A Book Forex Brokers - List

In Forex, A Book forex brokers pass investors’ orders straight through to liquidity providers. Their only job in the market is to match buy orders with sell orders. Such brokers do not need to provide the liquidity themselves, they merely act as middlemen between traders and liquidity providers. There are different models A Book brokers use in the market. They can be STP, ECN, or DMA.

Today, we are going to look at some of the best A Book brokers that exist. We are going to see the different trading conditions they have to offer and how they are regulated. But before that, let’s look at some of the advantages and disadvantages of A Book brokers.

Advantages of A Book Brokers

- A Book brokerage model greatly eliminates conflict of interest, as the broker's only job is to link client orders to liquidity providers.

- The charges for trading with A Book brokers can be fairly low as the brokers mostly earn profits from a commission, keeping spreads low.

- A Book brokers can have deeper liquidity as they only source from reliable liquidity providers.

- A Book brokers encourage more transparency in the market.

Disadvantages of A Book brokers

- While spreads can be low, the commissions charged by some A Book brokers can be fairly high.

- A Book brokers pass the market risk to other players in the industry.

After that brief look at the pros and cons of A Book brokers, let’s look at some of the best A Book brokers in the market.

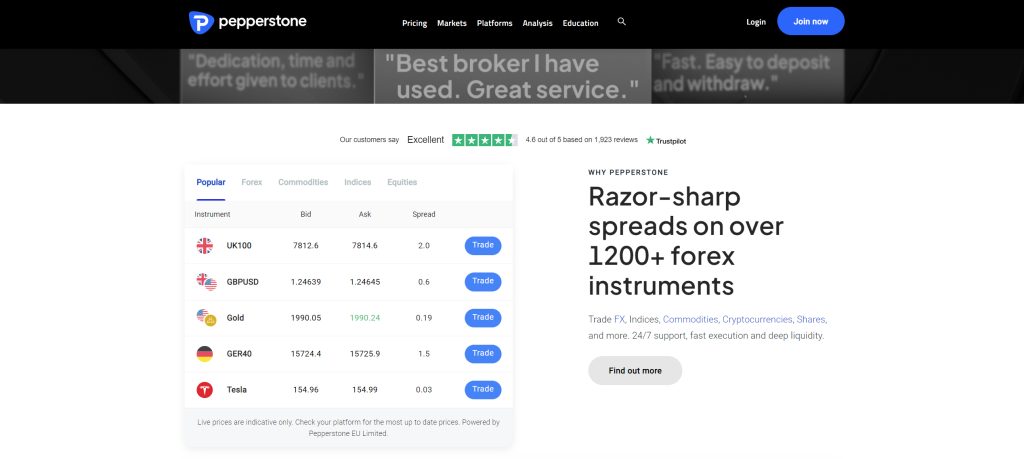

Pepperstone

Pepperstone is a forex and CFDs broker that has the tools, insight and support that clients need when trading. Pepperstone offers a combination of ECN and STP execution models which are both A Book in nature. By offering A Book services, there are no hidden markups, no dealing desk, low latency, and no requotes whatsoever.

Clients have a variety of tradeable instruments with over 1,200 CFD instruments available. Clients can trade CFDs on Forex, Indices, Shares, Commodities, and Currency Indices. This diversity of instruments is highly praised by customers. Diversity is also demonstrated in the trading platforms available. Clients can choose between MT4, MT5, cTrader and TradingView. These platforms give Pepperstone some of the fastest execution times in the market. Most orders are executed in less than 30 milliseconds (Pepperstone Group Limited) and 60 milliseconds (Pepperstone Limited).

Pepperstone offers two main trading accounts; the Standard and the Razor accounts. On the standard account, spreads fall as low as 1 pip for major currency pairs. Conversely, the Razor account features spreads starting from 0.0 pips and a commission of $3.50 per lot applies.

Finally, we look at this broker’s regulatory status. Peperstone is regulated by some of the top financial regulators in the market. These include the Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC).

75.5% of retail CFD accounts lose money

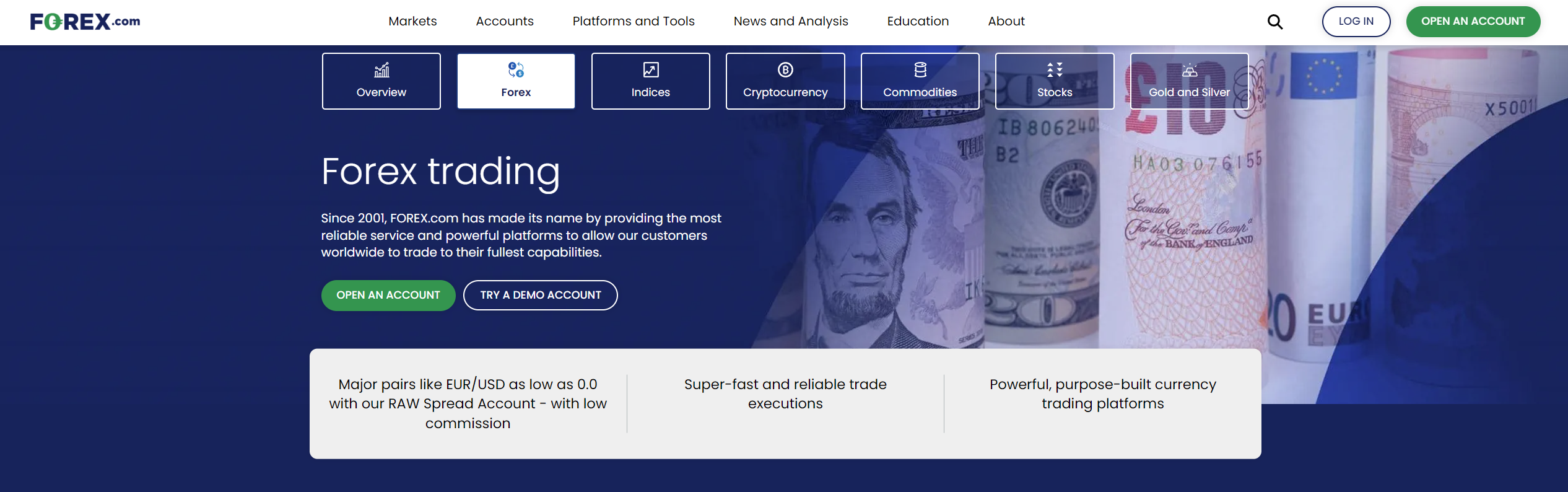

Forex.com

Forex.com is another broker that offers A book execution model on its DMA account and its STP account. The STP Pro account is only available to US clients while the DMA account is available to people outside the US. Both of these accounts charge variable commissions depending on the trading volume of a client. Clients with a trading volume of between $0M - $100M on the STP account pay a commission of $80 per million dollars traded. On the other hand, a client with the same trading volume on the DMA account would pay a commission of $60 per $1 million traded. Spreads on these accounts vary based on market conditions, including volatility, available liquidity, and other factors.

Clients outside the US can trade CFDs on forex, indices, shares, commodities, precious metals, and cryptocurrencies. In comparison, clients from the US can trade forex, gold and silver, futures and futures options on Forex.com. This is because CFDs trading is not permitted by financial regulators in the US.

The trading platforms provided by Forex.com include MetaTrader 4, MetaTrader 5, and Forex.com Trader. These platforms allow for easy customization and give this broker some of the fastest execution times in the market today. The average order execution time on Forex.com sits at a mere 0.06 seconds.

Looking at the regulatory status, Forex.com is under the watchful eye of several regulators. These include the FCA in the UK, the NFA and CFTC in the US, the CySEC in Cyprus, the ASIC in Australia, and the IIROC in Canada.

77.7% of retail investor accounts lose money when trading CFDs with this provider.

Vantage Markets

Vantage Markets offers A Book services on its standard STP account and its two ECN accounts. The Vantage Standard STP Account features spreads starting from 1.0 pips and no commissions. On the other hand, the two ECN accounts feature spreads as low as 0.0 pips and different sets of commissions. The Raw ECN account features commissions from $3 per lot per side. In contrast, the Pro ECN account has commissions starting from $1.50 per side per lot.

In all these accounts, people can trade CFDs on Forex, Commodities, Indices, and Shares. This allows clients to invest in multiple market instruments at the same time. Additionally, this broker provides a non-expiring MT4 demo account where clients can practise their strategies and test out the broker’s services. The full suite of trading platforms includes MetaTrader 4, MetaTrader 5, ProTrader, and WebTrader. Mobile traders can also choose to use the Vantage App built by Vantage Markets.

In terms of regulations, Vantage Markets is a regulated company in Australia by the ASIC, in Cyprus by the CySEC, in the Cayman Islands by the CIMA, and in Vanuatu by the VFSC. While regulations alone are not enough, the CySEC and the ASIC are two of the best regulators in the market.

Roboforex

The RoboForex broker is a brokerage firm that provides clients with various trading platforms. These include MetaTrader 4, a classic terminal, MetaTrader 5, and cTrader platforms. The broker has four main trading accounts available. These are the Prime, ECN, R StocksTrader, ProCent, and Pro accounts. Roboforex uses a Straight Through Processing model that removes any conflict of interest between the broker and the trader. Its ECN account also links client orders straight with liquidity providers.

Roboforex features a wide collection of market instruments to trade. The various markets available include Forex, EFTs, stocks, indices, ETFs, commodities, metals, energies, and cryptocurrencies. Here, clients can choose to invest in a single market or multiple markets at the same time. Investing in various markets would help spread the risk of investment between those markets.

The spreads on this broker site depend on the account a trader is using. The accounts with ECN pricing feature floating spreads starting from 0.0 pips and a commission paid. The commission is variable and depends on the asset a client is trading. Traders can find the specific commissions under the contract specifications page. The accounts with ECN pricing include the Prime, ECN, and RStocksTrader accounts. The Pro and ProCent accounts feature spreads starting from as low as 1.3 pips for major currency pairs.

Finally, let’s see how Roboforex is regulated in the market. RoboForex has over 12 yeast of experience serving forex traders and has regulatory licences from the CySEC and the FSC. While the FSC might be a more relaxed regulator, the CySEC is one of the best watchdogs in the market. It ensures that brokers follow strict policies before handing them a licence and authorization.

IC Markets

IC Markets is an A Book broker because they do not have a proprietary trading book as it offers ECN trading to clients. IC Markets has three main accounts: the Standard account and two Raw Spread accounts. The Standard account allows clients to trade on Spread based conditions. The spreads on this account start from 0.6 pips for major currency pairs. On the other hand, the Raw Spread accounts feature a commission when trading. One of the accounts is only available on the cTrader trading platform. This account features a commission of $3 per $100,000 traded and spreads starting from 0.0 pips. The other account is available on the MetaTrader platforms. This account comes with a commission of $3.5 per side per lot.

IC Markets provides its traders with a variety of platforms including MetaTrader 4, MetaTrader 5, and cTrader. Having varieties of trading platforms allows clients to pick and choose the platform that best suits them and their experience. Either way, this broker allows clients to trade in a variety of global markets. On this broker site, investors have access to assets in the forex, commodities, indices, futures, stocks, and metals markets. In total, there are over 2,200 trading instruments on IC Markets.

Onto the regulations of this broker. It has authorisation and regulations from various organizations including the CySEC and the ASIC. These two regulations have strict laws that companies have to follow.

FBS

We’re closing out our list with FBS, which operates on a no-dealing desk model. Its ECN account features floating spreads starting from 1.0 pips and a commission of $6 per lot applies. All the other accounts offered by this broker have STP processing and floating spreads starting from 0.3 pips upwards. Notably, this broker features one of the highest numbers of accounts that people can find on the accounts page. Orders are executed in the market in all FBS accounts. Orders are filled at actual market prices thus, requotes are not permitted.

FBS gives access to financial markets such as forex, commodities, stocks, metals, indices, and cryptocurrencies. The trading platforms available to use include MetaTrader 4, MetaTrader 5, and FBS Trader. These platforms are available on the Web, Windows, macOS, iOS, and Android. They accommodate clients of all kinds.

FBS has over 20 years of operation as a regulated broker. Such longevity is very attractive to traders. This company operates under the regulation of the ASIC, the CySEC, the FSCA, and the IFSC. It is always a safer bet to trade with regulated brokers than with unregulated ones.

Final thoughts

It is always a tough task to select a broker to invest with. Many brokers in the market focus on the profits they can reap from clients. Additionally, on some broker sites, the profits of clients can lead to losses felt by the brokers. When brokers use an A Book model, it helps traders and the company avoid any conflicts of interest. Any profits traders make do not yield losses to the broker.

Even so, traders still need to select brokers that offer the best trading conditions and have regulations from reputable organizations. Regulations are especially important as financial regulators lay the rules brokers need to follow for a fair trading environment for all parties. Investors are at less risk of being scammed when trading with regulated brokers.

Regulated Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.