CFDs on forex, commodities, shares, indices, cryptocurrencies, and ETFs. The wide range of markets allows traders to diversify their trading portfolios on one broker site. Further, the broker offers diverse trading platforms for traders to choose from. These include MetaTrader 4, MetaTrader 5, cTrader, and TradingView. These world-class platforms make Pepperstone one of the fastest order execution times brokers in the market.

Lastly, clients can choose between two main trading accounts on Pepperstone. They include the standard and the razor account. The standard account features spreads from as low as 1.0 pips with no commission. On the other hand, the razor account has spreads starting from 0.0 pips for major currency pairs with a small commission. The commission sits at $3.50 when using MetaTrader 4, MetaTrader 5, and TradingView. When using cTrader, the commission is $3 per side per lot.

Remember that forex and CFDs available at Pepperstone are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

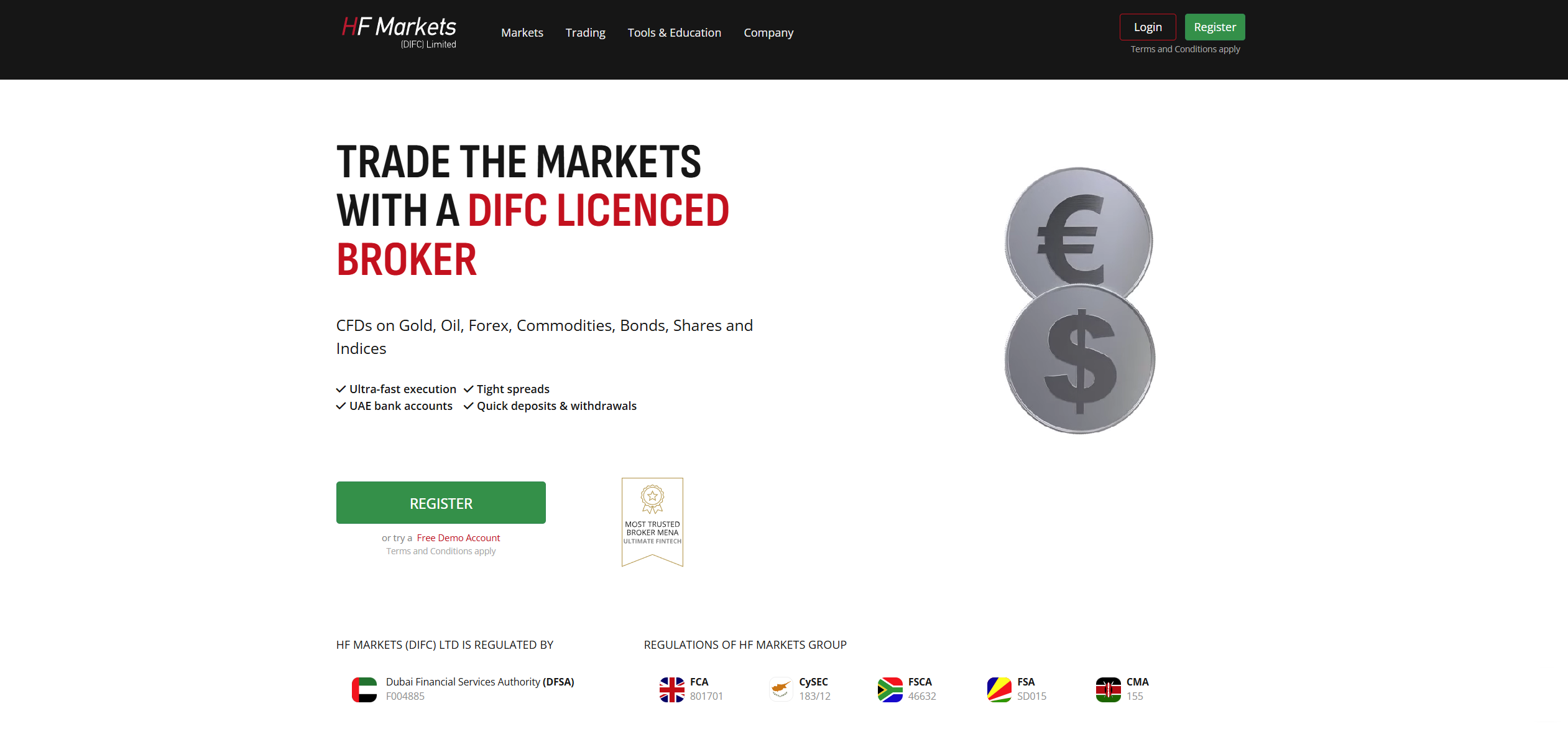

HFM

HFM is another broker that is regulated and authorized by the DFSA under the license number F004885. On top of that, the broker has regulations from other well-known regulators. These include the CySEC in Cyprus, the FCA in the UK, the FSCA in South Africa, and the CMA in Kenya. While regulations alone are not enough, they play a huge role in safeguarding both investors and brokers.

On market products, HFM offers a wide range of trading instruments. Specifically, HFM gives clients access to over 1,000 market products. The market instruments available include CFDs on ETFs, forex, metal, stock, indices, commodities, energies, and bonds. These markets are accessible on industry-standard platforms that include MetaTrader 4, MetaTrader 5, and the HFM Platform.

HFM accounts cater to all types of traders from beginner to advanced. The list of accounts offered by the broker includes cent, zero, pro, and premium. Both the Cent and the Premium accounts have spreads starting from as low as 1.2 pips with no commissions. In contrast, the Pro account features lower spreads starting from 0.5 pips for major currencies with no commission. Finally, the Zero account has spreads from as low as 0.0 pips with a floating commission from as low as $0.03 per 1k lot. To meet the needs of Muslim traders, the broker offers Islamic accounts in the UAE that comply with Sharia law.

Remember that forex and CFDs available at HFM are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

AXi

Axi is fully licensed and regulated by the DFSA under license number F003742. The broker is also under the regulation of other organizations including the ASIC in Australia and the FCA in the UK. With regulations that go as far back as 2007, this broker is attractive to many traders in the market.

Moreover, traders can choose from 220+ market products on Axi. The variety enables traders to diversify their trading portfolio. The range of markets accessible includes forex shares, indices, commodities, cryptocurrencies, and IPOs. The assets are available on industry-standard platforms that are easy to use for both advanced and beginner traders. The trading platforms available include MT4 and MT4 WebTrader.

Lastly, the broker enables a trader to use different account types and choose the one that better suits their needs. The available account types offered by Axi include the standard account, pro account, and elite account. The pro and elite account spreads start from as low as 0.0 pips with a commission of $7 and $3.50 round trip respectively. In contrast, the standard account spreads are from 0.9 pips for major currency pairs with no commission.

IG

IG allows its traders to access over 17,000 market instruments. These include CFDs on shares, forex, indices, commodities, and ETFs. These market products are accessible on different platforms which include MetaTrader 4, L2 Dealer, and ProRealTime. This allows traders to pick and choose the platform that best suits their needs.

For traders in the DIFC, the broker operates under the regulation of the DFSA in Dubai. It operates in this jurisdiction under the license number F001780. Further, the broker has regulations by other organizations in addition to DFSA. These include the FCA in the UK, the ASIC in Australia, and the FSCA in South Africa, among others. such regulations elevate the broker’s reputation among traders.

Finally, the spreads in IG are manageable and most traders would be able to afford them. The spreads on IG can fall as low as 0.6 pips for some major currency pairs with no commission. These are some of the lowest spreads in the market today.

HYCM

HYCM has regulations and licenses from different entities that include the DFSA in the DIFC (Dubai International Financial Centre), the CySEC in Cyprus, the FCA in the UK, and the CIMA in the Cayman Islands. Under the DFSA, the broker operates under the license number F000048. Clients can rest assured that they are trading with a company under constant examination and supervision.

Moreover, the broker has over 40 years of experience in the market. Notably, it offers a comprehensive range of products including forex, stocks, indices, cryptocurrencies, and commodities. To place orders on these markets, traders use world-class trading platforms which include MT4, MT5, and HYCM Trader. These are available on all kinds of devices including PC, macOS, Android, and iOS.

HYCM offers traders different accounts with different spread structures. The Classic account has variable spreads as low as 1.2 pips for major currency pairs. The Fixed account has fixed spreads from as low as 1.5 pips upwards. Both of these accounts do not charge a commission when trading. In contrast, the Raw account has raw spreads from as low as 0.1 pips and a low commission of $4 per round trip.

Amana App

Amana App is the final broker we will cover in this article. The broker site is yet another company under the regulation of the DFSA in the DIFC under license number F000048. The broker also has regulations from the CySEC in Cyprus, the FCA in the UK, and the CMA in Kenya. This shows that this broker is keen on following the financial laws of the jurisdictions it operates.

Positively, the broker allows traders to access various market instruments. The variety of global markets the broker offers includes stocks and ETFs alongside CFDs on forex, crypto, gold, oil, and other markets. The trading platform available to trade the various markets is the Amana Appy

Interestingly, this broker does not make any profits from spreads or commissions. What traders pay, is what the broker pays to facilitate trades. The company promises zero markups on the underlying prices.

Our Conclusion of DFSA Regulated Brokers in Dubai

In essence, regulations always contribute to a trustworthy and secure trading environment for investors. However, you still have to couple this with the commitment of brokers. As such, while traders should prioritize brokers with regulations, they should understand that regulations alone are not enough. A broker still has to demonstrate a history of following the law.

Examining prominent DFSA-regulated brokers in Dubai sheds light on the diverse offerings within this regulated region. Traders should seek brokers who offer world-class services on top of having strong regulations. Some of the other features to look at include the spreads, the trading platforms available, and the depth of market products available.

Since this is not an exhaustive list of all brokers that are regulated by DFSA, we call upon traders to do their research. By doing so, they can pick and choose the broker that best suits their needs. We understand that every trader has their own unique needs when choosing a broker.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.