Forex Brokers that accept Mobile Money

This article is dedicated only to African forex traders who are looking for forex brokers who accept the use of mobile money for forex deposits and withdrawals. But first, what is mobile money all about?

Mobile money refers to money stored in an account that is operated by telecom companies, in which the user’s mobile phone and other telephony details such as the phone number are integral components of the transaction process. This is possible because phone numbers are unique in themselves, and every phone device comes with a unique International Mobile Equipment (IMEI) number. The unique nature of phone numbers can be enhanced by subjecting each user to biometric registration, in which physical traits that cannot be replicated in any other human being such as the fingerprint, are captured and assigned to the phone number. That way, a user can perform financial transactions over a mobile network using the phone number as a unique identification number, just the way every bank customer would have a unique bank account number, chequebooks or savings passbooks of years gone by.

The mobile money payment channel is very common in Africa, especially in Ghana, Kenya, Cameroon, Rwanda, Uganda and Tanzania, where it is used as a tool for financial inclusion. Many African countries and indeed countries of the Middle East have large unbanked populations. Accessing services such as a forex trading account requires financial inclusion, where a user of the financial system can be identified and the individual’s financial history can be profiled, in compliance with international laws against money laundering.

What Forex brokers accept Mobile Money

The number of forex brokers that accept mobile money for deposits and withdrawals is still relatively low. Despite this fact, there are already a couple of solid forex brokers who work with mobile money.

HFM

HFM is a reputable broker that caters to African traders and supports mobile money payments. The broker supports various mobile money solutions depending on the region, including popular options like M-Pesa, Airtel Money, and MTN Mobile Money. The minimum and maximum deposit amounts depend on the payment option and region. In Ghana, the minimum deposit through mobile money is 50 GHS while the maximum is 5,000 GHS. In Kenya, the minimum deposit via mobile money is KES 700 and the maximum is KES 150,000. HFM offers instant deposits when using mobile money and charges no fees to traders.

Once traders make a deposit, they gain access to a diverse selection of trading instruments. These include CFDs on forex, metals, energies, commodities, indices, cryptocurrencies, stocks, ETFs, and bonds. This allows traders to diversify their portfolios and explore different markets. Traders can access these markets through different trading platforms including MetaTrader 4, MetaTrader 5, and the HFM Platform. The spreads on this broker site depend on the account that a trader chooses. For example, the spreads start from 0.2 pips on the Pro-plus account, with no commission charged. Finally, HFM is a regulated broker in various jurisdictions including in South Africa by the FSCA, in Kenya by the CMA, in the UK by the FCA, and in Cyprus by the CySEC.

Remember that forex and CFDs available at HFM are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

Exness

Exness is a Forex and CFDs broker with the biggest trading volume in the world (shy of $4 trillion per month). Having the the FSCA license in South Africa and the CMA license in Kenya it has a very strong regulatory framework in Africa. Exness supports mobile money deposits and withdrawals in a number of countries including Ghana, Uganda, Cameroon, Rwanda and Tanzania. On standard accounts, the company has competitive spreads starting from 0.3 pips on major currencies. The minimum deposit for a standard account is 10 USD, other base currencies such as GHS or GHS are also available. Special perks and even better trading conditions are available on zero-spread accounts (These are pro accounts which are available at a higher minimum deposit).

For executing trades, traders can use either the MT4 or MT5 trading platforms.

Remember that forex and CFDs available at Exness are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

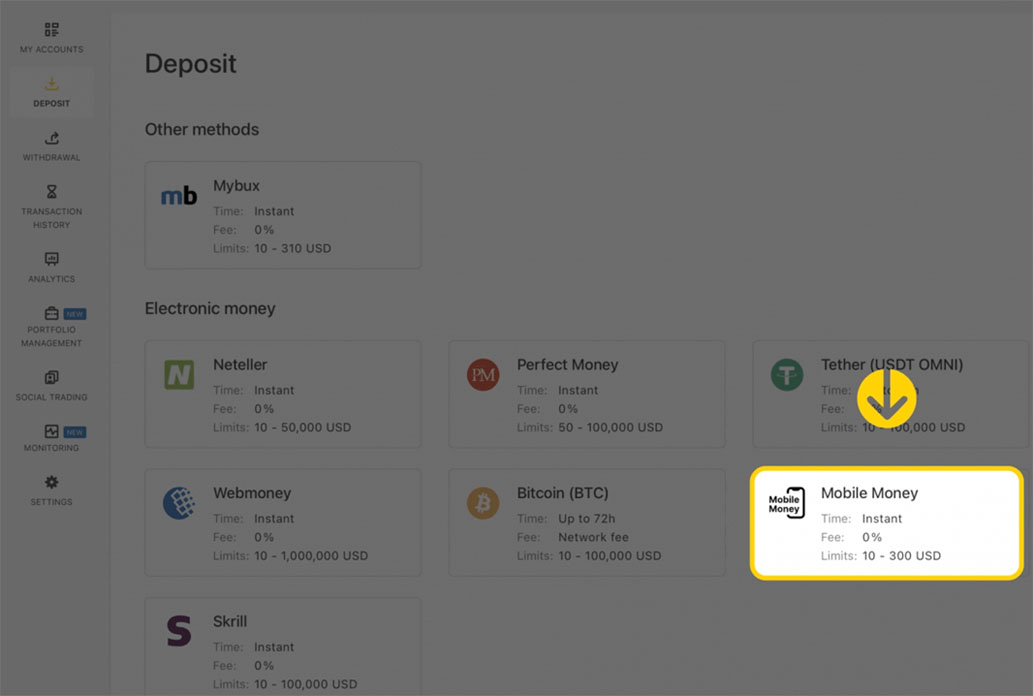

Step-by-step guide on how to deposit money to Exness using mobile money

1. STEP: If you don't have an Exness account,open a new Exness account. Login to the account and click on "Deposit" in your personal area. Here, select Mobile Money.

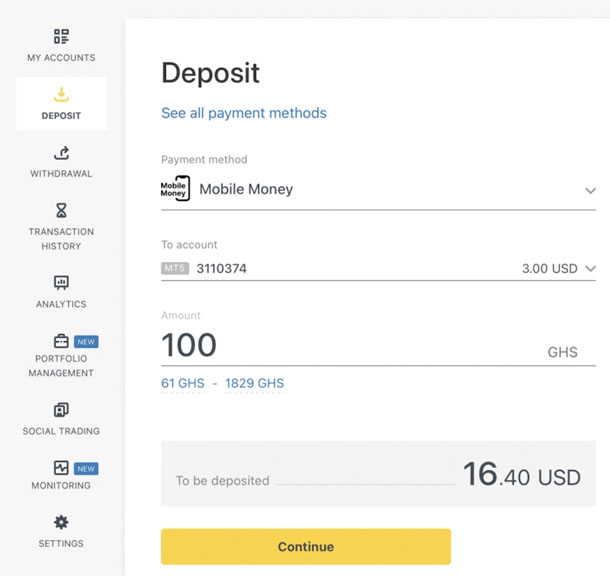

2. STEP: Please choose the trading account you wish to fund, input the deposit amount, choose the currency, and then click on the "Continue" button.

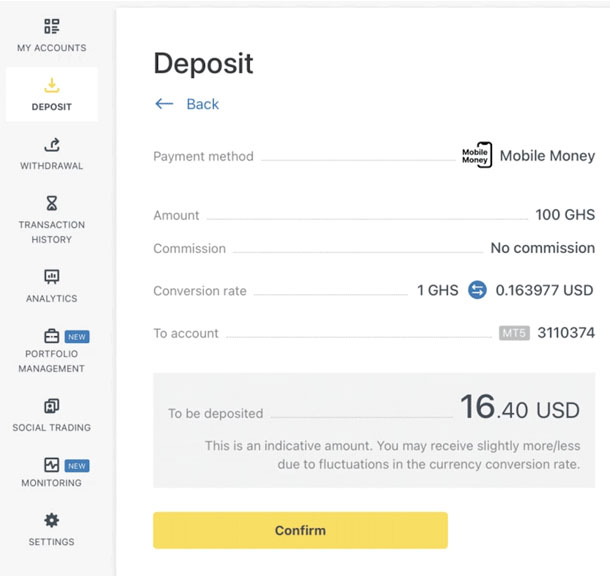

3. STEP: A transaction summary will be presented to you. Please review the details and then click on "Confirm."

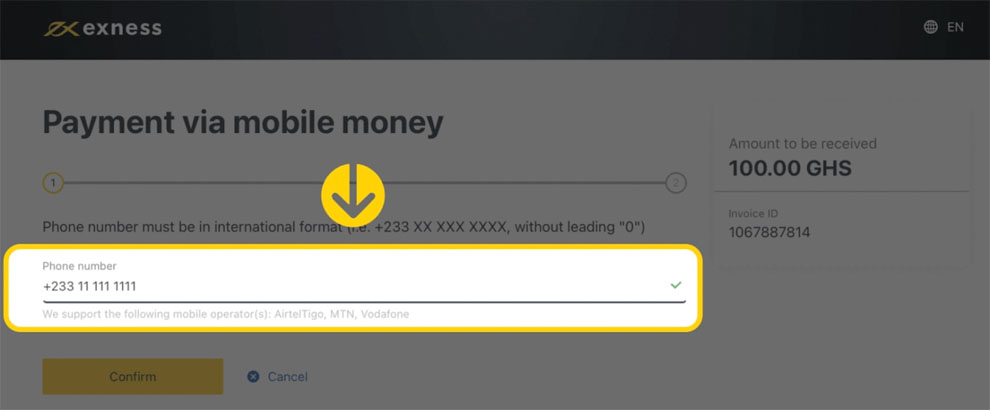

4. STEP: Kindly pick a mobile service provider, enter your phone number, and proceed by clicking "Confirm."

5. STEP: The subsequent steps for the deposit process will vary based on your service provider. Please proceed as instructed by your mobile provider.

Exness and Mobile money in Ghana, Uganda, Cameroon and Rwanda

One of the most popular forex brokers in Africa - Exness accept mobile money deposit and withdrawals in various countries. Here are the conditions that apply in Ghana, Uganda, Cameroon and Rwanda when using mobile money.

| Ghana | Uganda | Cameroon | Rwanda | |

| Minimum deposit | USD 10 | USD 10 | USD 10 | USD 10 |

| Minimum withdrawal | USD 10 | USD 10 | USD 5 | USD 2 |

| Maximum deposit | USD 245 per transaction | USD 1 050 per transaction | USD 940 per transaction | USD 1 700 per transaction |

| Maximum withdrawal | USD 245 per transaction | USD 1 050 per transaction | USD 940 per transaction | USD 1 700 per transaction |

| Deposit and Withdrawal processing time | Instant* | Instant* | Instant* | Instant* |

| Deposit and withdrawal processing fees | Free of charge | Free of charge | Free of charge | Free of charge |

*The term “instant” indicates that a transaction will be carried out within 3 hours for deposits and 24 hours for withdrawals without manual processing by our financial department specialists. Note that these limits are checked in their USD equivalent based on live exchange rates.

XM.com

XM.com is a Forex and CFDs Broker with a big popularity in Africa. The company offers here CFDs on forex, stocks, cryptocurrencies, commodities and indices. XM now also supports mobile money deposits and withdrawals in some African countries. The broker is regulated by the ASIC in Australia, by the CySEC in Cyprus and by the IFSC in Belize. The company features two popular forex retail trading platforms MT4 and MT5. The company offers to new users attractive no-deposit and deposit bonuses. Spreads on forex majors start here from 0.6 pips.

75.18% of retail investor accounts lose money when trading CFDs with this provider.

IQ Option

IQ Option is a Forex, CFDs and Binary Options Broker that also supports mobile money deposits and withdrawals in some African countries. The minimum deposit here is 10 USD and a free practice demo account can be opened at anytime. IQ Option spreads on forex start from 0.6 pips and the maximum leverage is in most African countries on majors 1:500 and on minor and exotic pairs 1:300. The broker has its own in-house built trading platform. Apart from mobile money traders can also deposit using credit/debit cards, M-Pesa, Skrill, Money transfer or Advcash.

General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds.

You should never invest money that you cannot afford to lose

Forex Brokers and Mobile Money

With the passage of the European Securities and Markets Authority (ESMA) rules of 2018, it has become very expensive for traders to open and operate trading accounts with UK and EU forex brokers. This has led to a mass migration of traders to so-called offshore locations and loss of business for many of these EU brokers. The loss of business has hit many of them so badly, that their loud protests have caught the attention of the European Commission, which has instituted a process to review the MiFID II protocols that ESMA derives its regulatory powers from.

Some EU brokerages have been able to adapt to the situation by creating international divisions to handle clients from outside the EU. Africa represents a huge opportunity for forex brokers because the penetration of forex trading on the continent is relatively low. However, there is a large unbanked population in the African market. For the unbanked, mobile money represents one of the major means of transaction. This has led to a slight increase in the number of forex brokers that accept mobile money for transactions. Kenya and Ghana are two countries where the use of mobile money is very high.

Forex brokers that accept mobile money in Ghana have an advantage because even those who operate bank accounts also have access to mobile money. Mobile money usage in Ghana is driven by telecom companies such as Airtel/Tigo, MTN and Glo. In Kenya on the other hand, the most popular mobile money payment system is Vodafone's M-Pesa.

Mobile Money As a Funding Method

To be able to get registered on a mobile money network, the user must have a phone number, with a registered SIM card matched to the user by means of biometrics. This provides an infallible means of identification, allowing the user to perform transactions on the mobile phone.

Forex brokers that accept mobile money in Ghana or other African countries are then able to accept deposits in the local currency, for instance, in the Ghana Cedis (GHS). Withdrawals are also conducted in the local currency. Users have the option of operating forex accounts in the local currency (if the broker allows it), or they can still maintain foreign currency accounts, in which case the appropriate conversion rates and charges are applied.

Since the mobile money registration process also incorporates biometric registration, all data can be harmonized and checked by the brokerage’s compliance department to ensure that appropriate Know-Your-Customer (KYC) protocols are followed.

Benefits of Using a Forex Broker That Accepts Mobile Money

The benefits of using an FX broker that accepts mobile money are as follows:

- a) Very fast deposits and withdrawals: Transaction times are very fast, as transfers are processed in a matter of minutes.

- b) It is a cashless method that allows the user to transact without carrying money.

- c) The convenience of this transaction method is virtually unrivalled. A country like Ghana has mobile money outlets on virtually every street. You can simply walk into a vendor’s shop, deposit Ghana Cedis with the vendor, have your mobile money wallet funded and proceed to fund your Forex account.

- d) No need to fill out any forms and there is no waiting time. You can do your Forex account funding anytime, including weekends and holidays.

Drawbacks of Using a Forex Broker That Accepts Mobile Money

What are the drawbacks of using forex brokers that accept mobile money?

- a) Initial sign-up processes can be a hassle. There are instances of registration failure due to problems with the internet network.

- b) Forex brokers that accept mobile money are relatively few. This narrows the user’s choice of brokers.

Choosing a Forex Broker That Accepts Mobile Money

Presently, the number of forex brokers accepting mobile money in Ghana and in other parts of Africa is low. However, this could change quickly as more brokers are entering the African market. For a user, make sure to use online forums and other information sources to get a first-hand account of the experience others have had with the mobile money transaction process. You can also check the list above to see some of the most popular FX brokers that are accepting mobile money.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.