Best TradingView Brokers for Crypto

The TradingView platform is all about the “look first, then leap” philosophy. This saying is simply encouraging traders to always do critical analysis before placing trades in the financial markets. Known not just as a trading platform but also a powerful charting tool and social network, TradingView has become a favorite for over 30 million traders worldwide. They rely on it to identify opportunities across a variety of financial markets, from forex to stocks, indices, and futures—and, of course, crypto.

However, TradingView has its limitations when it comes to live trading, particularly in terms of supported brokers. The broker you connect with your TradingView account influences which financial instruments you can actually trade live. For instance, while you can analyze crypto charts on TradingView, you can only execute crypto trades if your chosen broker supports it. With that in mind, let’s explore the top TradingView-compatible brokers for crypto trading.

Pepperstone

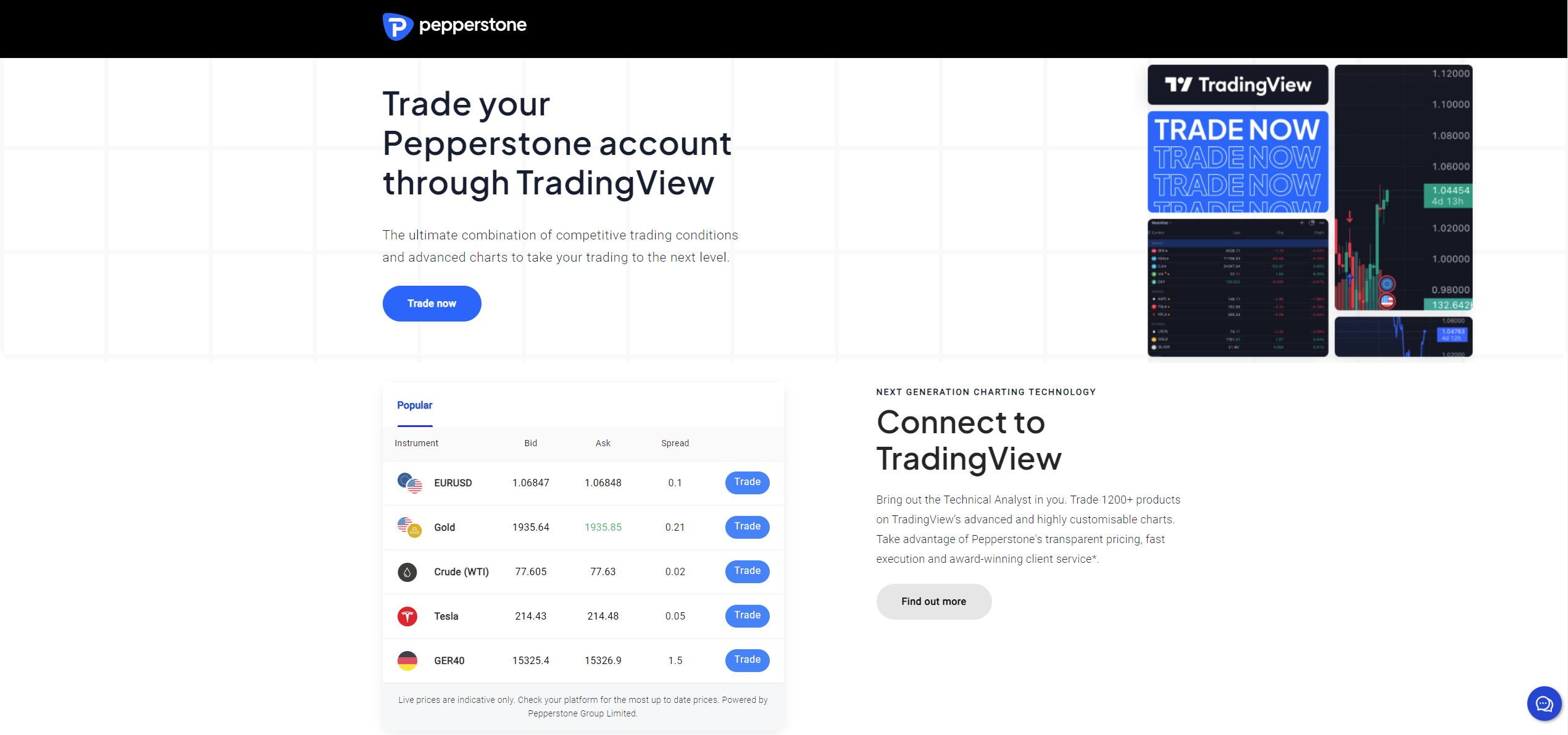

We cannot list the best TradingView Brokers without mentioning Pepperstone. Pepperstone avails TradingView to its traders as one of the platforms they can use to place orders. This means that the platform is not just available as a charting tool. Interestingly enough, this broker was voted TradingView Broker of The Year 2022 in the TradingView Awards.

Traders on this trading site can place orders in a variety of cryptocurrencies. Specifically, Pepperstone supports the trading of 21 different crypto CFDs. Some of the cryptocurrencies available to trade include Bitcoin, Ethereum, Dogecoin, Cardano, Binance Coin, and others. Major cryptocurrencies can be traded against USD as well as against EURO, GBP and AUD. The broker also features 3 crypto indices, Crypto 10, Crypto 20 and Crypto 30 that consist of the TOP cryptocurrencies. As one of the fastest order execution brokers in the market, traders have an edge here as most trades are executed in under 60 milliseconds. The fees for trading with this broker are competitively low and depend on the asset a trader is investing in.

The crypto with the lowest fee here is the Stellar Lumens against the US Dollar with a spread from 1.20 points. On Bitcoin, the spreads are as low as 15.0 points and on Ethereum, they start from 3.0 points. Luckily, Pepperstone is one of the brokers that allows traders to invest in crypto assets over the weekend. While TradingView is available, traders can also use MetaTrader 4, MetaTrader 5, and cTrader to place their orders.

In terms of regulations, this company is subject to the supervision of several regulatory commissions. Specifically, it is under the regulations of the CySEC in Cyprus, the ASIC in Australia, the FCA in the UK, the BaFin in Germany, and the CMA in Kenya.

Update to: 07/25 - Pepperstone is currently running a promotion where you can claim a free 3-month TradingView Essential subscription via the link below. Existing account holders can also take advantage of this offer, but it’s not automatic—you’ll need to contact your account manager to get it.

*The promo is available in the Asia-Pacific region, UK, European Economic Area, and LATAM regions, it is only not available to clients from Australia and UAE.

75.3% of retail CFD accounts lose money

FP Markets

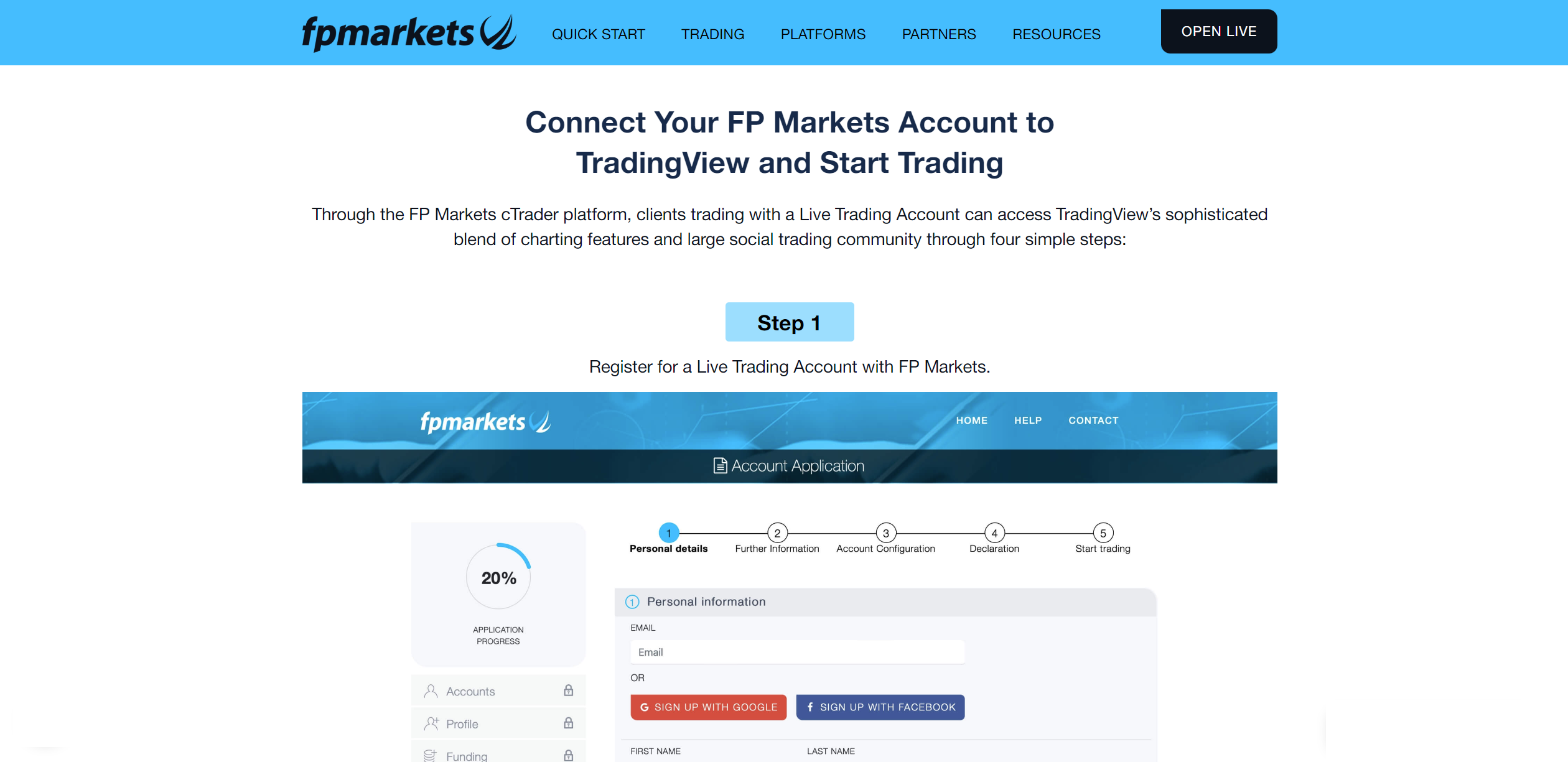

FP Markets gives its traders access to 12 different cryptocurrencies to trade against the US Dollar. These are twelve of the most popular cryptocurrencies and they come with fairly low spreads. For example, the BTCUSD pair has an average spread of 20.45 pips while ETHUSD has an average spread of 4.43 pips. Notably, cryptocurrencies are available to trade on this broker site from Mondays 00:00 to Fridays 23:55 with no weekend trading supported.

On a good note though, this broker provides its traders with market-leading trading platforms to use while placing orders. One of the trading platforms available to traders is TradingView, renowned for its arsenal of charting tools. Traders can analyse the markets deeply, and trade straight using this platform. Aside from TradingView, traders can also use MetaTrader 4, MetaTrader 5, Iress, and cTrader.

Further, FP Markets goes beyond just cryptocurrencies. Traders also have access to forex currency pairs alongside CFDs on indices, metals, stocks, commodities, ETFs, and bonds. In total, traders gain access to over 10,000 market products. Finally, this broker has regulations from several well-known financial institutions around the world. Its operations are under the supervision of the ASIC in Australia, the CySEC in Cyprus, and the FSCA in South Africa, among others.

72.44% of retail CFD accounts lose money

Tickmill

Tickmill is a reputable broker that integrates with TradingView and offers a variety of cryptocurrencies. This makes it a great option for crypto traders who rely on TradingView’s advanced charting tools. Notably, Tickmill offers a range of popular cryptocurrencies (CFDs), such as Bitcoin, Ethereum, and Litecoin, which can be traded against the US Dollar.

Further, Tickmill is particularly known for its low fees, which make it attractive to cost-conscious traders. As an example, the BTCUSD has a minimum spread of 12 points with a typical spread of 24.9 points. In total, there are 12 different cryptocurrencies available to trade with similarly competitive spreads. They are available to trade 24/7, making Tickmill one of the best forex brokers for weekend trading. In addition to TradingView, Tickmill also supports MetaTrader 4, MetaTrader 5, Tickmill Trader, and Tickmill Trader App.

In terms of regulation, Tickmill is overseen by multiple regulatory bodies. Tickmill operates under the stringent regulations of the CySEC in Cyprus, the FCA in the UK, the ASIC in Australia, and the FSA in Seychelles. These regulatory bodies enforce strict transparency and investor protection standards that Tickmill must adhere to.

71-74% of retail investor accounts lose money when trading CFDs with this provider.

Forex.com

Forex.com is a global international broker with a strong regulatory framework and a long history in the market as the broker has been in existence for more than 20 years. Forex.com is regulated by the Financial Conduct Authority in the United Kingdom and the Cyprus Securities & Exchange Commission (CySEC) in Cyprus. Crypto trading and the use of TradingView is supported in nearly all countries with some exceptions like the United States where crypto trading is not supported.

As a crypto trader, you get very low spreads when trading popular cryptocurrency pairs. On Forex.com you have access to trade CFDs on popular cryptocurrencies like Litecoin, Ethereum, Bitcoin, and Ripple. When trading crypto with Forex.com you get an average execution time of 0.06 seconds and 24/7 live customer support. If you are a trader who loves the TradingView platform, you can connect Forex.com to TradingView. Alternatively, you can use the MT5 trading platform if you are more of a MetaTrader fan. Crypto trading is available from 22:00 Sunday - 22:00 Friday.

Swap also applies when trading cryptocurrencies with Forex.com. For new traders, swap simply means the amount your trading account will either be credited or debited whenever you leave a trade overnight. When trading Bitcoin with Forex.com you will pay a swap of 0.0411% on long trades and receive a swap of 0.0136% on short trades. The swap for Litecoin, Ethereum, and Ripple is the same as Bitcoin for both long and short trades. If you choose to trade with Forex.com, it is very easy to integrate this broker with the TradingView platform. If you are a fan of scalping, the broker does support crypto scalping.

76-77% of retail investor accounts lose money when trading CFDs with this provider.

How to easily integrate your broker with TradingView

The first step is to open an account with your chosen TradingView broker and deposit funds if you want to live trade. This may take a couple of days as your broker may need to verify your identity and account details. When your account with the broker is approved, you should get the login details to your trading account. This login credential is important in the next steps where you actually connect your broker to trading view.

The next step is to open a TradingView account. You can consider a paid account to get an ad-free experience and enjoy other advanced features. Then, open the TradingView chart window. At the bottom of the chart window, select the ‘trading panel’ tab to view available brokers. Choose your broker and click connect. Then, proceed to enter your trading username and password that you got from your broker. By now, your broker should be fully connected to your TradingView account.

Conclusion on Best TradingView Brokers for Crypto

TradingView is a very easy-to-use trading platform that is loved by many traders across the world. Many traders choose TradingView as their chart analysis platform even though they can not place live trades there because the approved brokers in their region can not connect with the TradingView platform. It is not uncommon to see traders do all chart analysis on the TradingView platform, and then proceed to place their live trades on other trading platforms like MT4 and MT5.

Also, TradingView supports crypto trading provided your chosen trading view broker also allows it. As not every broker is trustworthy, we have listed some of the best TradingView brokers for crypto that we recommend. In case none of the listed TradingView brokers are approved in your region. You can still benefit from the awesome platform by using it for chart analysis. Then, you can proceed to place your trades in other trading platforms approved by your chosen broker.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.