How Stop Loss Hunting Works & How to Avoid It

Many traders have always wondered how a trade that should move in a particular direction heads the opposite way and takes out their stop loss settings before proceeding in the chosen direction. Many have described it as a scenario where it seems as though someone is watching their positions.

This phenomenon, known as stop hunting, actually occurs, but many retail traders are at a loss as to how this happens. The purpose of this article is to explain what stop hunting is and show you a strategy how to avoid it.

It is written from the standpoint of exposure to an institutional trading platform and how the big firms can entrap retail positions and knock out their stops before pushing the market in the desired direction for big profits. You could adjust your order settings and prevent this from happening to you as you progress in your trading career.

Stop hunting: What is it?

Stop hunting refers to a situation where market participants target and trigger stop orders placed by other traders to cause the price to move in a particular direction. A stop loss order is placed to sell (long positions) or buy (for short positions) an asset when the price reaches a certain level to prevent catastrophic losses.

Stop hunting can occur when market makers or other market participants intentionally move the price in a direction that is likely to trigger many stop orders. This can create a chain reaction, with the triggered stop orders causing further price movement in the same direction. The goal of stop hunting is to profit from the resulting price movement, either by taking the opposite position or selling back to the traders whose stop orders were triggered.

Stop hunting is generally considered a manipulative practice and is not permitted in well-regulated markets. However, it can still occur in some markets, particularly those with less stringent regulations or lower liquidity. Retail investors who use stop orders as part of their trading strategy may be particularly vulnerable to stop hunting, as they lack the market knowledge, tools or resources that larger market participants possess.

Most retail traders use a stop loss to protect their capital from being depleted catastrophically if their positions move in an adverse direction. The trouble is, sometimes, the adverse movement of the market may only just trigger their stop loss and not move much further before heading in the chosen trade direction. What could have been a very profitable trade now becomes an undesirable loss. This situation is sometimes referred to as stop hunting and leads to a lot of anger and frustration.

How do market participants view a Stop Loss?

The job of institutional traders in investment banks who operate on the sell side of the market is to make the market by taking on the risks of their traders. In other words, institutional traders at investment banks have the mandate to offload those trades at a profit immediately.

They will have a button that offers a sneak peek into the prevailing prices at the exchanges. Most times, they will see the stops of retail traders. Their trades are usually set where there is an extensive collection of stops.

How come?

A stop loss is a trade order. This is a point that all traders must remember. A stop loss is a trade order that is the same as an entry or a Take Profit order. A stop loss is a type of exit order opposite to the Take Profit (TP), the other type of exit order. If a trader has a Buy as an entry order, a Stop Loss will be a Sell at a price lower than the entry, set to protect capital if the market price falls too far lower than the entry order. If the trader has a Sell as the entry order, the Stop Loss is a Buy order for the dealer, set at a price higher than the entry.

An institutional trader's platform is built to aggregate the prices from various exchanges and market makers and converge them into an average set at a distance from the prices at which the institution made the market for its clients. This gap creates an opportunity to offload any risks assumed from making the market to the exchanges, usually at a price that is located at where there are numerous stop-loss orders.

Remember that a stop loss is a Buy order for an active Sell position to cut losses and a sell order for an active long position to cut losses. So for a stop to be triggered, there has to be an order from the opposing side of the trade to activate it. What would be a better price available for an institution to get filled than at a price area with many stops?

The end game is that when the institutions' orders have been filled and the stops have all been taken out, the price will move in the institutional money's direction. This is because the volume of their trades will create a demand pull and send prices along the direction of their trades. This is why some retail traders place positions, and the trade goes against them to take out their stops before resuming in the direction of the original trade. Here are some instances captured in these snapshots:

Stop hunt in action: Scenario 1 (Screenshot taken from TradingView)

Here, there are two instances of a stop hunt. In the first, the candle broke above the 4.1344 resistance (blue line) but quickly retreated. Any stops placed just above the resistance in setting up a sell trade would have been taken out. Sure enough, the market resumed the southward move all the way to 3.9706.

Having attained this target, the market bounced, which would fool some traders into thinking the trend had changed. A sharp move above the 4.0500 resistance was quickly followed by a pushback. Any stops placed just above 4.0500 would have been taken out, stop-hunting style. The market continued its move south eventually.

Stop hunt in action: Scenario 2 (Screenshot taken from TradingView)

In this instance, the long bullish candle has a long lower shadow, created when the price dipped against the market expectation of a bullish break of the falling wedge. The previous candles all had lows that converged around a particular area, and most retail traders would place stops just below these lows.

The long bullish candle initially retreated right to the support at 4.6049, and would have taken out any stops planted just below the wedge’s lower border. See how the market quickly reversed back to the north, fulfilling the breakout as the price approached the 4.6901 resistance.

How do institutional firms hunt protection stops?

Institutional firms, such as hedge funds and investment banks, may use a variety of strategies to take out stop losses of retail investors. These strategies may include:

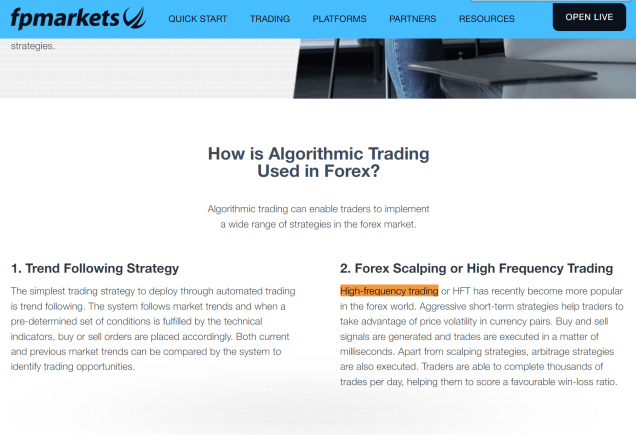

Trade aggregation: Institutional firms may use algorithms to continuously monitor the market and aggregate small trades, including those with stop loss orders, into larger orders. This allows them to take out stop loss orders without attracting too much attention or causing significant price movements.

High-frequency trading: Institutional firms may use high-frequency trading (HFT) strategies to quickly execute trades, including those that take out stop loss orders.

Market making: Institutional firms that act as market makers may use their position in the market to take out stop loss orders. A market maker is a firm that stands ready to buy or sell a particular security at any time, helping to ensure liquidity in the market.

It's important to note that these strategies are not necessarily nefarious or illegal, and they may be used for a variety of purposes. However, retail investors should be aware of these tactics and take them into consideration when placing stop loss orders.

How can retail traders avoid their stops being “hunted?”

One way for retail investors to avoid having their stop orders "hunted" is to use a "hidden" or "iceberg" order. This type of order allows the investor to specify a portion of their order to be displayed on the order book, with the remainder hidden. This can help to conceal the investor's true intention and potentially reduce the likelihood of their stop order being targeted.

Another way to reduce the risk of stop orders being hunted is to use a "mental stop." Look at where you would have set your market entry and your stop, and recalibrate your trade entry to be at the position where you would have placed the stop loss. This will turn your new stop loss into an entry that mirrors what the institutional traders are doing.

Can a forex robot prevent stop hunts?

There are a few different approaches that a forex robot could use to try to prevent stop hunting:

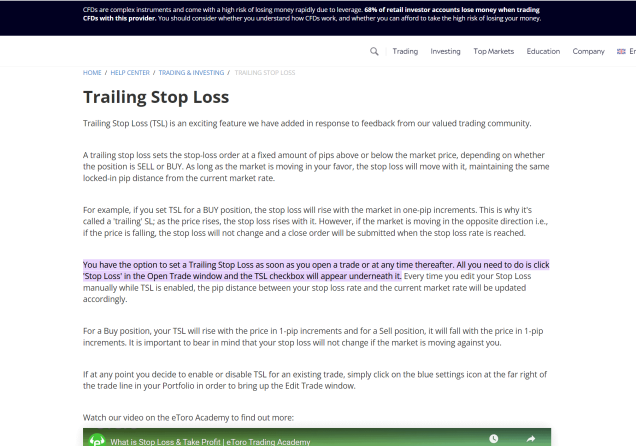

One approach is to use a dynamic stop loss that adjusts to changing market conditions. For example, the EA could use a trailing stop loss that moves in favor of the trade as the market moves in the desired direction. This can help to reduce the risk of the stop loss being triggered by sudden price movements that may be the result of stop hunting.

Another approach is to use a randomized stop loss that varies within a predetermined range. For example, the EA could select a random stop loss between a minimum and maximum value. This can help to make it more difficult for market participants to predict the stop loss levels of the EA's trades.

Hidden stop loss: The EA could also use a hidden stop loss, which is not visible on the order book. This can help to reduce the risk of the stop loss being targeted by stop hunters.

It's worth noting that these strategies may not completely eliminate the risk of stop hunting, as market participants may still be able to infer the stop loss levels of the EA's trades through other means. It's important for traders using an EA to understand the limitations and potential risks of the strategies employed by the EA and to use it as part of a well-thought-out trading plan.

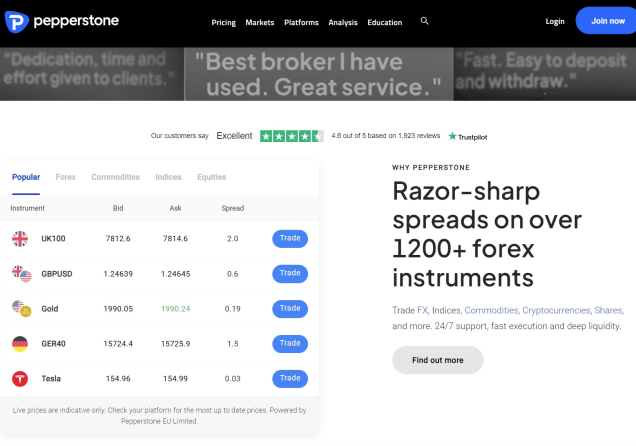

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.