Exness Deposit Methods - Fees, Processing Time & Limits

Exness, a prominent multi-asset broker, caters to a global clientele with a diverse range of trading instruments. It also provides a variety of accounts including two standard accounts and three professional accounts. One of the key aspects that make Exness stand out in the competitive world of online trading is its support for a wide range of deposit methods.

This allows traders to choose the payment option they are most comfortable with in terms of convenience, processing time, and fees. In this review, we will explore the various Exness deposit methods, highlighting their fees, processing times, and limits.

Exness' Approach to Deposits

Exness distinguishes itself by supporting a wide range of deposit methods to cater to the diverse needs of its global clientele. The company generally aims to provide traders with seamless transactions, under three main core principles.

- Variety of Payment Methods - Exness understands the diverse needs of traders worldwide. Therefore, it offers a wide array of deposit methods, including bank transfers, credit/debit cards, e-wallets, and cryptocurrency options, among others. We will cover these in more detail below.

- Emphasis on Speed - The broker strives for instant processing times, enabling traders to capitalise on market opportunities without undue delays. They process transactions automatically without manual intervention once they hit their processing end.

- Transparency Regarding Fees - While Exness often refrains from imposing its own deposit fees, it emphasises that third-party payment providers may apply charges. Therefore, the company maintains transparency regarding potential costs.

Remember that Forex and CFDs available at Exness are leveraged products.

Their trading can result in the loss of your entire capital.

Table of Exness Supported Deposit Methods

| Payment Method | Processing Time | Fee | Limits |

| Wire Transfers | Up to 48 hours | 0% | $5,000 - $100,000 |

| Credit/Debit Cards | Instant | 0% | $10 - $8,000 |

| Skrill | Instant | 0% | $10 - $100,000 |

| Perfect Money | Instant | 0% | $50 - $100,000 |

| Mobile Money | Instant | 0% | $10 - |

| WebMoney | Instant | 0% | $10 - $1,000,000 |

| Tether (USDT) | Up to 72 hours | 0% | $10 - $100,000 |

| Bitcoin (BTC) | Up to 72 hours | Network fee | $10 - $100,000 |

| Sticpay | Instant | 0% | $10 - $10,000 |

| Neteller | Instant | 0% | $10 - $50,000 |

| Mybux | Instant | 0% | $10 - $900 |

| Online Banking | Instant | 0% | $10 - $45,000 |

Overview of Exness Deposit Methods

1. Wire Transfers

Wire transfers are a way of funding your trading account by electronically transferring money from your bank account to the broker’s bank account. This is a common deposit method used by traders, especially for large transactions.

- Fees - Exness does not charge any fees for deposits made via wire transfers. However, it's important to note that individual banks may impose their own fees, which can vary depending on the bank involved and the country of origin.

- Processing Time - Wire transfers are generally slower compared to other deposit methods. The processing time can take up to 48 hours when depositing to Exness, depending on the bank involved and the country of origin.

- Limits - The minimum deposit amount for bank transfers on Exness is $5,000 and the maximum is $100,000.

2. Credit/Debit Cards

Credit and debit cards are among the most popular deposit methods on Exness due to their convenience and speed. Exness accepts deposits via major card providers including Visa, MasterCard, and Maestro.

- Fees - Exness does not charge any fees for deposits made via credit or debit cards. However, some card issuers may impose fees for international transactions or currency conversions. It's advisable to check with your card issuer for any potential fees.

- Processing Time - Deposits made via credit or debit cards are processed instantly by Exness. This allows traders to start trading almost immediately after the deposit is made.

- Limits - The minimum deposit amount for credit/debit card transactions is $10 while the maximum is $8,000.

3. Skrill

Skrill is a popular e-wallet that allows for quick and secure online transactions. It is widely used by traders due to its ease of use and fast processing times. Exness supports Skrill as one of its deposit methods, making it a convenient option for many traders.

- Fees - Exness does not charge any fees for deposits made via Skrill. However, Skrill may impose its own fees for transactions, especially for currency conversions or cross-border payments. It's advisable to check Skrill's fee structure for any potential charges.

- Processing Time - Deposits made through Skrill are processed instantly by Exness. This means that funds will be available in your Exness account almost immediately after the deposit is made.

- Limits - The minimum deposit amount for Skrill transactions on Exness is $10, while the maximum limit is $100,000.

4. Perfect Money

Perfect Money is another widely used e-wallet that enables traders to make seamless online payments. It is particularly popular among traders for its low fees and fast processing times. Exness supports Perfect Money as one of its deposit methods, providing traders with another convenient option for funding their accounts.

- Fees - Exness does not charge deposit fees for Perfect Money transactions, but Perfect Money may apply transaction fees, especially for currency conversions.

- Processing time - Deposits made via Perfect Money are usually instant.

- Limits - The minimum deposit amount is $50, while the maximum deposit is up to $100,000, just like with Skrill.

5. Mobile Money

Mobile Money is a convenient and widely used payment method, especially in African countries where Exness has a strong presence. It allows users to make transactions directly from their mobile phones. Exness supports a variety of Mobile Money systems such as M-Pesa and Airtel Money, offering traders a flexible and accessible way to fund their accounts.

- Fees - Exness does not charge any fees for deposits made via Mobile Money. However, the Mobile Money service provider may apply transaction fees, which vary depending on the country and the specific Mobile Money system used.

- Processing Time - Deposits made through Mobile Money are processed instantly by Exness. This ensures that funds are available in your trading account almost immediately after completing the transaction.

- Limits - The minimum deposit amount for Mobile Money transactions on Exness is $10. The maximum deposit limit depends on the country and the specific Mobile Money system used.

6. WebMoney

WebMoney is a well-established electronic payment system that allows traders to deposit funds into their Exness accounts quickly and securely.

- Fees - Exness does not charge any fees for deposits made via WebMoney. However, WebMoney may apply its own fees for transactions, such as transfer fees or currency conversion fees.

- Processing Time - Deposits through WebMoney are instant.

- Limits - The minimum deposit amount for WebMoney transactions on Exness is $10, while the maximum limit is $1,000,000 per transaction.

7. Tether (USDT)

Tether is a stablecoin cryptocurrency pegged to the US dollar, making it a popular choice for traders who prefer crypto-based transactions. Some people prefer this payment option because of its stability and ease of transfer. Exness supports USDT deposits for a secure and efficient way to fund trading accounts.

- Fees - Exness does not charge any fees for deposits made via USDT. However, network fees (gas fees) may apply depending on the blockchain used for the transaction. These fees are determined by the network and not by Exness.

- Processing Time - Deposits made through USDT may take up to 72 hours to be processed by Exness. This is due to the additional verification steps required for cryptocurrency transactions.

- Limits - The minimum deposit amount for USDT transactions is $10, and the maximum is $100,000 per transaction.

8. Bitcoin (BTC)

Bitcoin is the world's first and most widely used cryptocurrency. Many traders prefer using BTC for deposits due to its decentralisation and global accessibility. Exness supports Bitcoin deposits, providing traders with another crypto-based funding option.

- Fees - Exness does not charge any fees for BTC deposits. However, a network fee applies, which varies depending on blockchain congestion and is determined by the Bitcoin network, not by Exness.

- Processing Time - Deposits made via Bitcoin may take up to 72 hours to be processed, depending on blockchain confirmations and network activity.

- Limits - The minimum deposit amount for BTC transactions is $10, while the maximum per transaction is $100,000.

9. SticPay

SticPay is a well-known e-wallet that provides fast and secure online transactions. It is popular among traders for its low fees and quick processing times.

- Fees - Exness does not charge any fees for deposits made via SticPay. However, SticPay may impose its own transaction fees, especially for currency conversions.

- Processing Time - Exness processes deposits made through SticPay instantly, allowing traders to start trading almost immediately after making a deposit.

- Limits - The minimum deposit amount for SticPay transactions is $10, while the maximum deposit limit is $10,000 per transaction.

10. Neteller

Neteller is another popular e-wallet that offers fast, secure, and convenient online transactions. Exness supports Neteller as one of its deposit methods, providing a seamless and efficient way to fund trading accounts.

- Fees - Exness typically does not charge fees for Neteller deposits, but Neteller itself will have transaction fees.

- Processing Time - Deposits made through Neteller are processed instantly, ensuring immediate availability of funds in your Exness trading account.

- Limits - The minimum deposit amount for Neteller transactions on Exness is $10, while the maximum deposit limit is $50,000 per transaction.

11. Mybux

Mybux is a mobile payment app and voucher solution, widely used in Africa, enabling users to make purchases and pay for services using vouchers.

- Fees - Exness does not charge any fees for deposits made via Mybux. However, Mybux itself may apply transaction fees.

- Processing time - Exness processes deposits made through Mybux instantly.

- Limits - The minimum deposit amount for Mybux transactions is $10, while the maximum deposit is $900 per transaction.

12. Online Banking

Online Banking allows traders to transfer funds directly from their bank accounts to their Exness trading accounts via Internet banking platforms. This method is popular for its convenience and accessibility.

- Fees - Exness does not charge any fees for deposits made via online banking. However, individual banks may impose their own transaction fees.

- Processing Time - The processing time for online banking transactions on Exness is instant.

- Limits - The minimum deposit amount for online banking transactions is $10 and the maximum is $45,000.

Remember that Forex and CFDs available at Exness are leveraged products.

Their trading can result in the loss of your entire capital.

Account Base Currencies Supported by Exness

Exness offers one of the most extensive selections of account base currencies among online brokers worldwide, supporting a variety of options to accommodate traders from different regions and preferences.

However, different account types have different options for supported currencies. Here is a summary of the account currencies supported under each account:

| Trading Account | Account Currencies |

| Standard Cent | USC, EUC, GBC, CHC, AUC, CAC |

| Standard | AED, ARS, AUD, AZN, BDT, BHD, BND, BRL, CAD, CHF, CNY, EGP, EUR, GBP, GHS, HKD, HUF, IDR, INR, JOD, JPY, KES, KRW, KWD, KZT, MAD, MBT, MXN, MYR, NGN, NZD, OMR, PHP, PKR, QAR, SAR, SGD, THB, UAH, UGX, USD, UZS, VND, XOF, ZAR |

| Pro | AED, ARS, AUD, AZN, BDT, BHD, BND, BRL, CAD, CHF, CNY, EGP, EUR, GBP, GHS, HKD, HUF, IDR, INR, JOD, JPY, KES, KRW, KWD, KZT, MAD, MBT, MXN, MYR, NGN, NZD, OMR, PHP, PKR, QAR, SAR, SGD, THB, UAH, UGX, USD, UZS, VND, XOF, ZAR |

| Raw Spread | AED, ARS, AUD, AZN, BDT, BHD, BND, BRL, CAD, CHF, CNY, EGP, EUR, GBP, GHS, HKD, HUF, IDR, INR, JOD, JPY, KES, KRW, KWD, KZT, MAD, MBT, MXN, MYR, NGN, NZD, OMR, PHP, PKR, QAR, SAR, SGD, THB, UAH, UGX, USD, UZS, VND, XOF, ZAR |

| Zero | AED, ARS, AUD, AZN, BDT, BHD, BND, BRL, CAD, CHF, CNY, EGP, EUR, GBP, GHS, HKD, HUF, IDR, INR, JOD, JPY, KES, KRW, KWD, KZT, MAD, MBT, MXN, MYR, NGN, NZD, OMR, PHP, PKR, QAR, SAR, SGD, THB, UAH, UGX, USD, UZS, VND, XOF, ZAR |

Please note that deposits and withdrawals are always carried out in the same currency on Exness, so carefully select the currency during deposits. The currency chosen doesn’t need to match the trading account currency. You can deposit via any currency you wish. However, exchange rates will apply at the moment of transaction.

Exness’ Key Features

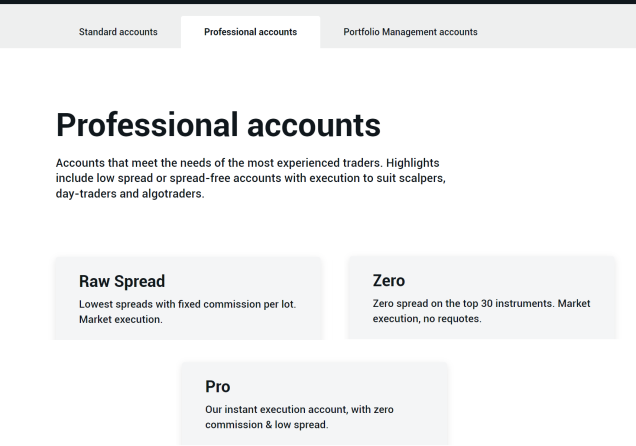

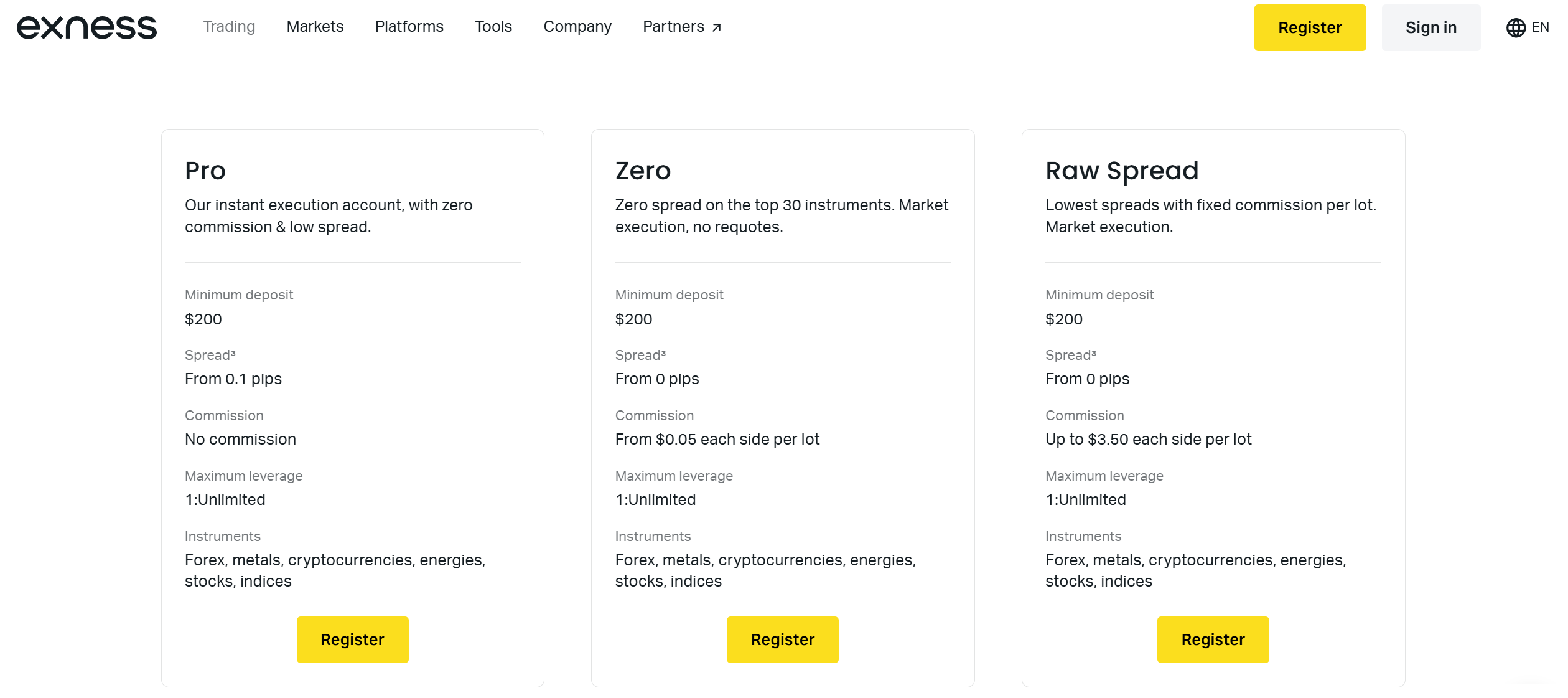

Exness provides traders with access to CFDs across a diverse range of assets, including forex, metals, cryptocurrencies, energies, stocks, and indices. The trading platforms available to use include MetaTrader 4, MetaTrader 5, and Exness Trader Terminal. Additionally, the broker offers five distinct trading accounts which include two standard accounts and three professional accounts.

The Standard Account features spreads starting from 0.2 pips, while the Standard Cent Account offers spreads beginning at 0.3 pips. The Pro Account provides even lower spreads from 0.1 pips. These three account types do not incur any commission fees.

On the other hand, the Raw Spread Account offers spreads starting at 0.0 pips with a commission of up to $3.50 per lot per side. Similarly, the Zero Account provides spreads from 0.0 pips on the top 30 instruments, with a commission beginning at $0.05 per lot per side.

In terms of regulation, Exness is a highly reputable broker, operating under the oversight of multiple regulatory bodies. These include the FCA in the UK, the CySEC in Cyprus, the FSCA in South Africa, and the CMA in Kenya, among others.

Closing Remarks

Exness stands out as a versatile and user-friendly broker that caters to a global clientele. It offers a wide array of deposit methods emphasising speed, variety, and transparency. Exness ensures that traders can fund their accounts seamlessly through options such as wire transfers, credit/debit cards, e-wallets, mobile money, cryptocurrencies, and more. The broker's commitment to instant processing times for most methods allows traders to swiftly capitalise on market opportunities without unnecessary delays.

Further, Exness does not charge deposit fees and has flexible limits, further enhancing its appeal. Nonetheless, traders should remain mindful of potential third-party charges. Coupled with its robust regulatory framework and diverse trading instruments, Exness provides an efficient platform for traders of all levels.

Remember that Forex and CFDs available at Exness are leveraged products.

Their trading can result in the loss of your entire capital.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.