Best Forex Brokers with Micro Accounts

Trading financial markets can be a daunting endeavour. Most brokers primarily offer trading in standard lots, which can involve significant capital and risk. Fortunately, some forex brokers provide micro accounts that support trading in micro lots. These accounts give traders the opportunity to access real market conditions without committing large sums of money, making them ideal for testing new strategies or evaluating a broker’s performance in a live environment.

In this review, we will be looking at the best forex brokers offering micro-accounts. We will also look at the trading conditions provided by the brokers including the fees, regulations, and available assets. But first, let’s look at what micro accounts have to offer.

What is a Micro Account or Trading in Micro Lots?

In trading, a standard lot represents 100,000 units of a currency. In contrast, a micro-lot represents 1,000 units of a currency. This is 1,000 times smaller than a standard lot, which allows clients to trade without investing a lot of money. Brokers that support micro-lot trading typically do so in one of two ways: either by offering special accounts designed for small-scale trading, such as cent accounts, or by allowing micro-lot positions within their standard account types. In the latter case, trading fees and conditions are usually the same as when trading standard lots.

Factors to Consider When Choosing a Forex Broker with Micro Accounts

When looking for a Forex broker that offers micro accounts, it's important to evaluate several key factors to ensure the best trading experience—especially if you're a beginner or trading with a smaller budget:

- Regulation and Trustworthiness – Always check whether the broker is regulated by a reputable authority. Regulation helps ensure a higher level of client protection and accountability. Brokers overseen by top-tier regulators like the FCA (UK), ASIC (Australia), CySEC (Cyprus), FSCA (South Africa), or CIRO (Canada) are generally more trustworthy.

- Account Types and Lot Sizes – Not all brokers structure their micro accounts the same way. Some offer dedicated micro or cent accounts, while others allow micro-lot trading through their standard accounts. Make sure the broker truly supports trading in micro lots and that the minimum trade size aligns with your needs.

- Fees and Trading Costs – Compare the broker’s spreads, commissions, and any non-trading fees like deposit or withdrawal charges. Some brokers offer micro-lot trading on standard accounts but maintain the same fee structure as they do for larger lot sizes.

- Trading Platform and Tools – A user-friendly and reliable trading platform is essential—especially when managing smaller trades or testing new strategies. Look for brokers that offer popular and well-supported platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), TradingView, or cTrader. These platforms provide essential features like fast order execution, a wide range of technical indicators, customizable charting tools, and mobile access for trading on the go.

- Range of Tradable Instruments – Even if you're trading in micro lots, having access to a wide range of currency pairs and other instruments can help you diversify and explore different market opportunities.

With those key points in mind, let’s now explore some of the best brokers offering micro accounts.

Exness

Clients can start trading on Exness with a small deposit of $10. This is a favorably low capital requirement for most traders. Exness has two main standard trading accounts, the Standard account and the Standard Cent account. Both of these accounts allow clients to trade with a minimum lot size of 0.01 lots (so in micro lots). It's perfectly suited for traders who want to gain real market experience while investing small amounts. It's also ideal for those looking to test new trading strategies without putting a large amount of capital at risk.

These micro accounts on Exness are very attractive. However, this is not the only attractive feature of Exness. This broker has some of the best trading platforms in the market. These include the Exness Trader, MetaTrader 4 and MetaTrader 5. Additionally, Exness has a wide variety of trading instruments available for trading. Clients can trade CFDs on popular assets across major markets, including forex, metals, cryptocurrencies, energies, stocks, and indices.

Further, Exness is a regulated forex and CFDs broker. This company has regulatory licenses from the FCA, the CySEC, the FSA, the FSCA, and the FSC. Having multiple regulatory licenses is a great sign for a broker. It shows that a company is willing to play by the rule of law.

Remember that forex and CFDs available at Exness are leveraged products and can result in the loss of your entire capital. Please ensure you fully understand the risks involved.

Pepperstone

Pepperstone is a well-regulated broker, authorized by top financial authorities like BaFin in Germany, the FCA in the UK, CySEC in Cyprus, and the DFSA in the UAE, ensuring high standards of trust and security. The broker accommodates a wide range of traders by offering the flexibility to trade in standard, mini, and micro lots. In addition, Pepperstone provides access to four of the industry's most popular retail trading platforms—MT4, MT5, TradingView, and cTrader.

Traders can explore an extensive selection of over 1,350 CFD markets, including forex, stocks, indices, commodities, cryptos, and ETFs.

The company offers two types of trading accounts, both suitable for micro lot trading. The first is the Standard account, which comes with no commission and low spreads starting from 1.0 pips on major currency pairs. The second option is the Razor account, which offers raw spreads starting from 0.0 pips and a low commission fee.

Additionally, the broker supports base account currencies in USD, EUR, CHF, GBP, and several other options.

75.3% of retail CFD accounts lose money

FP Markets

FP Markets is a popular broker with regulations from the CySEC in Cyprus and the ASIC in Australia. This makes FP Markets one of the best forex and CFDs brokers in the world. With over 10,000 tradable instruments, FP Markets has one of the largest collections of tradable assets. Clients can trade CFDs on shares, metals, commodities, indices, cryptocurrencies, bonds, and ETFs.

For traders looking to invest small amounts at a time, FP Markets has the perfect accounts for that. There are two main trading accounts on FP Markets. Both of these accounts allow trading in micro lots, as the minimum lot size is 0.01 lots. These are some of the best micro accounts in the market.

They are ECN accounts which come with the advantage of more control in the market. FP Markets also provides clients with some of the best trading platforms in the market. Clients can trade using the WebTrader, MetaTrader 4, or MetaTrader 5 platforms. These platforms are top-tier as they come with many charting tools to help clients make decisions when trading.

72.44% of retail CFD accounts lose money

XM

XM is another broker that supports trading in micro lots and has a very competitive offer for traders. This broker has two accounts that allow clients to trade a minimum trade size of 0.01 lots. These include the Standard account and the XM Ultra Low account. The minimum deposit for both these accounts is $5. Traders do not pay any commissions when trading on either of these accounts. However, spreads apply and differ for these two accounts. They start from 1.6 pips for the major currency pairs on the Standard account and from 0.8 pips on the XM Ultra Low account.

Traders can invest in a variety of markets on XM. They can trade over 1,000 trading CFD instruments from 8 different markets. These include forex, stocks, indices, shares, cryptocurrencies, commodities, precious metals, and energies. Investors can diversify their portfolios by investing in multiple markets at the same time. Further, XM provides clients with two of the most popular trading platforms in the industry, the MetaTrader 4 and MetaTrader 5 platforms. These are available on PC, MacOS, Android, iOS, and Tablets. All types of traders are accommodated here.

Finally, we look at the regulatory status of XM. Luckily, this company has regulations from the CySEC, the ASIC, and the FSC. The CySEC and the ASIC are two of the top financial regulators in the world. While regulations on their own are not enough, it is a good sign to have authorization from these two watchdogs.

75.18% of retail investor accounts lose money when trading CFDs with this provider.

Forex.com

Forex.com is a globally recognized forex broker under close regulation by some of the best regulators in the market. The company is regulated by the CFTC and the NFA in the USA, the FCA in the UK, the IIROC in Canada, the CySEC in Cyprus, and the ASIC in Australia. All these regulators are top-tier financial watchdogs. This makes Forex.com one of the best brokers in the market today.

Forex.com allows clients to trade micro and standards lots on currency trading. Traders can trade a minimum trade volume of 0.01 lots on this platform. As mentioned, this allows clients to practice trading without risking a large amount of their investment. This type of account is also perfect for traders who don’t have a large capital to invest.

Clients outside the us can trade CFDs on Forex, commodities, indices and cryptocurrencies and US traders can invest in three main markets which include the forex, futures and futures options markets. As such, Forex.com is one of the best micro forex account brokers in the market. After all, it gives clients access to three of the industry-standard trading platforms. These include the MT5, TradingView and MetaTrader 4.

76-77% of retail investor accounts lose money when trading CFDs with this provider.

XTB

XTB offers investment opportunities for both small and large volumes, with a minimum transaction size of just 0.01 lot, making it accessible to traders who prefer to trade in micro lots. The company is regulated in multiple countries, including the UK by the FCA, Cyprus by CySEC, Poland by the KNF, and Belize by the FSC. The company proudly boasts a global client base of over 1 million, reflecting its widespread appeal and trust among traders across various markets and regions.

XTB offers an extensive range of market assets on its website, allowing clients to trade CFDs on 48 currency pairs, indices, commodities, stocks, cryptos, and ETFs. Additionally, clients can buy and sell real stocks and ETFs. These assets are accessible through XTB's proprietary trading platform, xStation, known for its powerful features and fast execution times.

75-78% of retail investor accounts lose money when trading CFDs with this provider.

OANDA

OANDA has been offering brokerage services for over 35 years now. The company has impressive regulation from some of the top regulators in the world. OANDA has regulatory licenses from the NFA and CFTS in the US, the FCA in the UK, the ASIC in Australia, and the IIROC in Canada. We always insist that regulations alone are not enough. However, this company’s longevity and clean reputation give it good standing among traders.

Luckily, OANDA allows clients to trade in several financial markets. This allows interested clients to easily diversify their portfolios. Clients can trade over 71 currency pairs, 11 different commodities, and 7 different indices. They can trade these instruments on some of the best trading platforms in the world. These include the fxTrade App, MetaTrader 4, and MetaTrader 5. This is a great selection of trading platforms.

Even better, OANDA allows clients to trade on micro forex accounts. There are five main accounts on OANDA, three of which allow clients to trade lots as small as 0.01 lots. These include the Standard account, the Core account, and the Swap-free account. It is important to note that the Core account charges a commission of $40 per million traded.

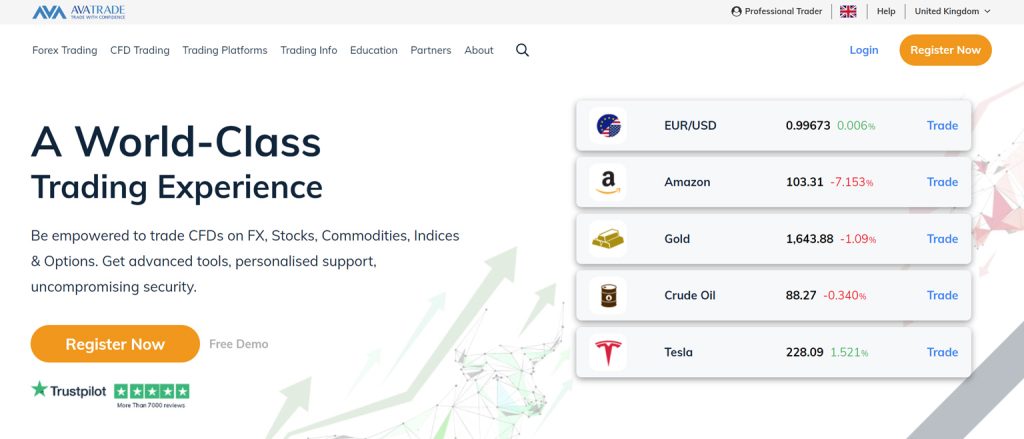

AvaTrade

AvaTrade is also among the best micro forex account brokers in the market today. The company allows clients to trade in micro lots, as the minimum lot size is as small as 0.01 lots. This ensures the company accommodates traders looking to trade small amounts at a time. This feature is available to the broker's more than 300,000 clients.

AvaTrade is regulated by the Central Bank of Ireland, the BVIFSC, the ASIC, the FSCA, and the CySEC, among others. Regulations alone are not enough. Still, you should only trade financial markets using regulated brokers. They are much safer than brokers without regulations.

Further, AvaTrade offers a great lineup of financial markets available to its clients. They have access to CFDs on forex, cryptocurrencies, commodities, stocks, indices, bonds, ETFs, and Vanilla FX Options. This is a great collection of trading instruments for clients who want to invest in multiple markets at the same time. It is also perfect for clients who want to invest in a single market at a time.

Clients also have access to the MetaTrader 4 and MetaTrader 5 platforms on AvaTrade. That is on top of AvaTradeGo. These are great trading platforms for both seasoned and beginner traders. As an added advantage, AvaTrade offers some of the lowest spreads in the market starting from as low as 0.9 pips for some major currency pairs.

FXTM

Closing out our list of micro forex account brokers is FXTM. FXTM has three main trading accounts: the Micro account, the Advantage account, and the Advantage Plus account.All of these accounts feature a minimum trade volume of 0.01 lots. The micro account only allows clients to trade forex, metals, commodities, FX indices, and stock baskets. However, the other accounts allow clients to trade all available markets including stocks and stock CFDs.

The trading software available to clients on FXTM include the MT4, MT5, and the FXTM Trader which are available on PC, MacOS, Tablets, and Mobile. This ensures that FXTM caters for all types of traders on all kinds of devices. Additionally, FXTM also accommodates traders looking to trade on ECN accounts. Today, it is one of the best ECN forex brokers in the industry. In terms of regulations, this company does not disappoint. It has regulations from two of the best regulatory organizations in the world, the FCA in the Uk and the CySEC in Cyprus. This regulatory status gives FXTM a good reputation among traders.

Final Words on Micro Forex Account Brokers

Micro forex accounts are crucial for traders who do not have large capitals to invest in the market. These accounts are also perfect for traders looking to practice new trading strategies using small amounts of money. These are the main advantages of micro forex accounts. On the other hand, the main disadvantage is low profits on micro forex accounts.

In this review, we listed nine of the best micro forex account brokers in the market today. Additionally, we looked at the trading conditions offered by these brokers including the trading instruments available and the platforms available. Finally, we looked at the regulatory status of the brokers. The brokers listed above met our criteria for the best micro forex account brokers in the market. Still, we encourage you to do your own research as this is not an exhaustive list. Whether a broker is on this list or not, do your due diligence before you invest.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.