Forex Brokers in Kenya with M-Pesa

Forex brokers that accept M-Pesa offer the opportunity to deposit and withdraw funds from a forex account using the M-Pesa payment channel. The M-Pesa payment channel is particularly popular in Kenya and Tanzania, but its popularity is also increasing throughout Afghanistan, Mozambique and India. M-Pesa is coined from a Swahili term: “m” stands for “mobile” and “pesa” stands for “money”. M-Pesa is a mobile payment method set up by Vodafone’s Kenyan partner, Safaricom as a means of transferring payments using mobile phone technology.

This payment solution was devised as a means of helping unbanked populations get financial inclusion. Most payment channels on forex platforms require access to conventional banking methods. Without financial inclusion, the unbanked are locked out of this market. For the large unbanked populations in Africa and other areas, M-Pesa has changed this narrative and offers access to the forex market via forex brokers that accept M-Pesa on their platforms.

Best Forex Brokers accept M-Pesa in Kenya

The number of forex brokers that accept M-Pesa for deposits and withdrawals is still relatively low. Despite this fact, some big international forex brokers offering good trading conditions already do support using M-Pesa. Here is a list of some of the most popular brokers that allow forex trading and support the use of M-Pesa as a funding method.

Exness

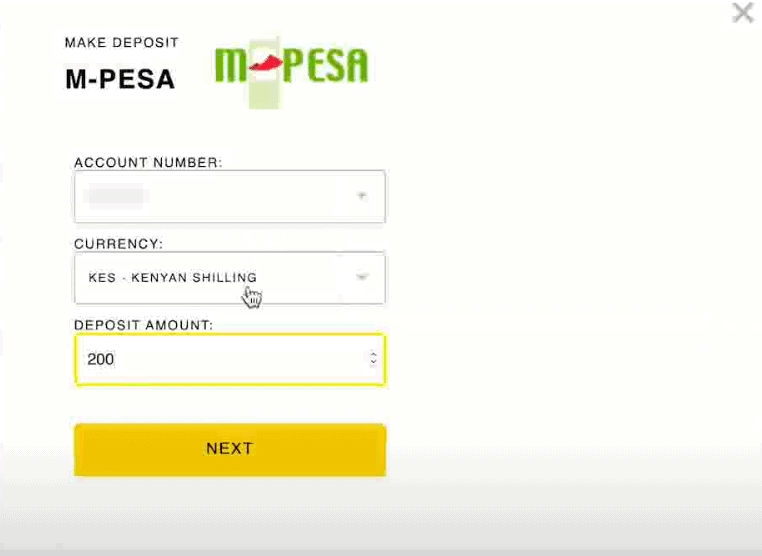

Exness is a broker that supports Mobile Money for deposits and withdrawals in Kenya. Traders can use the popular M-Pesa alongside many other deposit and withdrawal methods. The minimum deposit using this payment method is $10 and Exness promises to process transactions instantly on their side. This enables traders to access their funds immediately and commence trading without delay. Depositing funds via mobile money is straightforward. Traders can access the deposit section in their personal area, choose mobile money as the payment method, review the transaction details, and confirm.

Once traders make a deposit, they gain access to a deep collection of market products. In particular, traders can invest in CFDs on forex, indices, commodities, cryptocurrencies, and stocks. Importantly, they have access to some of the world’s top trading platforms, including MetaTrader 4, MetaTrader 5, Exness Terminal, and the Exness Trade App.

Exness offers a variety of account types to cater to different trading styles. The standard account features spreads from as low as 0.2 pips while the standard cent account has spreads from 0.3 pips. Both of these accounts do not charge a commission. Similarly, the pro account does not charge a commission and has spreads from as low as 0.1 pips for major currency pairs. The Zero account offers zero spreads on the top 30 most traded instruments but with a variable commission starting from $0.05 per side per lot. The Raw Spread account provides the tightest spreads from 0.0 pips but with a fixed commission of up to $3.5 per side per lot.

Finally, Exness is a well-regulated broker in multiple jurisdictions. The broker has regulatory licenses from the CMA in Kenya, the FCA in the UK, the CySEC in Cyprus, and the FSCA in South Africa, among others.

Remember that forex and CFDs available at Exness are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

Pepperstone

Pepperstone has integrated M-Pesa to provide clients with a convenient and accessible deposit and withdrawal method. Traders in Kenya can simply initiate a deposit on Pepperstone by selecting M-Pesa as a payment option and confirming the deposit on M-Pesa’s end. There is no minimum deposit requirement on Pepperstone.

Upon depositing funds with Pepperstone, traders can access a vast array of over 1,200 tradable instruments. Specifically, clients can trade CFDs on forex, cryptocurrencies, indices, stocks, commodities, and ETFs. The trading platforms available to execute trades include MetaTrader 4, MetaTrader 5, cTrader, Pepperstone Trading Platform, and TradingView.

Additionally, the spreads on this trading site are within market standards, offering two account types. The standard account provides spreads as low as 1.0 pips on major currency pairs with no commission. Meanwhile, the Razor account offers spreads starting from 0.0 pips, with a commission that varies depending on the platform a trader chooses. MetaTrader 4, MetaTrader 5, TradingView, and Pepperstone Trading Platform all charge $3.5 per side per lot, while cTrader has a slightly lower fee of $3 per side per lot.

Further, this broker operates under the regulation of various institutions worldwide. These include the CMA in Kenya, the FCA in the UK, the ASIC in Australia, the CySEC in Cyprus, and the BaFin in Germany, among others.

Remember that forex and CFDs available at Pepperstone are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

HFM

HFM is a popular choice for Kenyan traders, largely due to its convenient support for M-Pesa. This makes depositing and withdrawing funds quick and easy, which is a major plus. Depositing funds into an HFM trading account is simple. To do this, a trader needs to initiate a deposit on HFM’s website and then confirm the transaction from their MPesa account.

Beyond the convenience of MPesa, HFM offers a good range of trading instruments. It offers over 1,000 trading instruments, including CFDs on forex, metals, energies, commodities, indices, cryptocurrencies, stocks, ETFs, and bonds. The trading platforms available to use include MetaTrader 4, MetaTrader 5, and the HFM Platform.

Further, HFM offers various trading accounts to cater to different trading styles. The Premium and Cent accounts offer spreads starting at just 1.2 pips on major currency pairs with no commission charged. On the other hand, the Zero account features ultra-low spreads beginning at 0.0 pips on major currency pairs with a commission of $3 per side per lot. The Pro account delivers spreads starting from 0.5 pips on major currency pairs, with no commission charged. Finally, the Pro Plus account offers the tightest spreads among all HFM accounts, starting as low as 0.2 pips on major currency pairs with no commission.

Regarding regulations, this broker operates under the watch of the CMA in Kenya, the FSCA in South Africa, the FCA in the UK, and the CySEC in Cyprus.

Remember that forex and CFDs available at HFM are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

XM

XM is yet another well-known forex broker that supports M-Pesa in Kenya. To make a deposit using mobile money, traders can click Menu and click Deposit from the menu options. From there, they will select M-Pesa from the various deposit options provided and make a deposit. The minimum deposit is a low $5 which most traders can afford.

After making a deposit, traders gain access to over 1,000 different market instruments for investment. This enables them to diversify their risk across various markets within the same trading account. Specifically, investors can trade CFDs on forex, cryptocurrencies, indices, stocks, precious metals, and energies. The trading platforms available to use include MetaTrader 4, MetaTrader 5, and the XM Trading App.

Additionally, XM offers competitive spreads across its account types. The Standard and Micro accounts feature starting spreads of 1.0 pips for major currency pairs with no commission required. The XM Ultra Low account provides even tighter spreads, beginning at 0.6 pips for major currencies, with no commission. For shares trading, commissions apply and vary based on the asset and trade size.

The regulatory status of a company is crucial to consider. Fortunately, XM operates under a robust regulatory framework. Its activities are overseen by the FSC in Belize, ASIC in Australia, and CySEC in Cyprus.

Remember that forex and CFDs available at XM.com are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

Deriv

Deriv is another broker that supports M-Pesa for deposits and withdrawals. The processing time for this payment option is instant on deposits and up to a day for withdrawals. The minimum deposit is a mere $5, which then gives Kenyan traders a variety of market products. More specifically, traders gain access to CFDs on forex, derived indices, stocks, indices, commodities, cryptocurrencies, and ETFs.

The trading platforms available include Deriv MT5, Deriv X, Deriv cTrader, SmartTrader, Deriv GO, Deriv Trader, and Deriv Bot. Further, Deriv offers traders some of the lowest spreads when trading. When trading forex, the spreads on this broker site are as low as 0.5 pips on major currency pairs with no commission required.

Finally, Deriv is regulated by several organisations. Particularly, this broker operates under the supervision of the MFSA of Malta, the Labuan FSA, the BVIFSC of the British Virgin Islands, and the VFSC of Vanuatu. Usually, multiple regulatory licenses indicate a broker's commitment to compliance with financial laws. However, obtaining authorisation from a top-tier regulator like the CySEC, the FCA, or the ASIC would significantly enhance this broker’s credibility.

Why Forex Brokers accept M-Pesa?

Forex brokerage services were not originally offered to many emerging market economies until a full decade after the market was deregulated in 1997. Therefore, some of the peculiarities of the traditional financial systems of these economies were not accommodated in the design of payment channels for forex trading. The use of credit cards, bank wires and e-wallets all depends on the users within the target markets, owning and operating bank accounts. Given that some countries in Africa have unbanked populations that are as high as 85%, forex brokers that target such market using conventional payment channels typically miss out on a huge segment of their target market. Some FX brokers have realized this and are now offering payment channels that are specifically tailored towards the unbanked populations in these underserved countries. This is how M-Pesa came to be used as a payment channel that targets countries where there is a good penetration of mobile technology without commensurate financial inclusion. Ironically, some of these countries have large populations of people who already operate in the online gaming niche, where M-Pesa features prominently. While nearly 50% of the whole population of Kenya has an MPesa account, in other African countries, such as Ghana, Rwanda, or Tanzania often dominate other mobile money providers such as Airtel Money, MTN Mobile Money, Tigo Pesa, Ecocash or Orange Money.

M-Pesa As a Funding Method

M-Pesa targets the unbanked populations and is a form of mobile money. It enables the user to use his or her phone number as the account number. Typically, the regulators of the communications industry mandate the telecom companies to register all SIM card owners in a country using biometric registration methods. Therefore, a phone number can be assigned to an individual with a biometric stamp, ensuring that the number is unique to the individual and cannot be duplicated anywhere else. This process in itself enhances the Know-Your-Customer requirements that forex brokers must fulfil when onboarding a new client.

The user then registers on the M-Pesa platform and is assigned a unique set of login details. Verification of the user’s identity and address is done through submission of a government-issued ID card and other relevant documents.

Benefits of FX Brokers That use M-Pesa

The benefits of using an FX broker that accepts M-Pesa are as follows:

- a) Very fast deposits and withdrawals: Transaction times are very fast, as transfers are done instantly.

- b) It is cashless, which means that traders do not need to carry large amounts of money. In countries with high denomination notes and high exchange rates to the US Dollar, this is very convenient.

Drawbacks of FX Brokers That use M-Pesa

What are the drawbacks of using forex brokers that accept using M-Pesa?

- a) The initial verification process can be strenuous

- b) The use of M-Pesa is not widely available on forex platforms. This narrows the user’s choice of brokers.

Choosing a Forex Broker That Accepts M-Pesa

Presently, not many forex brokers accept M-Pesa on their platforms, but the list is growing. You can either use one of the brokers listed above which we verified that they support the M-Pesa payment system or you can use online forums and other information sources to find out what the experience of other users of M-Pesa forex brokers have been. Also, pay attention to other parameters to gauge the broker’s performance.

You can do some test transactions to see how easy it is to make a deposit or withdraw funds from a set of M-Pesa compliant forex brokers. You can also check out the quality of customer service from your first interaction with the forex broker as a prospect. Using these methods, you will find a forex broker that accepts M-Pesa that is good for you.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.