Best Brokers for API Trading

API trading is becoming increasingly popular among forex traders who seek automation, speed, and efficiency in executing their strategies. An API (Application Programming Interface) is a set of specifications and protocols that allow software applications to communicate. In forex trading, APIs enable traders to automate strategies, retrieve market data, and execute trades efficiently. Before exploring the best brokers for API trading, let’s first take a quick look at the different types of APIs available and how they cater to various trading needs.

Types of Forex Trading APIs

There are several types of APIs used in forex trading:

-

REST API – A flexible, widely-used API that allows traders to automate trading, retrieve historical data, and execute trades efficiently. It offers speed and flexibility but lacks built-in security protocols.

-

FIX API – Designed for institutional traders and high-frequency trading (HFT), FIX API provides ultra-low latency and direct market access but requires advanced technical knowledge and can be costly.

-

WebSocket API – Enables real-time data streaming and rapid order execution, making it ideal for traders who need instant market updates. However, it requires maintaining persistent connections.

-

MetaTrader API (MT4/MT5 API) – Integrated with MetaTrader platforms, this API is user-friendly and widely supported by brokers but may have limited customization options compared to other APIs.

Best Brokers for API Trading

Now that we understand different API types, let's explore some of the best brokers offering API access, evaluating them based on trading conditions, features, and regulatory status.

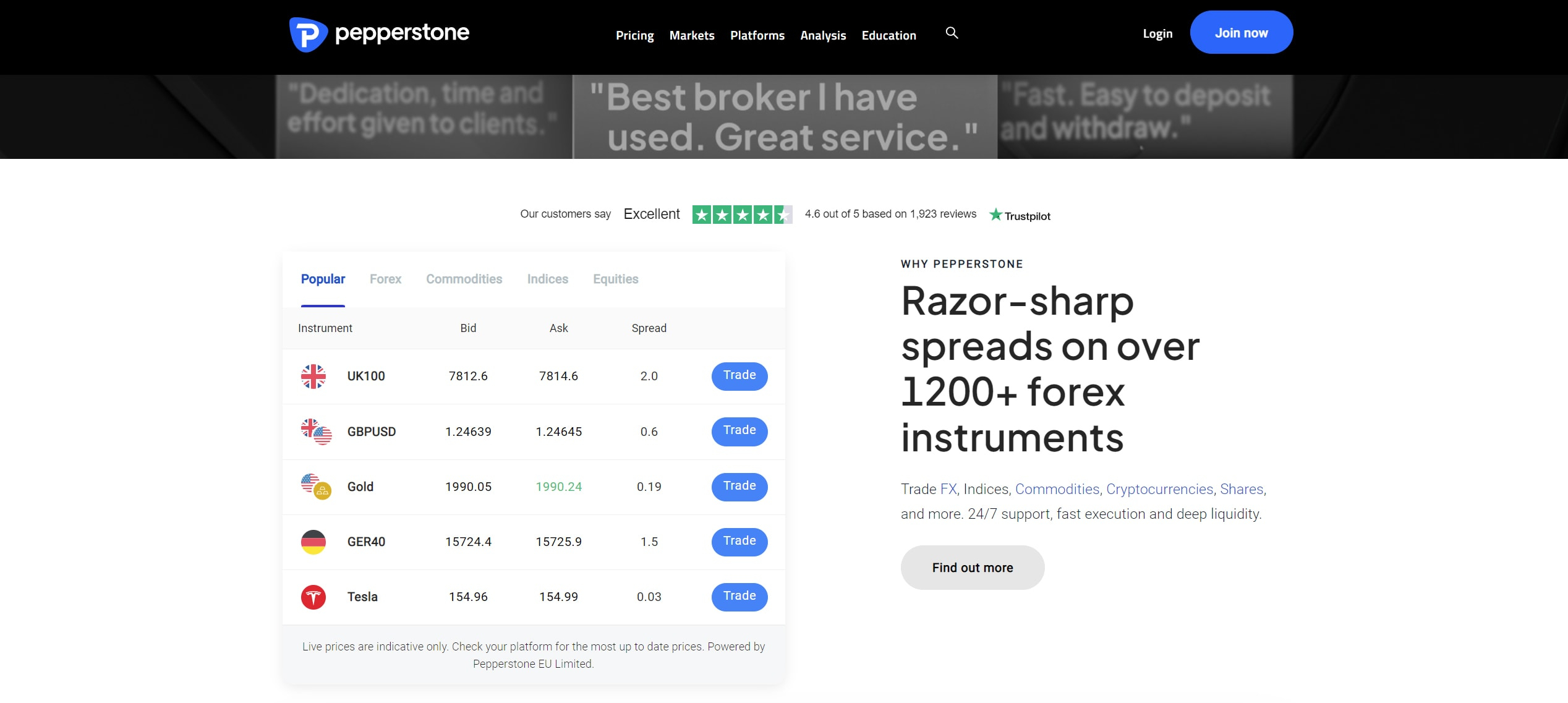

Pepperstone

Pepperstone is one of the top brokers for API trading, offering a wide range of API connections. Traders can use the MetaTrader 4 and MetaTrader 5 APIs, both popular and widely supported platforms. However, one of the most popular API options is the cTrader Automate API, which is specifically designed for margin trading. This API uses a programming language that is easy to read and understand, making it accessible to both developers and traders. The functionality of this API is extensive, supporting virtually all aspects of forex and CFD trading.

In addition to these three API options, high-volume traders with a minimum of €160 million in monthly trading volume can also request the Pepperstone FIX API. This advanced API is available only to qualified traders.

With Pepperstone, clients can trade over 1,200 CFDs across various markets, including forex, indices, commodities, stocks, and cryptocurrencies. The broker offers competitive spreads, starting from 1.0 pips on the standard account and from 0.0 pips on the Razor (raw) account, with a low commission fee. Pepperstone is also one of the most heavily regulated brokers in the industry, holding licenses from the FCA in the UK, BaFin in Germany, CySEC in Cyprus, the DFSA in the UAE, and the CMA in Kenya.

75.3% of retail CFD accounts lose money

Forex.com

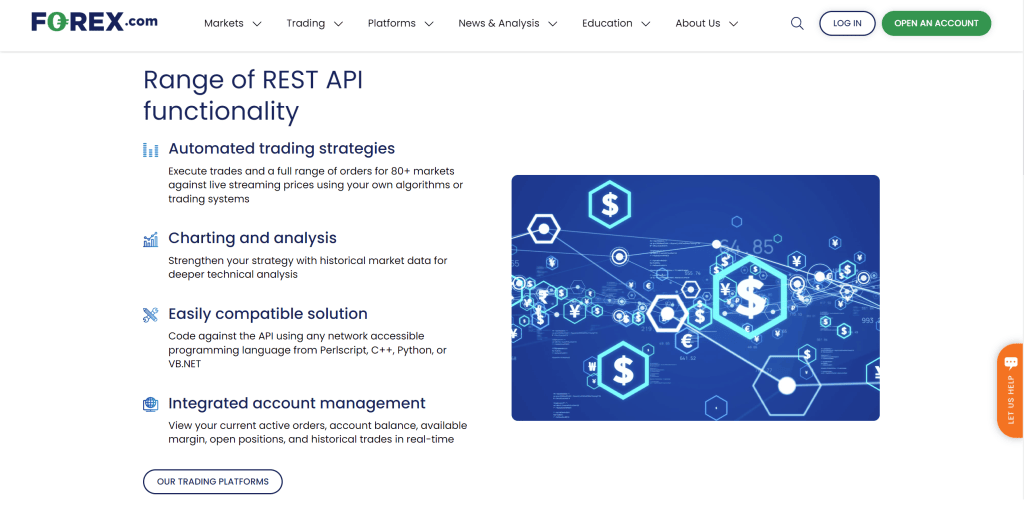

Forex.com offers REST API trading services that allow clients to access live streaming pricing, trade execution, sophisticated order types, and over 5,500 of the world's most traded market instruments. Traders can use their algorithms or systems to execute trades and orders by integrating EAs and other tools. This API is easily compatible since it can be coded against any network-accessible programming language such as Perl-script, C++, Python, or VB.NET. This allows clients with the technical know-how to code their own programs to integrate with Forex.com.

On Forex.com, clients can trade more than 5,500 tradeable assets. This includes CFDs on forex, indices, shares, commodities, precious metals, and cryptocurrencies. Clients from the United States should be aware that CFDs are not available due to regulations. As such, they can only access forex, futures and futures options. The trading platforms available to use include MetaTrader 4, MetaTrader 5, TradingView and Forex.com Trader.

Further, Forex.com offers great pricing when trading. There are three main trading accounts with different spreads. The spreads on this broker site can fall as low as 1.0 pips for major currency pairs on the standard account.

The Commission account and the Direct Market Access (DMA) account both charge a commission. The Commission account features spreads starting from 0.2 pips and charges a commission of $5 per 100k traded. The DMA account charges different commissions depending on the trading volume of a client. For example, a trader with a trading volume of $0M – $100M per month would pay a commission of $60 per $1 million traded.

In terms of regulations, we see great oversight from multiple regulatory organizations. Forex.com’s activities are supervised by the FCA, the ASIC, the IIROC, the CYSEC, the CFTC and the NFA. This suggests that Forex.com is committed to following the law.

76-77% of retail investor accounts lose money when trading CFDs with this provider.

eToro

Customers of eToro can use the eToroX API to trade on the eToroX exchange utilizing a REST API solution. This enables algorithmic traders and programmers to automatically issue or cancel orders to buy/sell crypto assets and obtain account information. EToroX manages all orders in the market. Customer orders are saved in numerous persistent (permanent) storage locations and the matching engine. The matching engine compares buy/sell orders. If a match (a buy order price equal to or higher than the sell order price) is identified, the orders are matched and executed within the specified price window. On the eToro broker site, REST API provides numerous capabilities such as getting the balance, managing orders, withdrawing funds, depositing funds, and so on.

The variety of trading instruments on eToro includes CFDs on stocks, commodities, EFTs, forex, crypto, and indices. The broker also allows clients to trade real stocks and cryptocurrencies. These products are tradeable on the eToro platform built by eToro itself. eToro has no hidden fees and no commissions. The company reveals all charges that apply when trading on its website under fees. In terms of spreads, the company offers fair pricing starting from as low as 1.0 pips for major currency pairs.

eToro operates under the watchful eye of several organizations. These include the CySEC in Cyprus, the FCA in the UK, the ASIC in Australia and many others. This is one of the most heavily regulated brokers in the market today.

61% of retail investor accounts lose money when trading CFDs with this provider.

OANDA US

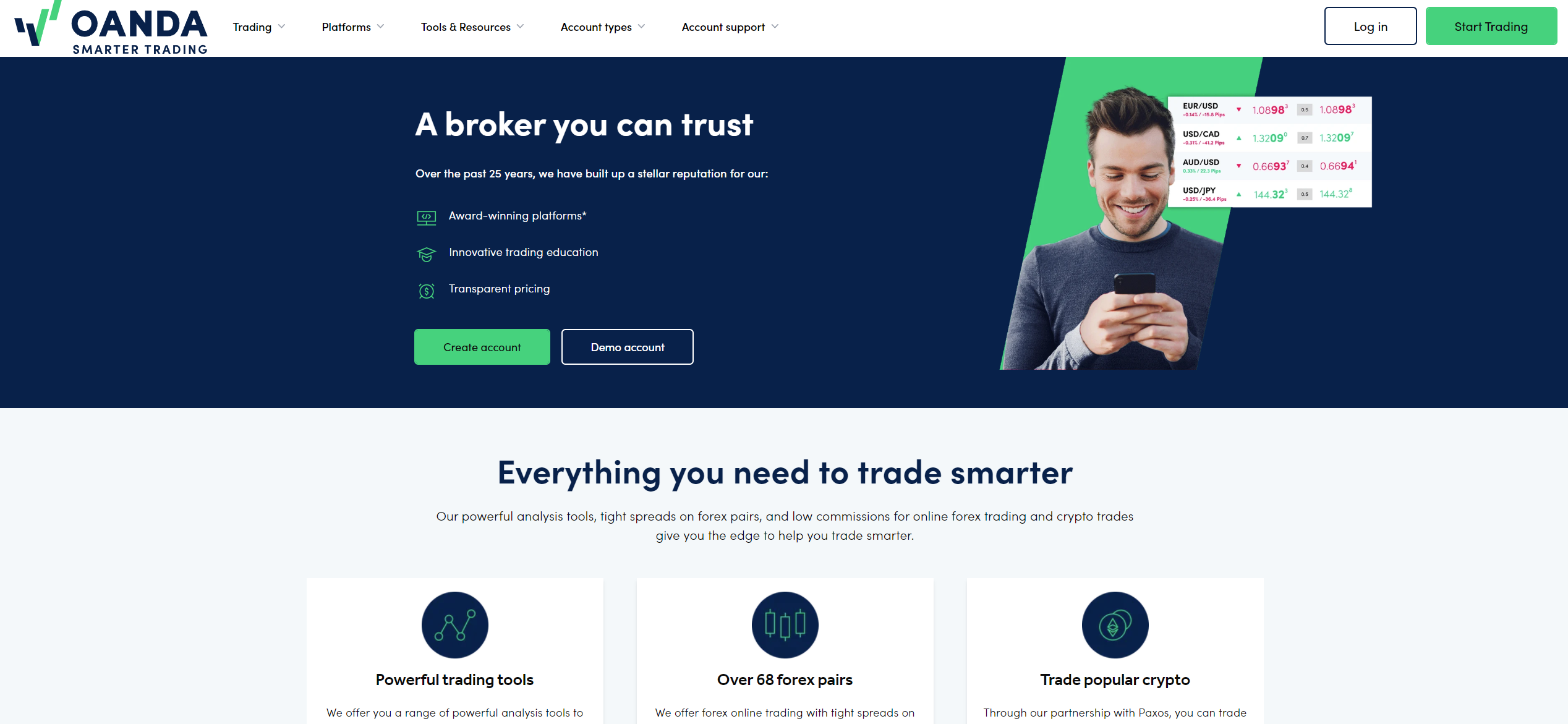

OANDA US is another broker that provides REST API to its clients. The API is simple to integrate into a client’s existing platform, offering over 25 years of historical data across multiple currency pairs, as well as data on commodities, indices, and precious metals. They have direct access to real-time Forex rates so they can be confident that the information is dependable. Access to historical pricing data goes all the way back to 2005. Further, clients can place, alter, and close orders, manage their account settings, and see their account/trading history using the REST API provided by OANDA.

Clients can also access MetaTrader 4 and TradingView trading platforms. These platforms allow clients to trade forex and cryptocurrencies (via the PAX exchange). The typical spreads on OANDA start from 1.0 pips on major currency pairs. There is no minimum deposit, and traders can deposit up to US$9,000. This accommodates traders of all kinds.

OANDA is regulated by numerous regulators in different countries including the US, UK and Australia. In the US it is regulated by the NFA under the NFA ID 0325821.

Forex trading involves significant risk of loss and is not suitable for all investors.

Saxo Bank

Saxo Bank supports API trading through SaxoOpenAPI, a REST-Like API based on the HTTP protocol with streaming support. It provides all the necessary resources for building a high-performance multi-asset trading platform, including reference data on tradable instruments, exchange details, and real-time portfolio overviews. SaxoOpenAPI also supports streaming quotes, request-for-quote, order placement, and trade confirmations. Additionally, Saxo Bank offers platforms like SaxoTraderGO and SaxoTraderPRO for seamless trading.

Through this, clients can access their entire capital markets infrastructure, including instrument and client portfolio data, charts, quotations, order placement, lead sign-up, and event notifications. Clients can trade over 70,000 assets that include forex, stocks, EFTs, bonds, crypto, and mutual funds among others. Saxo boasts of providing ultra-competitive spreads starting at 0.6 pips on major currency pairs.

In terms of regulation, Saxo Capital Markets is regulated by multiple institutions. These include the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC) in Australia, and the Swiss Financial Market Supervisory Authority (FINMA) in Switzerland. Such strong regulations help win the trust of traders and investors at large.

FXCM

FXCM is a broker that offers three FREE APIs, each connecting directly to FXCM's trading server: a FIX API, Java API, and a ForexConnect API. The FIX API is likely the most popular API offered by this broker. To access it, you need an FXCM Trading Station account with a minimum balance of $5,000. Built on the FIX Protocol standard, this API is designed for a real-time, customizable institutional interface, capable of delivering up to 250 price updates per second—more than any other API. It is the fastest and most widely used option, offering a full range of trading order types available at FXCM.

The details about these three APIs are listed under their St. Vincent-regulated entity, meaning they are likely unavailable to traders in the UK and EU.

Some of the trading instruments on this broker site include forex and CFDs on indices, shares, and commodities. Additionally, this broker provides a great lineup of trading platforms including Trading Station and MetaTrader 4. The spreads on this platform are competitive on currency pairs and CFDs. These spreads can go as low as 1.0 pips for major currency pairs.

FXCM is regulated by multiple reputable organizations from different jurisdictions. Notably, the broker under the regulation of the FCA, the FSCA, the CySEC, and the ASIC. The company also has over 20 years in the market which is an impressive achievement.

IG Markets

IG is another broker that provides access to its web-based API solutions, either REST-based or streaming. On this broker, integration is accomplished by four common HTTP operations where you can retrieve a resource, replace a resource, create a resource, and remove a resource. Most importantly, traders can integrate trading bots from various sources or code their own if they have the technical know-how.

This API gives clients access to a wide variety of market instruments. IG has one of the deepest collections of market instruments totalling over 18,000 assets. Clients of this broker can trade CFDs on forex, indices, commodities, shares, cryptocurrencies, and more. As the REST API allows it to fetch historical data, it is easy to use different programs to backtest trading strategies.

On another note, IG provides clients with industry-standard platforms including MetaTrader 4, ProRealTime, L2 Dealer, and the ProgressiveWebApp. The spreads in IG are manageable and most Swiss traders would be able to afford to trade with this broker. The average spreads on IG can fall as low as 0.6 pips for some major currency pairs.

Finally, this broker is regulated by the FCA alongside other organizations including the FINMA, the ASIC, and the FSCA. Regulations are an important feature to look at when choosing a broker to invest with. A broker with multiple regulations from reputable organizations stands out from the rest.

Final thoughts

As we have seen, API trading enhances the trading experience by enabling automation, speed, and efficiency. Many brokers recognize this and provide various API options, including REST, FIX, WebSocket, and MetaTrader APIs, allowing traders to integrate their strategies seamlessly. However, each broker has unique API requirements, documentation, and usage restrictions, so it's essential to review their API documentation for a clear understanding of capabilities and limitations.

Additionally, choosing a broker solely based on API availability isn’t enough. Factors like regulations, trading conditions, fees, and market instrument availability should also be considered. By evaluating these aspects, you can select the broker that best aligns with your trading needs.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.