What is The Minimum Amount to Trade Gold (XAUUSD)

Gold has been a symbol of wealth and stability for centuries. Today, it is one of the most traded assets in the world. Its reputation as a safe-haven asset and its potential for significant price fluctuations make it an attractive investment option. In modern financial markets, gold is often traded as a commodity pair against the U.S. dollar (XAU/USD).

As a highly liquid asset, gold trading provides numerous opportunities for both short-term traders and long-term investors. However, a common question arises:

What is the minimum amount required to trade gold (XAU/USD)?

In this article, we are going to attempt to answer exactly this question. We will explore the factors that influence the minimum trading amount and how different brokers handle gold trading. We will also mention some brokers that offer gold trading.

Factors Influencing the Minimum Amount to Trade Gold

The minimum amount required to trade an asset refers to the lowest amount of money that the trader must deposit to open a trade on a broker site. This amount varies from broker to broker and is influenced by a variety of factors. These factors include:

The Broker

The broker that a trader uses plays a major role in determining how much is needed to start trading. For starters, the broker that an investor selects will determine the minimum deposit required to open an account. Additionally, the broker that an investor chooses may have their own specific terms concerning the minimum trade size. Usually, the minimum trade size will be represented in lots. In gold trading, a standard lot typically represents 100 ounces of gold. However, brokers also offer mini lots (10 ounces) and micro lots (1 ounce), allowing traders with smaller capital to participate. It is essential to review the terms set by the broker before starting to trade.

The Leverage and Margin Requirements

This is another condition determined by the broker an investor uses. However, we saw it fit to split it from the rest as it is a complex factor. Leverage allows traders to control a larger position with a smaller amount of capital. Most forex brokers offer leverage on gold trading, which can significantly reduce the minimum capital required. However, it’s important to know that while leverage can increase your potential profits, it also increases your potential losses.

On another note, brokers require traders to maintain a given margin as collateral for holding trading positions. The margin requirement is a percentage of the trade size. Lower margin requirements mean traders can enter positions with less capital, but it also increases the risk of margin calls if the market moves against their position.

The Account Type

Brokers often offer different account types, such as standard, mini, and micro accounts. Each account type comes with specific minimum deposit requirements and minimum trade sizes. For example, a standard account might have a higher minimum trade size and minimum deposit than a micro or mini account. However, note that the larger accounts will often offer more benefits and better trading conditions to traders than the smaller accounts.

The Trading Strategy

The trading strategy of a trader and their risk tolerance also have a great influence on the minimum amount to trade gold. For more aggressive and high-frequency trading strategies like scalping, less capital might be needed initially. This is due to their short-term focus and smaller profit targets. In contrast, for longer-term and less frequent strategies like position trading, more capital is typically required to withstand market volatility and achieve meaningful gains.

Tips for Trading Gold

- Learn the Basics - Before trading gold, it's essential to have a solid understanding of the basics, including how gold is priced, the factors that affect its price, and different trading strategies. This will also help you determine the amount you want to trade.

- Develop a Trading Plan - A well-defined trading plan can help you stay disciplined and avoid impulsive decisions. Keeping check of emotions is one of the most important things needed to succeed in the market.

- Practice with a Demo Account - Many brokers offer gold trading demo accounts that allow you to practice trading without risking real money. This can help you develop your skills and test different strategies.

- Manage Your Risk - Risk management is crucial in trading gold. Set stop-loss orders to limit your potential losses, and diversify your portfolio to reduce risk.

- Stay Informed - Keep up-to-date with news and events that could affect the price of gold. This includes economic indicators, geopolitical events, and central bank policies.

- Consider a Gold ETF - If you're not comfortable trading gold directly, you can invest in a gold exchange-traded fund (ETF). This is a relatively easy way to invest in gold without taking physical possession of the metal. A gold CFD will also allow you to speculate on the price of gold without having to own it.

But where exactly can you trade gold?

Let’s take a look at Top Gold Brokers

Exness

Exness provides a convenient platform for people to trade Gold CFD (XAUUSD). For starters, the minimum deposit requirement on this broker site is a competitively low $10. Trading hours for gold are from Sunday 10:05 PM GMT to Friday 8:58 PM GMT, with a daily break between 8:58 PM GMT and 10:01 GMT. The minimum lot size is 0.01 on all five accounts.

The spread costs for trading gold (XAUUSD) on this broker vary depending on the account type. Both the standard and standard cent accounts offer average spreads of $2.0 (20 pips) with no commission for trading the XAUUSD pair. In contrast, the Pro account features lower spreads, averaging 12.5 pips with no commission on this pair. Additionally, the raw spread account provides average spreads of 6.2 pips, plus a commission of $3.5 per side per lot when trading gold.

Lastly, the zero account offers spreads as low as 0.0 pips, accompanied by a commission of $8 per side per lot. Interestingly, Exness has completely eliminated swaps on gold, making it an ideal choice for investors who wish to stay in their Gold positions for a longer time period. By default, all account types offer swap-free trading on Gold. However, if you primarily trade outside of market hours or consistently hold large positions overnight, you may lose swap-free eligibility.

Spreads are subject to change. Check your platform for the most up to date data.

Spreads are subject to change. Check your platform for the most up to date data.

In addition to gold, this broker offers trading for a wide range of assets which allows investors to diversify their portfolios. These include CFDs on forex, indices, various commodities, stocks, and cryptocurrencies. The available trading platforms are MetaTrader 4, MetaTrader 5, and Exness Trader. Regarding regulations, this broker is supervised by several authorities, including the FCA in the UK, the CySEC in Cyprus, the FSCA in South Africa, and the CMA in Kenya, among others.

Remember that forex and CFDs available at Exness are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

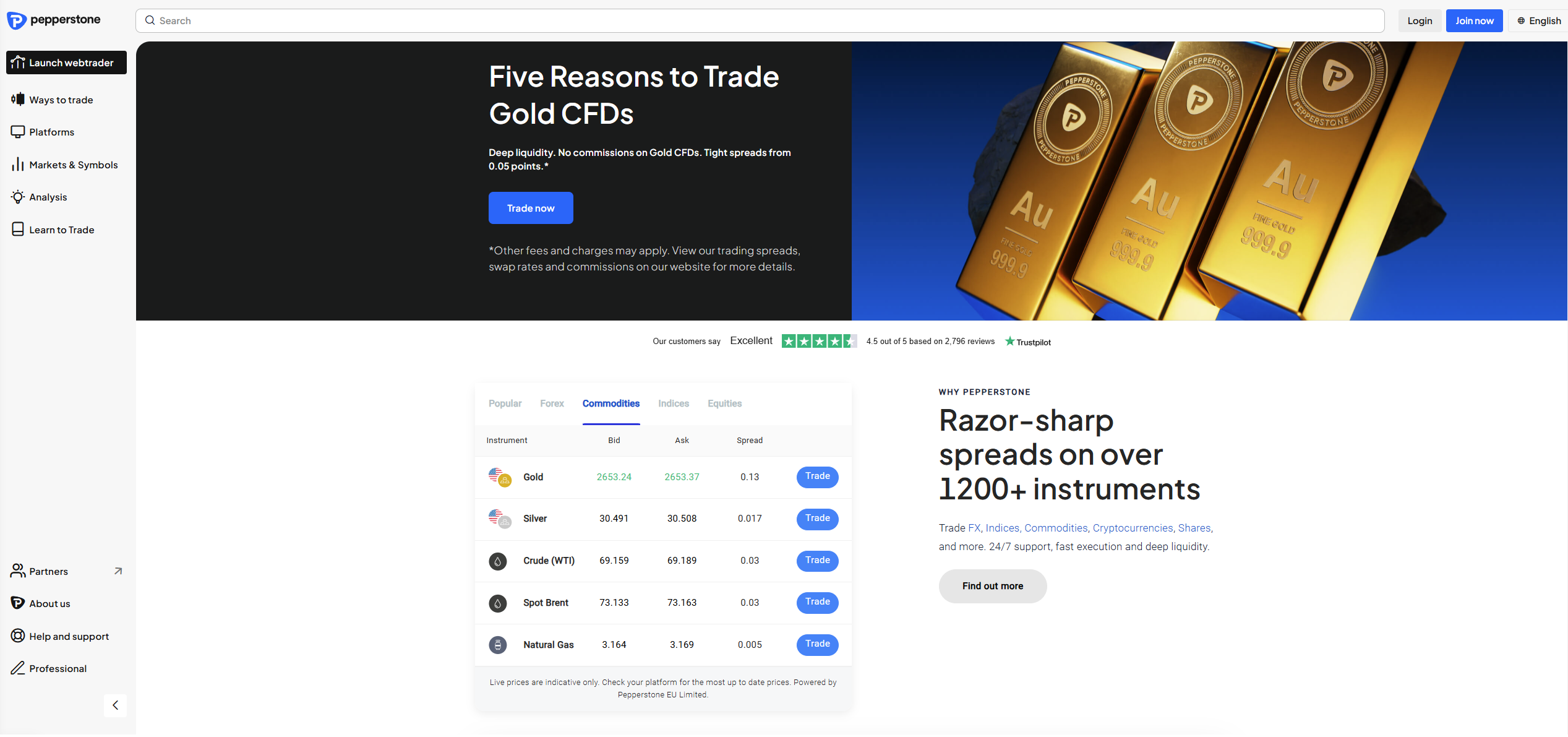

Pepperstone

Pepperstone also offers gold CFD trading with a very low entry point. This broker does not have a minimum deposit requirement, which means that traders can start investing in gold with whatever amount they want. The gold market on Pepperstone opens at 01:00 on Mondays and closes at 23:55 on Fridays GMT+2. The minimum lot size on this broker site is a low 0.01 lot.

Additionally, Pepperstone offers highly competitive spreads for trading gold (XAUUSD). The minimum spread for this asset is just $0.05, which is notably low. Additionally, the average spread for this pair remains low at $0.19. While the broker charges swaps on overnight positions, it provides a swap-free account for traders to traders from Islamic countries. Traders can access this pair, along with other assets, through five different trading platforms. These platforms include MetaTrader 4, MetaTrader 5, cTrader, TradingView, and the Pepperstone Trading Platform.

Spreads are subject to change. Check your platform for the most up to date data.

In addition to gold, investors can trade a wide range of assets, including other precious metals like silver, platinum, and palladium. Other trading options include CFDs on forex, indices, commodities, cryptocurrencies, and ETFs. The broker operates under the supervision of various regulatory bodies including the FCA in the UK, the ASIC in Australia, the CySEC in Cyprus, the CMA in Kenya, and the DFSA in the DIFC.

75.3% of retail CFD accounts lose money

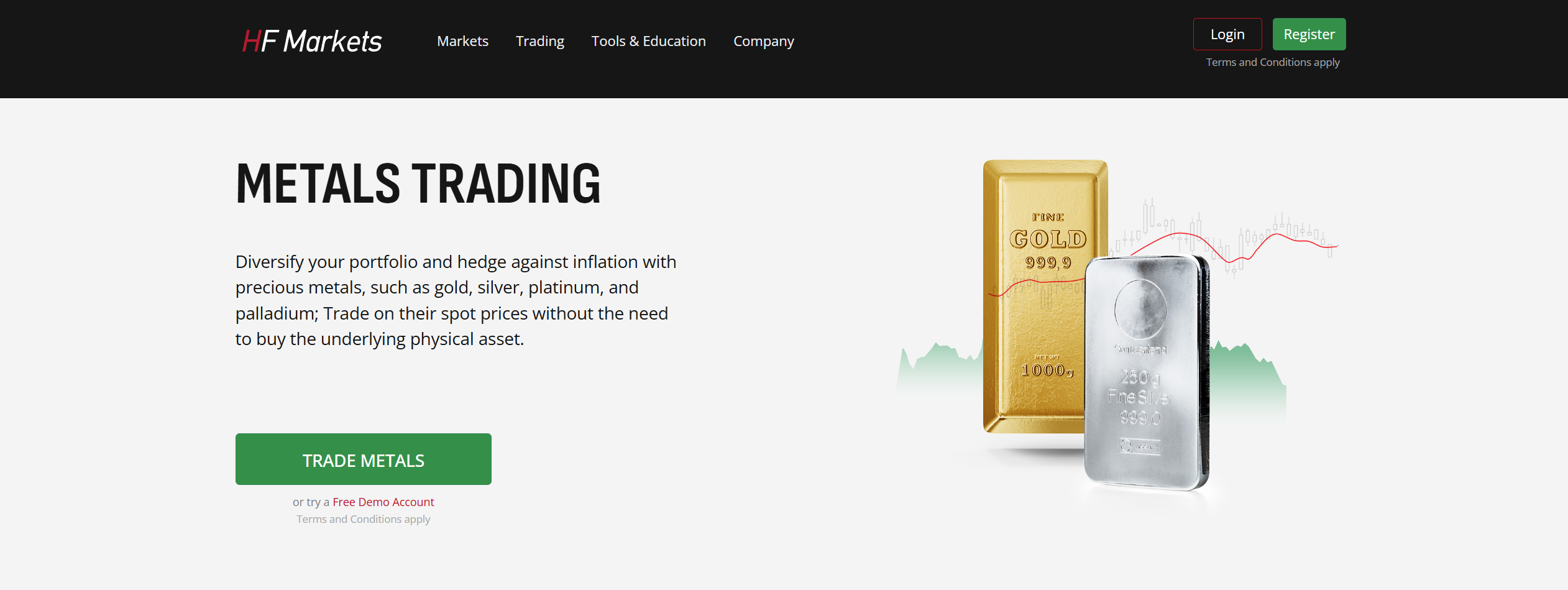

HFM

HFM (formerly HotForex) offers traders the opportunity to trade gold CFD against both the US dollar (XAUUSD) and the euro (XAUEUR). The trading hours for gold are from Mondays at 1:05:00 GMT+2 to Fridays at 23:57:59 GMT+2, with no daily breaks. The HFM broker site offers relatively low spreads on the XAUUSD pair across all account types.

Spreads on the premium and cent accounts are as low as 0,25. For the pro account, spreads start at just 0.16. In countries where the top-up bonus account is available, the account has a spread as low as 0.28 for gold. Lastly, the zero account provides the XAUUSD pair with spreads starting at a minimal 0.03 plus a low commision paid.

Please note that Spreads are subject to change. Check your platform for the most up to date data.

Please note that Spreads are subject to change. Check your platform for the most up to date data.

The minimum lot size on each of these accounts is a low 0.01 lots. There is no minimum deposit on all of its accounts except on the pro and the pro-plus accounts. Notably, this broker offers swap-free trading on gold to all its clients.

This broker provides a diverse trading environment, offering a wide range of assets. These include forex, metals, energies, indices, stock CFDs, commodities, bonds, ETFs, physical stocks, and cryptocurrencies. Traders can choose from MetaTrader 4, MetaTrader 5, and the HFM Platform for their trading activities. The broker operates under the supervision of various regulatory bodies, including the CySEC in Cyprus, the FCA in the UK, the CMA in Kenya, and the FSCA in South Africa.

68% of retail investor accounts lose money when trading CFDs with this provider.

FP Markets

FP Markets is a well-regarded broker that offers gold CFD for trading and is often regarded as the XAUU/USD lowest spread broker. The minimum lot size on this broker is 0.01 lots on both of its accounts. However, the minimum deposit on this broker site is slightly higher than the others discussed here at $100. On a good note, though, FP Markets provides competitive spreads for trading gold (XAUUSD). On its standard account, spreads for this asset begin at just 0.21 with no commission. Meanwhile, on its raw account, the broker provides spreads as low as 0.0 pips, with an average of 0.07 (commission fee applies)

Spreads are subject to change. Check your platform for the most up to date data.

Beyond gold, traders can explore other metals like silver, lead, palladium, zinc, and copper. These assets, like Gold, are available to trade as CFDs. Furthermore, the broker offers a range of other trading options, including forex currency pairs and CFDs on indices, stocks, commodities, and ETFs. The trading platforms available to use include MetaTrader 4, MetaTrader 5, TradingView, Iress, and cTrader. Lastly, the broker operates under the supervision of top-tier regulatory bodies like the ASIC, CySEC, and FSC.

72.44% of retail CFD accounts lose money

Closing Remarks

The minimum amount required to trade gold (XAU/USD) varies depending on a variety of factors. These include the broker's terms, leverage and margin requirements, account types, and individual trading strategies. While some brokers have no minimum deposit requirements, others may require a substantial initial investment. Leveraged trading can significantly reduce the minimum capital needed, but it also increases risk. It's crucial for traders to carefully consider these factors when choosing a reputable broker to trade with. It is also important to develop a sound trading plan, manage risk effectively, and stay informed about market trends.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.