What Broker Has the Most Stocks - Findings

The introduction of online trading platforms has made it easier to invest in the stock market. While some investors may prefer a concentrated portfolio, a majority are increasingly trading several stocks at a time for diversification purposes. The bottom line is choosing the right broker to invest with is paramount. While the number of individual stocks is important to consider, it is also important to consider accessibility, the types of stocks listed, exchange coverage, and the commissions and fees that apply. In this short review, we are going to be checking to see what broker has the most stocks in the market. Let’s jump in.

Understanding Stock Trading

Before venturing into the world of online brokers and their stock selections, it's crucial to grasp the fundamentals of stock trading. When you buy a stock, you're essentially purchasing a tiny piece of ownership in a company. The company's performance directly impacts the stock's price. If the company thrives, the stock price typically rises, potentially generating a profit when you sell. Conversely, a company's struggles can lead to a decline in stock price, resulting in a loss if you sell.

Stock trading is often categorised by the time or the holding period. Long-term trading involves buying shares of a company and holding them for a long period of time. Conversely, short-term trading involves buying and selling shares over a short period of time. Lastly, there is ultra short-term trading. It involves holding the trade for a very short period of time this can be even milliseconds. Usually, ultra short-term trading is done by high-frequency traders or algo traders.

It is important to know that some brokers list real stocks on their broker sites while others list stock CFDs. Real stocks allow traders to receive ownership rights proportional to the number of shares they hold. In contrast, CFDs are contracts between a trader and a broker. The trader speculates on the price movement of an underlying asset, in this case, a stock, without actually owning the stock itself. Today, we will focus more on the brokers that provide traders with real stocks rather than CFDs.

Quick Stock Broker Comparison Table

| Brokers | Number of stocks | Regulated by: |

| Public.com | 9,000 | FINRA, SEC, SIPC |

| Tastytrade | 8,000 | FINRA, SEC |

| Fidelity | 7,000 | FINRA, SEC |

| eToro | 6,000 | FCA, CySEC, ASIC |

| Robinhood | 5,000 | FINRA, SEC, SIPC |

| Vanguard | 3,700 | FINRA, SIPC |

| XTB | 3,095 | FCA, CySEC, KNF |

| Charles Schwab | 3,000 | FINRA, SEC, SIPC |

| E-Trade | 750 | SIPC |

Public.com

Public.com was founded in 2019 and is based in New York. It is an online brokerage platform that focuses mostly on technology and alternative investing. Notably, traders can diversify their portfolios with various global markets including stocks, ETFs, and fixed income. They can also invest in alternative investments such as fine art, collectables, and royalties. As a trader, you can access over 9,000 stocks using Public.com’s broker site. Moreover, there are more than 300 stocks which can be traded over-the-counter (OTC) which focus on large-cap international companies.

At Public.com, a trader can buy stock at a minimum of $5 for fractional trading. This is available for both the stocks worth less than $1 and Over the Counter stocks. Luckily, stock and ETF trades are commission-free on this broker site. Nonetheless, there are some fees that may apply such as regulatory fees, subscription fees, wire transfer fees, and paper statement fees.

The platform has a community of investors, creators, and analysts that allows users to share ideas and trading opportunities with each other. It also offers an AI research assistant that provides investors with the ability to ask questions and get answers in real-time.

Unlike most online brokers, Public.com does participate in payment for order flow (PFOF). This means that they don’t sell trades to market makers. By not offering PFOF, Public.com removes conflict of interest from its business model. This allows Public.com to get the best possible price for its traders.

Is Public.com safe?

Regulations are among the most crucial aspects to look for in a broker. Brokers who are regulated by respectable organizations typically have a stronger commitment to abiding by the law and order to ensure that the market is equitable for all investors. However, rules by themselves are insufficient. A business must nevertheless show that it is committed to following regulatory laws.

The Securities and Exchange Commission (SEC) primarily oversees Public.com’s operations. However, it is also subjected to regulation by state governments, stock exchanges such as Nasdaq and the New York Stock Exchange (NYSE), and the Financial Industry Regulatory Authority (FINRA). FINRA is a private, non-governmental organization that oversees all US securities companies that deal with the general public. Additionally, because Public.com is an SIPC member, all its clients are immediately eligible for protection on up to $500,000 on their accounts.

Honourable Mentions

eToro

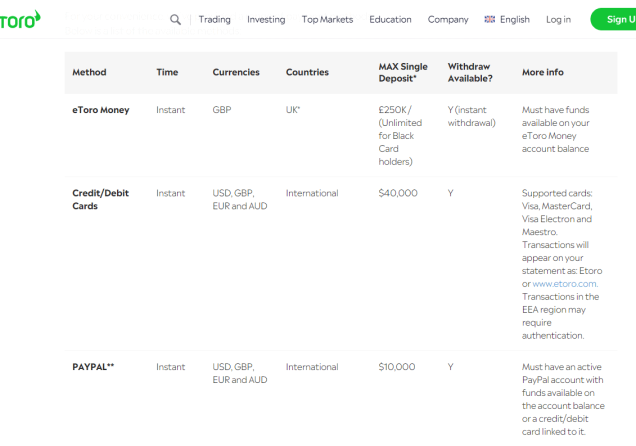

eToro is a globally popular broker that features a huge number of individual stocks to invest in plus a well-regulated trading environment. On this broker site, traders have access to stocks totalling over 6,000 different stocks from 20 different stock exchanges. This includes the stock of companies located all around the world. Better yet, eToro allows traders to invest in this deep collection of stocks with a low commission fee.

Apart from stocks the broker also provides access to ETFs and cryptocurrencies (both as real underlying assets). The broker provides its proprietary trading platform, eToro. This platform also features also the innovative CopyTrader technology, enabling traders to engage in copy trading seamlessly.

On regulations, this broker is under the supervision of a plethora of financial regulators. These include the FCA, the CySEC, and the ASIC.

Your capital is at risk

XTB

XTB is a well-established broker that features one of the deepest collections of real stocks on its broker site. On the XTB platform, traders gain access to a total of 3,095 different real stocks from 16 different exchanges worldwide. Traders can find here a wide array of stock selections including those for renowned companies like Apple and PayPal, among others. There is also a wide selection of stocks of lesser-known companies available to trade.

Even better, trading stocks on this broker's platform is completely commission-free. For trading real stocks on XTB, a 0% commission applies to monthly turnovers of up to EUR 100,000 (or the equivalent in other currencies) per account. While it may not offer the most stocks by any broker, it contains a deep enough collection and a good reputation to back it up.

The trading platform available to use on this broker site is the xStation 5, built by XTB’s in-house team. On regulations, this broker operates under the supervision of a couple of financial watchdogs. These include the FCA in the UK, the KNF in Poland, the CySEC in Cyprus, and the FSC in Belize. Regulations alone are never enough. However, having regulations from organisations such as the FCA and the CySEC is usually a good sign.

Your capital is at risk

Final Thoughts

Many investors who trade financial markets online want to diversify their portfolios to help spread the risk of investing. Fortunately, most of the brokers in the market offer a diverse variety of trading products across many asset classes. For stock brokers, there are various brokers that feature a huge collection of individual stocks from different industries and stock exchanges. The brokers we mentioned here stand out for the number of stocks they offer and the regulated trading environments they provide. Still, the choice of the broker comes down to an individual trader’s preferences.

While trading, it is crucial to consider your financial objectives, risk tolerance, and the amount of time and resources you are willing to devote. Additionally, you must conduct your own research and compare brokers to see which one best matches your needs.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.