10 Best Stocks for Day Trading

Day trading is a trading strategy that involves buying and selling financial instruments within the same trading day. Unlike long-term investing, day trading aims to capture profits from intraday price movements. Day traders do not hold positions overnight, minimising exposure to after-hours risks. Notably, day trading demands a keen understanding of market dynamics and strategic stock selection. The characteristics of a stock that make it attractive for day trading differ significantly.

In this guide, we’ll break down what makes a stock ideal for day trading and list some of the best stocks for day trading.

What Makes a Stock Good for Day Trading?

Before diving into specific stock picks, let’s outline the specific traits that make a stock ideal for day trading:

- Liquidity - This is arguably the most critical factor to consider. Liquidity refers to the ease with which a stock can be bought or sold without significantly impacting its price. High liquidity ensures that traders can enter and exit positions quickly and at their desired price, minimising slippage. Stocks with high daily trading volumes offer the necessary liquidity for day trading.

- Volatility - Volatility is the measure of the price fluctuations of a stock over a given period. For day traders, volatility is essential as it creates the price movements they aim to profit from. Stocks that experience substantial intraday price swings offer more trading opportunities for day traders.

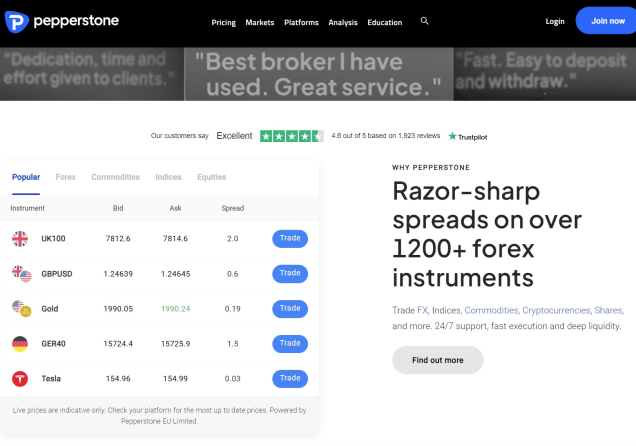

- Tight Spreads - A good stock for day trading should have low spreads, as this helps cut trading costs to a minimum and makes it easier to profit from intraday price changes. To keep your costs low, consider brokers known for offering tight spreads on stocks —some reliable choices include: Pepperstone, FP Markets and XTB.

There are other factors that come into play to further refine the suitability of a stock for day trading. However, we will focus mainly on these three factors to determine the best stocks for day trading for this article. Without further ado, here are some of the best stocks for day trading.

10 Top Stocks for Day Trading

Nvidia Corporation (NVDA)

The Nvidia stock is one of the top choices for day traders around the world. For starters, Nvidia is one of the most actively traded stocks on the stock market. It consistently sees a high average daily trading volume, often in the tens of millions. The rise of AI has further emphasised its trading volume as Nvidia is a big player in the production of processing chips needed in the field. This high liquidity is crucial for day traders because it ensures that there is always a buyer and a seller available at nearly every price level. As a result, NVDA typically has very tight spreads. This allows traders to enter and exit positions with minimal cost, which makes it ideal for quick trades where every cent matters.

On another note, NVDA frequently experiences significant intraday price swings. The stocks can move several dollars in a single session. This volatility creates multiple trading opportunities for day traders. As a global leader in AI, GPUs, and semiconductors, Nvidia is frequently in the spotlight. Its price can be affected by quarterly earnings releases, announcements of new technology, reactions to macroeconomic data, and government regulations, among other factors.

Tesla Inc. (TSLA)

Tesla Inc. (TSLA) is also widely regarded as an excellent stock for day trading. Like Nvidia, it’s extremely popular among day traders for several reasons. TSLA often ranks among the most actively traded stocks in the world, with daily volumes reaching tens of millions. This allows for easy entry and exit from trades. This is a crucial factor for day trading strategies that rely on quick execution. Additionally, it leads to relatively low spreads, reducing trading costs.

Furthermore, Tesla is renowned for its significant price volatility. The stock can move several percentage points in just a few hours. These price movements can be driven by a combination of macroeconomic news, EV industry developments, earnings announcements, and even social media posts by CEO Elon Musk. Either way, the volatility presents numerous opportunities for day traders to capitalise on short-term price fluctuations.

Apple Inc. (AAPL)

Apple is another blue-chip stock that frequently appears on the radar of day traders. As one of the most valuable publicly traded companies, Apple routinely sees daily trading volumes exceeding 50 million shares. This immense liquidity ensures that traders can execute orders easily without causing significant price fluctuations. Moreover, Apple typically features tight spreads, reducing the transaction costs for day traders who engage in frequent trading.

While Apple might not be as volatile as Nvidia or Tesla, it still experiences intraday price movements that can be profitable for day traders. These price movements are stronger during new product announcements, quarterly earnings reports, analyst ratings, and broader market trends. These movements are particularly attractive to day traders who prefer more predictable technical-based strategies rather than chasing highly volatile stocks.

Meta Platforms Inc. (META)

Meta Platforms, the parent company of Facebook, Instagram, and WhatsApp, is also a compelling stock for day trading. The stock exhibits high levels of liquidity, with substantial daily trading volumes. This deep liquidity allows day traders to enter and exit positions efficiently, a critical requirement for intraday trading strategies. Furthermore, Meta generally offers relatively tight spreads, which helps to minimise trading costs for frequent traders.

In terms of volatility, Meta can experience significant intraday price swings. More pronounced price movements usually happen around earnings announcements, major product releases, and news related to social media trends and regulatory developments.

Even CEO Mark Zuckerberg’s strategic comments can trigger sharp intraday price movements. These price fluctuations create opportunities for day trading from both upward and downward movements.

Palantir Technologies Inc. (PLTR)

Palantir Technologies has emerged as a noteworthy stock for day traders. This stock is particularly appealing to those focused on the data analytics and artificial intelligence sectors. While its liquidity might not consistently match the mega-cap giants like Apple or Meta, Palantir generally exhibits sufficient daily trading volume to allow for smooth entry and exit trades. Additionally, PLTR typically features reasonably tight spreads, keeping transaction costs manageable for high-frequency traders.

What makes PLTR particularly attractive for day trading is its characteristic volatility. The stock frequently experiences intraday price movements of 5% or more. These price movements are even more pronounced around earnings announcements, government contract awards, or significant developments in its commercial business expansion.

MicroStrategy Inc. (MSTR)

MicroStrategy Inc. is another standout choice for day traders, primarily due to its high correlation with Bitcoin price movements. As one of the largest corporate holders of Bitcoin, MSTR tends to exhibit significant intraday volatility driven by fluctuations in the cryptocurrency market. This unique dynamic makes it especially attractive to day traders with a fairly high risk appetite.

In terms of liquidity, MicroStrategy generally maintains adequate trading volume, particularly when Bitcoin is experiencing volatility. While not as liquid as mega-cap tech stocks, MSTR typically sees enough volume to support fast trade execution with acceptable spreads. These spreads can widen during low-volume periods but are usually manageable during peak trading hours.

Amazon.com, Inc. (AMZN)

Amazon stands as one of the premier stocks for day trading. As one of the largest companies by market capitalization, AMZN consistently ranks among the most actively traded stocks. This tremendous liquidity ensures traders can enter and exit positions smoothly throughout the trading day. Furthermore, due to its high liquidity, Amazon stock typically features tight spreads, minimising transaction costs for day traders.

While Amazon might not exhibit the same level of extreme volatility as some other tech stocks, it still experiences significant intraday price swings. The price movements are especially around earnings releases, economic reports affecting consumer spending, and key developments in the e-commerce and cloud computing sectors.

Further, Amazon's status as both a tech giant and retail leader means its stock reacts to a wide range of market influences. This diversity of catalysts creates multiple trading opportunities throughout the trading session.

Microsoft Corporation (MSFT)

As a cornerstone of the technology industry, Microsoft is also a strong contender for the best stocks for day trading. As one of the largest publicly traded companies in the world, MSFT enjoys exceptional liquidity. It consistently ranks among the most actively traded stocks on U.S. exchanges, with tens of millions of shares changing hands daily. This high liquidity enables tight bid-ask spreads, which are crucial for minimising costs.

Microsoft also experiences moderate but consistent volatility. While it may not exhibit the extreme price swings of Tesla or MicroStrategy, MSFT often sees steady intraday movements that can be capitalised on. Larger price movements are typically driven by earnings announcements, product launches (especially in AI and cloud computing), macroeconomic factors, and broader tech sector sentiment. The stock's combination of strong liquidity, reasonable volatility, and predictable trading patterns makes it a top choice for many day traders.

Advanced Micro Devices, Inc. (AMD)

Advanced Micro Devices (AMD) is another highly favoured stock among day traders, particularly those focused on the semiconductor industry. AMD exhibits strong liquidity, with significant daily trading volumes. This high liquidity allows for easy and quick execution of trades, which is essential for day trading strategies. Additionally, AMD generally offers competitive spreads, contributing to lower transaction costs for active traders.

AMD is also known for its significant price volatility. The stock can experience substantial intraday swings, often influenced by factors such as earnings reports, new product announcements (especially in CPUs and GPUs), competition with Intel and Nvidia, and overall market sentiment towards the semiconductor sector. These price fluctuations provide numerous opportunities for day traders. It usually exhibits news-driven volatility.

JPMorgan Chase & Co. (JPM)

JPMorgan Chase, the largest bank in the United States by assets, is another solid choice for day traders. It is especially a top choice for those interested in financial sector volatility. The stock consistently demonstrates high liquidity due to its large market capitalization and significant institutional interest. This ensures tight bid-ask spreads and smooth order execution, which are essential for day trading.

JPM’s volatility can be influenced by a broad range of factors. These include the Federal Reserve, earnings announcements, macroeconomic reports, and geopolitical developments. During periods of market uncertainty or major financial news, JPM tends to experience sharp intraday price movements. Additionally, JPM’s stock reacts not only to internal banking developments but also to broader economic and regulatory changes. This makes JPM an appealing option for day traders looking to diversify beyond tech stocks.

Important Considerations for Stock Day Traders

While selecting the right stocks is crucial, successful day trading also depends on a range of practical and strategic considerations. Stock selection is only part of the equation. Execution, discipline, and risk management all play equally important roles. Here are some key factors every stock day trader should keep in mind:

- Risk Management - Day trading involves high risk, and it’s crucial to manage that risk with tools like stop-loss and take-profit orders. Traders should also clearly define their maximum loss per trade and per day to protect their capital from excessive drawdowns.

- Trading Plan - A well-defined trading plan is paramount. This plan helps traders outline their trading goals, risk tolerance, capital allocation, and preferred trading strategies. It also features preferred entry and exit rules and the specific times an investor will be actively trading. Sticking to a plan helps to avoid impulsive and emotionally driven decisions.

- Market Awareness - It is important to stay informed about relevant news and events that could impact the stocks you are trading. This includes company-specific news (earnings, product launches), industry trends, and macroeconomic data releases.

- Broker Selection and Platform Speed - Using a reliable broker with fast execution speeds is crucial. Even a small delay can make a significant difference in the outcome of a trade. Traders should choose brokers that offer robust trading platforms, real-time data, and low spreads.

- Discipline and Psychology - The mental side of trading is often overlooked. Emotional control is essential. Traders must avoid revenge trading, overtrading, or deviating from their strategies.

- Starting Small - It is always advisable to start with a small amount of capital when trading. This allows you to gain experience and test your strategies without risking a significant portion of your funds. Moreover, traders should consider a demo stock trading account or paper trading to practice before trading with real money.

Closing Remarks

Day trading offers the potential for quick profits, but it also comes with significant risks and requires a clear approach. Choosing the right stocks is essential for maximising opportunities and minimising costs. The best stocks for day trading exhibit high liquidity, volatility, and tight spreads, making them ideal for quick entries and exits. The stocks listed in this article are some of the top choices for day trading for investors worldwide.

However, stock selection is only part of the equation. Effective day trading also requires strong risk management, a well-defined trading plan, market awareness, and emotional discipline. Choosing the right broker for stock trading is also a crucial part of the trading journey. By combining these elements, traders can navigate the fast-paced world of day trading more confidently.

Remember, day trading is high-risk and may not be suitable for everyone. It is advisable to start small, use demo accounts, and gradually build your skills before committing significant capital.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.