Tier one Trading Platforms and Brokers

Trading financial markets come with a lot of challenges. Choosing a broker to invest in significantly affects the trading experience of a trader. Many companies claim to offer the best trading conditions to clients. While there are many legitimate brokers in the world, not all of them provide the best trading conditions. This review will look at the online brokers that meet our tier 1 trading platforms criteria.

Our Criteria For Selecting Tier One Trading Platforms

Our criteria will be looking at four key features to make the selection:

- The regulatory status of a broker - This review will only feature brokerage companies with regulations from reputable watchdogs.

- Availability of Assets - Companies that feature trading instruments from various markets will rank higher than companies with fewer options. Such companies allow clients to better diversify their portfolios.

- Spreads and other fees - No trader wants to pay an exorbitant amount to trade. Hence, companies with cheaper charges will rank higher.

- Trading platforms - This review will feature companies that provide state-of-the-art trading platforms.

Now, here is our list of Tier 1 Trading Platforms.

Exness

Exness is one of the first brokers we consider to provide a tier one trading platform. We always have to look at a company’s regulatory status whenever we review them. Exness is regulated by the CySEC, the FCA, the FSA, the FSCA, and the FSC. This means that multiple regulators watch their every move to ensure they obey the law.

Note that regulated brokers can also break the law. However, having numerous regulators like this is a sign that a company is willing to operate within set rules and regulations. There are a variety of trading instruments clients can trade on Exness. Some markets they can trade instruments from include CFDs on Forex, metals, cryptocurrencies, energies, stocks, and indices.

Nonetheless, Exness offers some of the best trading conditions in the market. For example, the spreads can go as low as 0.6 pips for the EURUSD pair. Additionally, clients get access to some of the best trading platforms in the world. Exness traders enjoy access to the Exness Trader on top of MetaTrader 4 and 5. This is very attractive to both novice and experienced traders.

Remember that forex and CFDs available at Exness are leveraged products and can result in the loss of your entire capital. Please ensure you fully understand the risks involved.

FP Markets

FP Markets is another Tier 1 trading platform that offers a variety of trading instruments on its website. Clients can invest in forex currencies and CFDs in shares, metals, commodities, indices, cryptocurrencies, bonds, and ETFs. Forex traders have over 60 currency pairs available for trading on FP Markets. For crypto traders, there are 11 different crypto assets clients can trade against the US Dollar. In total, there are over 10,000 trading instruments on FP Markets.

The regulatory status of FP Markets does not disappoint. The company has licenses and regulations from the CySEC in Cyprus and the ASIC in Australia. These are two of the best regulators in the markets today. Even regulated companies can operate in a criminal manner. However, you are better off trading with companies with multiple regulators watching over them.

The lineup of trading platforms FP Markets offers clients gives it an edge in the market. Clients can use the WebTrader, TradingView, cTrader, MetaTrader 4, or MetaTrader 5 platforms. Many traders rank the MetaTrader platforms as the best trading platforms in the world. This is because they come with a plethora of charting tools and have fast order execution.

The spreads on FP Markets are competitive and reasonably low. The spreads on the standard account can go as low as 1.0 pips for major currency pairs. Clients looking to trade with ultra-low spreads can use the Raw ECN account with spreads starting from 0.0 pips. Other applicable fees include overnight swap fees and commissions on the Raw ECN account.

72.44% of retail CFD accounts lose money

Forex.com

Forex.com has been empowering clients in the markets since 2001. Such longevity in the market is a testament to the professionalism of this company. Additionally, the company has a remarkable regulatory status. The company has licenses and authorization from some of the best watchdogs in the market. It is regulated by the CFTC and NFA in the USA, the FCA in the UK, the IIROC in Canada, the CySEC in Cyprus, and the ASIC in Australia, among others.

In terms of trading instruments, Forex.com does not disappoint. This platform allows clients to trade different assets depending on the country of their residence. In most countries (excluding the US) traders can trade CFDs on Forex, Indices, Shares, Commodities and Cryptos while US residents can trade in three different markets: the forex, futures and futures options markets. Forex traders have over 80 different currency pairs available for trading on Forex.com.

Forex.com vows to offer the best prices in the market. There are three main trading accounts on Forex.com with different spreads and commissions. These include the standard account, the commission account, and the STP Pro account. The standard account does not require clients to pay a commission when trading. The only charges involved are the spreads. Luckily, the spreads on this account are competitively low, starting at 1 pip for major currency pairs.

On the other hand, the Commission and STP Pro accounts require clients to pay a commission when trading. However, the spreads on these accounts are very low, starting at 0.2 pips for the commission account and 0.1 for the STP Pro account. The commission on the Commission account is $5 per 100K and $80 per million on the STP Pro account.

There are a variety of trading platforms available to clients of Forex.com. These include Forex.com Trader, WebTrader, and MetaTrader 4. The MetaTrader 4 is one of the most powerful trading software in the market. Many clients will be excited to use such a platform on Forex.com.

76-77% of retail investor accounts lose money when trading CFDs with this provider.

XTB

Launched in 2002, XTB has close to 20 years of service delivery in the forex space. This longevity in the market and the regulatory status is what makes XTB a Tier 1 trading platform in the world. The company has regulations in the UK by the FCA, in Cyprus by the CySEC, in Poland by the KNF, and in Belize by the FSC.

Investors in XTB can trade 48 different currency pairs on XTB. They can also trade instruments from the indices, commodities, stocks, cryptocurrencies, and ETF markets. In total, there are over 3,000 tradable CFDs.

Clients can trade these instruments on the in-house built platform called xStation. The platform is easy to use and has fast execution speeds. The spreads on XTB are fairly low starting from 0.9 pips and no commissions paid.

75-78% of retail investor accounts lose money when trading CFDs with this provider.

XM

XM satisfies our criteria for selection as a Tier 1 trading platform. The company is regulated by several reputable regulators, including CySEC, ASIC, and the FSC. This is evidence that the company follows the law and does not engage in shady business.

The trading platforms on XM.com are some of the best platforms in the market. The company provides both MetaTrader 4 and MetaTrader 5 to its clients. These are powerful platforms with fast execution times. Clients can also perform technical analysis on these platforms. Additionally, all clients types of clients are catered for. These platforms are available on PC, macOS, iOS, and Android.

The spreads on XM are industry standard and competitive. There are three account types that come with different spreads. For example, the standard account has a spread of 1.6 pips for the EUR/USD pair. However, there is no commission for this account. On XM, clients can trade over 1,000 trading instruments. These fall under 8 different markets. These include forex, stocks, indices, shares, cryptocurrency, commodities, precious metals, and energies. All kinds of investors are catered for on XM.

75.18% of retail investor accounts lose money when trading CFDs with this provider.

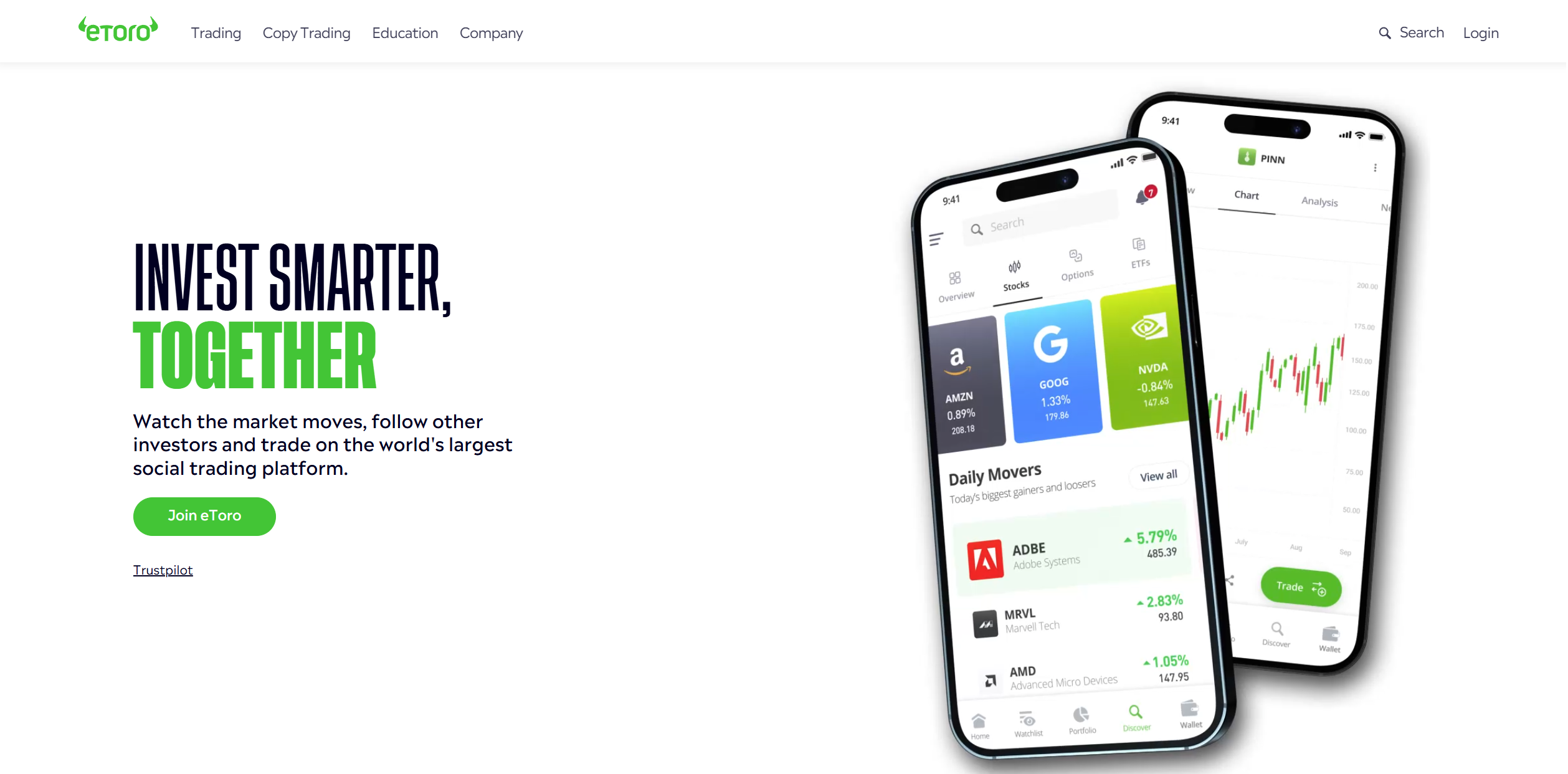

eToro

eToro is one of the most respected multi-asset investment platforms in the world and is often regarded as tier-one platform. One of the reasons eToro is attractive to traders is its regulatory status. The broker has regulations and licenses from several jurisdictions. The company is regulated by the FCA in the UK, the CySEC in Cyprus and the ASIC in Australia.

There are a variety of trading instruments on eToro. Clients can trade CFDs on forex, crypto, stocks, commodities, ETFs, and indices or purchase real stocks and cryptocurrencies. This variety of trading instruments is one of the reasons eToro has over 20 million registered users. Many traders are attracted by the ability to diversify their portfolios.

Furthermore, eToro does not have any hidden fees. All fees involved are revealed on the Market hours and Fees page. The company offers some of the tightest spreads in the market. Typical spreads on eToro can start from 1 pip for major currency pairs like the EURUSD pair. However, CFD positions that stay open overnight incur a small fee relative to the value of the position.

Clients on eToro can only use the in-house-built eToro trading platform. This platform is suitable for both experienced and novice traders. It is intuitive and has fast execution. Additionally, it allows inexperienced traders to copy experienced and successful traders through its CopyTrader technology.

61% of retail CFD accounts lose money with this provider. You should

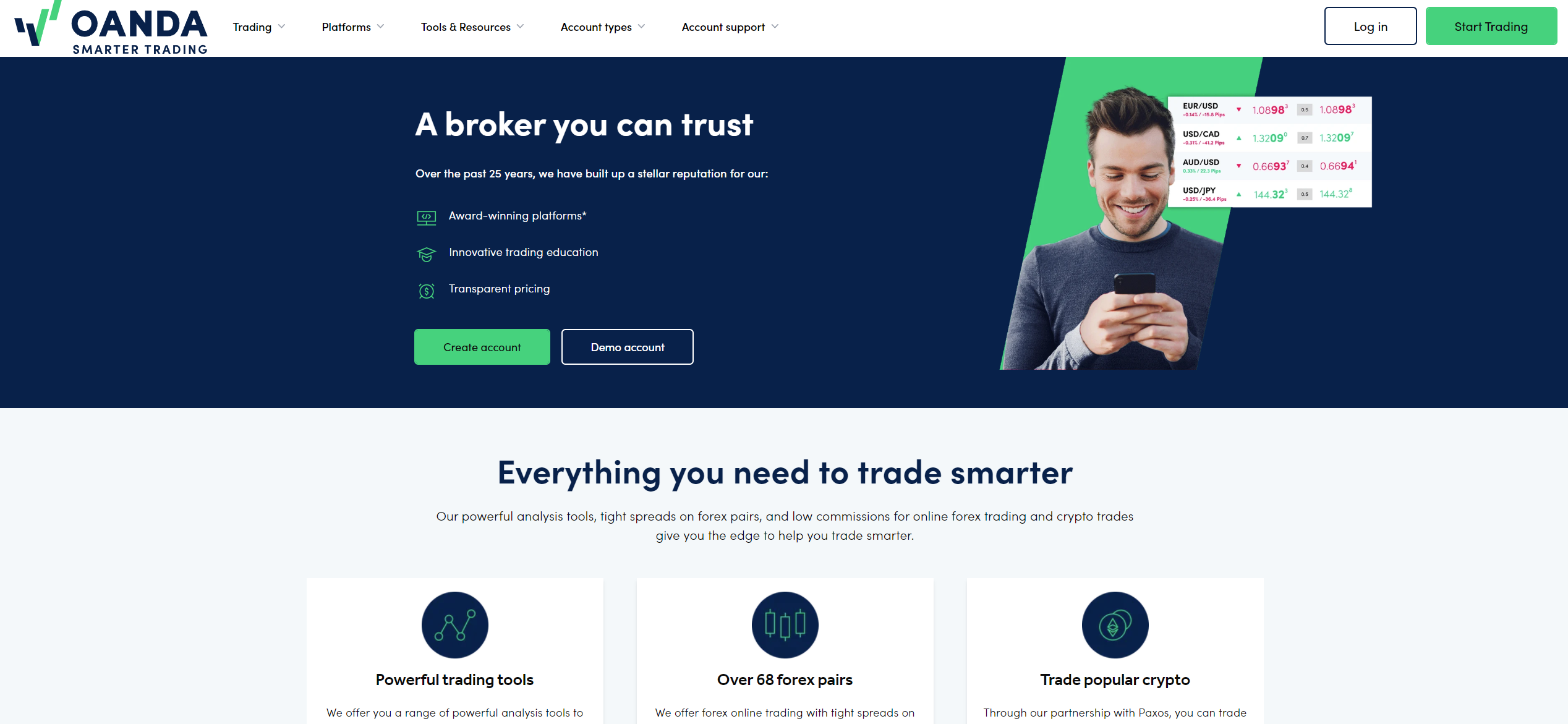

OANDA US

OANDA is a global forex broker with over 25 years in the market. The company has an outstanding reputation for innovation, excellent customer care, and transparent pricing. Additionally, the company has a great reputation regarding its regulatory status. It has regulations from the NFA and CFTC in the US, the FCA in the UK, the ASIC in Australia, and the IIROC in Canada.

Further, this company’s features are delivered through state-of-the-art platforms, including the fxTrade app, MetaTrader 4, and MetaTrader 5. The MetaTrader platforms come with great charting tools to support traders in their activities. On the other hand, the fxTrade app is OANDA’s premier mobile app that works with MetaTrader 4 and MetaTrader 5.

OANDA US primarily specializes in providing a vast selection of forex trading options, featuring more than 70 currency pairs. The spreads on OANDA are not exorbitant. They are fairly low, starting from 1 pip for major currency pairs.

Risk warning: Trading margined products carries a high level of risk.

AvaTrade

AvaTrade is yet another trading platform that meets our criteria for Tier 1 trading platforms. The company has regulations in multiple regulations. It has licenses and authorization from the Central Bank of Ireland, the BVIFSC, the ASIC, the FSCA, and the CySEC, among others. While regulation alone is not enough, it is a testament to the commitment of the company to play by the rule of law.

Clients can trade a variety of assets from different markets on AvaTrade. They can trade CFDs on forex, cryptocurrencies, stocks, commodities, indices, bonds, ETFs, and vanilla FX options. Having a variety of markets available for trading allows traders to greatly diversify their portfolios. This way, they can spread the risk of investment across various markets.

AvaTrade has one of the best selections of trading platforms available to clients. Clients can use the MetaTrader 4 and 5 platforms or the in-house-built AvaTradeGO. AvaTrade also provides clients with the DupliTrade platform for clients who want to copy the trading strategies of other successful traders.

AvaTrade features variable spreads on its website. Popular trading instruments have the lowest spreads due to high trading volumes. For example, the spreads for major currency pairs can go as low as 0.9 pips. Traders should stay updated on the movement of spreads on AvaTrade before they invest.

Conclusion on Tier 1 Trading Platforms

These are excellent selections that meet our criteria for tier-1 trading platforms. These companies have ample regulations, offer state-of-the-art trading software, and have low trading fees. On top of that, they have a wide range of trading instruments available to clients. While these are our selections, this is not an exhaustive list. We encourage you to do further research to find a company that best suits your trading needs. Whether they are on this list or not.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.