No Slippage Brokers - Are there any?

Slippage in forex is when an order is filled at a different price rate from the requested price. It is therefore the difference between the requested price and the price during execution. Typically, slippage happens due to market volatility or when trading in the off-peak hours of a currency pair.

Slippage is a part of forex trading that you cannot entirely avoid. Nevertheless, there are brokers on the market that thanks to superior execution times have little to no slippage.

It can happen in the favour of a trader or to their disadvantage. However, there is no guarantee of a positive slippage. Hence the need to minimize slippage by investors. Several brokers in the market have low to no slippage. Here is our list of the best little to no slippage brokers in the market.

Pepperstone

Pepperstone allows trading with minimal slippage in the market. The company promises ultra-fast execution ensuring prices remain as close to the order requests as possible. Most orders are executed in less than 30 milliseconds (Pepperstone Group Limited) and 60 milliseconds (Pepperstone Limited). Nonetheless, the company also educates customers on how to potentially mitigate the risks of slippage while trading. For example, placing correct stops relative to an instrument’s volatility and period range.

Pepperstone offers CFD trading on over 1,200 trading instruments. These include trading instruments from the forex, shares, indices, ETFs, commodities, cryptocurrencies, and currency indices markets. These instruments are available to trade on various industry-standard platforms. Clients can choose between TradingView, MetaTrader 4, MetaTrader 5, and cTrader. These trading software are among the most popular platforms among seasoned professionals because they deliver both functionality and ease of use.

The fees for trading on this broker site are fairly low with spreads as low as 1.0 pips on the standard account and no commissions paid. However, clients can trade forex with even lower fees on the Razor account, enjoying spreads starting at 0.0 pips and a commission ranging from $3 to $3.50 per side per lot, depending on the trading platform they use.

Finally, Pepperstone has regulations in various jurisdictions by reputable organizations. The company is regulated in Australia by the ASIC, in the UK by the FCA, in Germany by the BaFin, and in Kenya by the CMA. This is a great lineup of regulatory licenses.

75.3% of retail CFD accounts lose money

FP Markets

FP Markets is with ultra-fast execution times of under 40ms one of the brokers with little to no slippage in the market. The company allows clients to trade major markets including Forex, Indices, Shares, Commodities, Metals, Cryptocurrency and Bonds as CFDs. Investors do this on industry-standard trading platforms. They can choose between the MT4, MT5, cTrader, TradingView and Iress.

FP Markets has licenses from the CySEC in Cyprus and ASIC in Australia. These are two reputable regulators keeping the company in check. Although it is not definitive proof, this indicates that FP Markets operates in compliance with financial rules and regulations. Additionally, FP Markets supports various deposit and withdrawal methods. These include Wire Transfer, PayPal, Skrill, USDT, Neteller and Credit/Debit card payments. The minimal deposit amount is $100.

72.44% of retail CFD accounts lose money

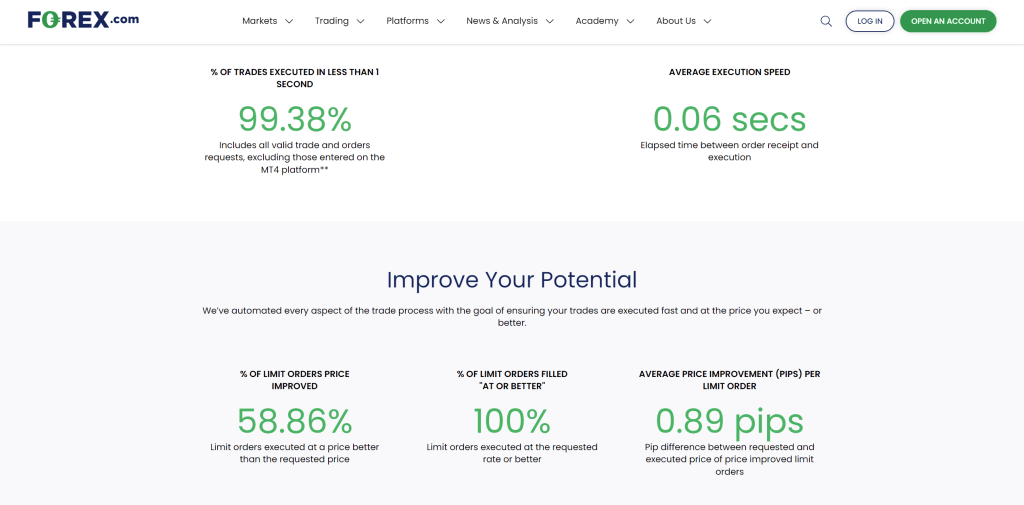

Forex.com

Forex.com is also on the list of forex brokers with low slippage as 99.38% of trades are executed in less than 1 second and the average execution speed sits at a remarkable 0.06 seconds. The company launched in 2001 and has licenses from the FCA, IIROC, CFTC and JFSA. These are all tier-1 regulators watching over the operations of Forex.com. This regulatory status together with its longevity in the market puts Forex.com among the best Forex brokers.

Further, Forex.com provides clients access to a variety of markets to trade in. Clients from most countries can trade forex and CFDs on stocks, commodities, indices and cryptocurrencies. US clients can trade here in the forex, futures and futures options markets. Traders can do this using state-of-the-art trading platforms, the MT4 and the MT5. They can also use Forex.com’s suite of in-house built programs to trade.

Forex.com allows users to use various payment options including VISA, MasterCard, Wire Transfers and Maestro. The minimum deposit is $100. There are three main account types to choose from on Forex.com.

The Standard account is ideal for traders who want a traditional spread pricing trading experience and wish to trade using the Web Trader. On the other hand, The raw spread account is ideal for traders seeking ultra-tight spreads with fixed commissions. Finally, the MetaTrader account is for traders looking to trade on the MetaTrader platforms with no commissions and tight variable spreads from as low as 1.0 pips.

76-77% of retail investor accounts lose money when trading CFDs with this provider.

XM

XM is a professional broker that allows clients to trade forex and CFDs on Stocks, Stock Indices, Oil and Gold. They do this on industry-standard platforms, MT4 and MT5. Mobile users can also trade these instruments using the XM App available on both Android and iOS. This broker is well-regulated with licenses from CySEC and ASIC. XM is also on the register of the FCA, Bafin and CNMV among others.

XM supports a variety of payment options for account funding. Clients can fund their accounts using Wire Transfers (including local bank transfers), Credit and Debit card payments and Skrill. The minimum deposit amount on XM is $5. Additionally, clients can choose between a number of available trading accounts, these include the Ultra Low Micro Account, XM Ultra Low Account, and XM Zero Account.

Note that, while this company has good regulations, it is no guarantee that investors will not lose their money. CFD trading comes with a lot of risks and a significant number of traders lose while trading.

XM adheres to a strict no re-quotes policy, stating that 99.35% of all orders are executed in less than one second, guaranteeing a 100% execution rate with no order rejections. Furthermore, XM highlights the crucial role of stop-loss and limit orders in risk management, guaranteeing fills on both types of orders for up to 50 lots at the best available market price. The fast execution times ensure that there is little to no slippage at XM.com.

75.18% of retail investor accounts lose money when trading CFDs with this provider.

XTB

XTB is a forex/CFD broker that offers clients access to over 2100 trading instruments. These trading instruments are CFDs in six different markets which include forex, indices, commodities, cryptocurrencies, stocks and ETFs. This range of markets is what attracts traders to XTB along with its tight-spread pricing. Additionally, XTB offers a powerful and responsive trading platform called xStation to its clients. They can access the xStation platform on PC, Mac, Android, iOS and on the Web.

XTB uses advanced technology to provide near-instant quotes—averaging 5ms for DE30 and 4ms for EURUSD—ensuring clients have access to real-time prices with minimal slippage. According to the broker's site, on their xStation platform, XTB aims to execute 95-97% of transactions at the top of the order book, providing transparency and optimal trade execution.

The regulatory status of XTB is notable, to say the least. The company has regulatory licenses from the FCA in the UK, the KNF in Poland, the CySEC in Cyprus and the FSC in Belize. This regulatory status puts a good case for the legitimacy of XTB. Furthermore, XTB supports various payment methods for deposits and withdrawals. Investors can fund their accounts and withdraw cash using Wire Transfers, Debit/Credit card payments, PayPal and Paysafe. The minimum deposit amount is $1.

75-78% of retail investor accounts lose money when trading CFDs with this provider.

AvaTrade

AvaTrade is a well-recognized Forex and CFD broker that has been founded back in 2006. The company has licenses to operate from several reputable regulators. It is regulated by the CySEC, ASIC, BVIFSC, FSCA and FFAJ among others. Traders can trade CFDs on currencies, stocks, commodities, indices, cryptocurrencies, ETFs and bonds. CFDs are complex instruments with a high risk of losing funds. Investors should understand the risks before they choose to invest.

Nonetheless, AvaTrade is one of the best brokers with little to no slippage in the market. Clients have access to top-notch trading platforms MetaTrader 4 and MetaTrader 5. They also have access to AvaTrade’s suite of platforms, AvaTradeGO, AvaOptions, DupliTrade and ZuluTrade. DupliTrade and ZuluTrade allow clients to copy the trades of top-performing traders automatically.

Further, AvaTrade supports a variety of deposit and withdrawal options. Wire Transfers and Credit card payments are available to most clients globally. However, credit card payments are not available to clients in Canada. Investors can also use e-payment options such as Skrill, WebMoney and Neteller. Unfortunately, e-payment options are not available to clients in the EU. The minimum deposit amount is $100.

76% of retail CFD accounts lose money

Final Thoughts on Brokers with low to no slippage

Slippage is a part of forex trading that you cannot avoid. While it may work in favour of the trader, there is no guarantee. The best thing to do is to minimize slippage at all costs. Trading with forex brokers with little to no slippage is the best bet for this.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.