Beginner’s Guide to Cryptocurrency Trading - Basics

Cryptocurrency trading is more popular than ever and a huge number of investors are looking to jump on the crypto hype to make easy money. But it is very important to understand that crypto trading is no get-rich-quick scheme as most people think.

As a beginner cryptocurrency trader, you have to do your research to be positive about the cryptocurrencies you choose to invest in. You most definitely do not want to put your money into something that you do not believe in. In this article, I am going to examine all the necessary steps you should take as a crypto beginner. However, in the end, it is up to you to take them. But first, let’s start with some basic facts about the cryptocurrency market.

Cryptocurrency market is open 24/7

Unlike fiat currencies, cryptocurrencies can be traded 24/7. Trading volume differs during the day as traders from different countries enter the market at different times. These changes have, however, a very low significance.

Crypto market is very volatile

The cryptocurrency market can skyrocket or fall down even by tens of per cent in a matter of minutes or hours. It is completely different from stock or classic forex markets and it is important to realize that investing in cryptocurrencies puts your capital at high risk. The crypto market is probably the most welcoming one, even for beginners. Nevertheless, you still need to understand that the huge price spikes cryptocurrencies experience on a regular basis do not always bring the desired profit. In fact, they can also have a devastating effect on investors' capital. Now, I am going to teach you how to significantly reduce the risk. However, you always have to be aware of the crypto market volatility.

1. Find a cryptocurrency broker you can trust

Searching for the best crypto broker is not an easy task. There are many crypto companies and their offers vary. The main aspects you should consider when choosing a broker are the following:

a) Trust & Regulation

If you come from a European country, the broker should be regulated, for instance, by the CySEC, a regulatory body based in Cyprus which oversees all the broker’s activities. They also provide full deposit insurance of up to 20,000 dollars. Investors from Australia should be looking for brokers with the ASIC license.

b) Fees

The less you pay in fees the more you can earn. So it’s only logical to find a broker with the lowest fees possible. Most brokers charge an amount equal to a spread for opening a position. A spread is the difference between what you pay for a cryptocurrency coin and what you get when you decide to sell it to the broker. Apart from that, many brokers charge a swap when you stay in a position overnight. Such brokers are usually best for day cryptocurrency trading and brokers with no swaps are best for a long-term holding.

c) Cryptocurrencies you want to trade

If a broker does not offer cryptocurrencies you desire to trade, there is no point in creating an account. Therefore, do not forget to check whether the company of your choice offers all the cryptocurrencies you plan to trade.

d) Leverage

Leverage can help you benefit from small price movements of cryptocurrencies. It is a very powerful tool when used by professionals, however, beginners should only use it with great caution or not at all. Fortunately, the cryptocurrency market is volatile enough to make a good profit even without it.

Popular Regulated Cryptocurrency Brokers

Here’s a breakdown of some of the best and most popular cryptocurrency brokers.

Regulatory agencies ensure that brokers operate in a transparent and honest way. They protect the best interests of clients and also feature an investor compensation scheme which protects trader's deposits up to a certain limit. Some of the major regulators in the industry include the CySEC in Cyprus, the FCA in the UK and the ASIC in Australia.

A trading platform is a computer or mobile software program used to execute transactions within the financial markets.

A list of features that provide a given broker with a competitive edge.

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Between 74-89% of retail investor accounts lose money when trading CFDs.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

2. Get started with the right cryptocurrency

If you haven’t chosen the cryptocurrency you want to trade, now is the time. Selecting a digital coin with the highest potential is a very important step. You do not want to choose a cryptocurrency you don’t have faith in. When you do your research about cryptocurrencies, there are several things you should look for:

- Infrastructure (App development, Cloud storage, Virtual Private Networks, funding, etc.)

- Technology (Quick transaction process, firm and easy to use UI that is easy to adopt, etc.)

- Development team (Skilled and experienced, solid amount of developers, etc.)

- Growing popularity (Rising demand for the cryptocurrency, more people using it, media coverage, etc.)

These are the most important general rules when determining a cryptocurrency's potential. Some of them are more important than others, but the cryptocurrency you select should meet at least 3 of these criteria.

3. Determine where the price is. Is it low or high?

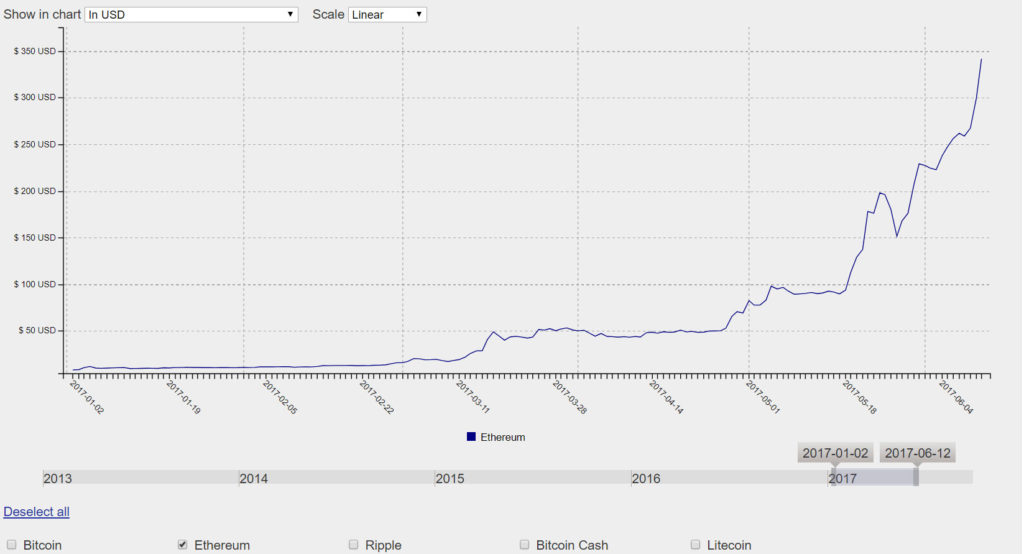

Is the price now at its 45-week low? Or is it at its maximum? You probably know the saying “buy low, sell high”. Let me show you a great example of what I mean on the Ethereum chart which displays the price movement from the beginning of the year 2017 to 12.6.2017.

Wow, that looks really great, doesn't it? That seems like a really good investment to make...Until...

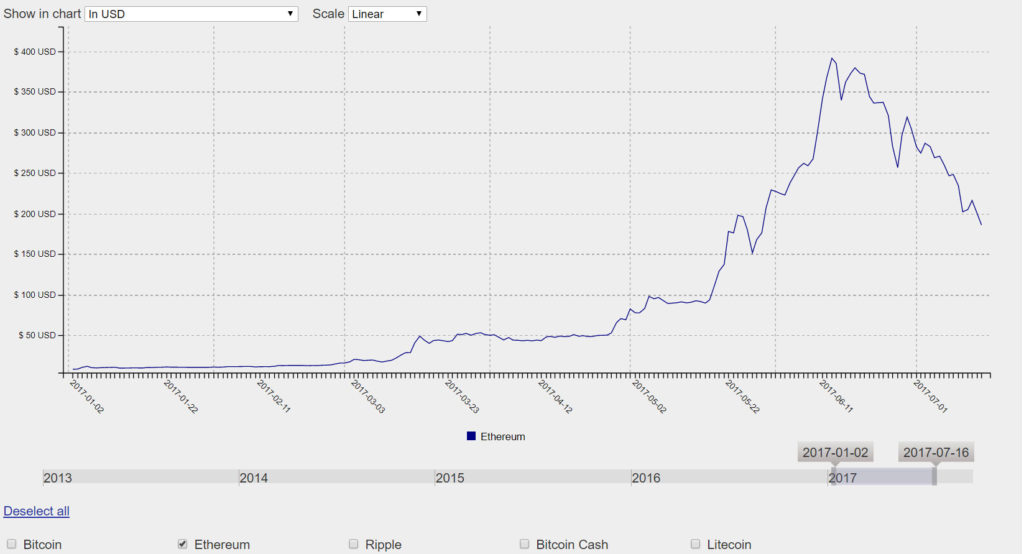

The price went down to half in one-month time. It is definitely true that there might be situations when the value of a certain cryptocurrency with good technology, funding and media exposure keeps rising for a long time. However, such investments are very risky for beginner traders because it is hard to determine how long the growth can last. We surely do not want to end up chasing highs and go with excessive optimism when it's actually the only thing pushing the price up.

4. The best way how to approach crypto trades not only as a beginner

One of the best investors of all time, Warren Buffett, once said:

Be Fearful When Others Are Greedy and Greedy When Others Are Fearful

And this is a great way to approach the cryptocurrency market. Are others dumping coins for a relatively low price? Great! It might be a good time to buy them. Is the market optimism fake? Well, now might be a good time to lock in those profits and get out of the trade safely.

5. Face the crypto market with an exit strategy

Traders buy cryptocurrency coins when they consider the price to be low. Now, once you are in a trade and the price goes up, you have to think about the best time to get out of the trade (if you speculate on the price growth). You do not want to hold onto it until the end of days. The best time for leaving is when the prices are going too high and the investors are getting carried away. One way to determine this moment is by asking yourself “Do I honestly believe the coin is worth more?”. If you think that there is currently no more space for the cryptocurrency to grow, it is time to get out of the position.

6. What affects the price of cryptocurrencies

There are many fundamental influences that can drive the price of cryptocurrencies down or up. The main of them are as follows:

-

a) Government Regulations

Whenever any government makes a public statement about the regulation of a cryptocurrency, the market always reacts to it. Do you remember when China banned ICOs? The price of Bitcoin and other cryptocurrencies dropped down rapidly. Therefore, it is very important to keep an eye on such events, whether you are a beginner or a skilled trader.

-

b) Media exposure and other influencers

Generally, cryptocurrencies gain in value when they receive positive media exposure. It is simply because more people are interested in buying the coins. There are also individuals who can influence the price of cryptocurrencies. Such people are usually extremely well-recognized in the field of finance and investing. So, when the CEO of the biggest American bank J.P. Morgan – Jamie Dimon publicly stated that he thinks that Bitcoin is a fraud that will eventually blow up, it was no wonder that the Bitcoin market took a big hit. Because of this statement, J. Dimon received many negative comments suggesting that his statements were intended to manipulate the price of Bitcoin.

-

c) Wider Mainstream Acceptance, New firms backing up the project

Has just Amazon, eBay or other huge international firm announced that from now on they will accept payments in Bitcoin? Great! You probably know what that means for the market… Similarly, when big companies like Microsoft, Intel or others provide their name and finance, it is another reason for the price to go up.

-

d) Technological Changes and Innovations

With every new technological change, there is a high chance that it might significantly affect the price of a cryptocurrency. For example, if a new security protocol that will make the cryptocurrency even more reliable, secure and scalable is scheduled to be released, it might induce a positive response of the market.

-

e) State of other markets

It should be no surprise that cryptocurrencies react to other markets' developments as well. In the past, cryptocurrencies tended to benefit from crashes of other markets. Gold and Japanese yen are no longer the only instruments categorized as safe havens investments.

Is that all? Let's wrap up the crypto guide for beginners & dummies

Here is the deal. The cryptocurrency market is still relatively new and unstable and its trading is complex. You should, therefore, never stop learning. Towards this very purpose, we have here on the website crypto guidepost where we feature crypto news, tips, guides, the market's best brokers and a crypto glossary. Here is a selection of 3 articles you might want to read after finishing this guide for beginners.

How to day trade cryptocurrencies like a pro + 5 Best Cryptocurrencies to Day Trade + How to buy the dips in cryptocurrency market

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.