Who is the Best Scalper Trader in the world?

In the world of online trading, scalping is one of the most popular trading strategies among investors. It involves making numerous trades over short timeframes, typically seconds to minutes, to capitalise on small price movements. Scalpers aim to scalp small profits repeatedly, which can accumulate into substantial returns.

This strategy requires quick decision-making, high concentration, and a solid understanding of market dynamics due to its fast-paced nature. Notably, there are many traders that have found success using this strategy. In this article, we will explore some of the most renowned scalpers in the world. We will examine what makes them stand out in an attempt to answer the question of who is the best scalper in the world.

A Brief Look at Scalping

Scalping is a popular forex trading strategy that focuses on entering and exiting trades quickly, often in just seconds to minutes. Scalping does not have to be done only on forex, but can also be performed for trading cryptocurrencies, silver and gold, stocks and other financial instruments. The primary goal is to capture small price movements to gain small profits from the fluctuations. Eventually, traders end up accumulating modest gains that can add up to significant profits over time. Basically, this trading strategy usually requires one to execute a high volume of trades daily, sometimes hundreds. As such, many traders resort to using automated trading robots to execute trades for them.

With that brief overview of scalping, let’s shift our focus to some of the best scalper traders in the world. Please note that determining the best scalper trader in the world is a subjective and challenging task. While there are many talented and successful scalpers, it's difficult to definitively rank them due to various factors. For starters, the forex market is characterised by a high degree of privacy. This means that there are a lot of traders that will not even disclose their strategies. As such, the information in this article is based mostly on publicly available data and expert opinions.

Paul Rotter

Paul Rotter is one of the most notable scalpers in the world today due to his remarkable success in the trading world. One estimate places Paul’s yearly earnings between $65 – 78 million, majorly earned through scalping. Rotter made his name on the Eurex exchange, where he was one of the most active traders, executing over one million trades per year at the peak of his career. His trading style is characterised by making rapid trades, sometimes executing up to 100 orders in a single day.

In 1998, he co-founded a Dublin-based proprietary trading firm with an initial capital of $1.3 million. Within three months, their trading generated a profit of $6.5 million with his strategy on the forefront. This is impressive, to say the least. Rotter emphasizes the importance of discipline and speed. He reacts quickly to market signals, executing trades in milliseconds, which is crucial in scalping.

AI Brooks

Al Brooks is another well-known figure in the trading world, especially among those who focus on scalping and day trading. He is a former ophthalmologist who switched careers to become a professional trader. He is renowned for his deep understanding of price action trading and has authored several books on the subject. Additionally, he now teaches some of his teaching concepts on his YouTube channel which has more than 150,000 subscribers.

Notably, Brooks’ strategies are majorly focused on reading bar charts and understanding price patterns. He barely uses indicators when trading. Brooks often advocates for taking small, consistent profits rather than holding out for large moves. This approach aligns perfectly with scalping, where the goal is to make numerous small gains over time. Note that Brooks uses several other strategies when trading, like any other trader on this list. But his emphasis on simplicity and his mastery of price action make him one of the most influential scalpers in the trading world.

Bob Volman

Bob Volman is a highly respected forex trader known for his expertise in price action scalping. Volman relies heavily on price action analysis, which involves interpreting price charts without the use of complex indicators. This method allows him to identify trading opportunities based on the natural movement of prices and patterns in the market. He mainly focuses on simplicity and precision, emphasizing short-term price movements to make quick profits.

In his popular book, Forex Price Action Scalping, Volman lays out a detailed, systematic approach to scalping. It has since become a valuable resource for traders looking to understand and implement scalping techniques. He highlights the importance of discipline, patience, and understanding market behaviour in the book.

Further, a critical component of Volman's trading strategy is effective risk management. By using tight stop-loss orders and carefully selecting trade setups, he minimizes potential losses while aiming for consistent profits.

Matt Diamond

Matt Diamond is a well-known trader and YouTuber who has gained popularity for his straightforward and transparent approach to scalping. Through his YouTube channel, Diamond shares his live trading sessions, focusing primarily on scalping strategies. His content has attracted a significant following of traders who appreciate his real-time insights and practical trading tips.

Diamond emphasizes the importance of key support and resistance levels in his scalping strategy. By identifying these crucial price points, he aims to enter and exit trades at optimal moments, capturing quick profits from short-term price movements. His trading style is straightforward and avoids over-complication. He often uses basic indicators, such as moving averages and volume, to make informed decisions. As such, his approach is accessible to all kinds of traders, both novice and experienced.

Momen Medhat

Momen Medhat is a well-known swing and day trader based in the MENA region. He is a member of Exness Team Pro, a group of experienced traders selected by Exness, a global multi-asset broker. According to Momen, he chose Exness to be their brand ambassador because of its user-friendly platform, fast execution, and wide range of trading instruments, which cater to both new and experienced traders. He also appreciates Exness’ transparent approach to managing deposits and withdrawals, which he believes helps build trust among its users.

Image from the official Exness site, Exness Team Pro section, featuring Momen Medhat.

Momen Medhat's journey to success began from rock bottom. He transitioned from being unemployed to becoming a thriving entrepreneur, achieving significant financial success through online trading. He founded W2M Trading, aiming to help investors gradually grow their assets and capital for substantial profits.

Beyond his trading activities, Momen shares his knowledge through educational content. His YouTube channel, with over 140k followers, features tutorials and live trading sessions designed to help individuals enhance their trading skills. He also uses his Instagram account to support and inspire investors in achieving financial success.

Tom Hougaard

Tom Hougaard is a former broker who is now a professional trader. He is best known for his tactical approach to scalping in the trading community. Hougaard's trading style is aggressive and highly disciplined, focusing on exploiting short-term market inefficiencies. He frequently shares his trades and insights through social media, gaining a large following of traders who admire his methods. His YouTube channel, Trader Tom, has attracted quite a substantial number of subscribers over 150,000 people.

Hougaard excels at market timing, entering and exiting trades at precise moments to capture small price movements. His ability to time the market accurately is a critical factor in his success. Hougaard emphasizes the psychological aspect of trading, highlighting the importance of maintaining discipline, managing emotions, and sticking to a trading plan.

Key Qualities of Successful Scalpers

Most successful scalpers possess several common traits. Here are some highlights:

- Discipline: Scalping requires strict adherence to a trading plan and risk management rules.

- Speed: The ability to execute trades quickly and efficiently is essential for capturing small price movements.

- Technical Skills: A deep understanding of technical analysis, price action, and market sentiment is essential for identifying profitable scalping opportunities.

- Adaptability: Scalpers must be able to adjust their strategies to changing market conditions. It ensures that traders remain profitable even in volatile environments.

- Risk Management: Effective risk management is crucial to protect capital and avoid significant losses. Scalpers often use tight stop-loss orders and small position sizes to mitigate against risk.

- Psychological Resilience: Scalping can be emotionally demanding. As such, it requires mental toughness to handle both wins and losses.

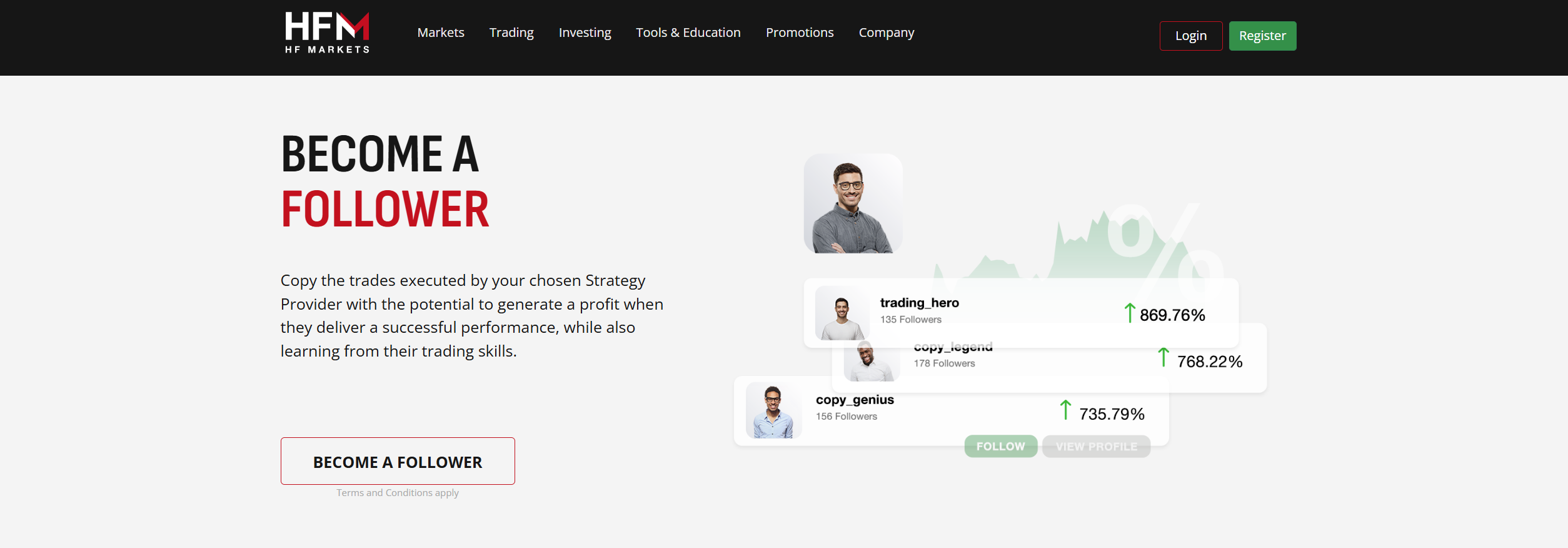

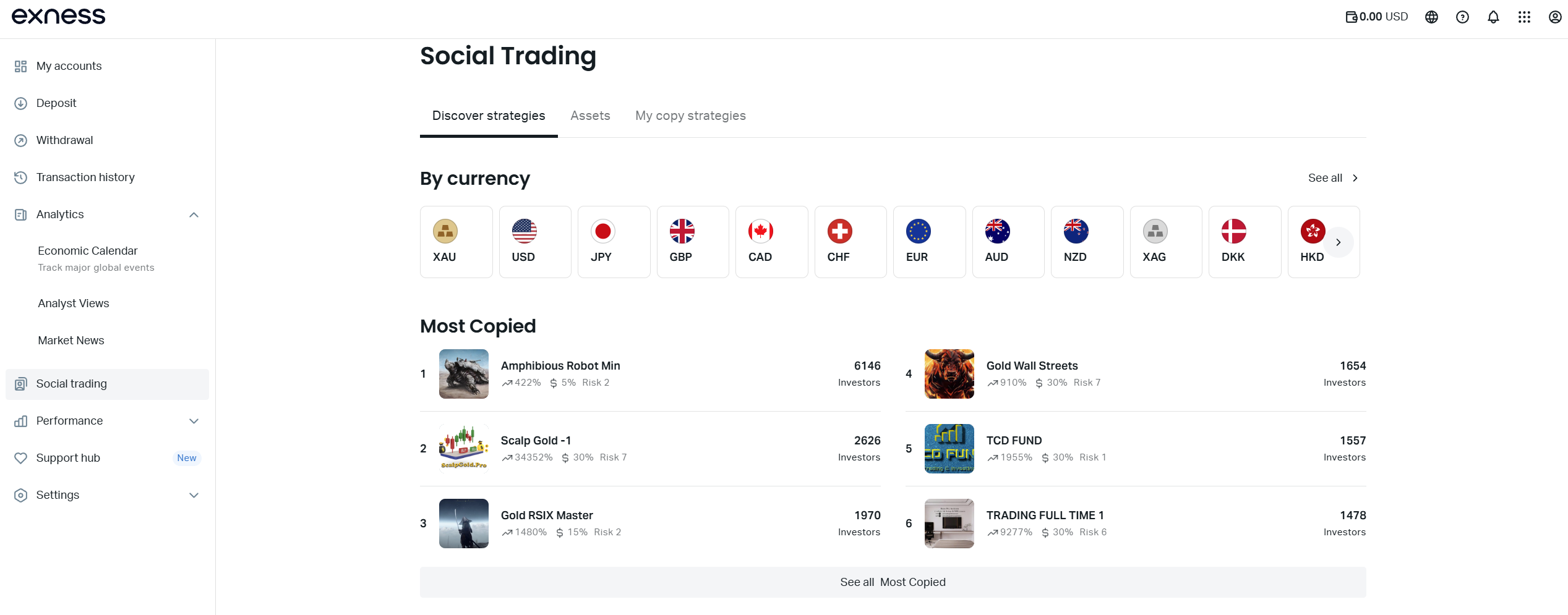

Top Scalper Traders on HFM and Exness

HFM and Exness, renowned forex and CFD trading brokers, provide access to some of the world’s cutting-edge copy trading platforms. These platforms host some of the Top Scalping Traders who excel in fast-paced, precision-driven strategies, enabling users to replicate their expert trades and capitalize on their ability to navigate and profit from rapid market fluctuations.

68% of retail investor accounts lose money when trading CFDs with this provider.

Past performance is no guarantee of future results.

Remember that Forex and CFDs available at Exness are leveraged products.

Their trading can result in the loss of your entire capital.

Past performance is no guarantee of future results.

Conclusion

Scalping is a dynamic and fast-paced strategy that requires a unique set of skills and mindset. As such, determining the best scalper trader in the world is no easy task and it is highly subjective. The article highlighted several renowned scalpers who have demonstrated exceptional prowess in scalping. Each of these traders has their distinctive strategies and mindset. What sets them apart is their discipline, psychological resilience, and commitment to continuous learning and adaptation. Scalping, by nature, is demanding and requires traders to make quick decisions under pressure. As such, it not only requires mastering the technical aspects of scalping but also the psychological discipline to succeed.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.