Plus500 Review - What to expect from the broker

The following review introduces the UK's No. 1 CFD Platform¹ and one of the best-known international CFD brokers, Plus500. Let's have a look at the company that is licensed by 5 regulatory watchdogs, including the UK's FCA.

The following review introduces the UK's No. 1 CFD Platform¹ and one of the best-known international CFD brokers, Plus500. Let's have a look at the company that is licensed by 5 regulatory watchdogs, including the UK's FCA.

Plus500 is a market-leading provider of CFDs that attracts clients to one of the most competitive spreads in the industry (e.g. for EUR/USD 0.6 pips*, BTC $55.1*), a guaranteed stop loss and a customer-friendly platform. The company features over 2 000 trading assets to which traders have access either from a demo account that can be created within 15 seconds or from a real account starting from £/€/$ 100. Plus500 provides full support in English, German, Spanish and other 29 languages.

| General Risk Warning: 77% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. |

Basic information about Plus500

- Website address: www.plus500.com

- Instruments: CFDs - Forex (71), commodities (22), stocks (1400), indices (33), ETFs (85), Cryptocurrencies (13), Options (500+-)

- Minimum deposit: £/€/$ 100 (or other account base currency)

- Demo account: Yes, unlimited for free

- Methods of deposit and withdrawal: Wire Transfer, PayPal, Skrill, Credit and debit cards (Visa/MasterCard)

Bitcoin trading at Plus500

Trading platform of the broker

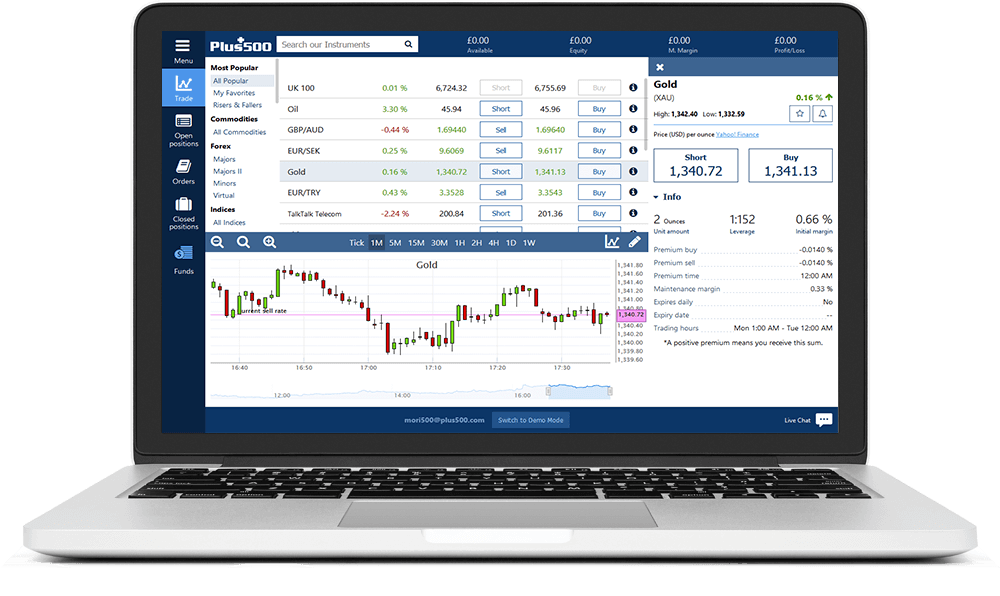

Plu500 provides access to a cutting-edge platform in which one can get around without any problems. Once you find your asset and you click on it, all information about the asset appears. Here, you can see the sentiment of the market, current spread, overnight fees for buy/sell positions (either positive or negative) or the trading hours for the selected asset (just as displayed on these two screenshots).

The trading platform can be also used for fundamental analysis as it provides a customizable environment with various charting tools and indicators. Be, however, aware that the trading platform does not support using expert advisors for automatic trading. For each of the available assets on the platform, you can create price notifications. When the price you specified is reached, you get notified by email or SMS.

With the option to set a guaranteed stop loss, take profit, trailing stop and free email & push notifications, you are as much in control as you can be.

Available assets on the Plus500 trading platform

The Plus500 trading platform features over 2 000 CFDs on stocks, indices, cryptocurrencies, forex pairs, commodities, options and ETFs.

- Stocks: On the trading platform, one can find stocks literally from all around the world. There are European stocks (Vodafone, Ryanair, Orange Polska…) as well as American stocks (Tesla, Amazon, Apple…) and Asian stocks (Toyota, Mazda, Panasonic…), or even Australian stocks. The number of tradable stocks hovers at Plus500 around 1400 from which over 900 are American stocks.

- Indices: The trading platform features over 3 dozen indices. Most of them are European and you will find here popular titles like UK 100, Germany 30, Cannabis Stock Index and many others.

- Forex: There are over 70 forex pairs that consist of major currency pairs like EUR/UD and GBP/USD as well as minor and exotic pairs.

- Commodities: Gold, coffee, oil, wheat and 2 dozen more commodities are available for trading.

- Cryptocurrencies: The broker offers CFDs on the following 13 cryptocurrencies: Bitcoin, Bitcoin Cash, Ethereum, Litecoin, Ripple, IOTA, Monero, EOS, Neo, Stellar, Cardano, Tron + Crypto 10 Index. All of these cryptocurrencies are traded against the American dollar.

- Options: Around 500 call and put options, including options on Germany 30, Oil or Facebook.

- ETFs: Almost 90 exchange-traded funds (ETFs) are available, the most popular titles are iShares, SPY and XLF.

Plus500 free demo account

The Plus500.com broker offers an unlimited practice account with 40 000 fake money units. The demo version works exactly the same as the real account, the only difference being that you trade with imaginary funds. In order to open a demo account, all one has to do is fill in an email and a password. After that, you instantly gain access to trading on the platform.

Plus500 fees and spreads

Plus500 makes most of its money from spreads (i.e. the difference between a bid price and an ask price). In some circumstances, you can be also charged with an Overnight Funding fee, which is either deducted (or added to) from your account balance when you remain in a position after the market has closed. Overnight funding can also be positive, in such a situation the amount is added to your balance. Plus500 has a 0-commission policy and does not impose fees on deposits or withdrawals.

Plus500 spreads differ from instrument to instrument but taking all into account we are not afraid to say that Plus500 has one of the most competitive spreads in the industry. The numbers back up this bold statement themselves.

| EUR/USD | UD/JPY | GBP/USD | AUD/USD | Bitcoin |

| 0.6 pips | 0.7 pips | 1.1 pips | 0.7 pips | $36.01 |

*Spreads recorded on 30.04.2020 at 20:05 GMT from the trading platform of the broker.

Plus500 - Credibility

There are several things indicating it is a trustworthy company. For a start, Plus500 has a huge base of traders from all over the world whom it managed to attract with its high-quality services. (In the year 2019 the whole Plus500 community made trades worth 1310 + billion $). As the broker has been around for quite some time (since 2008), its credibility has been tested by the traders. Moreover, the Plus500 Ltd broker is listed on the Main Market of the London Stock Exchange. Apart from the possibility to trade its shares (symbol: PLUS:LN), the London Stock Exchange also prescribes strict rules applying to the listed companies. Therefore, any unethical practices are fully excluded.

Plus500 Ltd. is a parent company, the broker is regulated by more than one regulatory authority.

- In the UK it is regulated by the well-known FCA (Plus500UK Ltd – license number 509909).

- In Europe - Cyprus by the CySEC (Plus500CY - license number 250/14).

- In Australia by the ASIC (Plus500AU Pty Ltd (ACN 153301681) – license number 417727).

- In New Zealand by the FMA (Plus500AU Pty Ltd (FSP #486026).

- In South Africa by the FSCA (Plus500AU Pty Ltd (l.n. 47546).

The conclusion of our Plus500 review

Plus500 is an attractive CFD broker, that has been ranked by the Investment Trends 2020 UK Leverage Trading Report as the UK's No. 1 CFD Broker. While it is especially popular in the UK, Plus500 as an international broker offering support in English, German, Spanish and other 29 languages operates worldwide. The company charges very competitive fees and they are very transparent about all their fees so you can see real-time spread charges for each available asset right from the homepage of the broker.

The broker features over 2 000 trading assets on its own-house built platform. The minimum deposit is quite small; £/€/$ 100 (or equivalent in another currency). For anyone who wants to try the Plus500 services, there is a free demo account that can be opened within a few seconds.

¹ By a total number of relationships with UK CFD traders. Investment Trends 2020 UK Leverage Trading Report.

Your review can make a difference to other traders, please leave a comment if you have any personal experience with Plus500.