Best Forex Brokers Accepting USDT

One of the reasons why a trader might choose a broker to trade with is the convenience provided by the broker. As brokers handle people’s money, convenience in deposit and withdrawal is a top priority. Today, hundreds of thousands of people prefer cryptocurrency payments due to their convenience. More specifically, the stablecoin Tether (USDT) is a top priority for people who prefer crypto payments.

In this research article, we are going to be looking at some of the best brokers accepting USDT for deposits and withdrawals. To determine the quality of their services, we are going to focus on four key areas. These include the company’s regulatory status, the market instruments available for investors to trade, the spreads offered, and the trading platform availed by the broker.

What is Tether/USDT?

Tether is a digital currency that was launched in 2014 in an attempt to facilitate fiat currency usage on the blockchain. Notably, every Tether coin’s value is pegged to the dollar in a 1:1 ratio. This means that every single coin is as valuable as the dollar. This introduces traditional fiat currency accounting and some stability to the blockchain.

Further, Tether tokens exist in different versions depending on the blockchain they are built on. The various blockchains Tether tokens exist on include Algorand, BNB Chain, Ethereum, Tron, and Solana, among others. Depending on the underlying blockchain, the Tether tokens will have different symbols to annotate the blockchain they run on. For example, Ethereum Tether tokens exist as USDT (ERC20) tokens, Tron as USDT (TRC20) tokens, and BNB Chain as USDT (BEP20) tokens.

Best Forex Brokers That Accept USDT for Deposits and Withdrawals

Now that we have briefly explored what USDT is, let's dive into some of the top brokers that accept this cryptocurrency as a payment method for deposits and withdrawals.

HFM

HFM is one of the top brokers that allows traders to make deposits using Tether. The minimum deposit when using Tether and other cryptocurrencies is $30, and the maximum sits at $10,000. There are no fees charged by HFM and the processing time for this payment option is instant.

HFM gives traders access to a variety of markets. Specifically, traders can trade forex, and CFDs on metals, energies, indices, stocks, commodities, bonds, ETFs, and cryptocurrencies. Evidently, this is a great place for people to diversify their portfolios. Further, the broker features reasonably low fees when trading on its four different trading accounts.

The Premium account and the Cent account both feature spreads as low as 1.2 pips for major currencies with no commissions. The Pro account features lower spreads starting from 0.6 pips for major currencies with no commission. Lastly, the Zero account has spreads that are as low as 0.0 pips with a floating commission from as low as $3 per side per lot. The trading platforms available on HFM include MetaTrader 4, MetaTrader 5, and HFM Platform.

While regulation alone isn’t everything, it’s still one of the most important safety indicators when choosing a broker. In that regard, HFM stands out—it holds licenses from two of the industry’s top regulators: the FCA in the UK and CySEC in Cyprus. On top of that, it’s also regulated by other respected authorities, including the FSCA in South Africa and the DFSA in Dubai.

Remember that Forex and CFDs available at HFM are leveraged products.

Their trading can result in the loss of your entire capital.

Exness

Exness is the world's biggest retail forex broker in terms of trading volume. Interestingly, this company accepts Tether (USDT) as a deposit method. More specifically, Exness accepts Tether as an ERC20 coin. To use this payment method on Exness, a user must have a fully verified Personal Area. The minimum deposit amount when using this payment method is $10. On the other hand, the maximum deposit amount is $10,000,000 per transaction. Exness promises instant deposits and withdrawals with no manual processing.

Once a trader makes a deposit, they can proceed to trade in a variety of market instruments. In total, there are over 200 different instruments available. These include CFDs on forex, energies, stocks, indices, metals, and cryptocurrencies. The trading platforms available to use in placing orders include MetaTrader 4, MetaTrader 5, Exness Terminal, and Exness Trade App.

Further, Exness prides itself on providing some of the lowest spreads in the market. On the standard and the standard cent accounts, the spreads start from as low as 0.3 pips for major currency pairs with no commissions paid. On top of that, there are three different professional accounts that come with even tighter pricing.

The raw spread account features spreads starting from 0.0 pips with a commission of up to $3.5 per side per lot. The Zero account has zero spreads (0.0 pips) on the top 30 instruments plus a commission from $0.05 per side per lot. Lastly, the Pro account has ultra-low spreads from as low as 0.1 pips with no commissions paid.

Let’s close out on this broker by looking at its regulations. Positively, this broker operates under the regulation and supervision of the CySEC in Cyprus, the FCA in the UK, the CMA in Kenya and the FSCA in South Africa. While Exness accepts traders from most countries around the world, they do not accept retail clients from the UK and EEA countries.

Remember that forex and CFDs available at Exness are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

Pepperstone

Pepperstone is another trusted broker that offers seamless deposits and withdrawals using USDT. Although this broker does not impose a general minimum deposit requirement, it sets specific limits for transactions involving Tether. The minimum deposit with Tether is $25, while the maximum is capped at $50,000. Deposits using this payment option are instant and there are no fees associated with deposits.

Please note that the USDT deposit method is restricted based on your country of residence. This option is available exclusively to international clients trading through their Bahamas-based entity, meaning it is not accessible to clients residing in the UK, EEA countries and Africa.

Once funds are deposited, traders gain access to a wide range of market instruments. In total, this broker provides access to over 1,200 different market products. These include CFDs on forex, stocks, commodities, cryptocurrencies, ETFs, and indices. To trade these market products, investors have a selection of trading platforms they can use. These include MetaTrader 4, MetaTrader 5, cTrader, TradingView, and Pepperstone Trading Platform.

The broker is known for its competitive spreads across its trading accounts. Its standard account offers spreads as low as 1.0 pips on major currency pairs with no commission required. On the other hand, the razor account has a spread as low as 0.0 pips plus a commission that depends on the platform a trader uses. MetaTrader 4, MetaTrader 5, TradingView, and Pepperstone Trading Platform all charge a commission of $3.5, per side per lot. In contrast, cTrader charges a lower $3 per side per lot.

Finally, Pepperstone is under the regulation of several financial authorities. These include institutions like the FCA in the UK, the ASIC in Australia, the CySEC in Cyprus, the BaFin in Germany, and the CMA in Kenya, among others.

75.3% of retail CFD accounts lose money

FBS

FBS entered the international financial market in 2009 and has grown to serve over 16 million traders worldwide. Such a high number of clients need diverse payment methods so that traders can choose the payment method that best suits their needs. Luckily, FBS provides just that. This includes Tether, the focus of our article today. On this broker site, traders can deposit funds using USDT (TRC20) or USDT (ERC20).

There are no limits on the amount traders can deposit when using Tether as a deposit method. Further, it takes about 15 to 20 mins for FBS to process payments made through Tether. Once traders make a deposit, they can start investing in a plethora of global markets. These include forex, stocks, indices, energies, metals, and cryptocurrencies. There are several trading platforms that are accessible to traders. These include MetaTrader 4, MetaTrader 5, and a mobile trading app.

The broker has a minimum deposit of 5 USD and its spreads are floating starting from 0.7 pips on major currency pairs. In regards to the FBS regulations, clients of FBS will be pleased to learn that the broker has regulatory licenses from both the CySEC and the ASIC. It also has regulations and authorization from the FSCA in South Africa and the FSC in Belize.

67.71% of retail CFD accounts lose money

Octa

Octa is with its 40 million registered accounts one of the biggest Forex and CFD brokers in the world. Interestingly, Octa traders can fund their accounts using USDT both as an ERC20 coin and as a TRC20 coin. The minimum deposit when using this payment option sits at $50 and there is no maximum limit. Positively, the broker does not charge any fees when funding using this payment method and promises to process transactions within 3 to 30 minutes.

Once the money hits a trader’s account, they can invest in a plethora of market instruments. Particularly, investors gain access to 35 of the most volatile currency pairs and CFDs on stocks, indices, commodities, and cryptocurrencies. The trading platforms available for traders to use include OctaTrader, MetaTrader 4, and MetaTrader 5.

Notably, there are three different accounts based on the three trading platforms. Each of these accounts has its own array of assets and features to shape a client's experience. Notably, each of these accounts features spreads as low as 0.6 pips with no commissions paid. The only difference between the three accounts is the number of assets available to traders.

The MetaTrader 5 account has the highest number of assets at 227, followed by the OctaTrader account at 77, and the MetaTrader 4 account has 71 assets available. On regulations, we have to highlight the license from the FSCA that this broker holds in South Africa. While Octa accepts traders from most countries around the world, they do not accept retail clients from the UK and EEA countries, among others.

Remember that forex and CFDs available at Octa are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

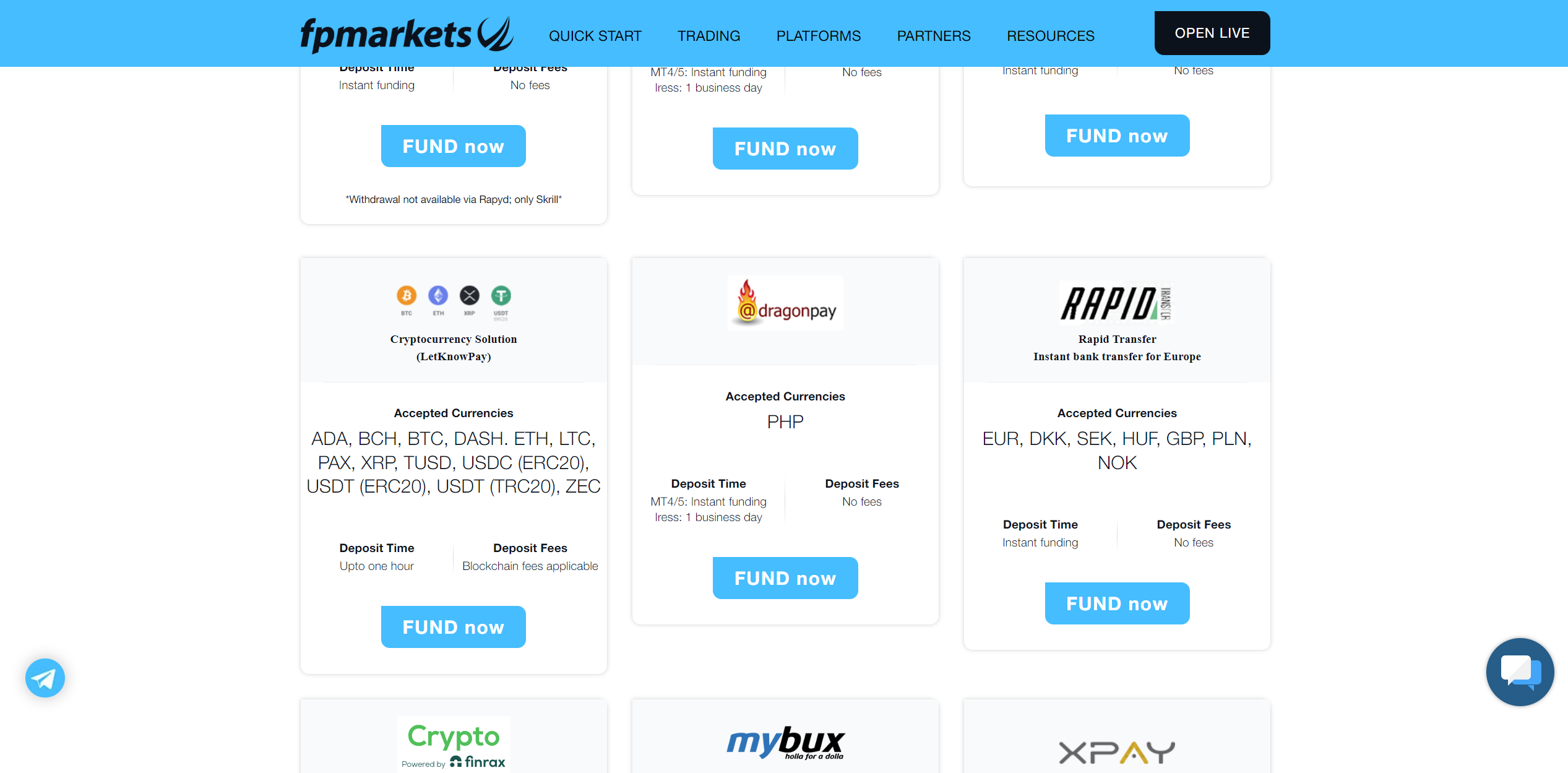

FP Markets

FP Markets supports a plethora of funding methods that traders can choose depending on their preferences. Among the many payment options, traders can use crypto payments powered by LetKnowPay, Finrax, B2Binpay, and Coinspaid. Better yet, Tether (USDT) is accepted by FP Markets as one of the cryptocurrencies traders can use to deposit funds. On FP Markets, Tether is accepted as an ERC20 coin, a TRC20 coin, and as a BEP20 coin. Depending on the payment method, the deposit can take up to 1 business day to reflect on a trader’s account.

After making a deposit using USDT, traders have access to a variety of market instruments. They can trade CFDs on forex, shares, metals, commodities, indices, ETFs, and cryptocurrencies. In total, there are over 10,000 different instruments allowing traders to considerably diversify their portfolios. The lineup of trading platforms provided are some of the best in the market. These include two depth-of-the-market platforms - MetaTrader 5 and cTrader alongside MetaTrader 4 and TradingView.

What’s more, the broker offers traders some of the lowest spreads when investing. There are two main trading accounts for traders to choose from. These include the standard account and the raw account. The standard account features spreads that start as low as 1.0 pips with no commission required. In comparison, the raw account features spreads as low as 0.0 pips with a low commission of $3 per side per lot.

As always, we must highlight the regulatory status of this broker. Luckily, it has regulations from two of the best financial overseers in the market. These include the CySEC in Cyprus and the ASIC in Australia. It also has regulations from other organizations which include FSCA and the FSA.

72.44% of retail CFD accounts lose money

Fusion Markets

Fusion Markets allows traders to make deposits and withdrawals using a variety of cryptocurrencies. These include Bitcoin, Ethereum, Litecoin, and notably, Tether (issued as an ERC20 token). The minimum deposit when using Tether and other cryptocurrencies is set at 10 USD.

Specifically, with Fusion Markets, investors can trade CFDs on forex, precious metals, commodities, indices, and shares. The trading platforms available to use in placing orders in these various markets include MetaTrader 4 and MetaTrader 5. These are two of the best trading platforms with advanced functionality. Better yet, the broker offers competitively low spreads when investing. The classic account features spreads from as low as 0.9 pips with no commissions required. In contrast, the zero account has spreads as low as 0.0 pips with a commission of AUD 4.50 per round trip.

Even with the attractive features that Fusion Markets offers, you should familiarize yourself with how it is regulated. Well, this broker holds a license from the ASIC in Australia. On top of that, it has regulatory licenses from the VFSC and the FSA.

Our Closing Remarks on Brokers Accepting Tether

Among all the cryptocurrencies, USDT is one of the most efficient methods of making payments. This cryptocurrency introduces the convenience of stability and easy accounting to the blockchain world. As people can use it from all over the world, it also helps people with no other options to make deposits to broker sites. Evidently, traders are spoilt for choice on the brokers that accept Tether as a deposit method.

While this is a welcomed feature on the various broker sites, there are other important features to look at before investing. Particularly, traders should prioritize brokers with good regulations, cheap trading fees, diverse collections of market instruments, and advanced trading platforms.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.