Best Brokers for Scalping Gold (XAUUSD)

Scalping is a popular trading strategy that involves making numerous trades over short time frames to capitalise on small price movements. In the world of trading, scalping gold (XAUUSD) has become increasingly attractive for a variety of reasons. As one of the most heavily traded assets in the markets, Gold has high liquidity and volatility which presents a wealth of opportunities for quick trades. However, the success of scalping gold also depends significantly on the broker you choose. The broker that you choose can make or break your trading experience. In this review, we are going to look at some of the best brokers for scalping gold (XAUUSD). But first, let’s understand a few things better.

What is Scalping?

Scalping is a short-term trading strategy where traders aim to make profits from small price changes. Traders enter and exit positions multiple times within minutes, seconds, or even milliseconds. The goal is to accumulate small profits that can add up to significant gains over time. This trading style requires precise execution, low spreads, and minimal slippage, making the choice of broker critically important.

Why Scalp Gold (XAUUSD)?

Gold is usually traded against the US Dollar denoted as (XAUUSD). It is one of the most popular commodities for scalping for a variety of reasons. These include:

- High Liquidity - Gold is one of the most liquid assets in the financial markets. High liquidity means there are always buyers and sellers. This leads to tighter spreads and quicker execution of trades.

- Volatility - Gold prices can be highly volatile due to various factors such as geopolitical events, economic data releases, and changes in interest rates. This volatility provides numerous opportunities for scalpers to enter and exit positions profitably.

- Safe-Haven Asset - Gold is often considered a safe-haven asset, especially during economic uncertainty. This characteristic can lead to predictable market behaviours, which scalpers can exploit.

- 24-Hour Market - The gold market is active 24 hours a day, five days a week, providing ample opportunities for scalping at any time.

Key Considerations for Choosing a Broker for Scalping Gold

When selecting a broker for scalping gold, traders should consider the following factors:

- Low Spreads - Scalping involves making numerous trades with small profit margins. Low spreads are essential to ensure that these small gains are not eroded by transaction costs.

- Fast Execution Speed - Scalping requires entering and exiting trades quickly. A broker with fast execution speeds can help traders avoid slippage, which can eat into profits.

- Regulation - Working with a regulated broker ensures a certain level of security and protection for your funds. Regulatory bodies impose strict standards on brokers, which can provide peace of mind for traders.

- Support for Scalping - Needless to say, the broker that a scalper chooses has to support scalping as a trading strategy. Not all brokers support scalping.

With that in mind, let’s now take a look at some of the best brokers for scalping Gold (XAUUSD).

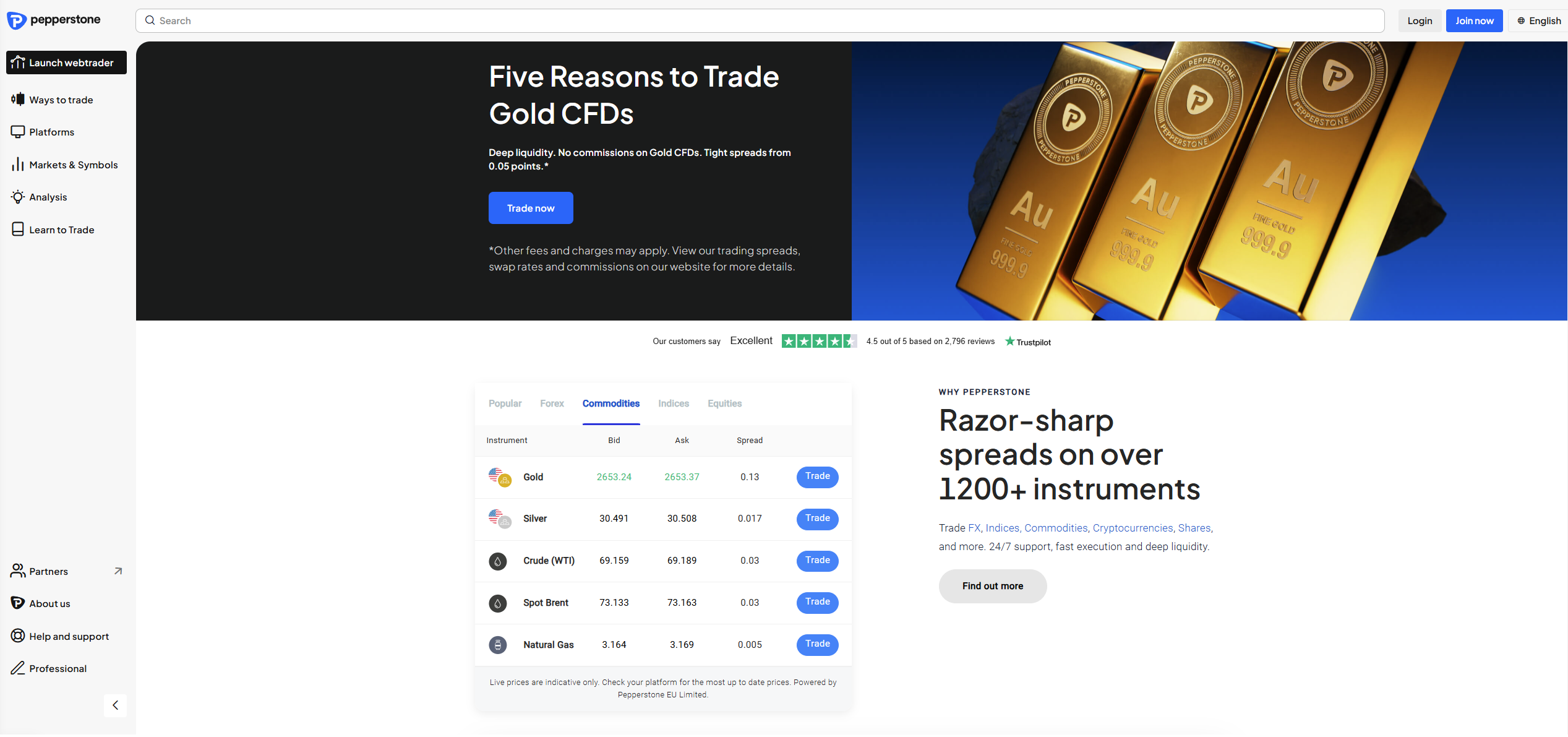

Pepperstone

Pepperstone is one of the top brokers when it comes to scalping gold as the broker features favourably low spreads on gold. The minimum spread for this asset is just $0.05 (equivalent to 0.5 pips), which is notably low. Note that minimum spreads can be slightly higher than average and typical spreads. However, the average spread for this pair remains low at just $0.19. Gold is available on this broker as a CFD.

Prices and spreads are subject to change. Check your platform for the most up to date data.

On another note, Pepperstone has probably the fastest order execution times in the market. Most orders are executed in less than 30 milliseconds or 60 milliseconds depending on the Pepperstone branch that a broker is trading on. These fast executions are thanks to industry standard trading platforms that include MetaTrader 4, MetaTrader 5, cTrader, TradingView, and the Pepperstone Trading Platform. Importantly, these platforms also give traders access to a plethora of other market products. These include CFDs on forex, indices, commodities, cryptocurrencies, and ETFs.

Finally, the broker operates under the supervision of various financial regulators. These include the FCA in the UK, the ASIC in Australia, the CySEC in Cyprus, the CMA in Kenya, and the DFSA in the DIFC.

75.9% of retail CFD accounts lose money

Exness

Exness is a popular broker known for its low spreads across its various accounts. This low spread characteristic is one of the reasons why Exness is among the best brokers for scalping. When trading gold, the average spread is $1.6 (16 pips) on both the standard and standard cent accounts with no commission charged. Conversely, the Pro account offers lower spreads, averaging 11.2 pips with no commission on the XAUUSD pair.

Meanwhile, the raw spread account delivers average spreads of 2.3 pips, with a commission of $3.5 per side per lot for gold trading. Finally, the zero account provides spreads starting at 0.0 pips, along with a commission of $5.5 per side per lot. Note that gold is only available to trade as a CFD on the Exness trading site.

Spreads are subject to change. Check your platform for the most up to date data.

Spreads are subject to change. Check your platform for the most up to date data.

Besides gold, this broker provides a diverse range of other trading instruments, enabling investors to diversify their portfolios. The other assets include CFDs on forex, indices, other commodities, stocks, and cryptocurrencies. The broker supports multiple trading platforms, such as MetaTrader 4, MetaTrader 5, and Exness Trader. These platforms have fast execution times, which makes them perfect for scalpers. Moreover, this broker supports the use of Expert Advisors which are also heavily used by scalpers.

In terms of regulation, this broker is overseen by several regulatory bodies. These include the FCA in the UK, CySEC in Cyprus, the FSCA in South Africa, and the CMA in Kenya, among others. While the broker accepts retail traders from most countries around the world, clients from the European Economic Area and the UK are not accepted.

Remember that forex and CFDs available at Exness are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

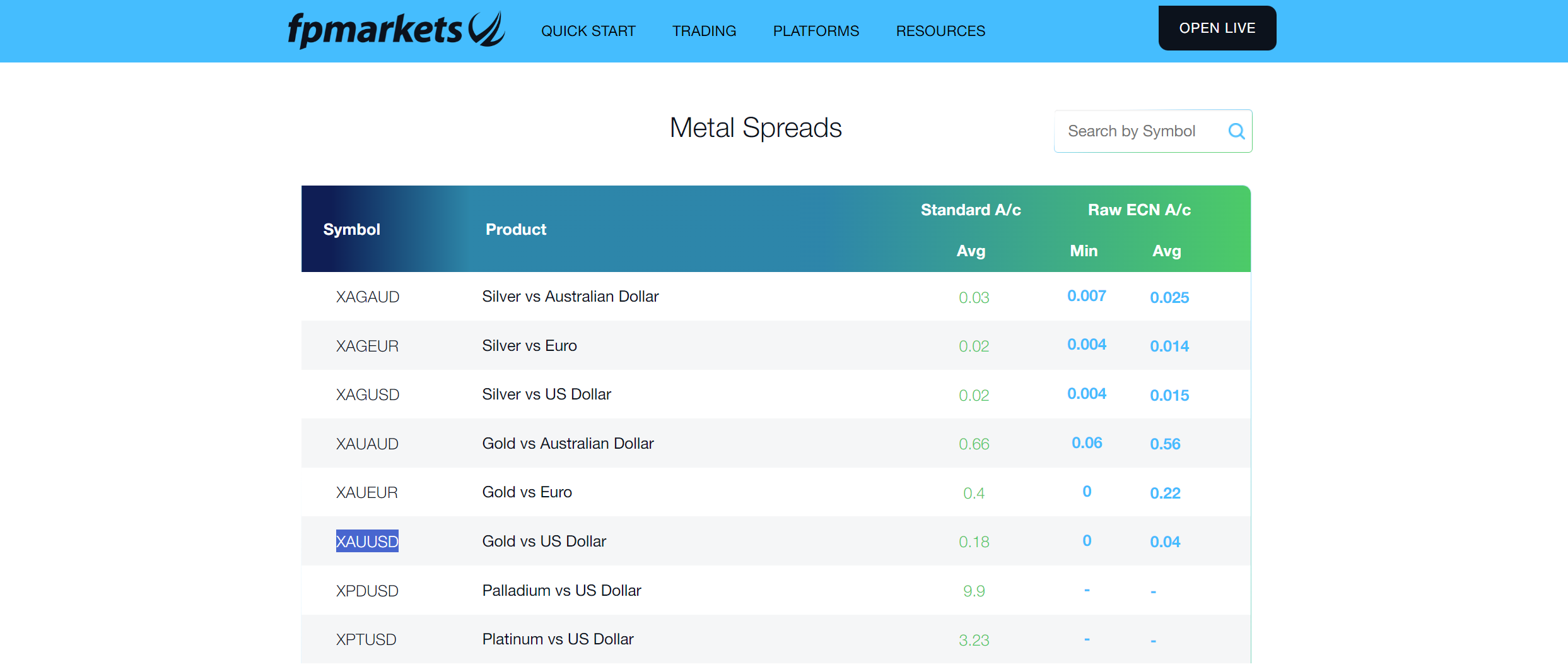

FP Markets

FP Markets is often regarded as the lowest-spread gold broker in the world. For its standard account, spreads for gold start at only 0.18 (1.8 pips) with no commission charges. In contrast, the raw account offers spreads as low as 0.0, with an average spread of 0.04 (a low commision of 3$ per side per lot applies here). On top of that, this broker features fast execution speeds, typically under 1 second, on all its trading platforms available. To place orders, traders can choose to use MetaTrader 4, MetaTrader 5, TradingView, Iress, or cTrader.

Prices and spreads are subject to change. Check your platform for the most up to date data.

Besides gold, there are other metals to trade, such as silver, lead, palladium, zinc, and copper. All these metal assets are available as CFDs, including gold. Additionally, traders can invest in forex currency pairs and CFDs on indices, stocks, commodities, and ETFs. This allows traders to diversify their portfolios as desired. Serious traders usually only invest with brokers who are regulated by recognised institutions around the world. Luckily, FP Markets operates under the authorisation and examination of the CySEC, the ASIC, and the FSCA, among others.

72.44% of retail CFD accounts lose money

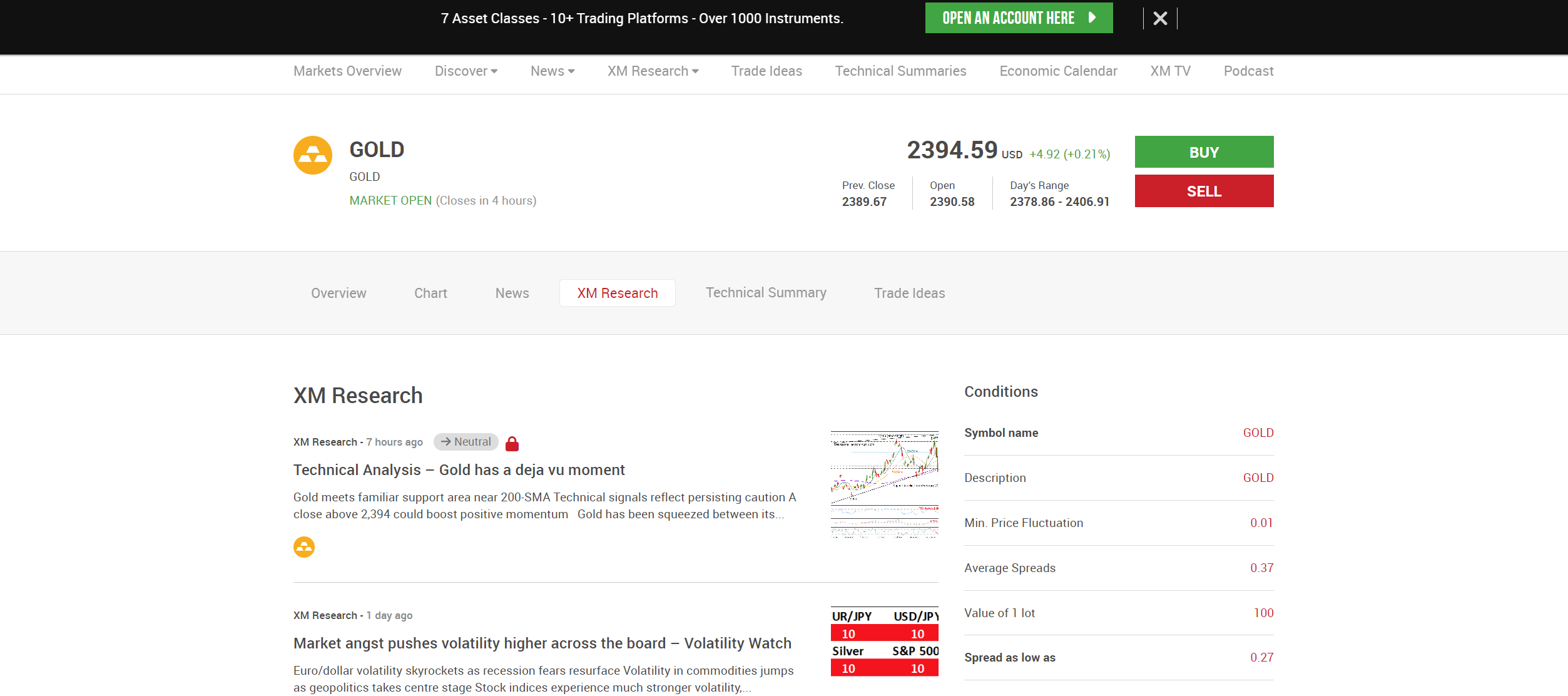

XM

XM is another broker that allows for gold scalping with some of the lowest gold spreads. Gold is available for trading as a CFD and comes with competitively low spreads starting at just 0.27 (2.7 pips). The available trading platforms are MetaTrader 4 and MetaTrader 5. The MetaTrader platforms are widely popular among traders for their fast execution and advanced functionalities. Typically, orders are executed in under 1 second on the XM broker site.

Prices and spreads are subject to change. Check your platform for the most up to date data.

Other than gold, traders also have access to assets in other asset classes. These include CFDs on forex, indices, energies, shares, cryptocurrencies, and other precious metals. XM offers low spreads when trading other assets on the broker site. Major currency pairs on this broker site feature spreads from as low as 1.0 pips on the standard account with no commission required. Finally, this broker is under the regulation of a variety of organisations including the ASIC in Australia, the CySEC in Cyprus, and the DFSA in the DIFC, among others.

75.18% of retail investor accounts lose money when trading CFDs with this provider.

XTB

XTB is widely recognised as one of the lowest-spread gold brokers in the market. On top of that, this broker features ultra-fast execution speeds in the markets. The combination of these two features makes XTB a perfect fit for scalping gold (XAUUSD). On the XTB broker site, gold is available to trade as a CFD against the US Dollar with spreads as low as 0.3 (=3.0 pips). There is no commission charged while trading Gold on the XTB trading site.

Spreads are subject to change. Check your platform for the most up to date data.

Beyond gold, traders can invest in a wide range of other assets. These include CFDs on forex, commodities, indices, cryptocurrencies, equities, and ETFs. XTB provides traders with its in-house trading platform called xStation 5, which has an intuitive interface. Further, XTB is overseen by several global organisations including the FCA in the UK, the KNF in Poland, the CySEC in Cyprus, and the FSC in Belize.

69-74% of retail investor accounts lose money when trading CFDs with this provider.

HFM

Next up is HFM which is another great broker for scalping gold. HFM offers relatively low spreads on the XAUUSD pair across all account types. The premium and cent accounts have spreads as low as 25 pips, while the pro account starts at 16 pips. In regions where the top-up bonus account is available, spreads start at 26 pips for gold. Lastly, the zero account features spreads for the XAUUSD pair starting at just 3.0 pips. Please note that preads are subject to change.

Check your platform for the most up to date data.

The broker has no minimum deposit requirement for gold trading. Another feature that makes HFM popular among the top scalpers in the world is the selection of trading platforms available. Traders can choose from MetaTrader 4, MetaTrader 5, and the HFM Platform for their trading activities. These have fast execution speeds and give traders access to a diverse collection of market products.

In total, traders have access to over 1,000 assets which include CFDs on forex, energies, indices, stocks, commodities, bonds, ETFs, and cryptocurrencies. Gold is also available on this broker site as a CFD. The broker operates under the supervision of various regulatory bodies. These include the CySEC in Cyprus, the FCA in the UK, the CMA in Kenya, and the FSCA in South Africa.

68% of retail investor accounts lose money when trading CFDs with this provider.

Octa

The last gold broker we will feature here is OctaFX. This broker also allows for gold scalping with relatively low spreads. With OctaFX, the XAUUSD pair has a spread as low as $1. 9 (=19 pips) with no commission required.The broker promises traders no spread markups when trading. With MetaTrader 4, MetaTrader 5, and OctaTrader, gold scalpers can expect some of the fastest order execution times in the market. Note that gold is available to trade as a CFD. This means that you will not actually own the gold when trading.

Please note that preads are subject to change. Check your platform for the most up to date data.

Besides gold, the broker allows its traders to diversify their portfolios by investing in a variety of other assets. In particular, traders can trade currency pairs, and CFDs on stocks, indices, commodities, and cryptocurrencies. Further, the regulatory status of this company is in good standing. It holds licenses from the FSCA and MISA in Mwali. While Octa accepts traders from most countries around the world, they do not accept retail clients from the UK and EEA countries, among others.

Remember that forex and CFDs available at Octa are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

Closing Remarks

Scalping gold (XAUUSD) can be a highly profitable trading strategy when executed correctly. However, choosing the right broker is crucial as it can greatly affect your success as a scalper. The brokers highlighted in this article are among the best options for traders looking to scalp gold. Each of these brokers offers competitive spreads, fast execution speeds, and reliable trading platforms, all of which are crucial for effective scalping. Additionally, they are regulated by reputable authorities, ensuring a secure trading environment. Nonetheless, the best broker for scalping gold will depend on your individual needs and preferences. It is important to do your research and compare different brokers before making a decision.

Top-Tier Trusted Broker

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.