Best Low Leverage Forex Brokers

Leverage is one of the key features of forex trading. It allows traders to control larger positions than they would if they funded these positions using only their funds. This can increase the profits that traders see in the market. However, leverage can be a double-edged sword. Overleveraging can lead to a trader losing their account from trading on borrowed cash.

In this review, we are going to look at some of the best low-leverage forex brokers in the market. Note that leverage can differ from economic zone to economic zone. We are going to mention just a few here.

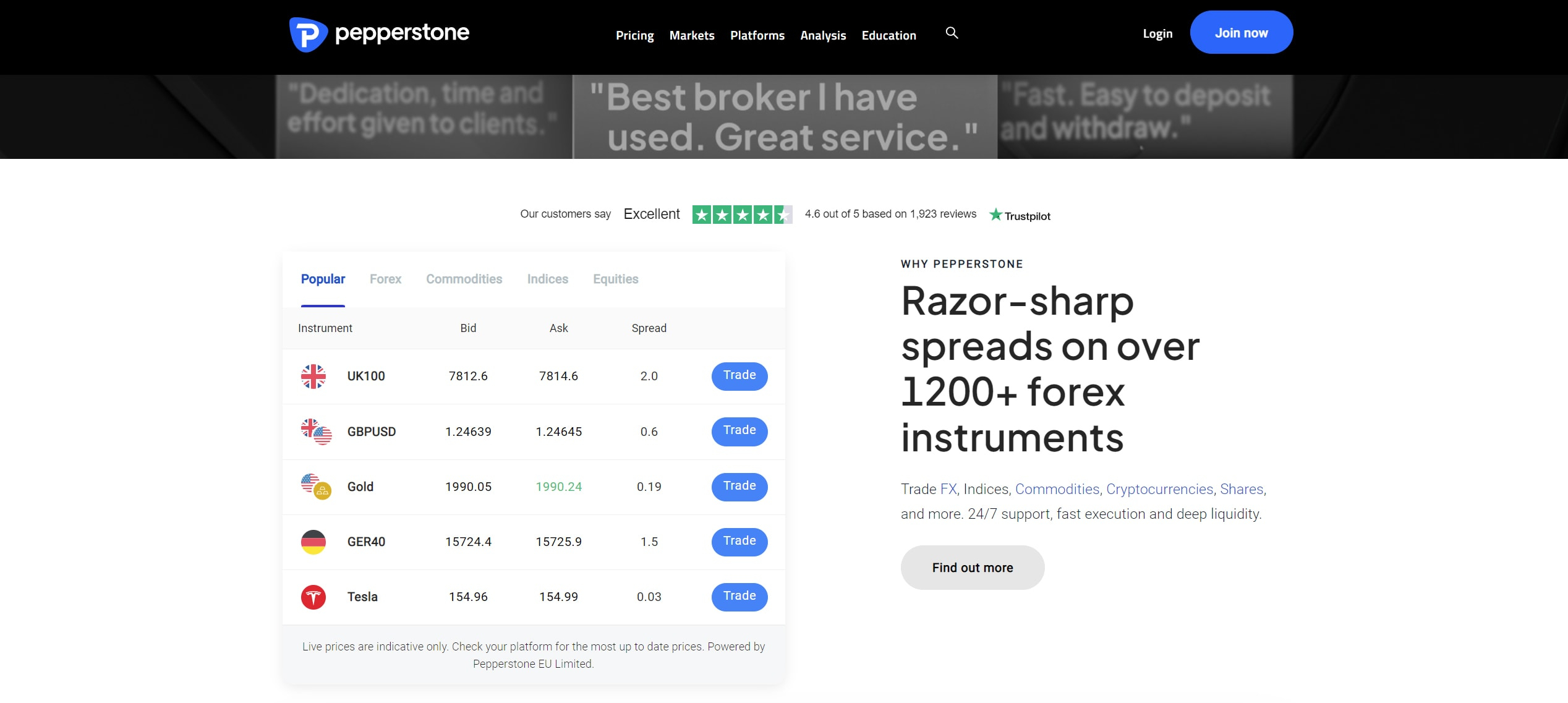

Pepperstone

Pepperstone is licensed and regulated by several organizations including the FCA in the UK, the CySEC in Cyprus, and the ASIC in Australia. All these regulators cap leverage at 1:30 in Europe and Australia. As mentioned, this is mainly to protect investors from overleveraging. Clients are loaded with trading instruments from different asset groups. There are over 1,200 instruments available across the forex, shares, indices, ETFs, cryptocurrencies, and commodities markets. This is a great collection of assets to diversify one’s portfolio. Most importantly, these assets are available to trade on some of the best trading platforms in the world, including MetaTrader 4, MetaTrader 5, TradingView and cTrader.

Moreover, the spreads on this broker site are competitive and are better than the industry standards. The spreads on the standard account for major currency pairs range from 0 pips to 1.59 pips. There is also a razor account on which are raw spreads that start from 0.0 pips, but they come with a small commission fee.

75.3% of retail CFD accounts lose money

FP Markets

FP Markets is another broker that keeps leverage levels at fairly manageable sizes. In Europe, this company is regulated by the CySEC which requires companies to cap their leverages at 1:30. Consequently, the leverage available to retail clients is between 1:1 to 1:30. With this tier-one broker, you can trade forex currencies and CFDs in shares, metals, commodities, indices, cryptocurrencies, bonds, and ETFs. Forex traders have over 60 currency pairs available for trading while crypto traders have 11 different crypto assets clients can trade against the US Dollar. In total, there are over 10,000 trading instruments available.

The trading platforms availed by this broker include MetaTrader 4, MetaTrader 5, TradingView and WebTrader. These are great trading platforms for traders to have. Evidently, FP Markets is committed to providing some of the best trading conditions in the market. Moreover, FP Markets charges favourably low spreads starting from as low as 1.0 pips on the standard account.

72.44% of retail CFD accounts lose money

Forex.com

Forex.com is one of the best forex brokers in Europe and the world. The maximum leverage when trading with this broker in Europe is 1:30. On the other hand, the leverage level rises up to 1:50 for clients in the US. These are two economic zones with strict regulatory laws on leverage levels. With Forex.com, clients can choose between three main trading accounts available. These accounts come with different spreads and commissions. These include the standard account, the commission account, and the DMA account. The standard account does not require clients to pay a commission when trading. The spreads on this account are competitively low, starting at 1 pip for major currency pairs.

On the other hand, the raw spread and DMA accounts require clients to pay a commission when trading. However, the spreads on these accounts are very low, starting at 0.0 pips. This company has a great regulatory status. It is regulated by the CFTC and NFA in the USA, the FCA in the UK, the IIROC in Canada, the CySEC in Cyprus, and the ASIC in Australia, among others.

76-77% of retail investor accounts lose money when trading CFDs with this provider.

XTB

XTB also offers clients variable leverage from 1:1 up to 1:30. The maximum leverage is lower when trading instruments from certain asset classes. For example, trading indices on this broker come with a maximum leverage of 1:30, while it is 1:10 when trading commodities. On this broker site, clients can trade forex, stocks, CFDs on indices, commodities, stocks, cryptos and ETFs. Such a variety of trading instruments allows clients to diversify their portfolios by investing in different asset groups without leaving the platform.

Currently, XTB provides clients with their own in-house-built trading platform, xStation 5. The platform has an intuitive user interface and fast execution times. This platform is also available on mobile as xStation Mobile. Further, the spreads on this broker site depend on the trading account one is using. On the standard account, the spreads start from 0.9 pips on major currency pairs.

75-78% of retail investor accounts lose money when trading CFDs with this provider.

eToro

eToro is subject to regulations by a couple of regulators within Europe and Australia, and hence curbs leverage in this economic zone at 1:30. This is for major currency pairs. For minor currency pair trading with this broker, the maximum leverage is 1:20 for clients within the EU and Australia. Crypto assets have the lowest leverage on this broker site at 1:2 (Crypto CFDs are not available to the UK and US traders)

With this broker, clients can trade CFDs on forex, stocks, commodities, ETFs, and indices or purchase real stocks and cryptocurrencies. While MetaTrader platforms are not available, the eToro trading platform is available on this broker site. It has a plethora of features including CopyTrader which allows clients to copy the moves of more successful traders in the market. Typical spreads on eToro can start from 1 pip for major currency pairs like the EURUSD pair. There are no commissions involved in trading stocks on eToro. However, CFD positions that stay open overnight incur a small fee relative to the value of the position. The company is regulated by the FCA in the UK, the CySEC in Cyprus, the ASIC in Australia, and FINRA in the USA.

61% of retail investor accounts lose money when trading CFDs with this provider.

Tickmill

TickMill launched its online brokerage services in 2014 and features multiple markets on its platform. Investors can buy and sell CFDs on forex, stock indices and energy, bonds, precious metals, cryptocurrencies, and stocks. These instruments are available on trading platforms that include MetaTrader 4 and MetaTrader 5. Regarding trading accounts, there are three main accounts to choose from. These include the Classic account, the Raw account, and the Tickmill Trader Raw account. All these accounts feature a maximum financial leverage of 1:30 in the EU and Australia.

Further, these accounts feature manageable and industry-standard spreads. The standard account does not come with any commission fees, the company is mainly compensated via spreads which can go as low as 1.6 pips for major currency pairs. On the other accounts, the spreads are raw and start from 0.0 pips with a commission charged. Finally, we look at the regulatory status of Tickmill. This broker has regulations and authorization from the FCA in the UK, the CySEC in Cyprus, the FSCA in South Africa, and the FSA in Seychelles. Multiple regulations are always a good sign from a forex broker.

71-74% of retail investor accounts lose money when trading CFDs with this provider.

AvaTrade

In the EU, AvaTrade is regulated by the CySEC and the Central Bank of Ireland. For clients in this economic zone, the leverage is capped at 1:30 in accordance with regulatory laws. Any leverage that is below this is available for clients of AvaTrade in the EU. With this broker, clients can trade CFDs on forex, stocks, indices, commodities, cryptocurrency, bonds, and ETFs. The broker charges variable spreads that are fairly low and industry-standard. When trading forex the spreads can go as low as 0.9 pips for major currency pairs.

AvaTrade provides four main trading platforms. These include MetaTrader 4, MetaTrader 5, WebTrader, and AvaTradeGo. These platforms are available across a variety of devices. This gives clients the flexibility to pick and choose whatever device they want to trade on. Moreover, AvaTrade supports the use of expert advisors, giving clients more flexibility.

76% of retail CFD accounts lose money

Libertex

Libertex clients within the EU can only trade with a maximum leverage of 1:30 in line with regulatory laws. Some of the assets available for trading with Libertex include CFDs on forex, stocks, metals, oil and gas, ETFs, and cryptocurrencies. Libertex offers three great trading platforms: Libertex Trader, MT4, and MT5. It also promises some of the lowest spreads in the industry. The spreads on this website can go as low as 1.0 pips for major currency pairs. However, they can go even lower, starting from 0.0 pips for professional clients (other fees like commissions may apply). These are also the people with access to trading without leverage.

This company is regulated by CySEC, one of the best regulators in Europe and the world. This company also has over 20 years in the market, having launched in 1997. This helps in building the credibility of the company in the eyes of traders. Clients can try out this company’s services on its non-expiring MT4 demo account before choosing to invest.

FXCM

FXCM is a forex and CFDs broker with over 20 years in the market. This company operates primarily from South Africa and is authorized and regulated by the FSCA. The company is also under the regulation of the CySEC, the FCA, and the ASIC. In Europe and Australia, financial regulators curb leverage at a maximum of 1:30.

Some of the trading instruments on this broker site include forex and CFDs on indices, shares, and commodities. Such a great collection of trading instruments is attractive to many traders, both new and old. Moreover, this broker provides a great lineup of trading platforms including Trading Station and MetaTrader 4. Better yet, the spreads on this platform are competitive on currency pairs and CFDs. These spreads can go as low as 1.0 pips for major currency pairs.

CMC Markets

CMC Markets is one of the best forex and CFDs brokers in the UK. This broker site allows investors to trade CFDs on forex, indices, cryptocurrencies, commodities, shares, share baskets, and treasuries. In total, there are over 300 currency pairs available on this broker site. In terms of regulations, CMC Markets is operating legally under the supervision of reputable regulators. The company is licensed and regulated by the FCA in the UK and BaFin in Germany. Consequently, in Europe, the broker offers a maximum leverage of 1:30 in line with regulations.

Now let’s look at the fees this broker charges its clients. CMC Markets charges variable spreads to clients when trading. For example, the spreads on the EUR/USD and the USD/JPY can go as low as 0.7 pips. This is very attractive to all kinds of traders. While the spreads are variable, it is good to know they can drop this low. The platform available to clients is MetaTrader 4 which is suitable for both novice and experienced brokers.

Conclusion of Our Best Low-Leverage Forex Brokers Review

Leverage is a very useful tool when trading financial markets. It allows traders to control large positions using a fraction of the investment required. While this is good, it can be a double-edged sword. In essence, using leverage is equivalent to trading on borrowed cash. Overleveraging can lead to a trader losing their account. Hence, there is a need to manage the leverage a trader uses.

This is the reason why many regulators in the EU, the US, and Australia have laws curbing leverage at fairly low levels. Either way, there is a need for forex brokers that offer low and manageable leverage levels to their clients. In this review, we mentioned a few of the best low-leverage forex brokers in the market. We hope that this is a good place to start your research as you pick and choose the broker that best suits your investment needs.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.