Financial Spread Betting - Say no to Stamp duty & Capital gains tax

Spread betting is a form of speculative trading in which the trader places a bet on the expected movement direction of an asset, and allocates a cash amount to the trade in order to profit from the price movement without actually owning the asset. Financial spread betting is in many aspects very similar to CFD trading, there are just a few differences that these two investment types have.

What financial assets can you spread bet?

It is possible to spread bet on several asset types: forex pairs, stocks, bonds, commodities and indices. Some platforms also support spread betting on cryptocurrencies. Spread bets are all traded the same way, no matter the asset type.

In this article, we will cover how to go about spread betting in 4 simple steps:

[stm_company_history][stm_company_history_item title="a) Asset direction" description="Getting the asset direction correct. This is dependent on using a profitable strategy."][stm_company_history_item title="b) Investment amount" description="Determining the right amount to commit to a spread bet."][stm_company_history_item title="c) Risk management" description="How should you manage the risk of your spread bets to increase your chances of succeeding."][stm_company_history_item title="d) How to identify the right entry and exit points" description="What methods should you use to get in and out of your spread bets at the best time"][/stm_company_history]

So assuming a trader intends to spread bet one of the stocks listed in the UK stock market, how will this be done using the 4 principles outlined above?

Asset Direction

The asset direction is at the core of the success of spread betting because one of the parameters used in calculating profits or losses in spread bets is the number of points by which the asset has moved. In order to successfully predict the direction in which an asset will head, you must use technical and fundamental analyses. Technical analysis relies on charts and is used to detect possible entry and exit points. Fundamental analysis, on the other hand, focuses on the news (for instance, earning reports of a company). The news provides a long-term view of an asset direction, while the chart information tells you when to enter and exit your spread bet.

Determining the Spread Bet Investment Amount

Let us assume you decide to set up a spread bet on a stock MNO at £4.05 per share. Spread bets are placed on the basis of £/point, so the spread bet provider will prompt you to state how much (in £) you want to set per point (or per pip) for your spread bet. Various assets are priced differently, so you need to know the lowest/highest amount you can set. This is important for risk management (which we shall discuss later).

Stocks are priced to 2 decimal places (i.e. 0.01 points). The cash amount (in £s) staked per point will determine in monetary terms, how much your investment will translate to when the price starts to move.

Important in this consideration is leverage, which determines what percentage of the overall cost of setting up the spread bet you will be required to put forward as the margin. Do not forget that spread betting is leveraged, so the trader is only required to come up with a fraction of the total investment for each trade.

For the purposes of simple explanation, let us assume that you use 1:50 leverage, with a spread bet for MNO stock set at a rate of £30 per point. Leverage of 1:50 will mean that you are only required to come up with 2% of the total cost of the trade. So, 2% from £30/point is £0.6/point, that is your margin in this particular bet.

Trade Size and Risk Management

The next point is determining the trade size. This should not be done randomly, but rather in the context of risk management. The cost of placing your spread bet should not exceed 3% of your total capital. So, if your account size is £5,000, the maximum investment in all trade positions should not exceed 3% of this amount, which means £150. If we worked again with the example in the paragraph above, we already know that the margin for MNO stock is £0.6/point. That means for £150 will be able to fetch 250 units of MNO stocks. If you intend to set up two positions, then you have to split the £150 into 2 trades.

Proper Entry and Exit points

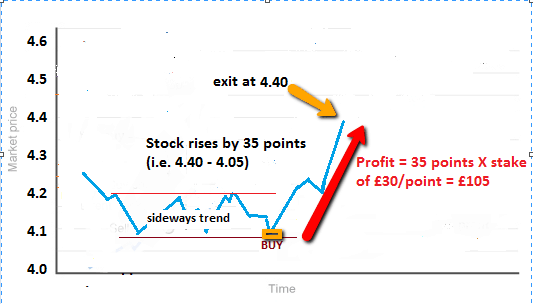

The concepts of technical analysis are beyond the scope of this piece, so you will have to study them privately. But the rule of the thumb is to buy on a dip in an uptrend and sell on rallies in a downtrend. If the price is in consolidation (i.e. in a sideways range), you might want to buy as close to the support level ass possible, and sell close to the resistance level.

Let us assume that prices are range-bound, and you buy at the support level of £4.05. Prices eventually pick up and you exit at £4.40. What is your profit then?

The profit is: (4.40 – 4.05) X £30/point = £105

You deduct the entry price from the exit price and multiply the result by the leveraged investment. Notice that profits (and losses) are calculated from the full cost of the position and not by the small percentage put up for the trade as margin.

Please take note. All assets traded as spread bets are priced with a bid and offer price. Therefore, you will be charged a spread on trade entry. The spread is the difference between the bid and ask (offer) prices and this fee is deducted from your account as soon as your trade becomes active.

The Tax-Free Nature of Spread Betting

Spread betting does not attract stamp duty charges and is also free of capital gains tax. Capital gains tax is a form of tax which is paid on profits from financial market trading. So how come spread betting is exempt from this tax when other forms of financial trading are not? Here is how the tax-free nature of spread betting works.

A spread bet is considered to be…a bet! It is not treated as a financial transaction because when spread betting, you are not purchasing or holding the physical asset. You are merely speculating on the outcome.

Spread Betting: The Pros and Cons

The pros of spread betting are as follows:- Spread bets are exempt from stamp duty and capital gains taxes.

- Spread bets are commission-free, which makes them cheaper to trade than futures or options.

- Spread bets are leveraged, which helps a little capital go a long way. But be careful; leverage is a two-edged sword.

- Spread bets can be done round-the-clock, meaning that in a 24-hour day, there is always a trade opportunity.

- Two-way trading enables short-selling; a good way to profit from falling markets.

- Spread betting provides access to thousands of markets around the globe.

- The trader can spread bet on various asset types. For instance, you can bet on Amazon shares, or on the FTSE100 index or a popular commodity like Brent crude.

- Spread bets cannot be hedged, and this magnifies the risk.

- It is not possible to offset any sustained losses when doing a tax report.

- The trader bets against the platform providers as the counterparty since spread bets are by nature, not exchange-based assets.

Who Should Be Spread Betting?

Spread betting carries an element of risk which surpasses the risk seen in conservative markets such as the stock market. Therefore, it is expected that those who spread bet should ideally have had some form of training on how to trade Over-the-Counter (OTC) derivative markets.

If you have had some experience in trading forex or regular options, then you would be in a good position to spread bet as many of the concepts would not be strange to you. For a complete spread betting beginners, it is highly recommended to practice on a demo account first.

Is Spread Betting Only a UK Thing?

Is Spread Betting Only a UK Thing?

Spread betting is deemed to be an activity practised only in the United Kingdom and Ireland, mostly because those jurisdictions are where you have a preponderance of spread betting companies. However, you can actually spread bet from anywhere in the world on these platforms, provided your country is one of the locations approved for such a service by the spread bet providers.

For instance, you can spread bet from South Africa with FSCA regulated brokers, Europe or Asia on various platforms. But depending on your location, you may not be tax-exempt; you have to check the tax laws in the country of your residence.

Is Spread Betting Legal Outside the UK?

The issue of the legality of spread betting is actually a matter of the location of the trader and the extant laws in that location. For instance, spread betting (as is most activity considered as online gambling) is considered illegal in the US. So if you are a US citizen or resident, you will be breaking the law if you engage in spread betting.

Spread betting is also illegal in Japan and Australia. It must be stated that the countries where spread betting is illegal are countries where laws have been passed banning the activity outright. There are countries where regulators have a negative view towards spread betting, but no laws have been passed to outlaw this activity. So traders in those countries tend to flock to the UK-based providers to spread bet on their favourite assets.

China represents a country which has a double-faced approach to spread betting. Spread betting is outlawed in the mainland but permitted in its administrative areas of Macau and Hong Kong.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.