eToro Review Ireland

eToro is a multi-asset investment platform launched in 2007 with a good reputation among traders. The company has roughly 30 million users and is one of the biggest CFDs brokers in the world. Additionally, eToro is perhaps the best broker for copy trading in the world. Luckily for traders in Ireland, eToro is available here. Let’s look at what eToro has to offer to clients in Ireland.

Is eToro Available in Ireland?

Yes, eToro is available and legal in Ireland. While not regulated by the Central Bank of Ireland, eToro can operate freely within Ireland thanks to the CySEC license that applies to all EU countries. Just like many other Top Ireland brokers, eToro gladly accepts clients from Ireland. The company has a page listing all the countries it does not accept clients from. Ireland is not one of these countries.

61% of retail CFD accounts lose money with this provider.

You should consider whether you can afford to take the high risk of losing your money.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs (such as forex, commodities and stocks).

Is eToro Safe?

All evidence we gathered in researching this review suggests that eToro is a safe broker. The company has regulations from several tier-1 regulators. These include the FCA in the UK and the CySEC in Cyprus. These are some of the best regulatory bodies in the world. Note that regulations alone are not enough. Even regulated companies can operate in criminal ways. However, companies with several regulators are much safer than those without.

Regulators ensure that brokers have the best trading conditions for their clients. For instance, eToro keeps client funds in segregated accounts following regulatory laws. Therefore, eToro cannot use client funds to run its business operations. Additionally, eToro has insurance to cover any losses to the clients caused by the company. Furthermore, this company has great reviews from its clients. The company has over 17,000 reviews on Trustpilot, with an impressive 4.3-star rating out of 5. It suggests that most of the clients on eToro are satisfied with the services provided.

What Trading Instruments Are Available on eToro?

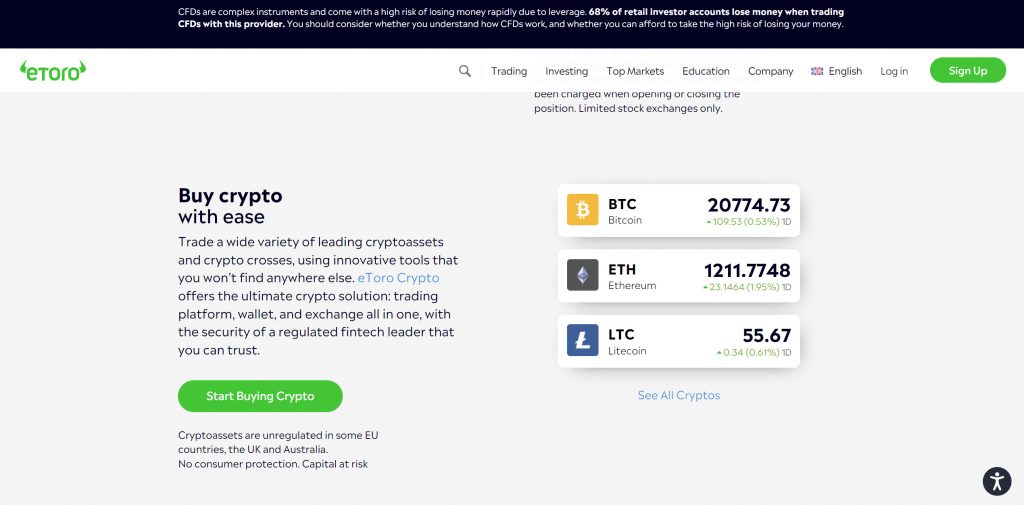

eToro has a range of trading instruments available to all its clients. They can trade CFDs on forex, crypto, stocks, commodities, ETFs, and indices or purchase real stocks and cryptocurrencies. For forex traders, there are 49 different currency pairs they can invest in on eToro. Some of the best currency pairs to trade on eToro include GBPUSD, EURUSD, USDCAD, USDJPY, and EURAUD.

Additionally, there are 119 crypto pairs, 19 indices, over 250 ETFs, 27 commodities, and a ton of stocks to invest in. Some popular cryptocurrencies you can invest in here include Bitcoin, Ethereum, Cardano, Dogecoin, and Binance Coin. This variety of trading instruments is always an advantage. Clients can easily diversify their portfolios. All these trading instruments are available to clients in Ireland.

eToro Trading Platform

The eToro trading platform is easily recommendable to all kinds of traders. This platform is intuitive and has fast execution. Fast execution times can give traders an edge in the market by ensuring they never miss out on trades. The intuitive nature of this platform allows beginner traders to quickly learn how to place trades and other operations.

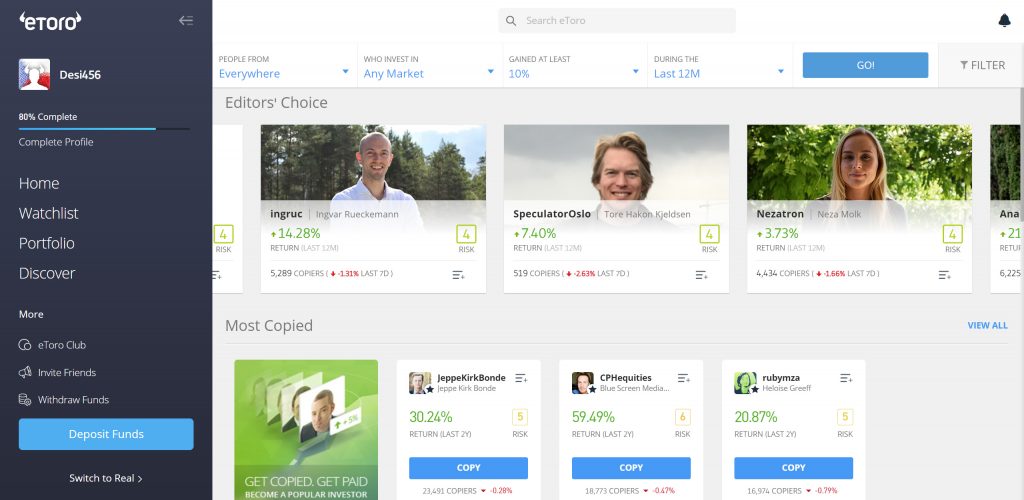

Furthermore, clients lacking experience and time can use the eToro social trading platform to follow and copy the moves of top-performing traders using the CopyTrader system. This allows clients to replicate the moves of other traders. You can choose the trader you want to copy based on their past performance, risk score, portfolio diversity, etc. eToro is perhaps the best platform for copy trading.

Past performance is not an indication of future results.

eToro Fees

eToro has the mandate to maintain full transparency in all the fees it charges to clients. Therefore, there are no hidden fees on eToro. The company even provides a page to keep track of Market hours and Fees featuring its rates. For example, crypto traders have to pay a fixed fee of 1% when trading any coin on top of the market price for each Buy and Sell position. eToro also charges inactivity fees on accounts after one year of inactivity. The inactivity fee on eToro is $10 per month and a $5 withdrawal fee. There is also a conversion fee on any currency that is not the US Dollar.

On a good note, eToro offers clients commission-free trading on stocks. It is very easy to trade stocks on eToro. All you have to do is search for the company stock you have to invest in and click on trade. Here, you will be buying real stocks and not CFDs.

Deposit and Withdrawal Methods

eToro supports a variety of payment methods for clients to fund their accounts and withdraw profits. These include Credit/Debit cards, PayPal, Neteller, Skrill, and Bank Transfers. The minimum first-time deposit for clients in Ireland is $50. The company only supports a few currencies. For Irish clients, the supported currency is the Euro.

However, eToro operates in US Dollars. As such, the company charges a conversation fee to convert funds to US Dollars. Additionally, eToro charges a conversation fee when clients withdraw funds in any currency that is not the US Dollar. Conversation fees vary according to a client’s payment method and eToro Club level.

eToro Education Section

The education section on eToro is one of the reasons it is suitable for beginner traders. The company provides a rich collection of resources to help all their traders learn the ins and outs of the markets and trading in general. Here, you will find Guides, Podcasts, Webinars, and many Videos dedicated to all kinds of traders. There is something here for both novice and advanced traders.

Further, traders can practice the new strategies they pick up on a free demo account credited with $100,000 virtual money. This demo account is also helpful in learning how to use the eToro trading platform.

Customer Support

Any company that handles people’s money should have ample and reliable customer support. People want to know they can reach the company if they have an emergency or need general assistance. To contact eToro, there are two main channels. First, you can open a support ticket with your registered email address. Secondly, you can reach the company via the live chat option. The company promises to be available to clients 24 hours a day from Monday to Friday. However, eToro does not reveal how long it takes to get back to clients.

Customer care is not a luxury for a company that handles people’s money; it is a necessity. eToro provides great options to reach the company. However, the company could still do more. Having several phone numbers dedicated to customer support could be an added advantage.

Our Final Thoughts on eToro Ireland Review

Evidently, eToro is one of the best trading platforms in the world. This broker allows clients to trade financial instruments in a variety of markets. This allows traders to diversify their portfolios. Additionally, eToro provides a state-of-the-art trading platform to its clients. It even comes with the CopyTrader technology to help traders lacking time and experience.

Most importantly, eToro has regulations from several regulators. These include the CySEC in Cyprus and the FCA in the UK. Clearly, eToro is committed to playing by the rule of law. These features are what make eToro a Tier One Broker not only in Ireland but also in the world.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs (such as forex, commodities and stocks).

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.