Best Forex Brokers For Backtesting

Backtesting is a very crucial practice in forex trading. Basically, it is the process of testing how well a trading strategy would perform under historical data before using it in the live market. While this sounds simple, selecting the best time period to test a strategy against is key and can be tricky. Traders need to select a time period that best represents market scenarios with diverse events and price movements. Additionally, it is crucial to select a broker that best fits backtesting purposes.

In this review, we will look at some of the best forex brokers for backtesting. But before that, let’s get a little more familiar with backtesting by looking at its advantages and disadvantages.

Advantages of Backtesting

- Backtesting allows traders to test the viability of a trading strategy before deploying it in the live market.

- It helps in improving trading strategies as traders can tweak them to better perform in different scenarios.

- Traders gain a deeper understanding of the market by studying historical data for backtesting. This can improve the techniques clients deploy in the market.

- Backtesting can be better than using a demo account as it is based on real past market conditions. On top of that, it is risk-free just like trading on a demo account.

Disadvantages of Backtesting

- Success in past market conditions is not a guarantee for future success in the live market. A strategy that may succeed in the backtesting process may fail in the live market.

- Backtesting may require technical knowledge to operate or program the software involved.

- Backtesting can be a time-consuming and tedious process as large amounts of data are involved.

While backtesting has both pros and cons, the rewards of a successful backtesting process are immense. Consequently, it is a process used by many professional traders to give them an edge in the market. With that, let’s take a look at some of the best brokers for backtesting.

Forex.com

Forex.com provides a whole page dedicated to educating clients on the ins and outs of backtesting. As such, this is a great broker for both beginner and experienced traders who want to put their strategies to the test against past data. Moreover, this broker has two main tools to help clients backtest their strategies.

On Forex.com, MT4 is one of the trading platforms available to clients. This trading software comes with many tools, including the Strategy Tester tool used for backtesting. To use the tool, you need to build an automated trading program using MT4’s Expert Advisors. Once you launch the program on Strategy Tester, you will receive several quantitative data and reports on your trading strategy.

Clients based in the US can use Capitalise.ai which is exclusive to US Forex.com accounts. This is a great software to backtest strategies as it allows traders to automate the process. The tool is code-free and text-based making it easy to create, test, and automate trading strategies. As such, this tool serves both beginner and seasoned traders alike.

Once a trader has tested out their strategy, then they can deploy it in the live market if they deem it successful. Luckily, on Forex.com, there are a variety of markets clients can invest in. Clients outside the US can trade CFDs on forex, indices, shares, commodities, precious metals, and cryptocurrencies. On the other hand, clients from the US can only trade forex, gold and silver, and futures and futures options assets on Forex.com. Spreads are low on this broker site starting from 0.0 pips plus a commission on the Commission account. On the Standard account, the spreads start from as low as 0.8 pips for major currency pairs.

Regarding regulations, Forex.com operates under the supervision of several top-notch organizations. These include the FCA in the UK, the NFA and CFTC in the US, the CySEC in Cyprus, the ASIC in Australia, and the IIROC in Canada.

77.7% of retail investor accounts lose money when trading CFDs with this provider.

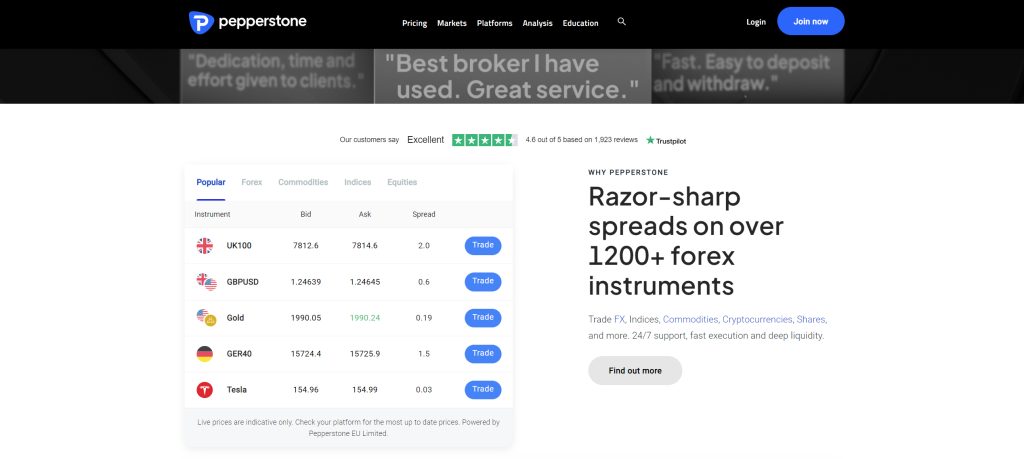

Pepperstone

Pepperstone was recently voted TradingView Broker of the Year 2022 in the TradingView Broker Awards. One of the reasons for this is its deep collection of trading instruments. On the Pepperstone broker site, clients can trade over 1,200 CFDs on forex currency pairs, shares, indices, ETFs, commodities, and currency indices.

On Pepperstone, the main strategy testing platforms are MT4 and MT5. With these platforms, clients can use real historical data over a range of timeframes to simulate EA and manual trading strategy performance. This allows traders to tweak their strategies and remove some of the guesswork used when trading. While MetaTrader’s Strategy Tester is the main tool for backtesting, Capitalise.ai is also available to Pepperstone clients. Clients can also use this software to examine the performance of their approach in the market.

Apart from MT4 and MT5, there are two other trading platforms to choose from on the Pepperstone site. TradingView and cTrader are both available to clients. These platforms give Pepperstone fast order execution times averaging 30 milliseconds for Pepperstone Group Limited clients and 60 milliseconds for Pepperstone Limited clients.

Further, Pepperstone has some of the lowest spreads in the market starting from 1.0 pips for major currency pairs on the Standard account. They go even lower on the Razor account starting from 0.0 pips with a commission paid. The commission on this account sits at €2.6 per side per lot on forex or $3.50 in US Dollars.

Finally, Pepperstone is licensed and regulated in many jurisdictions. These include in the UK by the FCA, in Australia by the ASIC, in Cyprus by the CySEC, in Kenya by the CMA, and in Germany by the BaFin. The legitimacy case for this broker is greatly supported by its regulatory status.

75.5% of retail CFD accounts lose money

AvaTrade

AvaTrade is also a great broker for clients who want to test out their strategies against historical data. Like Forex.com, AvaTrade also features a whole page under its education section for educating traders on backtesting. Additionally, it has two platforms that are suitable for backtesting. First, AvaTrade has partnered with Capitalise.ai to give clients access to one of the best backtesting software in the world. Additionally, clients gain access to a huge library of high-performance strategies through Capitalise.ai.

Further, MetaTrader 4 and 5 are available to use for trading on AvaTrade. These platforms have a lot of functionalities including backtesting capabilities. MetaTrader’s Strategy Tester is available for people to use. The other trading platform available on AvaTrade is AvaTradeGO. AvaTrade also gives its traders access to ZuluTrade and DupliTrade which have copy-trading capabilities.

On the AvaTrade broker site, clients have access to over 700 trading instruments, all of which are CFDs. The asset classes available to clients of AvaTrade include forex, stocks, indices, commodities, ETFs, bonds, and cryptocurrencies. Traders on this broker site will be spoilt for choice and can easily diversify their portfolios.

As we always mention the regulations of a broker, let's look at how AvaTrade’s activities are supervised. Well, this broker operates under the watchful eyes of the ASIC, the Central Bank of Ireland, the FSCA, and the BVIFSC. While regulations alone are not enough, you’re much safer with a company under the supervision of world-class organizations.

76% of retail CFD accounts lose money

IG

IG has the deepest collection of market instruments totalling over 18,000 assets. Clients of this broker can trade CFDs on forex, indices, commodities, shares, cryptocurrencies, and more. This is one of the reasons why IG is one of the best brokers according to Reddit users. Moreover, this broker is well-regulated in multiple jurisdictions. The company is currently regulated by the FCA in the UK, ASIC in Australia, BaFin in Germany, and the NFA in the USA.

For backtesting strategies, traders can use two main platforms. Like the other brokers on this list, IG provides MT4 to its clients which has backtesting capabilities using its Strategy Tester tool. On top of that, clients can use ProRealTime’s backtesting tool, ProBacktest. Traders can navigate to the indicators and trading systems tab on ProRealTime to launch the backtest.

Once a trader is satisfied with their strategy and chooses to deploy it in the market, they can use the same MT4 and ProRealTime to execute trades. They can also use L2 Dealer or choose from a wide range of user-friendly trading apps for Android and iOS. The spreads clients enjoy are usually low starting from 0.6 pips for major currency pairs.

Admiral Markets

There are many trading instruments available to clients for trading on the Admiral Markets broker site. Traders can invest in CFDs on forex, commodities, indices, stocks, ETFs, and bonds. Clients trade these assets on world-class platforms including MT4, MT5, MetaTrader WebTrader, and Admirals Mobile App. The MetaTrader platforms on this broker site allow clients to test their strategies using the Strategy Tester tool.

If clients are satisfied with the performance of their strategies, they can go ahead and invest in the various markets available. The spreads for trading on this broker site are not extravagant and depend on the account a client is on. The Trade.MT5 account has spreads starting from as low as 0.5 pips on major currency pairs. This is the main trading account on Admiral Markets. The other accounts feature spreads starting from 0.0 pips with commissions paid. The commissions range from $1.8 to $3 per lot depending on the account.

Fore regulations, this company has licenses from reputable organisations including the FCA, the CySEC, the ASFL, the JSC, and the FSCA. Having several regulatory licences allows a broker to operate freely within multiple jurisdictions.

FXCM

FXCM is a forex and CFDs broker with over 20 years in the market. This company operates primarily from South Africa and is authorized and regulated by the FSCA. The company is also under the regulation of the CySEC, the FCA, and the ASIC. The CySEC, the FCA, and the ASIC have very strict laws and are some of the top regulators in the market today.

This company also supports the use of Capitalise.ai to automate and backtest trading strategies. The ability to automate the backtesting process can save clients a lot of time they can use to analyse the market. MetaTrader 4 is also available for backtesting strategies. As such, clients can pick and choose the tool that best suits their needs.

In terms of the availability of instruments, this broker supports portfolio diversification by providing a wide range of markets. Clients can trade forex alongside CFDs on indices, shares, and commodities. The spreads on this platform are competitive on currency pairs and CFDs. These spreads can go as low as 1.0 pips for major currency pairs.

How to Backtest Your Trading Strategy

There are three main steps to backtesting your strategy. To start with, you need to have your strategy defined. Figure out the timeframes, assets you are trading, and your aggressiveness in the market. This will determine a lot of things in the backtesting process.

Find the most desirable entry point that meets your backtesting needs. Then follow the trades alongside the data through to the exit point. Make sure to pick a timeframe with different market conditions including both bear and bull markets conditions. This ensures that your strategy is diverse and works well under different conditions.

Record all results and calculate the net return ensuring you consider transaction costs, commissions, and subscription costs. Ensure you customize backtesting parameters to fit your trading needs. That way, when you calculate the net return, you can be confident that your strategy can work in the live market. A backtest is successful when the strategy yields profitable results.

Closing Remarks on Best Forex Brokers For Backtesting

Backtesting is a very crucial process to determine the viability of a trading strategy in the live market. In this review, we looked at some of the best forex brokers for backtesting. For the most part, we looked at the programs the brokers provide to clients for backtesting. This is the crucial feature to look at as success in the backtesting process will depend on the program rather than the broker themselves. However, we also looked at the trading conditions and the assets availed by the various brokers.

To close out, we would like to remind you that backtesting is not an assurance of the success of a strategy in the live market. Past market conditions do not represent present or future conditions. Moreover, similar market conditions could lead to different sentiments in the market. As such, it is important to maintain some reservations and consider all factors involved before investing.

Regulated Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.