Pepperstone M-Pesa – Deposits and Withdrawals

In forex trading, convenience, speed, and security are paramount when performing transactions. Traders seek platforms that offer seamless transactions. This enables them to focus on their strategies rather than worrying about cumbersome payment processes. Pepperstone has recognized this need and has integrated M-Pesa into its platform to facilitate deposits and withdrawals. This makes it easy for traders in Kenya, Tanzania, and Uganda to deposit and withdraw funds without much trouble.

This article will look at M-Pesa deposits and withdrawals on Pepperstone. We will also look at what Pepperstone has to offer traders and the benefits of using M-Pesa on Pepperstone.

75.5% of retail CFD accounts lose money

Introducing M-Pesa

M-Pesa stands for Mobile Money in Swahili. It is a mobile phone money transfer system that was launched in Kenya in 2007 by Safaricom. Since its inception, M-Pesa has revolutionized the way people transact, particularly in regions with limited access to traditional banking services.

The beauty of M-Pesa lies in its simplicity and accessibility. Users can deposit, withdraw, and transfer funds using their mobile phones. This eliminates the need for bank accounts or physical cash. M-Pesa operates through a network of authorised agents, who facilitate cash-in and cash-out transactions. These agents effectively convert cash into electronic money and vice versa.

How to Deposit Funds Using M-Pesa on Pepperstone

To make a deposit using M-Pesa on Pepperstone, traders must first ensure that they have an active M-Pesa account and sufficient funds available. The process typically involves the following steps:

-

Log in to the Pepperstone client portal and navigate to the deposit section.

-

Select M-Pesa as the preferred payment method.

-

Enter the desired deposit amount and currency.

-

Confirm the transaction details and initiate the deposit request.

Once the deposit request is submitted, traders will receive instructions on how to transfer the funds from their M-Pesa account to Pepperstone's account. This typically involves initiating a payment through the M-Pesa menu on their mobile phone and entering the recipient details provided by Pepperstone.

How to Withdraw Funds Using M-Pesa on Pepperstone

Withdrawing funds from a Pepperstone account via M-Pesa follows a similar process:

-

Log in to the Pepperstone client portal and navigate to the withdrawal section.

-

Select M-Pesa as the preferred withdrawal method.

-

Enter the desired withdrawal amount and currency.

-

Confirm the transaction details and initiate the withdrawal request.

Upon receiving the withdrawal request, Pepperstone will process the transaction and transfer the requested funds to the trader's designated M-Pesa account.

Benefits of Using M-Pesa on Pepperstone

Convenience - M-Pesa enables traders to deposit and withdraw funds using their mobile phones, eliminating the need for bank transfers. This convenience is particularly beneficial for traders in regions where traditional banking services are limited.

Speed - Transactions via M-Pesa are typically processed within minutes. This allows traders to start trading the markets as fast as possible.

Security - M-Pesa uses robust security measures to safeguard users' funds and personal information. As such, traders can have peace of mind knowing that their transactions are protected against unauthorized access.

Accessibility - M-Pesa is widely available across various regions, including Kenya, Tanzania, and other parts of Africa. This widespread accessibility ensures that traders can easily access the service without geographical limitations.

Pepperstone Trading Instruments

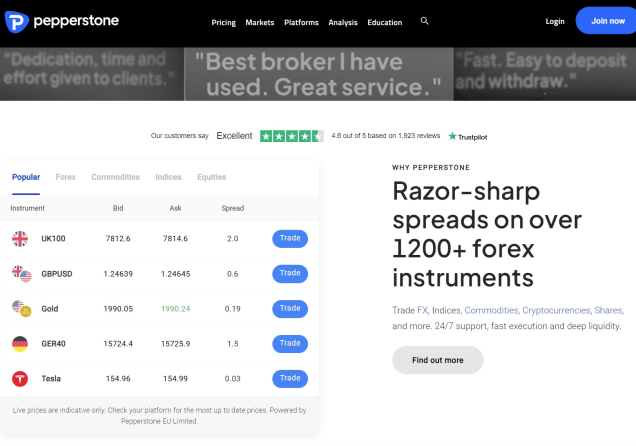

Once traders make a deposit to Pepperstone, they gain access to over 1,200 different market instruments. The collection of market instruments on Pepperstone include:

-

Forex currency pairs - On the Pepperstone broker site, traders can speculate on over 60 different currency pairs. These include majors, minors, and even exotics.

-

Indices - Pepperstone is one of the best indices brokers in the market today featuring over 20 different indices for traders to invest in.

-

Commodities - Pepperstone also allows its clients to trade a variety of commodities such as gold, crude oil, silver, and natural gas.

-

ETFs - Exchange-traded funds are available to invest with on the Pepperstone trading site. These include ETFs from Asia and the Pacific, North America, Africa, Emerging Markets, and more.

With this collection of market instruments, it is easy for traders to invest in multiple markets on the same account. For this, traders have access to four world-class trading platforms. Let’s take a look at the various trading platforms on Pepperstone.

Pepperstone Trading Platforms

As mentioned, there are four different trading platforms to choose from on Pepperstone. These include MetaTrader 4, MetaTrader 5, cTrader, and TradingView. The MetaTrader platforms are widely considered the best trading platforms in the world. They offer a mix of advanced capabilities and an intuitive interface that is suitable for both beginner and experienced traders. Additionally, they come with many trading tools including advanced trading charts.

Speaking of charts, the premier charting platform is available to use on Pepperstone. TradingView is available to traders, not just for technical and fundamental analysis, but for placing orders too. Traders can place orders on various markets directly on TradingView charts. Further, traders can also use cTrader which is one of the best depth of the market trading platforms.

Pepperstone Spreads

While M-Pesa presents a convenient way to deposit funds on Pepperstone, traders still need to trade with reasonably low fees. Luckily, Pepperstone’s spreads and fees are market standard and reasonably low. There are two main trading accounts on Pepperstone which include the standard and the razor accounts. The standard account features spreads from as low as 1.0 pips with no commission required. On the other hand, the razor account has spreads as low as 0.0 pips plus a commission that depends on the platform that a trader chooses to use. Traders using Tradingview and the MetaTrader platforms pay a commission of $3.5 per side per lot on the razor account. In comparison, traders using cTrader pay a commission of just $3 per side per lot.

Pepperstone’s Credibility

Beyond a broker accepting convenient payment systems like M-Pesa, they have to be credible enough to attract traders. The payment systems that the broker supports should be a secondary consideration after checking the credibility of the broker. Luckily, Pepperstone is a regulated broker in several jurisdictions. This broker has regulations by the CMA in Kenya, the FCA in the UK, the CySEC in Cyprus, and the ASIC in Australia, among others. Remember that regulations alone are never enough, but a broker having regulations from several reputable organizations is always a good sign.

Moreover, this broker has a good reputation among online reviewers. The company enjoys a 4.5-star rating out of 5 stars after over 2,100 reviews. Looking at this, it is safe to say that the majority of traders on Pepperstone enjoy the services that the broker offers. Further, traders do not have to commit immediately and make a deposit on Pepperstone via M-Pesa. They can first test the services of the broker using a demo account provided by Pepperstone.

Final Comments

M-Pesa provides traders with a seamless and efficient way to deposit and withdraw funds. Overall, this enhances the trading experience. In the fast-paced markets, speed is very crucial. Once traders make a deposit, they can start trading various markets within minutes with Pepperstone M-Pesa. For traders considering Pepperstone as their preferred broker, the payment option should be a secondary consideration. Traders should first look at the broker’s credibility and the services offered. Things like the fees and spreads that apply affect the trading experience even more than the payment options available. Overall, Pepperstone's integration with M-Pesa, combined with its offerings, makes it a compelling choice for traders seeking a reliable and efficient trading platform.

75.5% of retail CFD accounts lose money

Regulated Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.