Best TradingView Stock Brokers

TradingView is one of the most popular global market charting and trading platforms. It is an innovative venture founded by a group of developers and traders with experience developing trading software who share the vision that trading technology should be simple, powerful, and accessible to all. Using the most recent advances in cloud computing and browser languages, the idea of bringing interactive charts and widgets to people all over the world via any browser became a reality.

TradingView is also a social community where traders can interact and learn from one another, share ideas, and collaborate to improve their skills. The unique and simple method of instantly sharing live charts with technical analysis ideas brings traders together and is the first step toward having a full trading platform in a web browser. Let’s take a look at some of the best TradingView stock brokers in the market today.

Forex.com

Forex.com is the trading name of GAIN Global Markets Inc., which is regulated by the FCA, the CySEC, the ASIC, and the IIROC. Trading options are available through three accounts: a standard account, a commission account, and a direct market access account. Forex.com provides over 5,500 trading products. Clients from most countries can trade forex pairs alongside CFDs on stocks, commodities, cryptocurrencies, and indices. On the other hand, clients from the US can trade over 80 currency pairs, Gold and Silver, Futures and Futures Options. These instruments are available for trading on competitively low spreads starting from 0.8 pips for major currency pairs.

It offers two trading platforms which are the MetaTrader 4, MetaTrader 5, WebTrader, and Forex.com Trader. TradingView charts are integrated into the Forex.com web and mobile trading platforms and are free with the client's Forex.com account. Clients can log in or sign up to access the world's leading charts and take their stock trading to the next level.

Clients can trade directly from the charts, where they can easily create and modify order tickets. Clients can personalize the charts by changing the style, colors, and data presentation. It has over 80 indicators including MACD and RSI to Moving Averages and beyond. These indicators are customizable and can help traders make better decisions. Clients can choose between 14 time intervals for a comprehensive view of price action. It also has 50+ drawing tools that help you make sense of the technical with a variety of detailed drawing options.

Customers with ForexTrader accounts can trade through Forex.com on TradingView. MT4 accounts can log in but cannot place trades just as on Forex.com, MT4 accounts can log into ForexTrader but cannot trade through it.

77.7% of retail investor accounts lose money when trading CFDs with this provider.

Pepperstone

Pepperstone is an Australian-based online forex and CFDs broker that was launched in 2010. it is licensed and regulated by the Australian Securities and Investments Commission (ASIC), the Financial Conduct Authority (FCA), and the Federal Financial Supervisory Authority (BaFin).

Several trading platforms are available to choose from. These include the popular MetaTrader 4 and MetaTrader 5, as well as cTrader. Using these platforms, clients can trade over 1,200 CFDs. These fall in six main global markets including forex, indices, commodities, ETFs, shares, and currency indices. Further, as one of the world’s top ECN brokers, this broker site features some of the lowest spreads starting at 1.0 pips for major currency pairs on the standard account.

Pepperstone also offers two commission accounts depending on the trading platform the client prefers. For instance, clients on the MT4/MT5 Razor account pay a commission of $3.50 per side per lot. On the other hand, clients using the cTrader commission account pay a commission of $3 per side per lot.

Pepperstone is one of the top TradingView-supported brokers today. Clients can access TradingView's advanced charting tools and interact with over 30 million traders via the latest integration powered by cTrader. They can also trade directly from TradingView charts. It provides impressive charting technology and connects with one of the world's largest social trading networks. Its coding language Pine Script is simple to learn and allows people to explore a wide range of indicators, both pre-built and customizable.

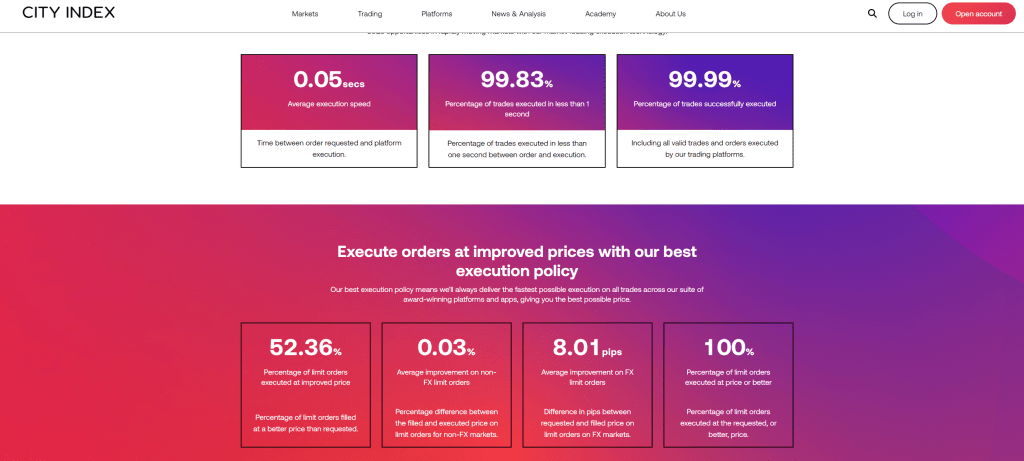

City Index

Through direct integration with TradingView, City Index allows clients to trade stocks, forex, and CFDs with low commissions and quick execution. They can simply log into their TradingView accounts and find City Index’s broker profile. They can then click on Trade and log into their City Index accounts and start trading.

Nonetheless, stocks are not the only assets available on this broker site. Clients can also trade CFDs on indices, shares, forex, commodities, interest rates, bonds, options, and cryptocurrency. This is available on a variety of platforms, including Webtrader and MetaTrader 4. City Index has four accounts which are standard, MT4 account, professional account, and corporate account from which clients can execute trades. Further, on this broker site, the spreads on major currency pairs can go as low as 0.6 pips on the standard account.

Finally, City Index is regulated by top-tier regulators including the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC), and the Financial Conduct Authority (FCA).

FXCM

FXCM is another global broker that supports TradingView stock trading. Clients can use TradingView every day and execute orders with FXCM thanks to live quotes, stock charts, and expert trading ideas. TradingView provides the client with volume profile indicators, multiple chart layouts, advanced price scaling, and many other features.

On another positive note, FXCM is a regulated broker in multiple jurisdictions. It is regulated by the Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC).

Further, FXCM offers three account types namely Mini, Standard, and Active Trader. The minimum deposit required is USD 50. These accounts allow investors to trade various global markets including Forex, stocks, indices, and commodities. This is available for trading on MetaTrader 4 platform. Additionally, the company features competitive spreads on currency pairs, beginning as low as 0.6 pips for major currencies.

Saxo Bank

Saxo Bank is one of the leading retail forex and multi-asset brokerage firms. It is a fully licensed and regulated Danish bank with an online trading platform that empowers you to invest across global financial markets. It has top-tier regulations from the FCA, the ASIC, and the FINMA.

Clients can trade more than 70,000 instruments across stocks, ETFs, bonds, mutual funds, options, futures or other leveraged products. This a huge lineup of trading instruments. Additionally, it offers competitive spreads starting as low as 0.6 pips. Clients execute their trades on Saxo's own platforms which are SaxoTraderGO and SaxoTraderPRO

Saxo clients can access TradingView as well as any of Saxo Bank's proprietary platforms for free with a single account. Clients can use TradingView's extensive functionality and its leading charting tools. TradingView allows clients to manage their Saxo trading activities without leaving the platform.

Connecting to Saxo is free, and clients can trade under the same terms as on Saxo Bank's own platforms. The most popular names are available for trading as stocks and CFDs on the New York Stock Exchange, NASDAQ, Hong Kong Exchanges, London Stock Exchange, NASDAQ OMX Copenhagen, Singapore Exchanges, Tokyo Stock Exchange, Deutsche Börse (XETRA), AMEX, and ARCA.

Capital.com

Capital.com is also one of the brokers that support TradingView stock trading. Clients can connect to Capital.com and TradingView to take advantage of the best of both trading platforms. This way, clients do not have to leave the analysis platform to go place a trade. They can apply the insights they gain on TradingView instantly to stock trading.

Regarding regulations, Capital.com is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC), the Financial Conduct Authority (FCA), and the Australian Securities and Investments Commission (ASIC). These are some of the best financial supervisory organizations in the world.

Finally, Capital.com offers several trading instruments such as CFDs on stocks, indices, commodities, forex and cryptocurrencies. The instruments can be traded on trading apps, website platforms and MT4 for trading. Capital.com does not offer account types, but rather account options for retail and professional accounts. Capital.com has one Retail Account and one Professional Account available. It has competitive spreads starting as low as 0.0pips.

Interactive Brokers

Interactive Brokers operates under the regulation of the Financial Conduct Authority(FCA), the Australian Securities and Investments Commission (ASIC), and the Investment Industry Regulatory Organization of Canada (IIROC).

TradingView is available on Interactive Brokers for stock trading. This is a great way to save traders some time as it allows them to gain insights and trade on the same platform. Moreover, TradingView is one of the most powerful charting tools in the market today. It makes sense that this tool would help improve the trading strategies of traders.

Further, CFDs on stocks are not the only trading instruments available for trading. Clients can also trade CFDs on options, futures, currencies, cryptocurrencies, US Spot Gold, bonds, and ETFs. The charges for trading these instruments are relatively low. Clients pay a commission that ranges from $16 to $40 per million traded.

It offers five types of accounts individual, joint, trust, IRA, and UGMA/UTMA. A minimum of $100 is required to open an Interactive Brokers LLC brokerage account for your Interactive Advisors investments. Client Portal, Trader Workstation, IBKR Mobile, natural language IBot, and IBKR APIs are among the trading platforms available. Popular trading platforms like MetaTrader 4 and MetaTrader 5 are not available. However, Interactive Brokers is one of the brokers that supports Capitalise.ai for automated trading.

Final thoughts

TradingView is an exciting robust trading environment that also serves as a social network for traders, which is a very unique and valuable feature. You not only gain access to powerful fundamental, technical, and trading tools, but you also join a community of like-minded traders who actively share trading ideas, strategies, and feedback.

However, access to TradingView for stock trading is still not enough to pick a forex broker. A broker still has to offer great trading conditions and have regulations from reputable organizations. In this article, we looked at some of the best TradingView stock brokers in the market. We still insist that you should pick the broker that best suits your needs as this is not an exhaustive list.

Regulated Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.