Best Times of Day to Trade Gold for Maximum Returns

For whatever we invest in to become successful, timing plays a major role, and gold trading is no exception. The way you trade can automatically change overall just because you understand or know the best times to trade gold. This article helps shed more light on the factors that influence the timing of gold trading, several optimal trading sessions, and ways returns can be maximized in the lively gold market.

Factors that Influence the Best Time to Trade Gold

Some factors influence market volatility and liquidity, which you have to understand before jumping to conclusions on the best time to trade gold. They are:

-

Economic Crisis / Instability

Instability or economic crisis cannot be easily measured with fairness. Whenever a nation has an economic crisis, its currency depreciates. For example, from March to July 2020, due to the coronavirus pandemic, the price of gold in U.S. dollars increased by slightly 23%, from $1.586 to $1,948, which exceeded the all-time high price of $1,921 made by gold in 2011.

-

Currency Correlation

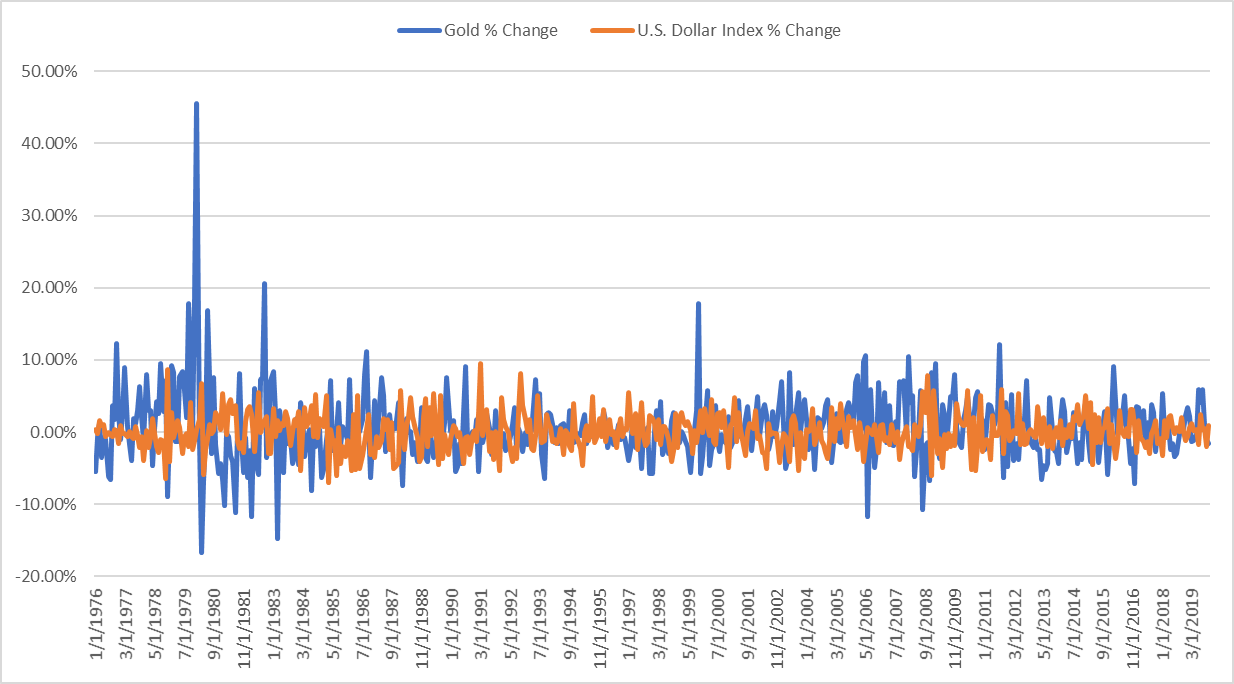

Because gold is priced in U.S. dollars, you would expect the price of gold in dollars to be strongly positively correlated with the U.S. dollar index, which calculates variations in the U.S. dollar value about a volume-weighted basket of foreign currency. Monthly price movements from 1976 to 2019 of the U.S. dollar index and gold prices have a little positive association, measuring about 25.23% when compared using the correlation coefficient. Because we're measuring the price of gold in U.S. dollars, this correlation is not ideally strong.

Gold / U.S. Dollar Index correlation chart

-

Negative Real Interest Rates

A currency’s real interest rate can be negative when it has a higher inflation rate than its interest rate. Gold can perform well in these circumstances because it is rare and not cheap. Unlike fiat currencies which can easily be inflated by their governing bodies. So this means that the price of gold in fiat currencies such as the US dollar tends to increase when the fiat currency is being artificially inflated. The depositors of this currency make a net loss over time because the currency is depreciating more than it is appreciating.

-

Market Sessions

Gold never sleeps. It can be traded five days a week round the clock thanks to overlapping markets in cities like Tokyo, London, and New York. Each hub comes through with its trade volumes and liquidity, which causes prices to dance differently depending on where and when you are looking.

-

Seasonal trends

The different seasons in a year matter too. Gold prices can fluctuate due to elections, festive activities, or economic hardship. For example, in nations like China and India, the demand for gold usually surges around the holiday season, driving up prices and stimulating trade.

Optimal Trading Sessions: Best Time to Trade Gold

Increased liquidity, volatility, and trading opportunities are offered in some specific trading sessions. Here are the optimal trading sessions for gold:

-

New York Sessions (US Market Open):

This session starts at 8 AM EST. It overlaps with the London session, which is a key period for gold trading. This session offers abundant liquidity and trading opportunities in the first few hours of the day when traders react to news events and economic data releases.

-

London Sessions (European Market Open):

This session overlaps with the Asian session, and it starts at 8 AM GMT. It is considered the most active and liquid period for gold trading. This session also overlaps with the early hours of the New York session. Intuitive traders could capitalize on the rapid action and significant price fluctuations during peak trading hours.

-

Overlapping Sessions (London/New York)

Things flare up nicely in London and New York overlaps, which happens from 8;00 AM to 12;00 PM. Best gold traders refer to this period as the “golden hours." You get to witness a ton of trades and crazy price movements because of the whales.

Best Strategies for Maximizing Returns

Here are some practical methods for boosting profits during these ideal trading sessions;

-

News Trading

This involves profiting from market turbulence and price surges brought about by central bank announcements, economic data releases, and geopolitical events. Traders should monitor the news closely so they can quickly place trades to capture short-term price movements.

-

Scalping

This is a short-term trading method. The goal of camping is to profit from minute changes in market price. During peak trading hours, traders can act quickly to capitalize on price swings and liquidity spikes to produce steady profits.

-

Trend Following

This involves finding established trends and trading in their direction. Smart traders can use advanced charts and indicators like moving averages and trend lines to identify promising trades. Strong trends are been searched for a good risk-reward ratio during active trading sessions.

Conclusion

Gold trading could turn out to be a very good way to grow your money, but timing is everything. Gaining insight into the variables affecting gold prices and identifying the best trading times can greatly increase your chances of success. Focusing on the New York and London sessions, particularly their overlap, puts you right where the action is.

However, timing, strategy, and continuing education are ultimately needed for effective gold trading. Since the market is constantly changing, be adaptable and never stop honing your strategy. With patience and practice, you can learn to ride this dynamic market's golden waves to maximize your returns.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.