FTSE 100 Spread Betting

FTSE stands for the Financial Times Stock Exchange. This stock exchange now goes by the name FTSE Russell Group and is owned by the London Stock Exchange alongside other bourses and companies. Notably, the FTSE provides a plethora of indices including the FTSE 100 index. Today, this index is one of the most popular among traders.

In this article, we are going to discuss FTSE 100 spread betting and look at some of the brokers that allow traders to do that. But before we do that, let’s have a little more information on the FTSE 100 and spread betting.

What is The FTSE 100?

The FTSE 100 is an index that keeps track of the 100 biggest companies listed on the London Stock Exchange by market cap. This index is issued by the Financial Times Stock Exchange and is commonly known as the footsie. The ranking of these companies in the FTSE 100 list changes depending on their performance at a given time.

The movement of the FTSE 100 is calculated as the total market capitalization value of the individual companies in the index. As such, the movement of the share prices for individual companies has a compounding effect on the movement of the FTSE 100 index.

What is Spread Betting?

Spread betting is a type of derivative trading that allows investors to speculate on the price of an asset without owning the underlying asset. As the name suggests, this type of trading involves traders betting on whether the price of an asset would rise or fall depending on the price the broker gives them. They do not need to own an asset to speculate on its price. Let’s look at some advantages and disadvantages of spread bet trading.

Advantages of Spread Betting

- Spread betting is leveraged. This means that traders can control larger positions than they could when using their capital only.

- You can bet on the price to go up or down. This can be better than just holding a share and hoping for the price to go up.

- Returns from spread betting are tax-free in the UK and Ireland. The returns are exempt from capital gain tax and you don’t have to pay stamp duty tax either because you don’t own the underlying asset.

- Spread betting is a great way to hedge a share portfolio. You can hedge an asset that moves in the opposite direction to your share portfolio, hence offsetting the risk.

Disadvantages of Spread Betting

- Spread betting is very risky due to market volatility and most traders end up losing their investment.

- As spread betting is leveraged, traders can end up losing over 100% of the amount they place the order with.

- No ownership of the underlying asset means that an investor has no impact on the market and remains a mere third-party participant.

Evidently, there are many risks involved in spread betting. However, this type of trading does have its advantages and many investors are comfortable spread betting while knowing the risks involved. And now that we have a little more understanding of FTSE 100 spread betting, let’s look at some brokers that allow investors to spread bet on the FTSE 100. Generally, spread betting is only available to clients in the UK and Ireland. However, it is important to check country regulations before investing to ensure it is legal.

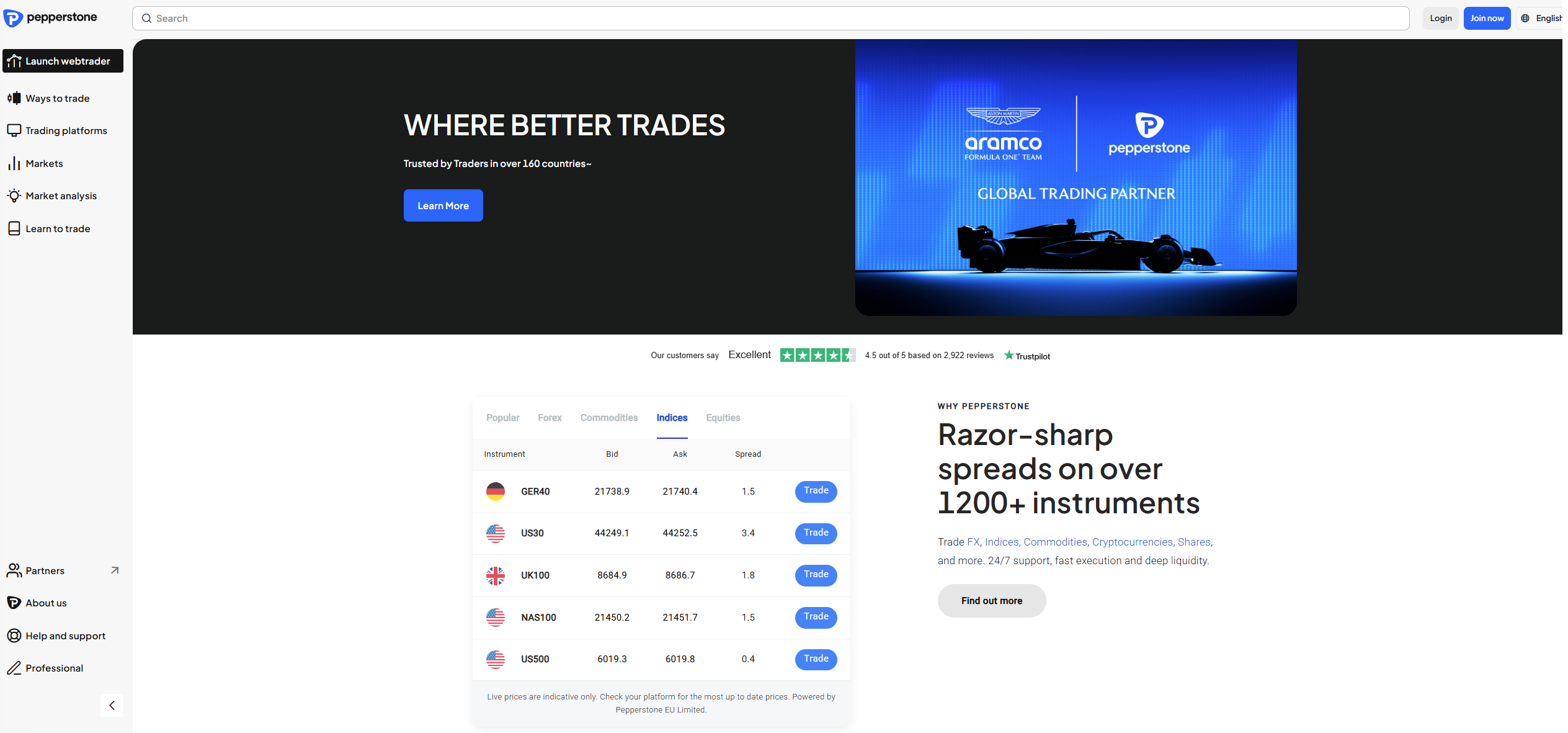

Pepperstone

Pepperstone is quickly growing in reputation among traders. Today, the broker offers a wide range of financial services to its clients. For example, it is one of the best forex brokers for backtesting. Notably, Pepperstone is one of the brokers that allow spread betting on the FTSE 100. This index is available on the Pepperstone broker site under the ticker UK 100 and is available for spread betting and trading as a CFD.

The FTSE 100 index is not the only index available for trading on the Pepperstone trading platform. There are many other indices available including US Tech 100, CANADA 60, US Wall Street 30, US 2000, and more. Clients can also diversify their portfolios by spread betting on assets from other markets. The markets available for spread betting on Pepperstone include indices, forex, commodities, and stocks.

The fees for trading on this broker site are fairly low with spreads as low as 1.0 pips on the standard account. However, clients can trade with even lower fees on the razor account with spreads as low as 0.0 pips and a commission from $3.50 per lot per side per lot.

For a trading platform, clients can choose between four world-class trading software. These include MetaTrader 4, MetaTrader 5, TradingView, and cTrader. These platforms are widely used for their ease of use and fast order execution. They give Pepperstone some of the fastest execution times in the market averaging between 30 milliseconds to 60 milliseconds.

Now let’s see how Pepperstone's activities in the market are regulated. Positively, this broker has regulations in Australia by the ASIC, in the UK by the FCA, in Germany by the BaFin, and in Kenya by the CMA.

75.3% of retail CFD accounts lose money

CMC Markets

CMC Markets is another reputable broker that allows brokers to spread bet on the FTSE 100. Traders can go long or short on positions depending on how they see the price moving. Notably, clients can also trade this index as a CFD or trade its ETFs. Even better, the FTSE 100 is not the only index available to trade on this broker site. In total, there are over 80 cash and forward global indices availed to clients for spread betting. Additionally, clients can spread bet on forex, commodities, shares, ETFs, share baskets, and treasuries.

Positively, the company promises the best pricing when trading these instruments. CMC Markets charges variable spreads to clients when trading. For example, the spreads on the EUR/USD and the USD/JPY can go as low as 0.7 pips. This is very attractive to all kinds of traders. While the spreads are variable, it is good to know they can drop this low. The platform available to clients is MetaTrader 4 which is suitable for both novice and experienced brokers.

Now let’s close out on this broker by looking at its regulatory status. CMC Markets is operating in multiple jurisdictions legally under the supervision of reputable regulators. The company is licensed and regulated by the FCA in the UK and BaFin in Germany. Investors should only invest in regulated brokers as they are less likely to defraud clients.

AvaTrade

AvaTrade is a global financial broker that is widely considered a tier-one broker among many traders. With this broker, clients get access to various market instruments available for spread betting. Traders can spread bet on forex, metals, energies, commodities, indices, bonds, equities, and ETFs. Among the indices available to clients is the FTSE 100 index under the symbol UK100. However, spread betting is only available to clients based in the UK and Ireland.

Trading with AvaTrade does not require clients to pay hefty fees. AvaTrade offers some of the lowest spreads in the market that go as low as 0.9 pips for major currency pairs. Such low spreads are attractive to all kinds of traders.

Further, AvaTrade offers market-standard trading platforms that include the MetaTrader 4 and MetaTrader 5 in addition to its own trading platform AvaTradeGO. These platforms have a lot of capabilities and fast execution. Traders also have access to ZuluTrade and DupliTrade for copy-trading in case they lack the time or knowledge to invest using their own strategies.

Finally, let’s talk about AvaTrade’s regulatory status. AvaTrade operates under the supervision of the ASIC, the Central Bank of Ireland, the FSCA, and the BVIFSC. While regulations alone are not enough, you’re much safer with a company under the supervision of world-class organizations.

76% of retail CFD accounts lose money

IG

IG is yet another top-tier broker that allows for spread betting of FTSE 100. This means that you take a position on the price of the FTSE 100 rising or falling. If you think the price would rise, you’d buy with spread bets and you’d sell if you think the price will fall. While this is one of the most popular indices on the platform, there are many others available for trading. These include Germany 40, US Tech 100, and US 500, among others. In total, there are 80 different indices to invest in through spread betting.

Other markets that people spread bet on include shares, forex, and commodities. These instruments are available to trade on industry-standard platforms including MetaTrader 4, ProRealTime, L2 Dealer, and the ProgressiveWebApp. Better yet, the fees for trading these instruments are industry-standard and manageable. The average spreads on IG can fall as low as 0.6 pips for some major currency pairs. These are some of the lowest spreads in the market.

Moving on to the regulatory status, IG has regulations and licenses from the FCA in the UK, the ASIC in Australia, the BaFin in Germany, and the FSCA in South Africa. Most of these regulators have strict rules that brokers must follow before attaining a license. While regulations alone are never enough, it is definitely a good sign to be regulated in multiple jurisdictions.

City Index

We will close out our list with City Index, a spread betting broker that launched in 1983. Today, City Index is considered one of the best forex brokers for spread betting. When spread betting on indices with City Index, clients can expect competitive pricing and round-the-clock trading. The FTSE 100 index is available for trading on this broker site under the ticker UK 100.

Interestingly, Indices are not the only asset class available for spread betting on City Index. Investors can also spread bet on shares, forex, and commodities. In total, there are over 4,000 spread betting markets to choose from. Such a collection of instruments allows clients to diversify their portfolios and spread their risk of investment across various markets. The spreads on this broker site can go as low as 0.6 pips for major currency pairs.

The trading platforms available to choose from include MetaTrader 4, WebTrader, and Tradingview. These are powerful platforms that feature powerful tools to assist clients in trading and analysis. Furthermore, investors have access to Trading Central, one of the best analytical software in existence.

In terms of regulations, this broker has a nice collection of regulatory licenses. The broker is regulated by the CySEC, the ASIC, and the FCA, three of the top financial regulators in the market.

Final Thoughts on FTSE 100 Spread Betting

The FTSE 100 is one of the most attractive indices for traders to invest in today. And while there are many benefits to spread betting on this index, there are also risks that traders must be aware of. Nonetheless, this index has great significance, especially in expressing to some extent the strength of the UK economy.

In this review, we looked at some of the brokers that support FTSE 100 spread betting. These brokers have fair trading conditions and regulations from strict world-class regulators. Still, there are other brokers that support FTSE 100 spread betting that did not make it to our list. Make sure you pick and choose a regulated broker that best suits your needs, whether they are in this article or not.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.