Best Forex Brokers with 1:500 leverage

| This material is not intended for viewers from the UK and European Economic Area countries. The maximum leverage in the UK and EEA countries is 1:30. |

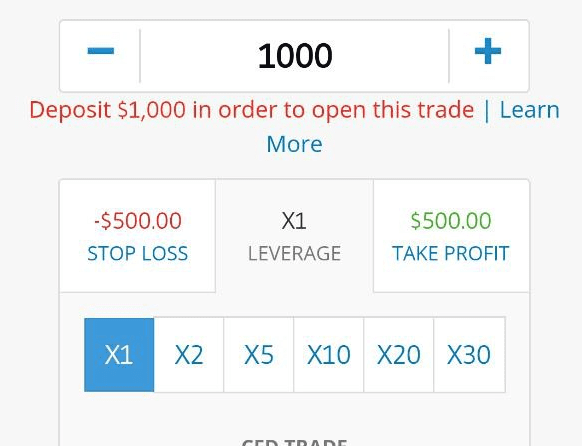

Leverage is widespread in forex trading and is one of the most important aspects of forex trading. It allows traders to open a position with a much larger stake in the market than they would using their own account balance. Therefore, trading on leverage is like using borrowed funds to magnify a trader's trading position. To access leverages a trader will only need to have the initial margin to open a position and they will be able to gain exposure to a larger position depending on the leverage a broker offers.

Today, we will look at some of the best forex brokers with 1:500 leverage. We will look at their features to examine what makes them stand out among the rest.

How Does Leverage Work?

Leverage is the use of borrowed funds to stake a larger position when trading. It allows a trader to maximize profit but it also amplifies the possible losses. So how it works is simple, a trader must first open a position by depositing the initial margin requirement and they will be able to access leverage. The leverage available depends on the broker and the jurisdiction. We must insist that leverage is a double-edged sword. This means that it can lead to considerable profit or losses. We advise traders to employ risk management techniques to avoid losses.

Pros and Cons Of Using Leverage

Advantages

Increased profit potential - Leverage boosts capital that a trader can place on a given position. The capital increase enables a trader to strengthen their trading position and hopefully increase profit.

Interest-free loan - Even though a trader can access funds to increase their capital no interest is charged on the funds. The funds do not come with any obligation of interest or commission.

Mitigating against low volatility - Financial markets are very volatile meaning that prices change constantly. Leverage helps traders maximize profits during low volatility when the price fluctuations are low.

Trading premium markets - Some assets in the market are considered expensive to purchase or acquire and leverage helps make it easier for a trader. The leverage enables a trader to purchase the so-called premium assets.

Disadvantages

Amplifies losses - Just as it amplifies profit, leverage can also lead to considerable losses. That's why a trader needs to develop a risk management plan before using leverage.

Margin Call - A margin call occurs when a trader does not have enough money to maintain or open a leveraged position. When it happens, the broker may forcibly close some open positions.

That being said, let’s now see some of the best brokers that offer a leverage of 1:500.

FP Markets

FP Markets is one of the most reputable brokers that offer a leverage of 1:500 to its traders. When a trader has enough to cover the margin, they can then access the leverage. The broker features a variety of trading instruments for a trader to choose from. They range from forex currency pairs to CFDs on shares, commodities, indices, cryptocurrencies, bonds, and ETFs. Traders can diversify their trading portfolio while using leverage as they desire.

Notably, the broker is regulated by well-known organizations including CySEC in Cyprus and ASIC in Australia. The broker has other regulations from FSCA in South Africa and FSA in Seychelles. However, note that this leverage level is not available to traders from all jurisdictions. Due to regulatory limits, traders within the European Economic Area can only access leverage of up to 1:30.

Nonetheless, the broker offers two main trading accounts for traders to choose from. They include the standard account and the raw account. The standard account features spreads as low as 1.0 pips for major currency pairs with zero commission. In contrast, the raw account has spreads that start from 0.0 pips with a small commission of $3 per side per lot. FP Markets also features world-class trading platforms for a trader to choose from. They include MT4, MT5, cTrader, and Iress.

72.44% of retail CFD accounts lose money

XTB

XTB is yet another broker that offers leverage of up to 1:500 to its traders. The broker was founded in 2002 and it has over 20 years of experience. It’s no surprise why the broker is highly rated. Furthermore, the broker has regulations from reputable organizations including the CySEC in Cyprus, the FCA in the UK, KNF in Poland, and the FSC. Such regulations make XTB one of the best brokers that offer a leverage of 1:500.

In terms of trading instruments, XTB traders are spoilt for choice. They can invest in a variety of global markets that include forex, indices, commodities, stocks, cryptocurrencies, and ETFs. In total, there are over 2,200 trading instruments for traders to diversify their trading portfolios.

XTB features two account types which include the standard and the swap-free account. The standard and the swap-free both feature spread from as low as 0.5 pips and 0.7 pips respectively. The swap-free account is the Islamic account version of the standard account without charging rollover fees. XTB does not charge commissions on the two accounts.

Lastly, XTB offers its own in-house trading platforms xStation 5 and xStation mobile. The two platforms are customisable and offer quick execution speeds. Further, the platforms have simple and intuitive designs with professional analytical tools to help traders make decisions quickly.

75-78% of retail investor accounts lose money when trading CFDs with this provider.

Fusion Markets

Fusion Markets offers a variety of markets. The markets accessible via this broker site site include forex, indices, precious metals, commodities, energy, and shares. Notably, the broker offers a maximum leverage of 1:500 on forex and metals. This allows traders to take up larger positions in the market depending on their risk appetite.

The trading platform available for trading the assets includes MetaTrader 4 which is one of the popular platforms worldwide, MetaTrader 5, and cTrader. These are three of the best trading platforms with advanced functionality. Furthermore, the broker offers competitively low spreads to its traders.

Fusion Markets provides two trading accounts that have the same access to products with slightly different spreads. The two accounts offered include the zero account and the classic account. The zero account features spreads from as low as 0.0 pips with a commission of AUD 4.50. In contrast, the classic account spreads are from 0.9 pips for major currency pairs with no commission.

Regulations help in elevating a broker to a higher status in comparison to an unregulated one. Even though regulations are not enough to make a broker valuable, it is a good start. Luckily, Fusion Markets has several regulations including ASIC in Australia. Additionally, it has regulations by the VFSC and the FSA.

AXi

Axi also offers traders a leverage of 1:500. The broker has licenses and regulations from top-tier regulators in the market. They include the ASIC in Australia and the FCA in the UK. Having regulations from such organizations is pleasing to traders.

Further, the broker offers industry-standard trading platforms that are simple to use for both advanced and new traders. MT4 offered by the broker features advanced tools and analytics. It also includes tools that traders can use to backtest their strategies. The other platforms include MT4 WebTrader and Axi Trading Platform. The platforms give clients access to various market products including CFDs on forex, gold and silver, oil, commodities, indices, and cryptocurrencies.

The variety of trading instruments is indeed impressive. Luckily, the broker also offers industry-standard spreads to its clients. There are three accounts that the broker offers: the standard, the pro account, and the elite account. The pro and elite account spreads start from as low as 0.0 pips with a commission of $7 per round trip and $3.50 per round trip respectively. On the other hand, the standard account has spreads starting from 0.9 pips with no commission.

FXTM

FXTM is the last broker we will cover that offers leverage of 1:500 to its traders. This leverage level is specifically for the metals category of assets. The maximum leverage on the broker site sits at 1:2000. Notably, there are many assets available for trading including forex, indices, shares, stocks, crypto, and commodities. The diversity of the trading instruments is an attractive feature to traders who want to spread their risk across various markets.

Even better, FXTM has great diversity when it comes to the trading platforms available to traders. The broker offers MT4, MT5, and FXTM Trader. These platforms are available on three different accounts including the micro, the advantage, and the advantage plus accounts. The Micro account and the Advantage Plus account both feature spreads starting from 1.5 pips upwards. On the other hand, the Advantage account features average commissions of about $0.4 to $2 based on the volume.

Lastly, the broker is regulated by several well-known regulators in the market. These include CySEC in Cyprus and the FCA in the UK. The broker is also under the regulation of the CMA in Kenya.

Closing Remarks

Various brokers in the market offer a leverage of 1:500 to their traders. The brokers listed on this list offer competitively low spreads, a variety of trading instruments, and world-class trading platforms on top of being regulated by some of the best regulators in the market. We also looked at the advantages and disadvantages of using leverage when trading. We highlighted that leverage is a double-edged sword that should be used in moderation. Again we must insist that a trader should develop a risk management plan to avoid extreme losses.

Nonetheless, this list of brokers that offer a leverage of 1:500 is not exhaustive. Other brokers did not make the cut for our list but they may be preferable to some traders. We advise traders to do a lot of research considering their individual needs to find a broker that best suits their needs.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.