Stock day trading for beginners - How to start

The stock market is a place where stocks, bonds, options and ETFs are traded. Day trading on the stock market means opening and closing trades within the trading hours of a single day. Unlike the forex market which operates for 24 hours, the stock market is opened only for a few hours in a business day. Therefore, traders have far less time to make their trades work. That is why it is essential they understand how to trade stocks profitably within the few hours that market gives them.

Before you start day trading stocks

In terms of pre-trading processes, you will be looking at how to prepare yourself for a day trading career in the stock market. There are a few things and aspects to consider before you start, such as:

- Where to open an account so the stock broker would support day trading.

- What capital will you use

- What is the best payment method for you

- What trading device are you going to use (desktop, laptop, tablet or smartphone).

Let us look at these factors one after the other.

Opening a Day Trading Account

You need to open a trading account with a broker that supports day trading. You will most likely have to trade with a discount brokerage. It is not within the scope of this article to start to suggest brokerage firms to use. What works for one may not work for another. We can only provide you with a guide to use in doing your research and making an informed choice. You should ideally use a brokerage that offers you the following:

- 1) Ability to open and close trades within hours at a minimal cost.

- 2) Interactive charts for technical analysis.

- 3) An assortment of trading tools and resources.

- 4) A regulated environment.

Also, find out if the broker you are interested in is allowed to do business with your country. For instance, stock brokerages in the US are very picky on nationals allowed onto their platforms; fallout from the 9/11 attacks.

Assembling Sufficient Capital

An undercapitalized trading account is doomed to fail. Capital plays a part in not just being able to fund trades, but also to help provide support for account recovery if losses have occurred, or if the use of leverage is stretching the ability of the account to withstand any ongoing losses. Most discount brokerage offer accounts with a $500 minimum deposit requirement, but should you trade with more? Probably not as a beginner, but if you have some experience, you should consider using more capital.

If you do not have enough money, it is best you engage in some offline activity like working a job in order to raise the funds you need for trading. As a rule, you should not use money you cannot afford to lose.

A Payment Method that Works for you the best

If you cannot comfortably fund and withdraw from your trading account, your day trading endeavour is useless. Your broker should be able to offer you a payment solution which works for you and your situation.

Trading Devices

The advent of smartphones and tablets has been a game-changer as far as day trading of stocks is concerned. You can now trade stocks from anywhere on the planet, using your devices. Ensure you get one which has enough memory and processing speeds to handle the trading platform provided by your broker.

Stock day trading process in 4 steps

Day trading stocks profitably involves the following steps:

[stm_company_history][stm_company_history_item title="a) Planning" description="What should be in your trading plan? It should contain your stocks watchlist, the best time to trade that stock, your trading strategy, risk management, etc."][stm_company_history_item title="b) Demo trading" description="Many stock brokers do not provide an unlimited demo account for practice trading. So you may need to look for one that can allow you to practice with a demo account that does not expire. Demo trading allows you to practice and get better at doing a lot of things that are part of the trading process. You will learn how to place orders, how to apply strategies, how to read charts, etc."][stm_company_history_item title="c) Learn" description="Of course, you do not become a day trader overnight. You have to learn how to trade stocks. So you may enrol for courses, webinars, or even have a mentor to take you through the process (preferred option)."][stm_company_history_item title="d) Study" description="If you do not study continuously, you will stagnate and even forget anything you have learned previously. Studying material, your past trades, chart setups, and other learning materials will help you improve."][/stm_company_history]

You should also learn the various types of orders and when to use them. For instance, a Good-till-Day (GTD) order is one you may find yourself using constantly. You cannot as a day trader use the Good-till-Cancelled (GTC) order a lot because situations change on a daily basis. If a trade is not triggered during the course of a trading day, a Good-till-Day order is one you can use to get the order cancelled if it is not filled.

How to day trade stocks as a beginner

Once you have acquired some knowledge and you have funded a live account or opened a stock demo trading account, you can start trading. You should only trade high probability setups using the various order types: buy, sell, limit orders, stop orders, OCO, etc.

Day trading involves buying a stock and selling that stock within the same trading day. In order to give yourself a chance of making a profit, you should be trading stocks capable of making some significant movement on a day-to-day basis. Armed with your tools and your plan.

How do you go about a day trade?

The process starts with picking out one or two stocks from your stock watch-list. A watch-list can feature stocks in sectors that are commanding market attention. If you are unsure how to select such stocks, check out our guide on how to search for the best day trading stocks. For instance, Cannabis stocks are a huge hit in the market for 2018 and look set to get even bigger once the legalization of pot starts sweeping across the US and Canada. But this sector may not work for all. For instance, I personally do not smoke pot for religious reasons, and I do not think it should be legalized. So I may look for another sector which holds great potential.

My search has taken me to the genome editing companies in the healthcare sector. Due to certain laws, the companies must put out press releases about their products and goings-on within the company. Some companies in that sector are doing great things. If good (or bad) information hits the market, traders will react and either rush to snap up the stock (creating excessive demand), or they may dump a stock (creating excessive supply). Stock trading is governed by demand-supply dynamics.

- Excess demand -> a stock price increases

- Excess supply -> a stock price decreases

So your business as a day trader is to find such stocks, put them in your watch-list, and trade them on a day-to-day basis. If you do not know how to identify strong sectors or stocks, have a look at our post about Finviz.com.

Now that you have a watch-list, you need to find a way to convert the information into money. You do this by using the information (news) and the charts. In other words, you carry out fundamental analysis and technical analysis.

Fundamental analysis involves using the news, press releases, earnings reports and other information put out by the company or reported on the company to decide on where the market sentiment for that stock will be headed. Positive sentiment will lead to demand, which will push up prices. Negative sentiment will lead to dumping of a stock, creating a supply glut and a fall in prices. Your business as a day trader is to quickly decide with the news, what sentiment will prevail.

This has to be followed by technical analysis, which is all about determining the right entry and exit points for a trade, made in the direction of the expected market sentiment. As a day trader, you have a few hours to decide all this very quickly. Your trades are going to last just a few hours, so your exit point is just as important as your entry point.

As a rule, your entries should be made off the hourly charts. While it is good to use the weekly and daily charts to get an idea of the trend of the asset, the hourly charts present the best picture as to where a trade entry/exit should be made.

Example of a stock trade

Let’s use an example. For the purposes of this illustration we will want to trade a genome-editing stock known as EDIT (Editas Pharmaceuticals): how do we go about it?

The first step is to look for any news that will impact market sentiment. We got one for EDIT in the late November 2018 with the FDA approval of clinical trials for one of its gene-based products.

[caption id="attachment_8093" align="aligncenter" width="425"] News release for EDIT[/caption]

News release for EDIT[/caption]

This is a news release which would cause positive sentiment. We are therefore looking to BUY, and will apply technical analysis to determine good entry and exit points.

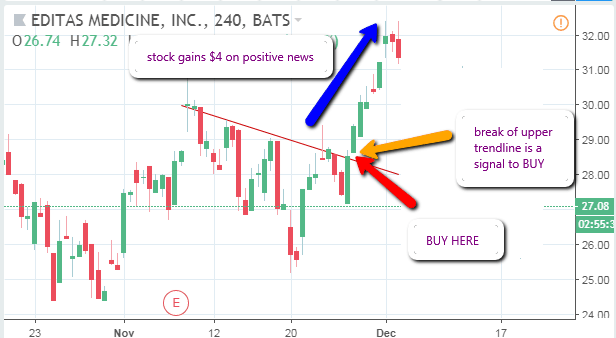

[caption id="attachment_8094" align="aligncenter" width="616"] EDIT Chart[/caption]

EDIT Chart[/caption]

We get an actionable signal with an upside break of the trendline. A Buy is initiated at the break of the trendline, and the trade is exited at the nearest resistance.

4 Tips for Day Trading Stocks

Here are some tips on good day trading practices for the stock market.

#1: Avoid Using Leverage if You are a Beginner

Excessive leverage causes the trader to rack up profit AND losses beyond what their level of original investment. As a beginner day trader, you are more likely to suffer initial losses. No baby ever starts walking without falling a few times. So what makes a baby trader any different? Leveraged trades require you to put up an amount as collateral called margin. Once losses rack up in active trades and your margin is about to be eroded, the broker will issue a margin call. A margin call is an instruction to add more funds to protect your margin and active positions, or they will be closed automatically. If that ever happens to you, your account will be blown. Not only is this very depressing, but it is also a morale killer. As a beginner, take on all the risk of trading yourself by not using any leverage.

#2: Learn Some Technical Analysis

Stocks movements are easily picked with technical analysis. So why is everyone not profitable? It is because they do not know how to apply technical analysis. One of the premises of technical analysis is that history repeats itself. So cycles and patterns seen on stock charts tend to repeat themselves. If you can use technical analysis to pick out a stock chart pattern that has occurred in the past, you can almost be sure the same outcome will repeat itself.

#3: Choose and Master the Stocks in Your Watch-list

You cannot trade every stock under the sun. Make a selection of stocks and master them in and out. Learn how to read the earnings reports for these stocks, and how these stocks behave. If you are unsure how to select such stocks, there are a number of metrics that will help you select stocks with good potential.

#4: Always Revisit Your Old Trades

Look at the trades that failed and identify where it all went wrong. Also, look at the trades that turned out to be winners and see if the outcome was a result of your strategy or a stroke of sheer luck. Being honest with yourself in identifying what caused your trades to end in profit or loss will help you in the future immensely.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.