10 Best Forex Brokers with Instant Withdrawals

One of the most considered features when choosing the best forex brokers is the instant withdrawal feature. If you want quick cash access to your profits and want to use the money in your account, you should choose a Forex broker that offers fast withdrawals. The broker should be regulated and reliable for withdrawals to be processed immediately and happen instantly or within the same day. In this article, we will take a look at forex brokers and trading apps that offer instant or same-day withdrawals.

Exness

Exness is one of the most respected and biggest brokers on the market that exceeded the $3 trillion monthly trading volume mark early this year. The broker focuses mainly on its forex trading offer as Exness features over 100 trading forex pairs. Exness is heavily regulated across the globe with licenses in Cyprus (CySEC), South Africa (FSCA), Kenya (CMA) and a few other countries.

When opening a new account you can select between classic or professional accounts which differ in the trading costs that will apply to your trading account. Both of them are very favourably, but the professional ones have a slight edge, in my opinion, as the spreads for some of them start from as little as 0 pips (with low commission applied). The broker supports MetaTrader 4 and 5 trading platforms.

In regard to withdrawals, Exness offers instant withdrawals 24/7. According to the broker's deposit and withdrawal page.

At Exness, 95% of withdrawals are processed instantly (under 1 minute). Once your funds leave our custody, it's up to your chosen payment provider to process the funds and credit your account.

The reason why the withdrawals are nearly always instant is because they are processed instantly with no human interaction. When making a deposit or withdrawal you can choose from flexible payment options in local currencies, including the world’s most popular payment systems, e-wallets, and crypto wallets.

Unfortunately, the company does not accept EU, US or UK clients, tho a wide range of other countries are welcome.

Remember that forex and CFDs available at Exness are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

FP Markets

FP Markets provides over 10,000 trading instruments from 8 different markets. These include forex currency pairs and CFDs on shares, metals, commodities, indices, cryptocurrencies, bonds, and ETFs. The company has been in the market since 2005 and is regulated by multiple regulatory bodies across the globe including the CySEC in Cyprus, the ASIC in Australia and the FSCA in South Africa.

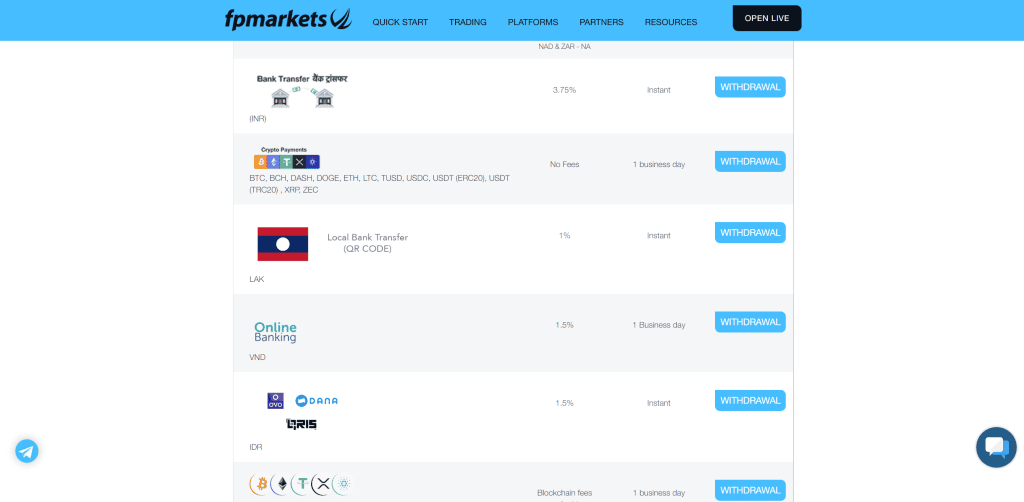

The minimum deposit to open an account with this broker is $100 or equivalent in other currency. Deposits and withdrawals on FP Markets are fast and easy. The broker supports a wide range of deposit and withdrawal methods. To name a few, they support credit cards, bank transfers (including local bank transfers), crypto, Skrill, and Neteller. The FP Markets withdrawal time is usually either instant or one business day.

72.44% of retail CFD accounts lose money

Forex.com

Clients outside the US can trade at Forex.com CFDs on forex, stocks, commodities, precious metals, indices and cryptocurrencies. In contrast, US traders can trade here forex, gold and silver, and futures and futures options assets. To trade these asset categories clients can use with Forex.com popular forex retail platforms such as MT4 or MT5.

While the bank transfers are not instant at Forex.com as may take up to 48 hours to process, the debit card withdrawals are processed by FOREX.com typically immediately without any delays. Nevertheless, according to Forex.com, it may still take to the receiving bank up to 48 business hours to process (but Forex.com does not delay the withdrawal).

76-77% of retail investor accounts lose money when trading CFDs with this provider.

OANDA US

The OANDA Group is a globally regulated broker that has been around since 1996. One of the things that make OANDA Corporation stand out compared to its competitors is the withdrawal methods and speed. Other brokers’ bank transfer methods usually take 2-3 business days, while at OANDA they take on average 1 business day. The same withdrawal time also applies according to the company for Paypal withdrawals.

OANDA Corporation is regulated by the CFTC/NFA. OANDA is a member Firm of the NFA (Member ID: 0325821). Offering more than 3 deposit and withdrawal methods to its customers, OANDA has no minimum deposit requirement.

Forex trading involves significant risk of loss and is not suitable for all investors.

XTB

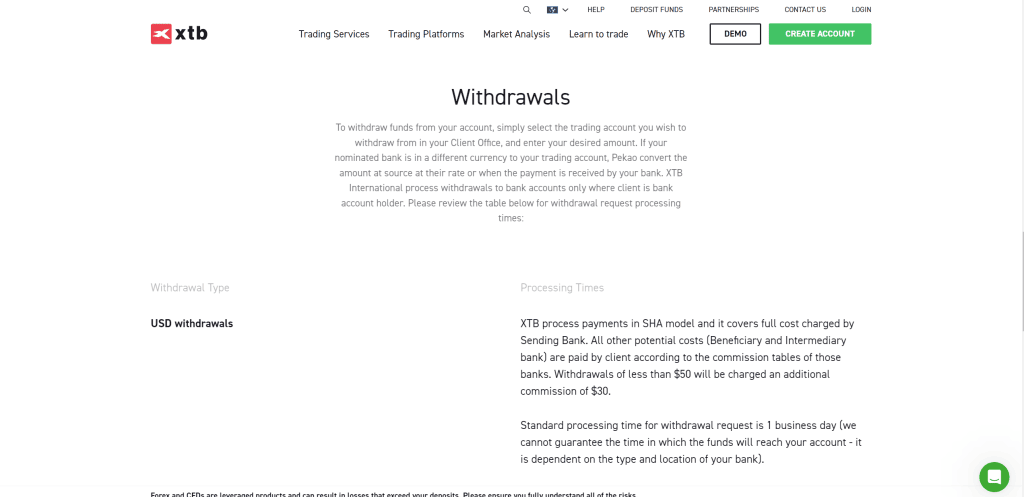

XTB is a popular forex and CFD broker where traders can trade on XTB's in-house built platform called xStation. The broker supports trading on over 2200+ instruments from a wide range of markets such as CFDs on forex, commodities, indices, cryptos, stocks or ETFs. XTB supports the following deposit and withdrawal methods: Bank transfers, credit cards, or e-wallets (such as Skrill and Neteller). According to the company, the standard processing time for withdrawal requests is 1 business day.

75-78% of retail investor accounts lose money when trading CFDs with this provider.

Go Markets

GO Markets is a well-regulated broker that offers a wide range of trading instruments and a simple account structure. Offering its clients two types of trading accounts, Standard and VIP, Go Markets charges very low transaction fees on both accounts. Go Markets has tight spreads starting from 0.8 pips and ultra-fast execution. There is no stock trading at Go Markets and their customer service is 24/7 support. The minimum deposit requirement at Go Markets is $200. Go Markets supports 6 different deposit and withdrawal methods, most withdrawals are processed instantly with the exception of bank transfers that take 1 – 3 business days to process.

AvaTrade

AvaTrade, a 16-year-old online broker, is a reputable company that offers very comprehensive trading services. Regulated by many market regulators, the broker offers the opportunity to trade more than 1,300 instruments. AvaTrade offers competitive and fair trading conditions for all its clients. Offering innovative and powerful trading platforms, the broker allows social trading and has a high execution speed.

At AvaTrade, the minimum deposit is $100, which is a bit high compared to other brokers. The platform does not charge any deposit or withdrawal fees. Some of the withdrawal methods offer the option to withdraw within the same day.

At AvaTrade, the minimum deposit is $100, which is a bit high compared to other brokers. The platform does not charge any deposit or withdrawal fees. Some of the withdrawal methods offer the option to withdraw within the same day.

76% of retail CFD accounts lose money

FBS

FBS is a broker that offers its clients the opportunity to invest in instruments in many financial markets. It is possible to trade CFDs on forex, cryptocurrencies, stocks, indices and commodities. Having user-friendly trading platforms, FBS also offers users a variety of educational materials.

FBS offers low minimum deposits and high maximum leverage in certain countries outside of the EEA. The spreads offered by the broker are slightly higher than the industry average. FBS supports a wide range of deposit and withdrawal methods. They are sorted into 3 main categories: e-payments, credit or debit cards and local bank transfers. E-payment withdrawals such as Skrill, Stickpay, Neteller or Perfect Money take only up to 30 minutes, credit or debit cards take up to 3-4 business days and local bank transfers take up to 1-3 business days. The minimum withdrawal amount is set to $1.

CMC Markets

With next-generation advanced trading tools and a wide range of instruments, CMC Markets is a solid broker for both retail and institutional clients. CMC Markets' educational resources and research materials are guidelines for successful forex trading.

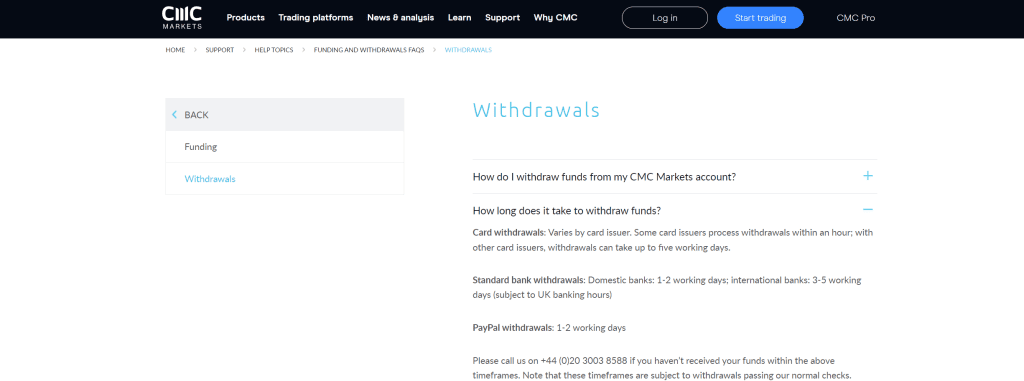

Suitable for both beginners and professional traders, this broker lets you trade CFDs on commodities, forex, indices and cryptos. Founded in 1989, the broker offers over 9,500 CFD products with spreads starting from 0.7 pips. CMC Markets does not have any minimum deposit requirements which means you can deposit whatever amount you like. CMC Markets supports 3 main withdrawal methods - bank transfers, credit and debit cards and Paypal. The fastest withdrawal method here is in most cases the card withdrawal option as some card issuers process withdrawals within an hour. However, please note that with other card issuers, withdrawals can take up to five working days. Paypal withdrawals and domestic bank withdrawals take up to 1-2 working days and lastly, international bank transfers take about 3-5 working days.

XM

XM is a well-established broker that offers many benefits for beginners and experienced alike. Having very good trading tools and offering many promotions, this broker allows traders to trade using the latest technology. XM has a total of 16 different trading platforms, including MetaTrader 4 and 5. It is very easy to reach customer service if you have any problems or have any questions. You can trade CFDs on over 1,000 + instruments from the forex, stocks, indices and commodities markets. At XM, the minimum deposit is $5 and withdrawals are free of charge. Most withdrawal methods take about one business day to process. For active traders, XM also offers the option to grab a FREE VPS to minimise the execution time of their trades to an absolute minimum.

75.18% of retail investor accounts lose money when trading CFDs with this provider.

Who is the fastest withdrawal forex broker?

In this article, we have gone through leading forex brokers that have one of the fastest withdrawals. Some of the companies also offer instant withdrawals for certain withdrawal methods. From our selection, I think either Exness or FP Markets would take the crown of being the fastest forex brokers. For US users it would be probably OANDA with its 1 day payment processing time or Forex.com, which processes card payments immediately.

Are there any instant withdrawal trading apps?

Yes, there are. All the brokers we mentioned today offer trading apps so their withdrawal conditions are the same no matter whether you use their mobile trading apps or their desktop versions.

Conclusion on Forex Brokers with Instant Withdrawals

When choosing a broker, you should consider the trading platforms available, the fees they charge, the types of accounts they offer, and the withdrawal times. When you choose a good forex broker for your individual trading goals, you can trade with different financial instruments and benefit from low spreads.

Each broker has differences in commission rates, spreads and the way they charge. With the development and progress of the industry every day, the competition between brokers has increased and better platforms have been developed for users. Withdrawal time from a broker varies according to payment methods. While some brokers make instant payments with payment methods such as PayPal, Skrill, and Neteller, the processing time may take up to a few days for bank transfers and debit card withdrawals.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.