XM Islamic Account Review

While the forex market offers numerous opportunities, traders must ensure they operate within both religious principles and national laws. For Muslim traders, ensuring compliance with Sharia law is paramount. Luckily, there are various brokers in the market that offer Islamic accounts that operate within Islamic finance principles.

One of the top brokers that offers investors an Islamic account is XM. As one of the biggest brokers in the world, it is very important for XM to accommodate this demographic of traders. But what does the XM Islamic account have to offer to traders? In this XM Islamic account review, we will examine the account’s features, benefits, and overall suitability for Muslim traders.

75.18% of retail investor accounts lose money when trading CFDs with this provider.

Understanding Islamic Finance and Forex Trading

Before looking at XM’s Islamic account, it's important that we first understand the principles of Islamic finance in the context of forex trading. Islamic finance operates under specific principles derived from Sharia law. There are three key principles that guide financial transactions for Muslims, including:

- Riba (Interest) - Charging or paying interest is strictly forbidden in Islam. This prohibition extends to overnight financing charges, commonly known as swaps or rollovers, in forex trading.

- Gharar (Excessive Uncertainty) - Transactions involving excessive speculation or ambiguity are not allowed.

- Maysir (Gambling) - Engaging in games of chance or purely speculative activities is prohibited.

In the context of forex trading, the primary concern for Muslim traders is the presence of swap fees. In traditional Forex accounts, traders may incur or earn swap rates (interest) on overnight positions. However, the practice of charging or receiving interest is not compliant with Islamic principles. To address this issue, brokers offer Islamic accounts, also known as swap-free accounts, which eliminate these charges.

XM Islamic Account Review

XM's Islamic account is designed to provide Muslim traders with a Sharia-compliant trading environment. The most significant feature of this account is the absence of swap or rollover interest on overnight positions. This creates a compliant environment for Muslim traders to engage in long-term trading strategies without worrying about violating religious laws.

Better yet, XM offers Islamic accounts with the same trading conditions as regular trading accounts.

Unlike most brokers who substitute swap fees by widening the spread on Islamic accounts, XM does not do that and does not impose any additional charges. There are no hidden fees or additional commissions associated with Islamic accounts. This ensures that traders are not subjected to any disguised forms of interest. Further, there is no time limit on how long traders can hold positions.

Beyond this, traders have access to a deep collection of market products offered by XM. In particular, investors gain access to CFDs on forex, stocks, indices, energies, precious metals, and cryptocurrencies. To trade these various market products, investors can use MetaTrader 4 and MetaTrader 5 alongside XM’s Trading Point App.

Key Benefits of the XM Islamic Account

- Compliance with Sharia Law - The most significant advantage is the adherence to Islamic principles, which is achieved by eliminating swap fees, making it compliant with Islamic law.

- Transparent Fee Structure - XM ensures that there are no hidden fees related to the swap-free nature of the account, offering a clear pricing structure.

- Competitive Trading Conditions - Traders can access the same spreads, leverage, and instruments as standard accounts.

- Reputable Broker - XM's strong regulatory status and reputation provide peace of mind.

- Wide Range of Instruments - The Islamic account allows traders to access all the instruments that are available in regular accounts.

- No Restrictions on Trading - Traders can use the same trading strategies, including scalping and long-term positions, without worrying about swap-related issues.

XM’s Spreads

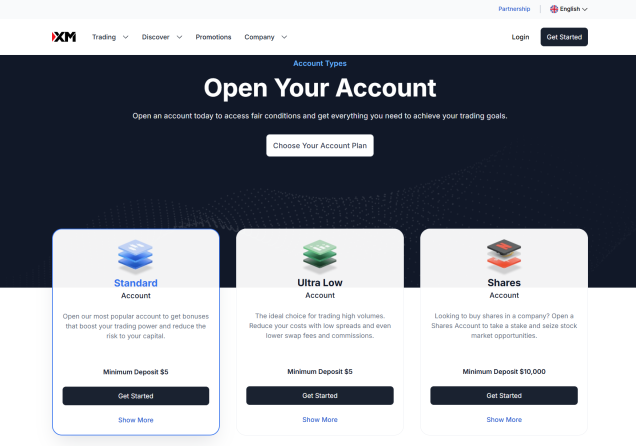

XM caters to different trader profiles by offering three different trading accounts which include the Standard, the XM Ultra Low account, and the Shares account. The standard account offers spreads from as low as 1.6 pips on major currency pairs with no commissions charged.

In contrast, the XM Ultra Low account has spreads as low as 0.8 pips, also with no commissions. Finally, the Shares account charges commissions depending on the share an investor is trading and the size of the trade. All the accounts on XM offer an Islamic option upon request.

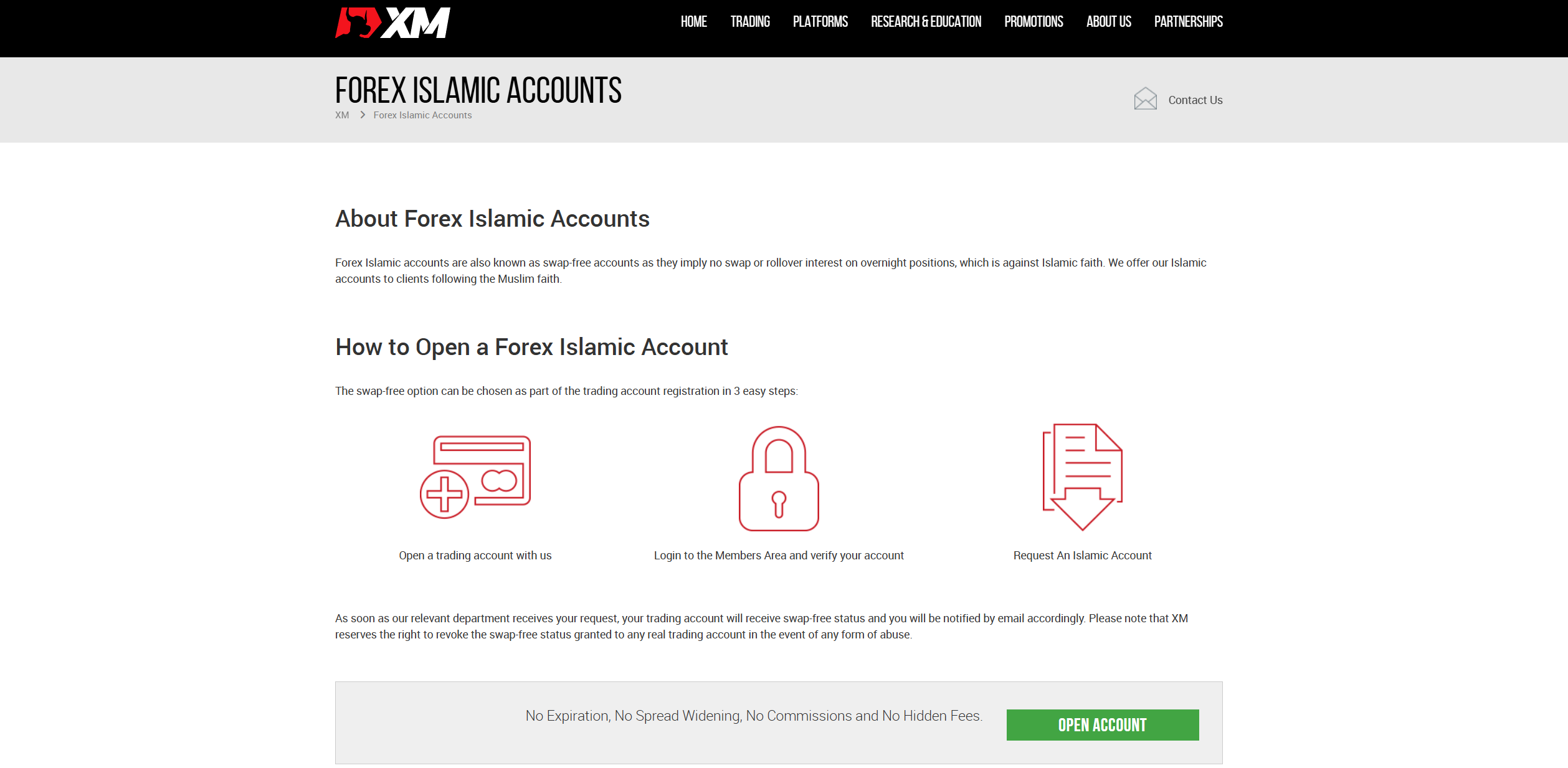

How to Open an XM Islamic Account

Opening an XM Islamic account is a straightforward process. It involves three main steps:

- Register a Standard Account - First, you need to open a trading account with XM. This involves providing personal information and completing the necessary verification procedures.

- Verify Your Account - After opening an account, you will need to log in to the Members Area and verify your account.

- Request an Islamic Account - Once your standard account is verified, you can request to convert it to an Islamic account. XM will review your request and, upon approval, convert your account to an Islamic account. This process is usually quick and efficient.

Is an XM Islamic Account Reliable?

While an Islamic account is crucial for Muslim traders, it is important to also consider the overall credibility of a broker before investing. To assess a broker's trustworthiness, we typically examine their regulatory status and read reviews from traders who have used their services.

Luckily, XM is a well-regulated broker with a strong reputation in the online trading industry. The company is authorised and regulated by several reputable financial authorities. These include the CySEC in Cyprus, the ASIC in Australia, and the FSC in Belize.

On a different note, XM has over 15 million clients across more than 190 countries, establishing itself as one of the largest forex brokers globally. This extensive client base highlights the company's solid reputation and its ability to cater to traders' needs effectively.

Final Verdict

The XM Islamic account is an excellent option for Muslim traders who wish to participate in Forex trading without violating Islamic principles. It eliminates swap fees while maintaining competitive trading conditions. On top of that, XM provides access to a wide range of instruments and trading platforms without compromising religious principles.

XM's strong regulatory standing and global presence further strengthens its position as a reliable choice for Muslim traders seeking a trustworthy and ethical trading environment. Nonetheless, it's essential to conduct your own research and consider all the broker’s features to see if they fit your specific needs.

75.18% of retail investor accounts lose money when trading CFDs with this provider.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.