Zero Spread Crypto Brokers – Are There Any?

When trading any financial markets, the fees involved are one of the major factors that investors consider. Typically, brokers charge a spread, the difference between the bid and ask price, to people when trading. Notably, there are also forex brokers that offer spreads from zero pips on forex trades, typically accompanied by a commission fee.

This offers the advantage of transparency and predictability in trading costs. But are there any zero spread crypto brokers in the market? Let’s explore the concept of zero-spread crypto brokers, highlighting their potential benefits and drawbacks.

What Is a Zero Spread Crypto Broker?

A zero spread crypto broker is a brokerage that offers cryptocurrency trading with spreads from 0.0 pips. This means traders can enter and exit positions without paying a spread, making it an attractive option for scalpers and high-frequency traders.

In forex trading, zero-spread accounts are more common. However, the dynamic and volatile nature of cryptocurrencies makes achieving true zero spreads a challenge. Crypto markets operate 24/7, with liquidity varying significantly across exchanges and pairs, making the concept of zero spreads harder to sustain. So, are there any zero-spread crypto brokers?

Are There Any True Zero Spread Crypto Brokers?

While true zero spread crypto brokers are rare, there is one broker that stands out for offering spreads from zero pips for crypto on one of its accounts. Let’s take a look.

Exness

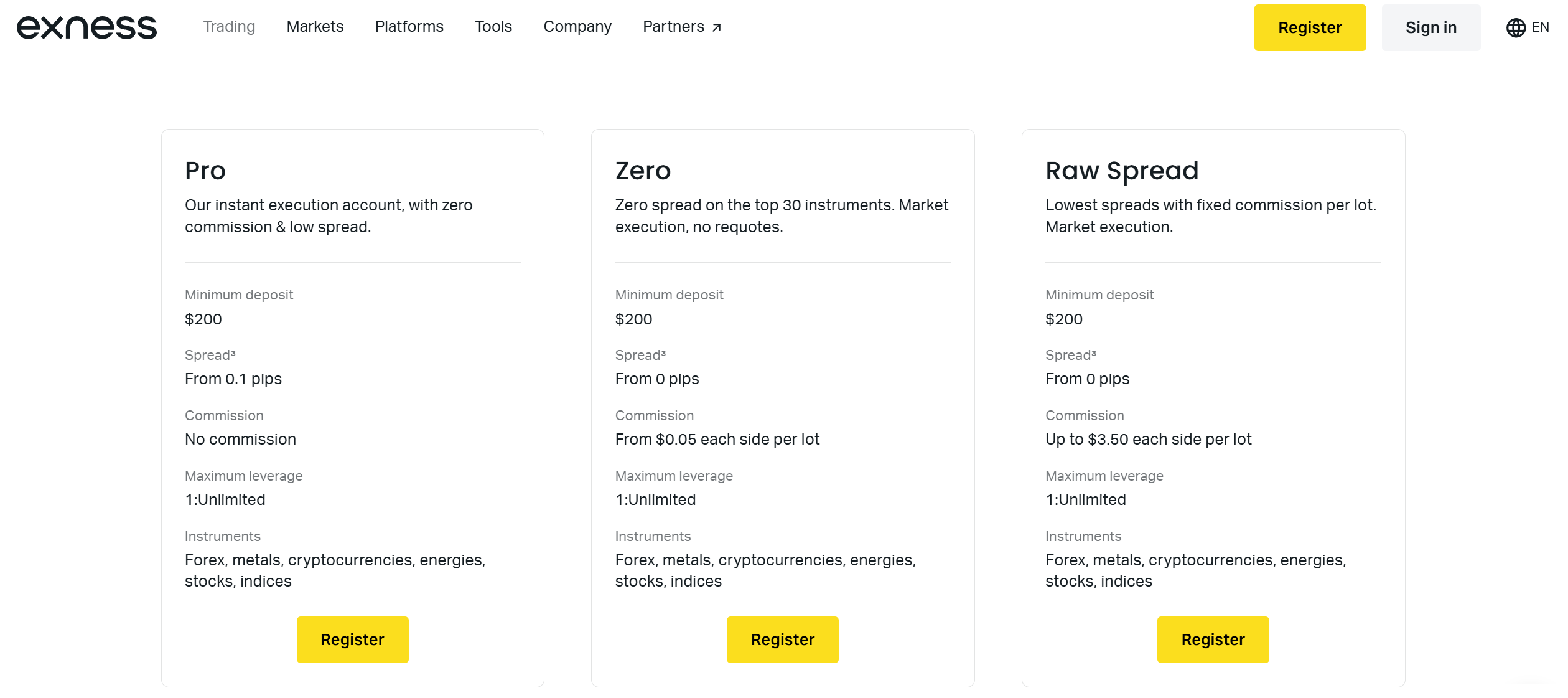

Exness is probably the only zero-spread CFD Crypto broker in existence. On its Zero account, Exness offers spreads from 0.0 pips on the top 30 instruments, including CFD on cryptocurrencies. The spreads are from as low as 0.0 pips and there is a variable commission that starts from $0.05 per side per lot.

Please note that spreads are floating on this account and depend on market conditions. While they can go as low as 0.0 pips, spreads may widen when the markets experience lower liquidity.

Importantly, Exness does not charge any swap fees on CFD cryptocurrency positions. This makes the broker a great choice for traders who use long-term trading strategies. Notably, the minimum deposit to open an Exness Zero Account is $200*. The account features unique maximum leverage of 1:unlimited, allowing investors to control considerably large positions with small initial capitals. There are no limits on the maximum number of positions that traders can open at a given time on this account.

Remember that CFDs on forex available at Exness are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

Please note, that Exness does not accept retail traders from the European Economic Area, UK or the USA. But traders from most other parts of the world are welcome.

Exness Zero Spread Account

Is Exness a Credible Broker?

While Exness offering zero-spread CFD crypto trading is important, traders also need to consider its credibility before investing any funds. To evaluate the credibility of a broker, we usually consider its regulations and its overall reputation among traders. Exness is a regulated broker, holding multiple regulatory licenses from several financial authorities across the globe such as the Seychelles Financial Services Authority (FSA), Cyprus Securities and Exchange Commission (CySEC), the Financial Conduct Authority (FCA) in the UK, South Africa Financial Sector Conduct Authority (FSCA), Central Bank of Curacao and Sint Maarten (CBCS), Financial Services Commission (FSC) in the British Virgin Islands, Capital Markets Authority (CMA) in Kenya.

These regulatory bodies ensure that Exness operates in compliance with international financial laws and standards, providing a secure trading environment for its clients.

*Disclaimer: Exness (Cy) Ltd and Exness (UK) Ltd do not offer trading services to retail clients.

On another note, Exness has a great reputation among traders. It has a solid 4.6 star rating out of 5 stars on Trustpilot after over 13,400 reviews. This suggests a high level of satisfaction among its traders. Moreover, Exness is probably the largest broker by trading volume in the world, showing how highly regarded by traders it is.

Pros and Cons of Zero Spread Crypto Trading

Pros

- Reduced Trading Costs - This is the most obvious benefit. Eliminating the spread can significantly lower your trading expenses

- Cost Transparency - Knowing the exact cost per trade makes it easier to calculate profitability. Zero spread accounts usually reveal the cost in commission that will be charged upfront.

- Ideal for Volume Traders - Zero spreads are ideal for strategies that rely on small, frequent trades. These include scalpers, high-frequency traders, and day traders in general.

Cons

- Commissions - To compensate for the lack of spread revenue, zero spread brokers typically charge commissions on each trade. These commissions can be high, especially with increased trading activity.

- Market Conditions Still Apply - Even with a zero-spread account, spreads can widen during periods of high volatility or low liquidity. This is a market reality and not solely dependent on the broker.

Why Aren’t There Many Zero-Spread Crypto Brokers?

Achieving zero spreads in cryptocurrency trading is very challenging for a variety of reasons. First, cryptocurrencies are known for their high volatility, with prices fluctuating within short time frames. Maintaining zero spreads under such conditions is challenging and often impractical. Additionally, crypto markets often experience changes in liquidity levels depending on the coin, time of day, or broker. Low liquidity can lead to wider spreads. This is unlike forex markets where liquidity is generally abundant.

Further, brokers incur operational costs, which they cover through spreads. On top of that, they are businesses that need to make a profit. Offering zero spreads would require alternative revenue models, such as higher commissions. This may not be appealing to all brokers, especially in a volatile sector like cryptocurrencies.

Fortunately, Exness offers a zero spread account with spreads starting from 0.0 pips on cryptocurrencies. However, it's important to note that even Exness may widen the spread, as the 0.0 pips figure represents the starting point, and spreads can increase depending on market conditions. Conversely, most brokers offer a spread that starts at a particular amount for crypto trading, rather than zero.

If Exness doesn't meet your needs or you prefer to trade with a different broker, consider those with low spreads for the best experience. Just be sure they offer transparent fee structures, disclosing all costs, including commissions and overnight fees, so you fully understand the true cost of trading.

Final verdict

Zero-spread crypto brokers are rare due to the volatile nature of cryptocurrencies and other challenges. However, Exness stands out as a notable exception. It offers spreads from zero pips on CFD cryptocurrencies on the Zero account with a commission involved.

This makes it an attractive choice for cost-conscious traders. However, traders should always consider factors such as commissions, broker reputation, and regulatory oversight when choosing a broker. If zero spreads on cryptocurrencies are not a priority, then opting for a low-spread crypto broker with transparent fees may be the best alternative.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.