Ctrader Crypto Brokers - Best picks

The cryptocurrency market has become one of the most active financial markets in the world. As the trading of cryptocurrencies becomes more and more popular, so does the need for an efficient and reliable trading platform. In recent years, cTrader has emerged as one of the top online trading platforms for trading crypto and other financial products.

It offers a user-friendly interface, advanced charting tools, and exceptional execution speed. This makes it an ideal platform for trading cryptocurrencies due to the fast-paced nature of the market. In this review, we are going to look at some of the best cTrader crypto brokers to see which ones stand out from the rest.

Why Choose cTrader for Crypto Trading?

cTrader is a powerful trading platform designed to meet the needs of professional and retail traders. Unlike some other platforms that cater to a broader audience, cTrader is designed with the needs of active traders in mind. While cTrader is widely used for forex trading, its features make it well-suited for cryptocurrency trading as well. Below are some of cTrader’s key features:

- Advanced Charting - cTrader offers a wide array of technical indicators, drawing tools, and chart types, allowing traders to conduct in-depth market analysis.

- Level 2 Pricing - This feature provides traders with a view of the order book, showing the depth of market liquidity at different price levels.

- Fast Execution - cTrader is known for its low-latency execution, minimising slippage and ensuring that orders are filled at the desired price.

- Order Management - The platform offers sophisticated order types, including market, limit, stop, and trailing stop orders, giving traders precise control over their positions.

- Automated Trading - cTrader supports automated trading through its cTrader Automate feature, allowing traders to develop and use custom trading robots (cBots).

Factors to Consider When Choosing a cTrader Crypto Broker

When selecting a cTrader broker for cryptocurrency trading, several factors should be taken into account:

- Regulation - Choose a broker that is regulated by a reputable financial authority. This provides a level of security and protection for your funds.

- Cryptocurrency Offerings - Ensure that the broker offers a wide range of cryptocurrencies for trading, including major coins like Bitcoin and Ethereum, as well as altcoins.

- Trading Conditions - Consider the spreads, commissions, and leverage offered by the broker. These factors can significantly impact your trading costs and profitability.

With that said, let’s take a look at some of the best cTrader cryptocurrency brokers available to traders.

Please note that the data about spreads is subject to change over time. Therefore, we recommend checking the broker's official websites for the most up-to-date information.

Best Picks for cTrader Crypto Brokers

Pepperstone

Pepperstone is one of the top cTrader brokers available for cryptocurrency trading. It offers access to a range of cryptocurrencies as CFDs on the cTrader platform. In particular, Pepperstone offers trading on 21 cryptocurrency CFDs, including major coins like Bitcoin, Ethereum, Dogecoin, Cardano, and Binance Coin. These can be traded against USD, EUR, GBP, and AUD. Pepperstone also provides access to three crypto indices which track the top cryptocurrencies. These include Crypto 10, Crypto 20, and Crypto 30.

The fees for trading crypto using cTrader on Pepperstone are competitively low and depend on the asset a trader is investing in. The BTCUSD pair features an average spread of $32.25 and a minimum of $17.0 on both the standard and the razor accounts. Pepperstone's integration with cTrader provides access to advanced charting tools, technical indicators, and customisable layouts. Nonetheless, this broker also offers other platforms for trading crypto including MetaTrader 4, MetaTrader 5, TradingView, and its proprietary Pepperstone Trading Platform.

Spreads are subject to change. Check your platform for the most up to date data.

On another note, Pepperstone offers many other market products for traders to diversify their investments. These include CFDs on forex, indices, ETFs, currency indices, shares, and commodities alongside crypto CFDs. Pepperstone also appeals to traders due to its strong regulatory standing. It holds licenses from several respected organisations including the FCA in the UK, the CySEC in Cyprus, the ASIC in Australia, and the DFSA in Dubai, among others.

75.3% of retail CFD accounts lose money

FP Markets

FP Markets is another strong contender in the cTrader crypto broker space. It offers investors a comprehensive trading experience with a wide range of cryptocurrencies available. On this broker site, traders have access to 12 of the most popular cryptocurrencies to trade against the US Dollar all as CFDs. The typical spreads associated with these cryptocurrencies are competitively low on the FP Markets trading site. For example, the BTCUSD pair has an average spread of $21.28 while ETHUSD has an average spread of $4.72.

Positively, cTrader offers crypto traders a variety of benefits on FP Markets. Some of the key benefits include rapid execution, level 2 pricing, smart stop-out, and selection of order types. On top of that, it offers traders numerous technical analysis tools, customisation, and one-click trading. However, this is not the only trading platform available to traders. FP Markets also offers MetaTrader 4, MetaTrader 5, and TradingView to its investors.

Spreads are subject to change. Check your platform for the most up to date data.

On another note, FP Markets provides crypto traders with great opportunities to diversify their portfolios. Aside from cryptocurrency CFDs, investors also have access to CFDs on forex, indices, metals, stocks, commodities, ETFs, and bonds. In total, traders gain access to over 10,000 market products. Finally, FP Markets is a well-regulated broker with licenses from several organisations. It operates under the supervision of the ASIC in Australia, the CySEC in Cyprus, and the FSCA in South Africa, among others.

72.44% of retail CFD accounts lose money

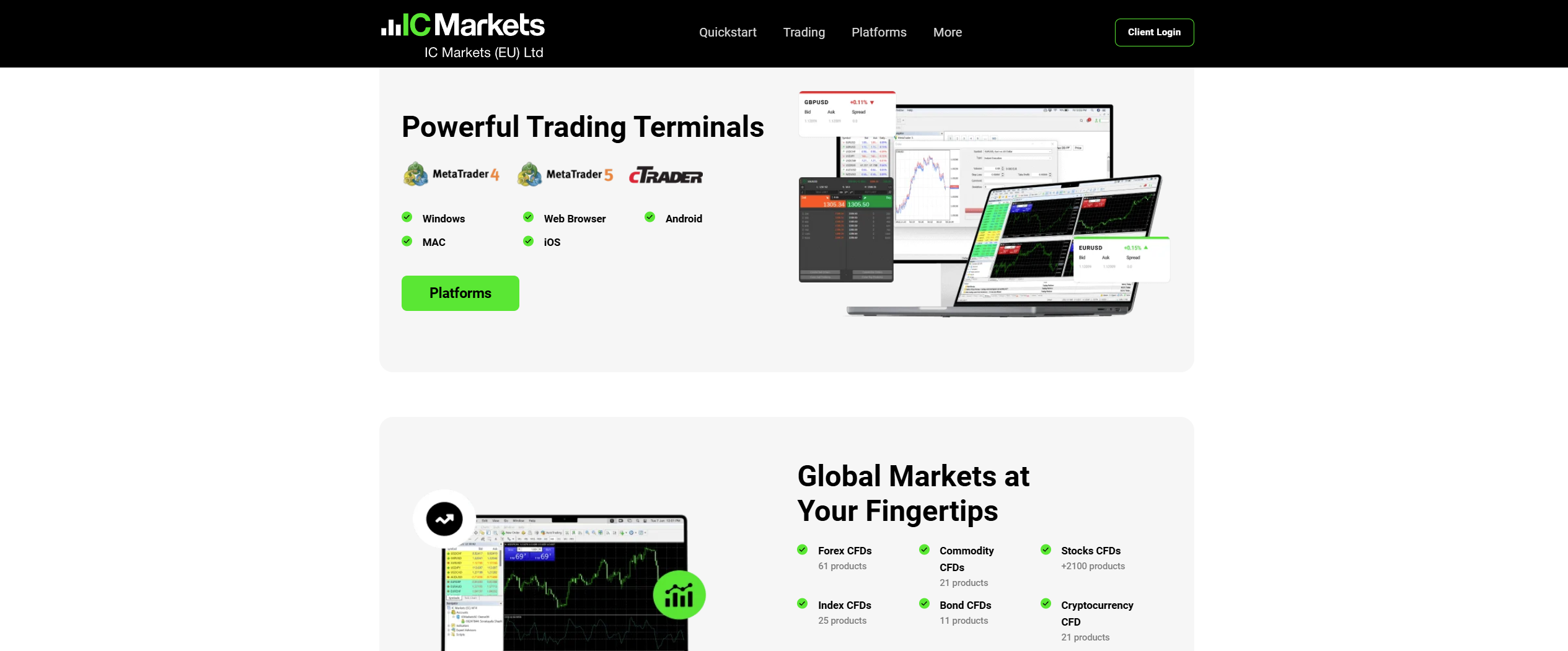

IC Markets

IC Markets is a popular online broker that also offers crypto trading on cTrader. This broker provides access to 21 different cryptocurrencies as CFDs, allowing traders to speculate on price movements without owning the underlying assets. The spreads for trading these assets are within market standards with the BTCUSD pair having a minimum spread of $8.7. However, the average spread on this pair sits at a relatively higher $42.036.

Notably, cTrader on IC Markets offers level II pricing, giving traders a clear view of market depth and order book activity. It also offers high-speed execution, a user-friendly interface, and advanced charting tools, among other features. However, it is not the only trading platform available to traders. IC Markets also avails MetaTrader 4, TradingView, and MetaTrader 5.

Spreads are subject to change. Check your platform for the most up to date data.

Further, IC Markets allows crypto traders to diversify their portfolio by speculating on other global market products. Alongside crypto CFDs, traders can also access CFDs on forex, indices, commodities, stocks and futures. In terms of regulations, the broker operates under the strict oversight of several regulatory authorities. These include the CySEC in Cyprus, the ASIC in Australia, and the FSCA in South Africa, among others.

FxPro

FxPro is another well-established broker that offers cryptocurrency trading through the cTrader platform. It provides access to a selection of popular cryptocurrencies. With FxPro, traders gain access to a variety of cryptocurrency CFDs, including Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and Litecoin (LTC), among others. FxPro offers floating crypto spreads on cTrader but does not provide information on typical spreads. On a good note though, this broker does not charge commissions when trading crypto on cTrader.

FxPro's cTrader platform offers fast execution speeds and level II pricing, providing insights into market depth. FxPro also supports automated trading on cTrader through the cTrader Automate feature. In addition to cTrader, FxPro offers other popular trading platforms, including MetaTrader 4, MetaTrader 5, and FxPro WebTrader.

In addition to cryptocurrency CFDs, FxPro provides access to a wide array of financial instruments. These include CFDs on forex, indices, futures, and shares. This makes it easy for traders to diversify their portfolios and manage risk effectively. The broker’s regulatory framework further strengthens its appeal. It holds regulatory licenses from the FCA, the CySEC, and the FSCA.

Fusion Markets

Fusion Markets offers traders a seamless cryptocurrency trading experience on cTrader. This broker provides access to a selection of cryptocurrency CFDs, enabling traders to speculate on the price movements of popular digital assets without owning the underlying tokens. Fusion Markets is known for its commitment to low spreads on cryptos, making it an attractive option for crypto enthusiasts. For example, the BTCUSD pair features a minimum spread of $27.5 and an average spread of $28. (Spreads are subject to change. Check your platform for the most up to date data.)

The integration of cTrader on Fusion Markets ensures that traders can benefit from advanced charting tools, sophisticated order types, and fast execution speeds. These features are essential for navigating the volatile cryptocurrency market effectively. Additionally, the broker offers other trading platforms including TradingView, MetaTrader 4, and MetaTrader 5.

In addition to cryptocurrencies, Fusion Markets offers a wide range of other financial instruments. The various global markets available include forex, shares, energy, precious metals, and commodities. This allows traders to diversify their portfolios within a single brokerage. On another note, Fusion Markets holds licenses regulatory licenses from the ASIC and the VFSC in Vanuatu.

Skilling

Skilling is another leading broker that offers cryptocurrency trading through cTrader. At Skilling, traders have access to a diverse collection of the top 50 traded cryptocurrencies. These crypto pairs are available to trade against a variety of currencies including USD, GBP, EUR, and even JPY. The spreads for trading these cryptocurrencies are relatively higher on Skilling compared to some other broker sites. The BTCUSD pair has a minimum spread of $67.64 on the standard account and an average of $80.94. On the premium account, the same pair has a minimum spread of $54.18 and an average of $65.4. (Spreads are subject to change. Check your platform for the most up to date data.)

Skilling’s integration with cTrader unlocks access to a powerful trading platform with more advanced trading capabilities which helps investors to make trading decisions. It offers advanced charting tools, extensive customisation options, and seamless order execution. Aside from cTrader, the broker also offers MetaTrader 4 its own Skilling Trader.

Finally, this is a regulated broker which holds a license from one of the top regulators in the market. It operates under the regulation and supervision of the CySEC and the FSA in Seychelles.

Closing Remarks

cTrader has established itself as a robust and feature-rich platform that is well-suited for cryptocurrency trading. It offers advanced charting tools, fast execution, and level II pricing, among other features. Choosing the right cTrader broker is crucial for optimising the trading experience. The brokers discussed in this article each bring unique strengths to the table.

Ultimately, the best cTrader crypto broker for an individual trader will depend on their specific needs and preferences. Each trader should conduct their own research to determine whether the broker they choose best suits their specific needs. After all, this is not an exhaustive list of all cTrader crypto brokers in existence.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.