Exness Social Trading Review

The innovation of social trading has revolutionized the way investors participate in financial markets. One prominent forex broker in the social trading arena is Exness. This brokerage firm has gained attention for its innovative approach to trading. It provides accounts specifically tailored to traders who want to engage in social trading.

In this comprehensive review, we will look at Exness social trading, exploring its features, benefits, and potential drawbacks. So here is Exness social trading and everything you should know about it.

Remember that forex and CFDs available at Exness are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

What is Social Trading?

Before we look at the specifics of Exness social trading, let's establish a foundational understanding of social trading itself. Social trading is a modern approach to investing that leverages the power of social networks and collaborative tools to enable traders to share insights, strategies, and trades in real-time. This concept allows less experienced traders to learn from the more seasoned ones. This promotes a sense of community and knowledge-sharing within the trading ecosystem.

Exness Overview

Exness is a globally recognised online brokerage firm that has been in operation since 2008. The company is known for its commitment to transparency, reliability, and technological innovation. Headquartered in Cyprus, Exness serves a diverse clientele from around the world, providing access to various financial instruments. These include forex, commodities, indices, and cryptocurrencies. Exness is now one of the biggest forex brokers in the market by trading volume. Let’s see what it has to offer traders in the social trading sector.

Exness Social Trading Review

Exness' social trading offers traders the opportunity to trade financial markets using the strategies of other more successful investors. Here are some key aspects of Exness social trading. Novice traders can benefit from the expertise of seasoned professionals without having to actively manage their portfolios. Moreover, traders with little time to make their own trades can still invest in the financial markets by replicating the moves of other active traders. Traders can also diversify their portfolios by investing in markets they are not familiar with using Exness social trading.

Notably, Exness provides a leaderboard that showcases the performance of various traders on the platform. Traders can access the track record, risk levels, and profitability to determine the traders they want to copy from. This promotes transparency and traders can choose who they copy from based on their own preferences and choice.

Further, the experienced traders whose moves are copied also have something to gain. The social trading platform on Exness allows traders to leverage their expertise by being strategy providers. They can set up their own commission rate that can go all the way up to 50%. This helps experienced traders make an extra income from their knowledge and skills. Moreover, they can track their performance and gain market popularity based on their track record.

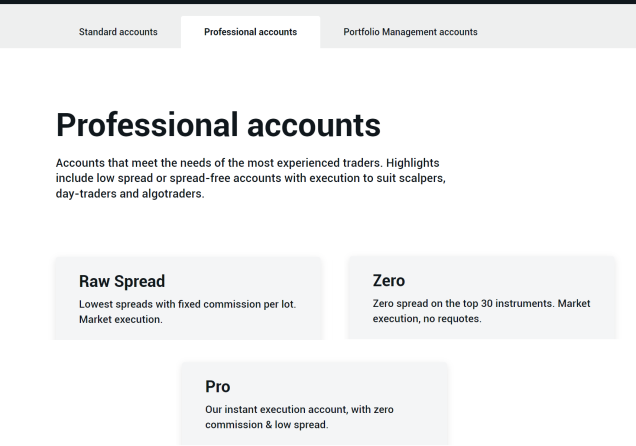

Exness Social Trading Accounts

Exness provides traders with two main social trading accounts to choose from. These include the Social Standard and the Social Pro accounts. The Social Standard account requires a minimum deposit of $200* and features spreads from as low as 1.0 pips for major currency pairs with no commission. The order execution style on this account is Market execution and there is a swap-free version for Muslim traders who cannot pay overnight fees due to religious laws.

In comparison, the Social Pro account requires a minimum deposit of $2,000* and features spreads from as low as 0.6 pips with no commissions. There is also a swap-free version of the Social Pro account. Interestingly, this account has Instant execution for forex and metals and market execution for cryptocurrencies.

Both of these accounts give traders access to only three global markets. These include forex, metals, and cryptocurrencies. Each of the accounts also features a maximum lot size of 400 lots. They also feature an unlimited number of positions a trader can hold. *Please note that the minimum deposit may differ depending on your country of residence.

Remember that forex and CFDs available at Exness are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

Exness Trading Platforms

When investing, traders want to use the most capable trading platform available. Luckily, Exness provides traders with three market standard platforms that include MetaTrader 4, MetaTrader 5, and Exness Terminal. Each of these platforms comes with intuitive platforms that are suitable for both beginner and experienced traders. Moreover, they come with advanced charting tools for technical and fundamental analysis. Further, these platforms are ultra-fast which gives Exness one of the fastest average order execution times at a mere 25 milliseconds.

Exness Credibility

It is crucial that traders only invest with brokers that have stellar credibilities. The best way to determine the credibility of a broker is to check its regulatory status and its online reviews. That will give you an idea of what kind of services you should expect from the broker. Luckily, Exness is a globally regulated broker in multiple jurisdictions. Specifically, the broker is under the regulation of the FCA in the UK, the CySEC in Cyprus, the FSCA in South Africa, and the CMA in Kenya, among others. This suggests that the broker is more than willing to follow the financial laws of the countries it operates in.

Further, the reputation of Exness among online reviewers is in good standing. This broker has an impressive 4.6-star rating out of 5 on Trustpilot. This is after more than 5,600 user reviews. This suggests that the majority of traders on Exness enjoy the services that the platform has to offer, including social trading services.

Benefits of Exness Social Trading

- Access to Expertise - For novice traders, the ability to automatically replicate the trades of experienced professionals can be a game-changer. Exness social trading provides a bridge for less experienced individuals to benefit from the insights and strategies of seasoned traders.

- Diverse Asset Classes - Exness offers three different global markets on its social trading accounts. These include forex, metals, and cryptocurrencies.

- Community Engagement - The social aspect of Exness social trading adds a layer of engagement and community building. Traders can connect, share knowledge, and learn from each other.

- Transparent Performance Metrics - The leaderboard feature provides transparent performance metrics for each trader on the platform. This transparency allows users to make informed decisions when selecting traders to follow.

Potential Drawbacks and Considerations

While Exness social trading offers numerous benefits, it's essential to consider potential drawbacks and limitations. Below are some to consider.

- Market Risks - Trading always involves inherent risks. Even with the ability to copy experienced traders, there are no guarantees of profits. Users should be aware of the potential for losses and exercise caution in their trading activities.

- Dependence on Leaderboard Metrics - Relying solely on leaderboard metrics to select traders may not capture the full picture of a trader's capabilities. Users must conduct thorough research and consider factors beyond profitability, such as trading strategies and risk management practices.

Closing Remarks

Exness Social Trading presents an innovative and user-friendly platform that caters to a wide range of traders. Both beginners and experienced professionals can utilise this feature. Traders can utilise the strategies of more successful traders on the platform. They can also engage with each other to share ideas and learn from each other. However, users should approach social trading with a clear understanding of the risks involved. Like any other trading activity, there is still considerable risk involved in social trading. Traders should perform due diligence to ensure that they are well informed about the decisions they make.

Regulated Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.