Best Forex Brokers With $5 Minimum Deposit

In recent years, forex trading has become more and more accessible to traders as forex brokers continue to lower the barrier of entry. Today, investors can start trading forex and other financial markets with a low minimum deposit of just $5. While a low entry point is important, it is also crucial for traders to consider other factors when selecting a broker to invest with. This review will explore some of the best forex brokers with a $5 minimum deposit. We will consider the broker’s regulations, the spreads and commissions, the trading platforms offered, and the collection of market products.

Benefits of Forex Brokers With $5 Minimum Deposit

Low minimum deposit brokers offer traders a variety of benefits. These include:

- Lower Risk - Starting with a small amount of capital generally reduces the risk. This does not mean that the emotions associated with losing this amount of money are any less. This is still hard-earned cash and proper risk management should be used when trading.

- Increased Accessibility - Brokers with low minimum deposits make trading accessible to a wider range of people, regardless of their financial situation.

- Test the Broker’s Services - A low minimum deposit allows you to test a broker’s platform, execution speeds, and overall service quality before committing larger sums of money.

- Practice and Learn - Traders of all levels can use low-deposit brokers to experiment with strategies and trading techniques without the pressure of significant financial loss.

These are just a few highlights of the benefits offered by low-deposit forex brokers. Let’s now shift our focus and look at some of the best forex brokers with a $5 minimum deposit.

XM.com

XM.com is one of the most popular brokers globally with a client base of over 10 million people from over 190 countries. This broker offers traders a low minimum deposit of just $5, which is affordable for most people around the world. There are several payment options that traders can use to fund their accounts including Wire Transfers, Skrill, Neteller, Credit and Debit cards, and PayPal.

On another note, this broker is under the regulation of a variety of organisations around the world. These include the CySEC in Cyprus, the ASIC in Australia, and the FSC in Belize. Regulations alone are never enough. However, it helps a broker’s reputation when they have regulatory licenses from several institutions.

Further, XM offers over 1,000 financial instruments for traders to explore. It provides access to CFDs on forex, stocks, indices, cryptocurrencies, precious metals, and energies. These market products are available to trade with some of the lowest spreads in the market. The broker provides three main trading accounts to choose from: Standard, XM Ultra Low, and Shares.

The Standard account offers spreads starting from 1.6 pips on major currency pairs, with no commission fees. The XM Ultra Low account features even tighter spreads, beginning at 0.8 pips, also without commissions. For the Shares account, a commission is charged based on the specific share and trade volume.

75.18% of retail investor accounts lose money when trading CFDs with this provider.

Are There Others?

While there may be others, XM is the only reputable broker that we could find with a minimum deposit of $5. However, there are other brokers that offer traders similarly low minimum deposit requirements, including $0, $10, and $50. Below are some of the top brokers:

HFM

HFM also has a no-minimum deposit requirement for most of its accounts. This means that traders can start investing with whatever amount they want. There are a variety of payment options investors can use to fund their accounts including Wire Transfers, Credit and Debit Cards, PayRedeem, Neteller, Skrill, FasaPay, and Cryptocurrencies.

Positively, this broker gives its traders access to a plethora of market products. These include over 1,000 CFDs on forex, energy, stocks, metals, commodities, cryptocurrencies, indices, bonds, and ETFs. To trade these market products, the broker provides three main trading platforms. These include MetaTrader 4, MetaTrader 5, and its own HFM Platform.

The broker provides six main trading accounts for traders to choose from. These include the Premium, Cent, Zero, Top-up Bonus, Pro, and Pro Plus accounts. The spreads vary depending on the chosen account. The Premium and Cent accounts have spreads starting at 1.2 pips on major currency pairs, while the Top-up Bonus account has spreads starting at 1.4 pips. The Pro account offers spreads as low as 0.5 pips, and the Pro Plus account offers spreads as low as 0.2 pips on major currency pairings. None of these accounts charge commissions for forex trading. Meanwhile, the Zero account has spreads as low as 0.0 pips but requires a small commission of $3 per side for every lot.

On a positive note, this broker maintains a strong regulatory standing. It holds licenses from several authorities including the FCA in the UK, the CySEC in Cyprus, the DFSA in the DIFC, and the FSCA in South Africa, among others.

68% of retail investor accounts lose money when trading CFDs with this provider.

XTB

XTB offers its traders a low entry point into the world of forex trading. With this broker, traders can start trading with a low deposit of $5 as it does not have a minimum deposit requirement. To fund their accounts, investors can use a variety of payment options. These include Credit and Debit cards, Paysafe, Neteller, Skrill, Safety Pay, and Bank Transfers.

XTB provides its traders with its own trading platform, xStation 5. This platform gives traders access to CFDs on forex, commodities, cryptocurrencies, indices, equities, and ETFs. As such, traders can diversify their investment portfolios as they see fit. The spreads involved when trading with XTB are some of the lowest in the market. Spreads on the Standard account are as low as 0.5 pips for major currency pairs with no commission. On the Swap Free account, the spreads start slightly higher at 0.7 pips with no commission.

In terms of regulations, this broker is in good standing. It holds regulatory licenses from the CySEC in Cyprus, the FCA in the UK, the FSCA in South Africa, and the KNF in Poland.

75-78% of retail investor accounts lose money when trading CFDs with this provider.

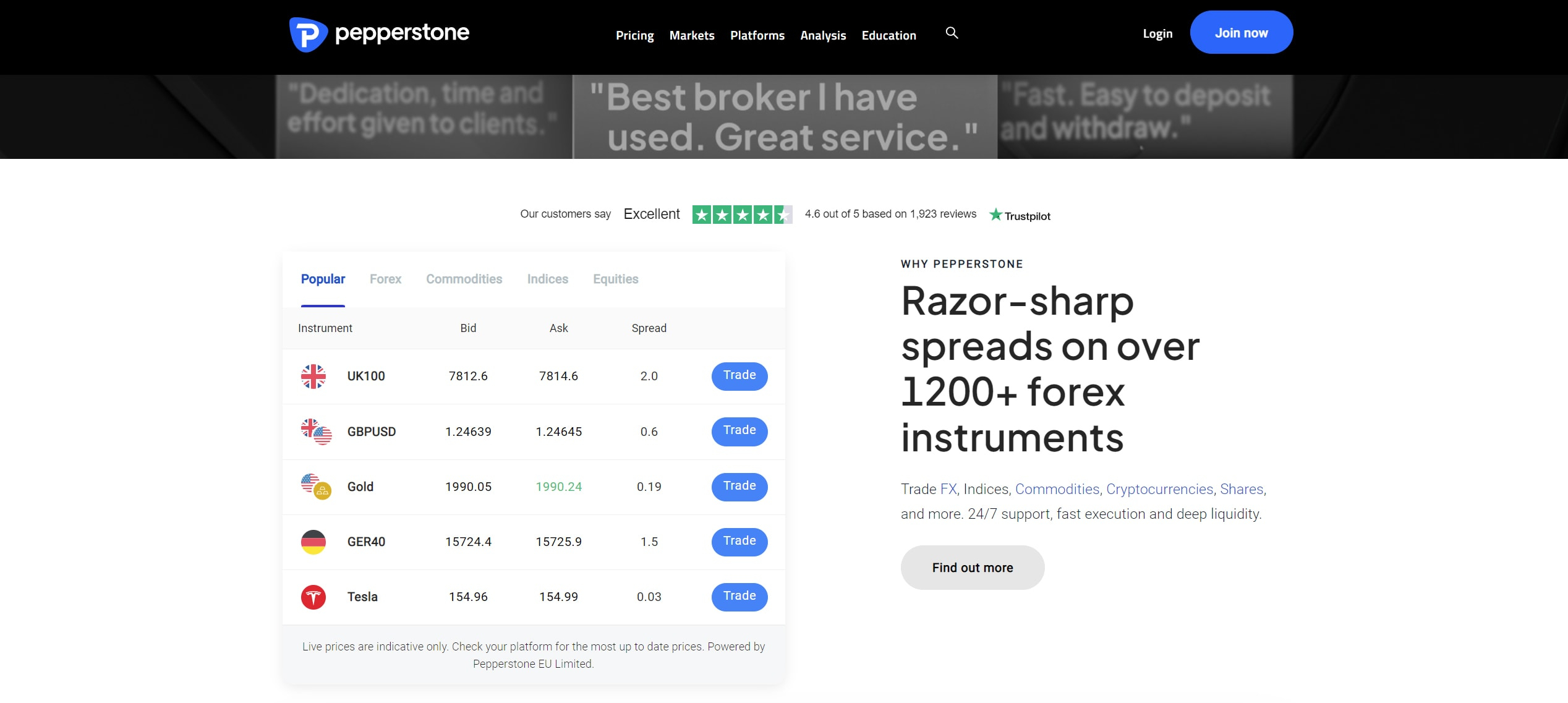

Pepperstone

Pepperstone also allows traders to start investing with any amount. This is because the broker does not have a minimum deposit requirement. As such, an individual can start trading financial markets with an investment as low as $5. Pepperstone offers a variety of funding options including credit/debit cards, MPesa, Flutterwave, Neteller, Skrill, PayPal, and bank transfers.

Pepperstone stands out by offering two types of accounts. One features only spreads without commissions while the other charges a commission alongside ultra-low spreads. The Standard account provides spreads starting from 1.0 pips with no commission fees. On the other hand, the Razor account offers spreads as low as 0.0 pips, with a commission that varies based on the trading platform. For MetaTrader 4, MetaTrader 5, the Pepperstone Trading Platform, and TradingView, the commission is $3.50 per side per lot. When using cTrader, the commission is slightly lower at $3 per side per lot.

There are plenty of investment opportunities available for clients on Pepperstone. These include CFDs on forex, indices, commodities, cryptocurrencies, currency indices, ETFs, and shares. On regulations, Pepperstone has oversight from some of the most reputable authorities in the world. These include the FCA, the ASIC, the CySEC, the BaFin in Germany, and the DFSA.

75.3% of retail CFD accounts lose money

Axi

Axi is another excellent option for traders looking to start trading with a low deposit. The broker offers a minimum deposit of $0, allowing you to start trading with any amount, including $5. To fund accounts, this broker supports a variety of payment methods, including Credit and Debit cards, Local Bank Transfers, Skrill, Neteller, Astropay, and Cryptocurrencies.

Additionally, Axi accommodates both novice and seasoned traders with its trading platforms. It offers the widely used MetaTrader 4 platform along with its proprietary Axi Trading Platform. These platforms give traders access to a variety of market products. These include products from global markets such as forex, shares, indices, commodities, and cryptocurrencies.

Axi also provides three account types to cater to different trading preferences. These include the Standard, Pro, and Elite accounts. The Standard account offers competitive spreads starting at 0.9 pips on major currency pairs without any commission fees. On the other hand, the Pro and Elite accounts offer spreads starting as low as 0.0 pips on major pairs but they both charge commissions. The Pro account charges a commission of $7 per round trip while the Elite account charges a commission of $3.50 per round trip.

Finally, let’s see how this broker is regulated. Well, Axi holds regulatory licenses from several organisations including the FCA, the ASIC, and the SVGFSA. While regulations alone aren't a guarantee, Axi's licenses from top-tier organisations instil confidence in their services.

CMC Markets

CMC Markets is another top-rated broker that provides traders with the flexibility to start trading without a large initial investment. While it does not have a strict $5 minimum deposit, CMC Markets allows traders to open an account with as little as they choose. Some of the payment options that traders can use to fund accounts include Credit/Debit cards, Bank Transfers, and PayPal.

CMC Markets offers access to a wide range of financial instruments, including forex, indices, cryptocurrencies, commodities, shares, share baskets, and treasuries. While MetaTrader 4 is the sole platform for placing orders, it allows access to this extensive product variety.

In terms of costs, spreads can be as low as 0.7 pips for major currency pairs on this broker site. Further, the broker is well-regulated by reputable institutions such as the FCA in the UK and the ASIC in Australia, ensuring a high level of security and transparency for traders.

Final Comments

Brokers with a $5 minimum deposit offer an accessible entry point for traders of all experience levels. These brokers provide an excellent opportunity to explore forex trading with considerably lower financial risk. However, while a $5 minimum deposit can be an attractive entry point for forex trading, it's crucial to consider other factors beyond just the initial investment.

These include factors such as regulations, spreads, commissions, and the range of tradable assets. This review featured some of the best forex brokers with a minimum deposit of $5 and below. Traders can leverage this information to choose a broker that best suits their needs and risk tolerance. Remember, starting small allows you to test the waters of forex trading before committing larger sums. Regardless of the minimum deposit, prioritize responsible risk management and a well-regulated broker to ensure a safe trading experience.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.