Forex Brokers That Accept Bitcoin Deposits and Withdrawals

Cryptocurrency payments are becoming more and more mainstream as time moves. Many brokers in the forex market are part of this cryptocurrency revolution. Some brokers accept cryptocurrency payments when traders are funding their accounts. Bitcoin is a top priority for people who prefer crypto payments. One of the benefits of using Bitcoin as a mode of deposit is that it does not have cross-border restrictions.

This article will look at some of the best brokers that accept Bitcoin for deposits and withdrawals. To determine the best brokers we will first have to determine the quality of service the broker has to offer. This will include looking at the regulations the broker has, market instruments available, spreads, and trading platforms.

What Is Bitcoin/BTC

For those who don’t know, Bitcoin is a decentralized digital currency that was launched in 2008. It is the biggest and most popular crypto in the world. Bitcoin transactions are verified by network nodes through cryptography and recorded in the public distributed ledger called a blockchain. Bitcoin has been promoted as a ‘Digital store value’. Nonetheless, the crypto suffers from price fluctuations relative to fiat currencies such as the US Dollar and the euro. If the price volatility is reduced more brokers in the forex market will likely accept Bitcoin as an alternative payment method.

Now, let's look at forex brokers that accept Bitcoin as a deposit method.

HFM

HFM offers Bitcoin funding to its traders with a minimum deposit amount of $30 and a maximum of $10,000. What's more, when deposited the amount will reflect instantly with no additional fees. Just like other brokers HFM has a variety of trading instruments for a trader to choose from. The range of the market products includes CFDs on forex, metals, energies, indices, stocks, commodities, bonds, ETFs and cryptocurrencies. The variety of global markets is attractive to traders who want to spread their risk. The trading platforms available include HFM platform, MT4, and MT5.

HFM offers different account types including Cent, Zero, Pro, and Premium. The Cent and Premium accounts have spreads starting from as low as 1.2 pips with no commissions. The Pro account features lower spreads starting from 0.5 pips for major currencies with no commission. Contrarily, the Zero account has spreads that are as low as 0.0 pips with a floating commission from as low as $0.03 per 1k lot.

HFM has two regulations from reputable organizations in the market. It's authorized and licensed by the CySEC in Cyprus and the FCA in the UK. The broker also has other regulations from other regulators that include the FSCA, the FSA, and the CMA.

68% of retail investor accounts lose money when trading CFDs with this provider.

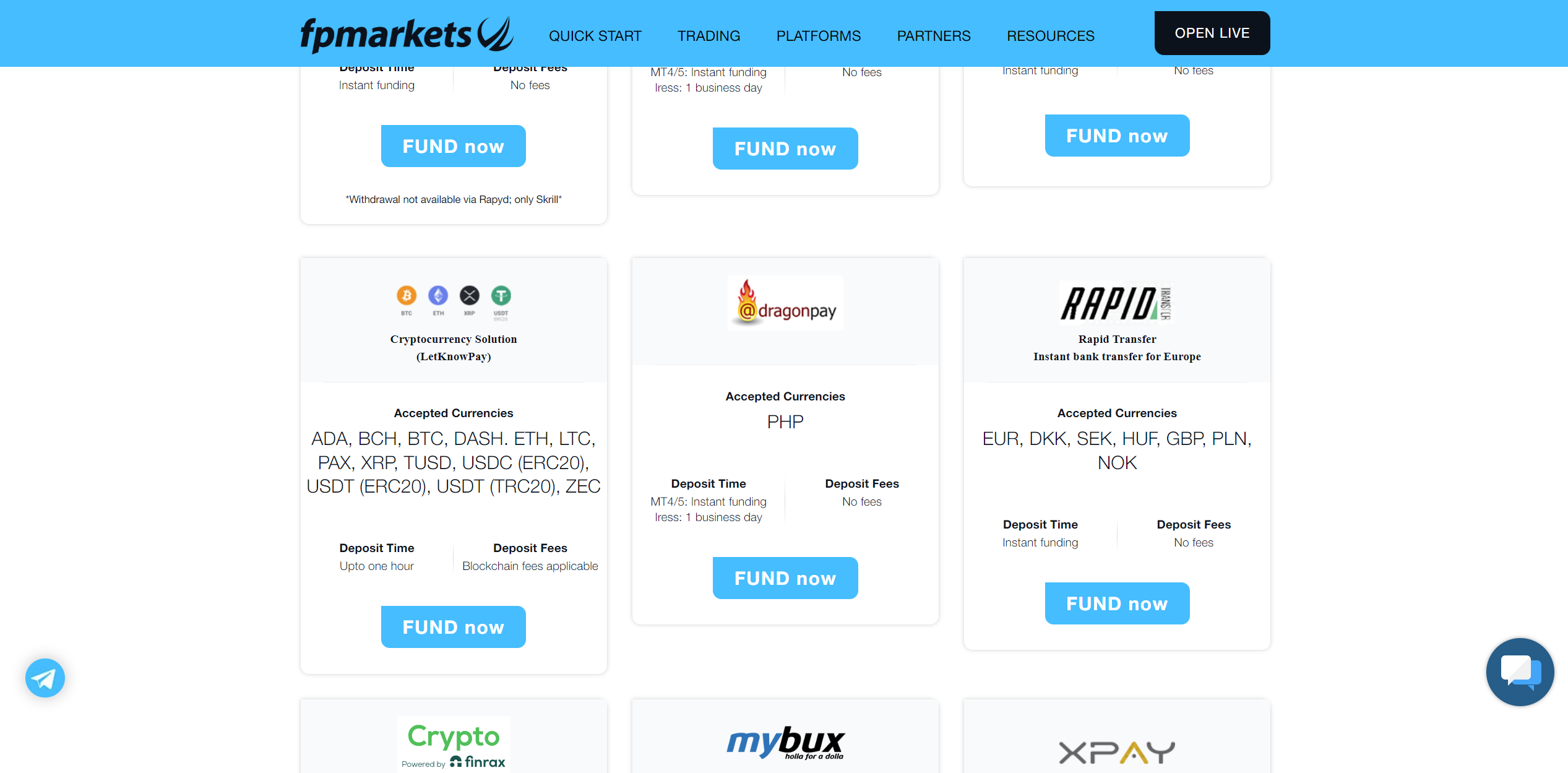

FP Markets

FP Markets offers over 10 flexible funding options, including Bitcoin. Funding and withdrawing money using Bitcoin is at FP Markets fairly easy and inexpensive. Traders can use various crypto payment solutions supported by the broker. These include Coinspay, B2Binpay, LetKnowPay, and more. Notably, FP Markets accepts a plethora of other cryptocurrencies for deposits and withdrawals, including Tether, Bitcoin Cash, Cardano, and Ripple.

Further, traders can take advantage of trading Bitcoin CFDs and other well-known cryptocurrencies including Ethereum, XPR (Ripple), and Litecoin. FP Markets has other markets a trader can invest in apart from cryptocurrencies. These include CFDs on forex, indices, futures, bonds, ETFs, metals, and shares. Traders who want to diversify their trading portfolio will find FP Markets appealing.

What's more, FP Markets allows traders to choose between two main trading accounts including the standard and the raw account. The standard account has spreads as low as 1.0 pips for major currency pairs with no commission. In contrast, the raw account features spreads that start from 0.0 pips with a low commission of $3 per side per lot. FP Markets has several advanced trading platforms for a trader to choose from. The trading platforms the broker offers include MT4, MT5, Iress, TradingView and cTrader.

Lastly, FP Markets has regulations from two main reputable organizations in the market. The broker is regulated by the CySEC in Cyprus and the ASIC in Australia. It is also regulated by the FSCA in South Africa and the FSA in Seychelles.

72.44% of retail CFD accounts lose money

Exness

Exness is another broker that enables account funding via Bitcoin. To use this feature, traders must first have a fully verified account. A minimum deposit of just $10 is required, making it an accessible option for many traders. Additionally, Exness ensures instant deposits and withdrawals, without the need for manual processing.

The broker offers a variety of account types, with five options available. These include two standard accounts and three professional accounts. The standard accounts feature spreads starting at 0.3 pips with no commission fees. The professional accounts, on the other hand, come with even tighter spreads, starting at 0.0 pips on the zero and raw spread accounts, which charge commissions starting at $0.2 and $3.50 per side per lot, respectively. The Pro account offers spreads starting from 0.2 pips on major currency pairs, also without commission fees.

Traders can invest here in a wide range of assets without leaving the broker’s platform, including CFDs on Forex, Indices, Metals, Stocks, Cryptos and Energies. These assets can be traded on popular platforms such as MetaTrader 4, MetaTrader 5, the Exness Terminal, and the Exness Trade App.

In terms of regulation, Exness is licensed by several authorities including the CySEC in Cyprus, the FSCA in South Africa, the CMA in Kenya, and the FCA in the UK. However, despite holding a license in the EU, the broker does not accept retail clients from most European Economic Area (EEA) countries.

Remember that forex and CFDs available at Exness are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

Tickmill

Tickmill is another high-profile broker that we will review that accepts Bitcoin. The minimum deposit is $100 with a minimum withdrawal is 25. When depositing, the waiting time is instant while withdrawals take usually 1 working day. The broker does not charge any fees on depositing or withdrawing.

Once a trader deposits funds they can start investing in a variety of markets that the broker offers. The global markets offered include CFDs on forex, indices, stocks, commodities, bonds, and cryptocurrencies. The trading platforms available on Tickmill include MetaTrader 4, MetaTrader 5, WebTrader, and Tickmill Mobile App.

Tickmill has regulations from various jurisdictions. The broker has regulations from the CySEC in Cyprus, the ASIC in Australia, the FSCA in South Africa, and the FSA. Traders can then invest while knowing they are dealing with a broker under the regulation of several organizations.

Lastly, clients can choose between three account types that have different spreads and commissions. the accounts available depend on a trader's experience and trading style. the accounts available include the classic account, the pro account, and the VIP account. The pro account offers spread as low as 0.0 pips with a small commission of 2 currency units per side per 100,000 traded. While the classic account features spread from 1.6 pips for major currency pairs with no commission. Lastly, the VIP account spreads are as low as 0.0 pips with a small commission of 1 currency unit per side per 100,000 traded.

71-74% of retail investor accounts lose money when trading CFDs with this provider.

FBS

FBS has various payment methods that a trader can choose from and Bitcoin is included. A trader can deposit Bitcoin from as low as 0.01. There are other cryptocurrencies that traders can use to fund their accounts including Tether, Bitcoin Cash, and Litecoin. It takes only 15-20 minutes to process Bitcoin transactions on FBS.

Further, the broker has various trading instruments that a trader can invest in. The markets available range from CFDs on forex, indices, metals, energies, and stocks, to crypto. The diversity of global markets enables traders to diversify their trading portfolio and spread risk across the markets.

What's more, FBS offers world-class trading platforms that are easy to use for all kinds of traders. The platforms include MetaTrader 4 which is one of the most popular platforms worldwide, MetaTrader 5, and mobile apps. Further, FBS offers some of the lowest spreads in the market today. The standard account has spreads from as low as 0.7 pips for major currency pairs with no commissions charged.

Lastly, the regulations on the broker are tight suggesting that the broker is keen on following financial laws. The broker has licenses from the CySEC in Cyprus, the ASIC in Australia, and the FSCA in South Africa.

67.71% of retail CFD accounts lose money

Octa

Octa is with its 40 million registered accounts one of the biggest Forex and CFD brokers in the world. Interestingly, Octa also allows traders to fund their accounts via a variety of cryptocurrencies. They include Bitcoin, Litecoin, Dogecoin, Tether, and Ethereum. The minimum amount of Bitcoin clients can deposit is 0.00037000 BTC. Once deposited, the amount will reflect in about 3-30 minutes. That's not all, the broker does not charge any deposit and withdrawal fees.

Octa offers several account types that a trader can choose from including OctaTrader, MetaTrader 4, and MetaTrader 5. The OctaTrader, MetaTrader 4, and MetaTrader 5 accounts feature spreads as low as 0.6 pips. Trading with the three accounts does not charge any commissions and this feature is very attractive to traders.

Further, the broker has a plethora of trading instruments to choose from. The markets the broker offers include CFDs on forex currency pairs, shares, indices, commodities, and cryptocurrencies. The trading platforms available for traders to use include MetaTrader 4, MetaTrader 5, and OctaTrader. OctaFX has regulation and licenses from the FSCA which is a reputable regulator in the market. While Octa accepts traders from most countries around the world, they do not accept retail clients from the UK and EEA countries, among others.

Remember that forex and CFDs available at Octa are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

Fusion Markets

Fusion Markets allows traders to invest in a variety of market instruments. These include forex currency pairs and precious metals alongside CFDs on energies, equity indices, shares, and commodities. The trading platforms available to use in placing orders in these various markets include MetaTrader 4 and MetaTrader 5. MetaTrader 5 is one of the best depth-of-market platforms in the world which is a welcomed feature.

Notably, Fusion Markets allows traders to fund their accounts using a variety of cryptocurrencies. These include Tether, Ethereum, Litecoin, and importantly, Bitcoin. There are no minimum or maximum deposit amounts on this broker site. Therefore, traders can invest whatever amount they have and start trading.

Trading can be hard as it is, and having complicated account types makes it even harder. That is why Fusion Markets offers two account types that are simple to comprehend. The account types include the Zero account and the Classic account. The zero account has a low spread from 0.0 pips and a small commission of AUD$ 4.50. On the other hand, the classic account features spreads from 0.9 pis for major currency pairs with no commission.

Regulation on its own is not enough to make a broker valuable but it's a good start for a broker to have one. Fusion Markets has regulations from the ASIC in Australia which is a reputable regulator in the market. It is also under the regulation of the VFSC and the FSA.

Closing Remarks

Most brokers are part of the cryptocurrency revolution meaning they allow traders to fund their accounts using Bitcoin and other cryptos. Cryptocurrencies introduce stability and easy accounting to the financial world. A lot of brokers now accept Bitcoin and other cryptocurrencies and traders can benefit from borderless transactions.

There are other brokers on the market that accept Bitcoin apart from the ones listed in this review. Hence, we advise traders to do a lot of research before choosing a broker. Some of the factors they should consider include regulation from reputable organizations, low spreads, world-class trading platforms, and diversity of global markets.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.