Best Brokers for High-frequency Trading

High-frequency trading is a trading strategy that utilises computer programs to place large quantities of orders in a very short time, usually seconds. This automated trading strategy favours traders with fast execution programs and takes advantage of market inefficiencies. However, the trades placed using this trading strategy usually yield tiny profits individually. But cumulatively, the earnings can be significant.

While there are many brokers that support high-frequency trading, not all offer quality services. Today, we are going to be looking at some of the best brokers for high-frequency trading. But first, the benefits of high-frequency trading.

Benefits of High-Frequency Trading

Below are some of the benefits of high-frequency trading.

- It allows traders to earn from small price movements.

- As it is an automated strategy, traders do not have to keep inspecting the market to place orders.

- Since many orders are placed in a short time, this strategy improves market liquidity.

Drawbacks of High-Frequency Trading

Everything that has advantages certainly has disadvantages. Let’s look at some of the drawbacks of high-frequency trading.

- Many orders placed at the same time could cause a significant shift in market prices.

- Traders barely get to develop their own trading strategies as they depend on automation programs.

- It is mostly used by large corporations and smaller traders are usually the collateral.

Note that high-frequency trading heavily depends on fast order executions. Consequently, the fastest order execution brokers will feature prominently on this list. Now, with that out of the way, let’s take a look at some of the best brokers for high-frequency trading.

FP Markets

FP Markets supports high-frequency trading and traders can find information on this strategy in the education section under algorithmic trading. Notably, the broker mentions two main trading platforms that traders can use for algorithmic trading. These include the MT4 and MT5. These are two of the best trading software making FP Markets one of the best broker choices for high-frequency trading. Moreover, FP Markets has some of the fastest order execution times in the market. The broker features an average order execution time of 0.04 seconds.

In terms of the markets available for investors to trade, FP Markets has one of the deepest collections of market instruments. Specifically, this broker offers more than 10,000 different trading instruments. This includes over 70 currency pairs alongside CFDs on shares, metals, commodities, indices, cryptocurrencies, bonds, and ETFs. This shows that the broker supports the diversification of portfolios.

Further, the spreads for trading on this broker site are some of the lowest spreads in the market. There are two main trading accounts to choose from. The standard account features spreads starting from as low as 1.0 pips for major currency pairs. In comparison, the raw account features spreads starting from 0.0 pips with a small commission of $3 per side per lot.

Further, the spreads for trading on this broker site are some of the lowest spreads in the market. There are two main trading accounts to choose from. The standard account features spreads starting from as low as 1.0 pips for major currency pairs. In comparison, the raw account features spreads starting from 0.0 pips with a small commission of $3 per side per lot.

Finally, let’s look at the regulatory status of this broker. Well, the broker licenses from recognized organizations including the CySEC, the ASIC, and the FSCA.

71.23% of retail CFD accounts lose money

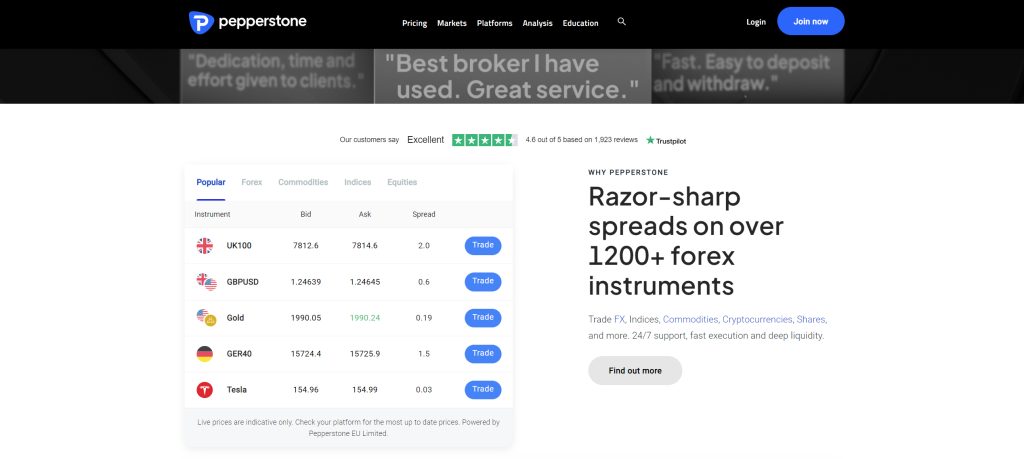

Pepperstone

Pepperstone is yet another broker that supports high-frequency trading. Interestingly, it also features some of the fastest order execution times in the market. The average order execution time for this broker sits at 30 milliseconds for the Pepperstone Group Limited branch and 60 milliseconds for the Pepperstone Limited branch. Understandably, it is a popular broker among traders who use high-frequency trading.

Next up, let’s look at market accessibility. With this broker, traders gain access to over 1,200 different trading instruments. These include CFDs on forex, shares, indices, ETFs, commodities, cryptocurrencies, and currency indices. This allows the traders to invest in various market instruments at the same time which is an added advantage. Moreover, this broker features four world-class trading platforms for traders to use while trading. These include TradingView, MetaTrader 4, MetaTrader 5, and cTrader.

The spreads for trading with this forex broker are competitively low, beating out most competitors in the market. On the standard account, the spreads start from as low as 1.0 pips with no commissions paid. On the other hand, the razor account has spreads from as low as 0.0 pips with a commission depending on the trading platform. When on the MT4 and MT5, traders pay a commission of $3.5 per side per lot. Comparatively, the commission sits at $2 per side per lot when using cTrader and TradingView.

Now, let’s look at who supervises this broker’s activities. Well, this broker has regulatory licenses from the ASIC, the FCA, the BaFin, and the CMA, among others.

75.5% of retail CFD accounts lose money

XTB

XTB also supports high-frequency trading and provides lessons on this trading strategy in its education section. The average order execution time on XTB sits at a mere 0.201 seconds. This makes XTB a choice broker for deploying high-frequency trading. Moreover, its xStation 5 trading platform offers an API that allows traders to link automation software to their accounts.

On another good note, XTB offers traders a deep collection of market instruments. In total, traders have access to more than 2,100 market instruments. These include CFDs on forex pairs, indices, commodities, cryptocurrencies, stocks, and ETFs. Better yet, the charges for trading these instruments are competitively low. The spreads on this broker site can go as low as 0.5 pips.

Regarding the regulatory status, this broker has good standing. It has regulations from two tier-one organizations which include the CySEC and the FCA. Additionally, it is regulated by the FSCA in South Africa.

78% of retail investor accounts lose money when trading CFDs with this provider.

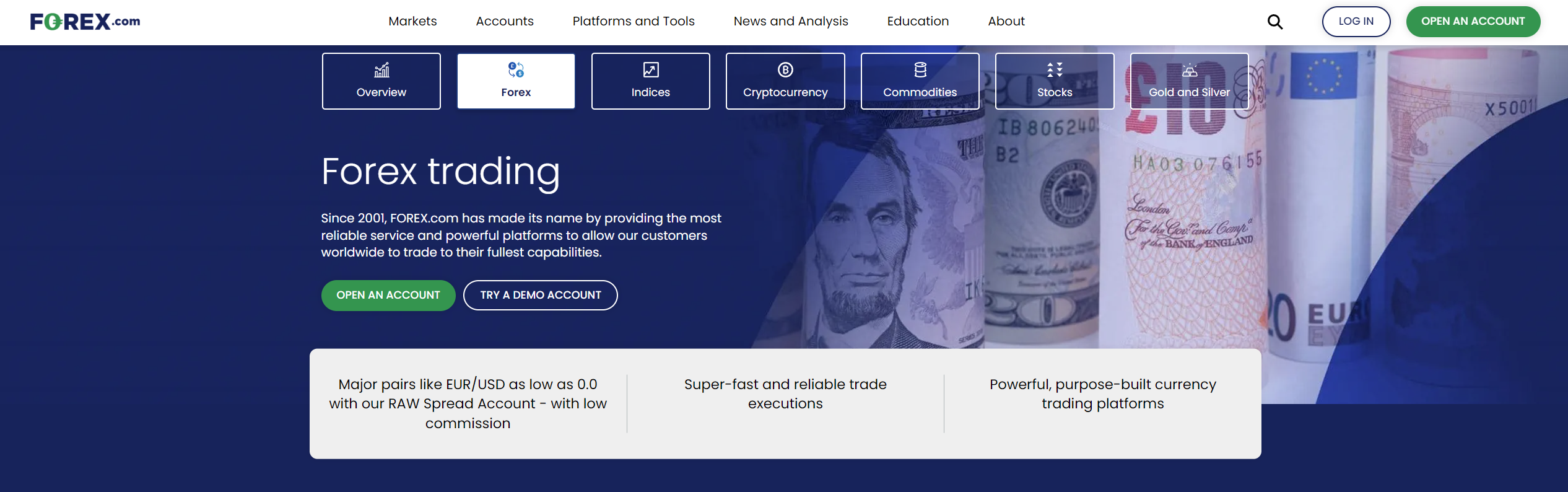

Forex.com

Forex.com gives traders over 5,500 different trading instruments. On this broker site, traders have access to global markets such as forex, stocks, indices, cryptocurrencies, commodities, and precious metals. Investors can use a variety of trading strategies to trade these markets, including high-frequency trading. This broker has a RESTful API that traders can use to link to third-party automation programs. Such programs make high-frequency trading possible for investors.

To execute trades, traders have access to some market-standard software which include MetaTrader 4, MetaTrader 5, and Forex.com Trader. Such trading platforms give traders an edge in the market due to their speed and functionality. While this is an attractive feature to traders, the fees are also market standard and most traders will afford them.

The standard account has spreads as low as 0.8 pips for major currency pairs with no commissions. On the other hand, the Commission account and the DMA account have lower spreads plus a commission. The commission account charges a commission of $5 per 100k traded with spreads from 0.2 pips. Contrarily, the DMA account has spreads from 0.0 pips with commissions depending on the volume. A trader with a trading volume of $0M – $100M per month would pay a commission of $60 per $1 million traded.

Forex.com is one of the most heavily regulated brokers in the market. This broker has regulatory licenses from the FCA, the ASIC, the IIROC, the CFTC, and the NFA, among others.

77.7% of retail investor accounts lose money when trading CFDs with this provider.

City Index

City Index is yet another broker with some of the fastest order execution times in the market. The average order execution time on this trading site is 0.05 seconds, making it prime for high-frequency trading. Traders can deploy automation programs to help them execute this strategy on City Index. City Index also provides some educational material on this trading strategy, just like some of the other brokers on this list.

The spreads for trading major currency pairs on this broker site start from 0.7 pips. This is competitively low compared to competing brokers in the market. Further, the broker offers traders a choice between several trading platforms. These include MetaTrader 4, WebTrader, and Tradingview. Investors can use the platform that best suits their needs.

Onto the regulatory status of City Index. The broker has a good collection of regulatory licenses from three of the top organizations in the world. These include the FCA in the UK, the CySEC in Cyprus, and the ASIC in Australia. Regulations alone are not enough. However, having licenses from these three organizations helps with a company’s reputation.

69% of retail investor accounts lose money when trading CFDs with this provider.

Tickmill

Tickmill is a regulated broker in several jurisdictions. The broker has regulatory licenses in the UK by the FCA, in Cyprus by the CySEC, and in South Africa by the FSCA. On its trading platform, traders have access to over 180 instruments across 6 different asset classes. This is great diversity for traders who want to invest in more than one market.

Tickmill also offers a diversity of trading platforms traders can use. The trading platforms available to use include MetaTrader 4, MetaTrader 5, and the Tickmill Mobile App. These platforms give Tickmill some of the fastest order execution times in the market. According to the broker’s website, the average order execution time is 0.20 seconds. This makes the broker a prime choice for high-frequency trading.

There are over 180 different market instruments available for clients to trade. These include forex pairs and CFDs on stock indices, oil, precious metals, bonds, stocks, and cryptocurrencies. What’s more, the spreads on this broker site are relatively low starting from 1.6 pips for major currency pairs on the classic account.

However, traders can trade using even lower spreads from as low as 0.0 pips plus a commission. The VIP account charges a commission of 1 currency unit per side per 100,000 traded. Conversely, the Pro account requires a commission of 2 currency units per side per 100,000 traded.

Interactive Brokers

To close out our list, we will look at Interactive Brokers. This broker allows its traders to automate their trades using the TWS API. This is good for traders who want to link high-frequency trading software to their accounts. The trading platform available to execute trades is the in-house-built Interactive Brokers trading platform. It is available on the web, mobile, and desktop.

In terms of market availability, Interactive Brokers allows clients to trade a variety of market instruments. Traders can invest in stocks, options, futures, currencies, cryptocurrencies, US Spot Gold, bonds, ETFs, funds and more. Interestingly, Interactive Brokers primarily charges a commission for trading. The commission depends on the market instrument a client is investing in and can range from $16 to $40 per million traded.

Looking at the regulatory status of this broker does not disappoint. This is because the broker holds licenses from the FCA, the SEC, the CFTC, the ASIC, and the Monetary Authority of Singapore. This is an impressive collection of regulatory licenses, to say the least.

AvaTrade

AvaTrade is an international broker that also supports high-frequency trading. Notably, this broker has lessons on this and other trading strategies in its Education section. This gives investors an edge as they get acquainted with the different trading strategies. Better yet, the broker offers a demo account on which traders can practice their strategies.

There are several markets that traders can invest in with this broker. They can trade CFDs on forex, cryptocurrencies, stocks, commodities, indices, bonds, ETFs, and vanilla FX options. Such variety is always a good thing for traders. Moreover, the broker also supports a variety of trading platforms for traders to choose from. Traders can choose between MT4, MT5 and the in-house-built AvaTradeGo. On top of that, the broker provides several other tools to help traders on their journey. These include AvaProtect and copy trading programs such as DupliTrade and ZuluTrade.

Closing Remarks

High-frequency trading is usually used by large organizations that can afford high-tech software. As such, it can put smaller traders at some disadvantage in the market. This is one of the reasons why this trading strategy is controversial among traders. Moreover, it might cause a shift in prices that traders did not anticipate. In any case, there are also advantages to using this strategy. For example, it allows traders to earn from small price movements.

In this review, we listed some of the best brokers for high-frequency trading. As speed matters a lot here, we heavily featured brokers with fast execution times. Nonetheless, we encourage you to find the broker that best suits your needs. To do that, you will need to look through these brokers with your own keen eye. This information is meant to get you started on that journey.

Regulated Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.