How to day trade cryptocurrencies like a pro

Day trading cryptocurrencies greatly differs from typical long-term investing and one can not approach it the same way. Traders who focus on day trading can earn significantly more since their profits are locked in daily. That means gains are made on prior gains (in addition to the first investment). So theoretically speaking, a trading account can balloon tremendously. As a day trader, a big initial investment is not required from you in order to make a good profit. Whereas in the case of long-term investing, you need to put aside some serious money to make at least something from your investment. Many investors also like the idea of getting into and out of cryptocurrency trades and at the end of the day having just a good old fiat currency like dollars or euros on their accounts. Owing to many traders rather choose to day trade cryptocurrencies. To help you minimize them, we have created the following guide.

1. Open a brokerage account

I don’t care what others might say. The fact is you will always learn the most from practice. And in order to gain experience in day trading cryptocurrencies, you have to open a trading account. It does not have to be a real account if you don’t have a trading background, a free demo account will suffice. If you have no idea how to find a solid and reliable company for day trading cryptocurrencies, you can check our article “How to choose crypto broker” where we talk about the most important features that a broker should have. We also compare the most recognised brokers in the industry and their offers so you can easily pick a company depending on your needs.

2. Learn about day trading cryptocurrencies as much as possible

The cryptocurrency market is probably the most volatile market that there is which makes it an ideal place for day trading if one knows how to do it correctly. If we want to understand how the crypto market behaves in certain situations we need to start from the basics. We have already created a great cryptocurrency guide for beginners where we summed up the most important features of the market. However, this guide should only be your starting point. Keep learning, there are many other great resources about day trading cryptocurrencies.

3. As a day trader follow the news - always

As a day trader, the news is a sacred thing for you that you have to monitor and act upon. There are many great resources that cover everything that is related to cryptocurrencies and that could affect market's development. I personally use cryptocoinsnews.com and coindesk.com. Both of these portals go to great lengths to provide a comprehensive and an up-to-date information about the crypto market. However, I believe that there also other great resources I don’t know of. I recommend choosing at least two such portals (that write about cryptocurrencies in general) and visiting them regularly. Once you have selected the crypto news websites, decide which cryptocurrency you want to day trade. Is it Bitcoin? If so, you might want to bookmark news.bitcoin.com. Proceed with the same strategy with other cryptocurrencies you want to day trade and find at least one resource that focuses explicitly on your cryptocurrency.

4. Forums - do not avoid them

Forums are a great place where individual traders and investors meet to freely talk about their trades. Being a member of such community will not only help you learn from mistakes of others but it will also help you understand how others might see presented trading opportunities. Thoughts and ideas of other traders might prevent you from making stupid decisions. One of the most recognized forums is Bitcointalk.org. As the domain name indicates, it is a place dedicated mainly to discussions about Bitcoin. However, other cryptocurrencies are also covered in different sections of the forum. Very popular is also the Reddit forum and its subsection that focuses on cryptocurrencies reddit.com/r/CryptoCurrency/. There you will find crypto news and open discussions on all subjects related to cryptocurrencies.

5. Entry and exit points - the key to successful day trading

Day trading is all about getting into a trade at the best possible time when the price of a cryptocurrency is low and getting out of the trade before it is about to drop. We now know the theory, but what about the practice? Well, it should be no surprise that at the foundation of everything is a solid technical analysis. Each and every trade should be created for a specific analytical reason – i.e. we have identified resistance and support levels or we have a clear trend. Once you figure out the potential entry and exit points, do not forget to monitor news that might shift the price.

6. Time to dump? It might be too soon!

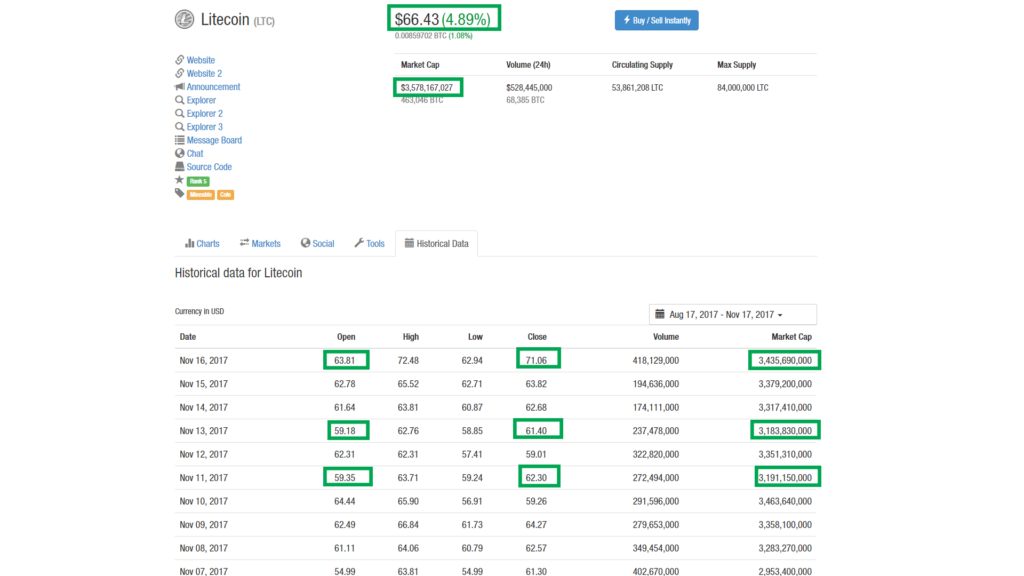

The law of supply and demand is extremely important and not only on the cryptocurrency market. The price of any cryptocurrency you pick is always very closely linked to the amount of the currency in circulation. That means if the market capitalization increases so does eventually the price of the cryptocurrency. In other words, the more the market cap grows the more grows the price of a cryptocurrency (usually directly proportional). Here is an example of a Litecoin graph so I can prove this theory in practice.

Did you notice that when the market cap on two different days was nearly identical, the same could be observed with the price? This might help you understand what to expect within the day. Check this information when the price drops to a considerably low level before you start selling in panic. A good idea is to create case patterns writing down possible market caps and corresponding probable ranges of a cryptocurrency price. This way you will know where the market might be heading and if it’s the right time for you to sell or whether the price will bounce back again (if the market cap is high and only the value dropped. You can check daily records of market caps and prices of all cryptocurrencies at coinmarketcap.com. Just select a coin you want to monitor and click on the tab “historical data”.

7. Set up a stop loss and a take profit

A stop loss is a must for every cryptocurrency day trader. And one should not even try trading without it. Given the volatility of the cryptocurrency market, it would be a suicide mission. That being said, a stop loss has to be set up properly so it would not trigger all the time. Think about the lowest price at which you are willing to hold a cryptocurrency in hopes that it will bounce back up again. A take profit tool enables you to lock in your profit at a price you consider adequate before it goes down again.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.